TANTALEX LITHIUM RESOURCES Reports up to 1,02% Li20 From it's Infill Drilling on Manono Tailings K Dump

| |||||||||

|  | ||||||||

Toronto, Ontario – TheNewswire - September 6, 2022 – Tantalex Lithium Resources Corp. (CSE:TTX) – (FSE:DW8) – (OTC:TTLXF) (“Tantalex” or the “Corporation”), is pleased to announce that assay results received to date from it’s 2117m infill drilling program on the K dump has returned consistent high grade Li2O results with all drill holes returning Li2O intercepts between 0,565% and 1,018% Li20 from surface over entire length of drillholes.

Manono Tailings – K Dump Intercepts

Further to assay results received on our maiden 10,000m drill program, an additional drill program was conducted in Q2 2022 targeting the K and G dumps. On the K dump, a total of 2117 metres from 156 aircore drillholes was completed on nominal 50m centres to define a measured category for the Mineral Resource Estimate currently underway.

Drillholes were sampled at 1 metre intervals with 3m composite samples submitted to SGS Lab, Randfontein RSA, for multi-element assay by GE_IMS90A50 method.

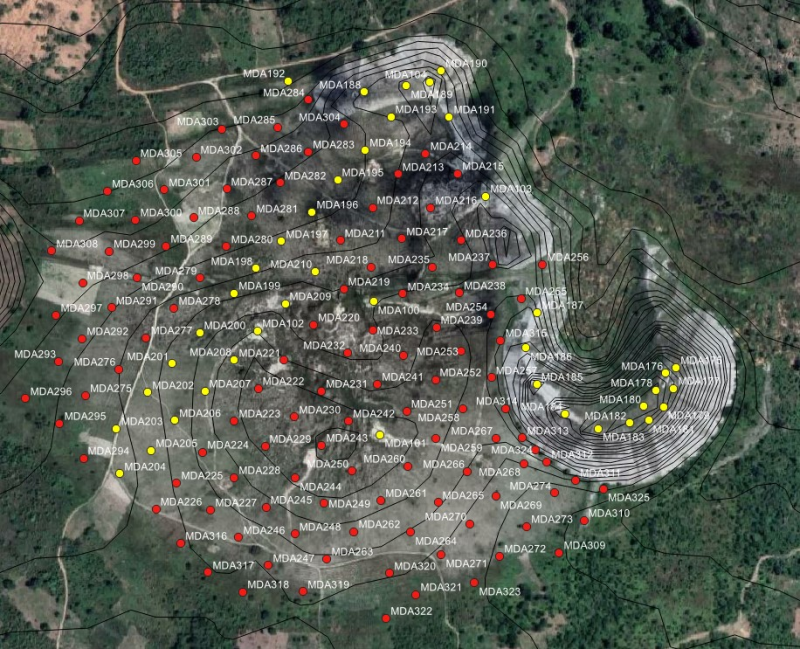

To date results from 382 out of a total of 836 submitted samples from 36 of the 156 drillholes has been received. (Figure 1).

The K dump is composed of two different sections; 1) a steeply stacked section to the northeast that varies from 47m to 21m thick with an average thickness of 38m, and 2) a gently domed 500m x 600m terrace section with an average thickness of 11m with depths generally 15m to 20m in the centre shallowing to 3-5m at the edges.

Figure 1: Drill holes completed on the K dump

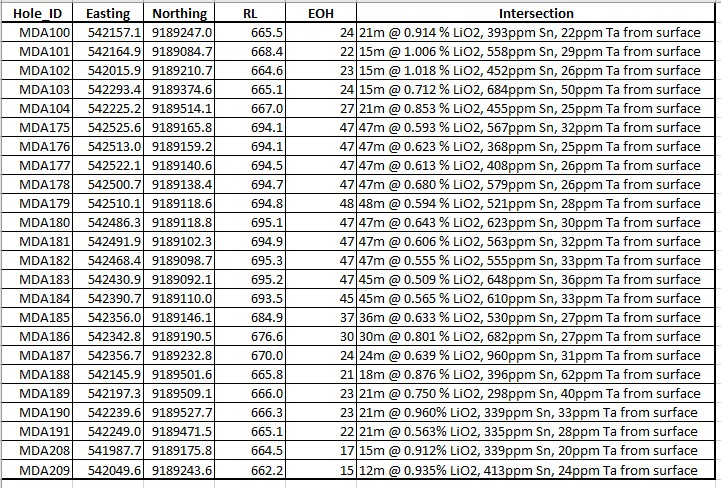

From the assays returned to date (figure 1 yellow dots) 24 holes were drilled to more than 15 metres. All 24 holes deeper than 15m returned mineralisation from the surface (Table 1). The 17 holes in the stacked material have a global average of 0.625 % LiO2. The 7 holes in the terrace have a global average of 0.928% LiO2.

