Lexaria Releases Annual Letter from the CEO

| |||||||||

|  |  | |||||||

Kelowna, British Columbia – TheNewswire -- January 24, 2024 – Lexaria Bioscience Corp. (Nasdaq:LEXX) (Nasdaq:LEXXW) (the “Company” or “Lexaria”), a global innovator in drug delivery platforms is pleased to provide this annual letter from CEO Chris Bunka as a strategic update to all stakeholders.

CEO LETTER TO STAKEHOLDERS

According to the Wall Street Journal, near the end of 2023, there were 446 companies listed on the Nasdaq that were trading under $1 and risking being de-listed; compared to nearly nil in 2021.

It was a tough year for microcap companies, which are often too early-stage to have profitable operations and withstand the harsh realities of the investment banking and finance industries: capital was much harder to come by in 2023 than at any time in recent years.

Considering the alternatives, we can at least breathe a sigh of relief and say, “we survived” and, in fact, made considerable advancements.

While we made strong progress on the intellectual property front and signed a new corporate client from our newly created nutraceutical subsidiary, we faced real challenges in the capital markets that negatively affected shareholder value and overwhelmed our progress in other areas.

I always try to be as communicative as possible to all Lexaria stakeholders and so herein please find my thoughts related to our plans for 2024. (All dates within this letter refer to calendar periods, not fiscal periods.)

CAPITAL MARKETS and SHAREHOLDERS

XBI is the S&P biotech index. It closed the final trading day of 2022 at 82.98; and the final trading day of 2023 at 89.29: a theoretical gain of 7.6%. I say “theoretical” because, if not for a rally during the last 3 weeks of the year in relatively few mid-cap biotech stocks, the index would have closed in a losing position. Combined with the regional banking crisis in the spring of 2023, that did not foster a positive environment for raising capital for nanocap companies. Thus, the devastation across nano-cap sectors as noted above by sub-$1 share prices.

Lexaria had to raise capital during 2023 to fund continuing operations and, thankfully, we were able to do so at a time when many small companies were not able to accomplish even that. But Lexaria shareholders paid the price with the worst development we have experienced at any time in the last several years: a horrific decline in stock price associated with raising capital. Lexaria management felt that was a manipulative, punitive experience that had us all feeling quite upset due to it being unrelated to other real-world and positive corporate events.

LEXX stock price (daily bars) vs. XBI biotech Index (solid black line)

Since then and on the positive side of things - because of our fantastic shareholders - the stock has climbed well above the $1 minimum bid price as required by Nasdaq to maintain our listing. We raised additional capital the first week of October on much less punitive terms which may be taken as a sign of confidence. Also, despite what had appeared at one time to be the inevitability of having to effect a reverse stock split in order to maintain our Nasdaq listing, we escaped that outcome and at this time, have no plans nor appetite to do so.

Lexaria welcomed a number of new shareholders this year who saw the value that presented itself after the May market shenanigans and have been accumulating LEXX stock ever since. If there is good news in all of this, here it is: we have never before had so many new shareholders who so thoroughly understand the Company and its objectives. THANK YOU for your support.

Indeed, by the middle of October with the combined decline of the biotech index and the marginal advancement of LEXX; LEXX was once again in a position of parity. Really, it is only the final month of the year where the biotech index has shot back up and LEXX has not. Hopefully that situation will be remedied sooner rather than later.

As promised, we also did NOT take on any debt during 2023, and I have no intention of doing so during 2024. My rule of thumb remains valid until proven otherwise: until such time as we have back-to-back quarterly profitable operations, I do not want to burden Lexaria with debt.

According to the Nasdaq, LEXX had a registered short position of 778,075 shares as of Dec 15, 2023, which was more than double the average level during 2023. Of course, it is not possible to know the unregistered naked short position although I presume it is much higher than that. Why Lexaria remains of such interest to short sellers is a mystery, but one that will have a happy ending (for us, not for them) if we manage to achieve our objective of executing a major collaboration with a large corporate partner.

On January 19, 2024, we filed a Form S-8 Registration Statement with a reoffer prospectus (the “S8”), in order to effectively register the additional shares issuable under our Incentive Equity Plan (the “Plan”) as approved by our shareholders on May 9, 2023 and to allow our insiders the ability to trade any shares currently issuable to them under the Plan. The filing of an S8 does not mean that insider selling is imminent! In fact, Lexaria has had a valid S8 in place since our listing on the Nasdaq and to date no insider has sold any shares pursuant to it. Every situation is unique, but as a rule, paying much heed to the “short and distort” community is not a smart way to manage your investments.

