[Video Enhanced] Monumental Minerals (MNRL.V) Founder Max Sali Talks to GSN About Lithium in Chile

| |||||||||

September 14, 2022 - TheNewswire - Global Stocks News - Monumental Minerals (TSXV:MNRL) (FSE:BE5) (OTC:MNMRF) is developing raw materials for the global energy transition.

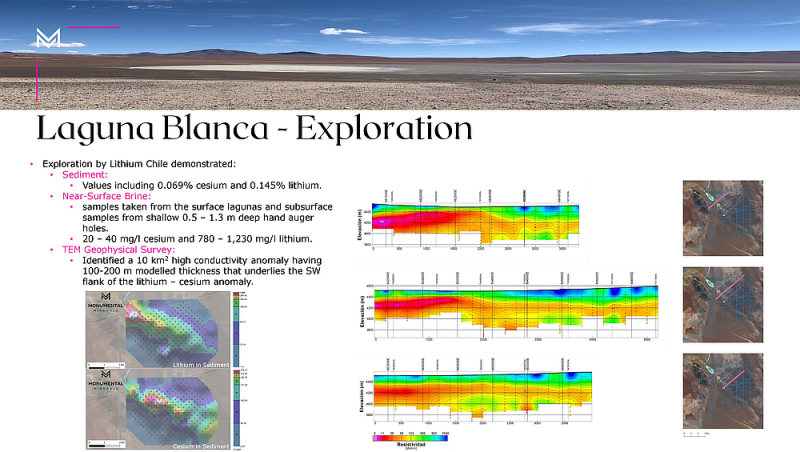

Its mineral portfolio includes the Laguna Blanca Lithium Brine and cesium project located in Chile and the Jemi HREE project in Mexico.

On August 22, 2022 Monumental signed an LOI with Lithium Chile to acquire a 50.01% interest in the Salar de Turi Project, located within the famed Lithium Triangle.

Upon completion of a definitive agreement, the Salar de Turi project will be added to MNRL’s portfolio.

Recent Laguna Blanca sediment samples returned values of 1450 ppm lithium, and 690 ppm cesium. Cesium – a specialised industrial lubricant - sells for about $100/gram, making a single wheelbarrow of Cesium worth $12 million.

On Sept 12, 2022 Monumental Minerals Founder and Director, Max Sali, spoke with GSN’s Guy Bennett about his investment and development strategies.

“I don't do things I don't know,” explained Sali, “For me, it comes down to mining”.

“Advantage Lithium was the first company I co-founded. It sold for $69 million,” continued Sali, “If you look at the value of the stock received, that transaction is now worth about $400 million. So, I wanted to get back into the lithium sector”.

“Defense Metals was the second company I founded. There is a great possibility that following the upcoming PFS this project could be a very economical mine and be put into production.”

“Jamil Sader [Monumental CEO] and I have found some phenomenal assets in Chile. Getting back into the space is good. If you look at our recent news, we had brine sample results from an auger hole, up to 405 milligrams per liter. That is following precipitation.”

Typically, rain or snow will dilute surface samples.

“Having that high grade of lithium content, with a low magnesium is extremely significant,” stated Sali.

“Reducing magnesium levels in lithium brines is crucial in order to produce high-purity lithium carbonate,” reports the Investing News Network, “The separation process is costly, requires additional steps and uses large amounts of electricity, which increases the carbon footprint for lithium operations”.

“The average producer is getting about one-to-one lithium/magnesium,” confirmed Sali, “For us to have 2.5 lithium to magnesium is significant. It makes the quality of the brine better for production.”

“If you look at my insider filings,” said Sali, “You’ll see that I have been buying a lot of Monumental stock.”

Earlier this year, a new leftist president, Gabriel Boric (36) became President of Chile, promising that “the poor will no longer keep paying the price of Chile's inequality”.

“Chile hosts 55 Canadian mining companies, making it home to 11% of Canada’s international mining assets, according to the federal Department of Natural Resources,” reports the Financial Post, “Chile is Canada’s second-most important mining market after the United States.”

“There has been a change recently to a more leftist government in Chile, focused on providing social programs,” confirmed Monumental CEO Jamil Sader, “but I don't see them trying to stifle foreign investment or mining.”

Sader’s prediction was proved correct when Chileans voted overwhelmingly (62%) against President Gabriel Boric’s proposed constitutional changes, which would have brought fiscal and regulatory uncertainty to Canadian mining operations in the region.

“This is how countries advance best, learning from experience and, when necessary, turning back on their tracks to find a new path forward,” stated President Boric in a measured response to the constitutional defeat.

Currently, about 1% of the 250 million vehicles on North American roads are electric. An analysis by IHS Markit projects that 25% of new car sales will be electric by 2030.

Electric Vehicles require lithium and rare earths (REEs).

Sociedad Química y Minera de Chile (SQM.NYSE) operates the nearest producing salar to MNRL’s assets. In its latest quarterly earnings report, SQM reported lithium sales revenue rising 1,000% year-on-year to hit USD $1.84 billion, with average prices of USD $54,000 per tonne.

“The market needs what we have,” concluded Sali, “Anything we do with a quality result will bring in significant investment.”

Contact: guy.bennett@globalstocksnews.com