From the volume estimation report that Tantalex conducted in Q4 2021, the estimated total volume of the K dump is 3 512 532m³. With an approximate density of 1,5 g/cm³ this represents a total estimated volume of 5 268 797 metric tons.

Table 1: Dill hole intercepts for drillholes of minimum 15m depth

“These results are highly encouraging as they demonstrate that the K dump is well mineralized laterally and vertically and confirms our efforts to define a measured resource in this area .” said Eric Allard, CEO of Tantalex. “Our additional assay results on the K and G Dump as well as our final report on preliminary metallurgical testing are also expected any time now. Our Maiden Mineral Resource Estimate for the Manono Tailings is progressing well and we continue targeting it’s completion before the end of September.”

CORPORATE UPDATE

Grid promissory Note

The Corporation has issued a grid promissory note dated July 20, 2022 (the “Note”) with AfriMet Resources AG (“AfriMet”) whereby AfriMet agreed to advance up to USD$1,000,000 to the Corporation pursuant to the terms below (the “Loan”).

The Loan will primarily be used for general working capital purposes. The Loan will be evidenced by a promissory note in favour of AfriMet. The maturity date of the Loan is one (1) year from the date of issuance of the Note (the “Maturity Date”) and said Note bears an interest of 10% per annum calculated monthly in arrears and not in advance.

Closing of Tranche 1 Private placement

On July 15th, the Corporation was granted by the Canadian Securities Exchange (the “CSE”) a confidential price protection set to expire on August 28, 2022 and later extended to October 7th for completing a non-brokered private placement for gross proceeds of a maximum of 2,000,000 USD through the issuance of common shares at a price of $0.08 per common share of the Corporation.

The Corporation has completed an initial closing by issuing 6,512,500 common shares in favour of the holders. Simon Collins, a Director of the Corporation subscribed for 3,225,000 common shares.

Conversion of debt into shares of the Corporation

Further, the Corporation has issued 2,943,558 common shares of the Corporation (the “Common Shares” or a “Common Share”) at a price of CAD$0.08 per Common Share in satisfaction of approximately CAD$235,485 compensation payable to independent consultants and related parties of the Corporation.

2,943,558 Common Shares were issued to related parties (within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”)) and such issuances are considered "related party transactions" for the purposes of MI 61-101. 750,000 Common Shares were issued to 3IM Technologies Inc. a consulting firm controlled by Eric Allard, President and CEO of the Corporation. 500,000 Common Shares were issued to CFO Advantage Inc., a consulting company controlled by Kyle Appleby, CFO of the Corporation. 1,271,250 Common Shares were issued Burton Financial Services Ltd., 266,063 Common Shares Hannes Miller, an officer of the Corporation. Finally, 156,245 Common Shares were issued to Ikigai Specialist Solutions PTY Ltd., an independent consultant of the Corporation.

Such related party transactions are exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the securities being issued to the related parties nor the consideration being paid by the related parties exceeded 25% of the Corporation’s market capitalization at the date of issuance. The recipients of the Common Shares and the extent of such participation were not finalized until shortly prior to the completion of the issuance described herein. Accordingly, it was not possible to publicly disclose details of the nature and extent of related party participation in the transactions contemplated hereby pursuant to a material change report filed at least 21 days prior to the completion of such transactions. All of the Common Shares were issued pursuant to an exemption from the prospectus requirement of applicable securities laws.

OTCQB Listing

Our application with the Depository Trust & Clearing Corporation (“DTCC”) to further enable the easier electronic clearing and settlement of the Corporation’s common shares in the United States is still pending due to the Corporation’s name change and additional procedures which were required thereafter.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Mr. Gary Pearse MSc, P. Eng, who is a “Qualified Person” as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Tantalex Lithium Resources Corporation

Tantalex is an exploration and development stage mining company engaged in the acquisition, exploration, development and distribution of lithium, tin, tantalum and other high-tech mineral properties in Africa. The Corporation is listed on the Canadian Stock Exchange (symbol: TTX) Frankfurt Stock Exchange (symbol: DW8) and OTCQB Venture Market (symbol TTLXF).

Cautionary Note Regarding Forward Looking Statements

The information in this news release includes certain information and statements about management's view of future events, expectations, plans and prospects that constitute forward looking statements. These statements are based upon assumptions that are subject to significant risks and uncertainties. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance may differ materially from those anticipated and indicated by these forward looking statements. Although Tantalex believes that the expectations reflected in forward looking statements are reasonable, it can give no assurances that the expectations of any forward looking statements will prove to be correct. Except as required by law, Tantalex disclaims any intention and assumes no obligation to update or revise any forward looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward looking statements or otherwise.

The Canadian Securities Exchange (CSE) has not reviewed this news release and does not accept responsibility for its adequacy or accuracy.

For more information, please contact:

Eric Allard

President & CEO

Email: ea@tantalex.ca

Website: https://tantalexlithium.com/

Tel: 1-581-996-3007