I wrote extensively last year about the strategic wisdom of pursuing licensing and Research and Development (“R&D”) collaboration deals, and I encourage you to review last year’s letter to refresh your memory. Despite our best efforts we only managed to close one new corporate customer during 2023. Generally speaking, it is hard to convince companies active in the consumer-packaged goods (“CPG”) sectors to pay for technology to improve their product offerings. Profit margins in those sectors are thin, and we’ve learned that most companies operating there simply do not have the ability to pay for technology. In light of this, we are concentrating our focus on our rapidly growing biotech and pharmaceutical objectives where technology partnering ability and interest is much higher and commonly practiced.

Last year we provided a table of our ten largest institutional shareholders who collectively owned 690,344 shares according to their then current disclosures.

This year, either one of our top two institutional shareholders own more stock than ALL the institutions combined did last year. Although the data is quite old (it is the most recent available), it is still heartening to observe that more and more institutions (19 holding an aggregate 1,805,504 shares) are taking an interest in us – see our table of the ten largest institutional shareholders below. We extend our thanks in particular to Invenomic Capital Management who have been shareholders for a long time and who have accumulated more stock throughout the year – we appreciate your support.

|

Owner Name |

Date |

Shares Held |

|

9/30/2023 |

889,272 |

|

|

9/30/2023 |

764,332 |

|

|

9/30/2023 |

78,950 |

|

|

9/30/2023 |

47,416 |

|

|

9/30/2023 |

33,329 |

|

|

9/30/2023 |

12,900 |

|

|

9/30/2023 |

10,545 |

|

|

9/30/2023 |

8,330 |

|

|

9/30/2023 |

2,686 |

|

|

9/30/2023 |

1,086 |

FOOD AND DRUG ADMINISTRATION (FDA) REGISTRATION

We had expected to file our Investigational New Drug (“IND”) application around the end of August in 2023, but as you know that was delayed because of overdue delivery of required analytical and stability information from one of our core ingredient suppliers. That put us in a tough position where we could either abandon that supplier and all the work including GMP production work that we had completed using their material (which would have been a delay likely of 9-15 months and a cost of at least $600,000) or try to work with them to remedy the situation.

I apologize for the roughly 5-month delay, but there truly were no great choices for us to pursue. However, the supplier has now received most of the information from their contracted laboratories to satisfy their paperwork needs which will enable us to soon submit our application to the FDA. Stay tuned for updates on our IND filing.

RESEARCH & DEVELOPMENT

Lexaria remains committed to achieving success through innovation. It is not necessarily an easy path and, while setbacks must be expected, we have been very fortunate that DehydraTECH continues to impress. Lexaria has enjoyed a high rate of success in its R&D pursuits for many years, and 2023 did not disappoint. Although no technology and no company is capable of producing a 100% rate of success in R&D programs, we have truly been blessed with positivity.

Because we focus on innovation, later in the year we took some chances and experimented to learn whether DehydraTECH might work with an entirely new class of molecules that we had never worked with before. That educated risk-taking may have led to the most important discovery in the Company’s existence. Read on!

Hypertension. In February 2023 we issued follow-up results from our 66-person DehydraTECH-CBD hypertension study HYPER-H21-4, wherein we communicated our discovery that we had lowered the quantity of catestatin in the human blood stream. This could have important implications for better understanding a mechanism of action of how cannabidiol processed with DehydraTECH was capable of lowering human blood pressure, and further implications with a potentially positive bias towards our regulatory pathway for same.

In May, we released our final set of results from the DehydraTECH-CBD hypertension study HYPER-H21-4 wherein we reported on DehydraTECH-CBD’s ability to lower interleukin inflammatory biomarkers by statistically significant amounts of between 19% and 43%. At the time, Dr. Phillip Ainslie, Scientific Advisor to Lexaria in the field of cardiovascular diseases and Lead Investigator to our hypertension studies, remarked that, "There is some pre-clinical evidence for the anti-inflammatory actions of CBD, but this is likely the most convincing evidence in humans that I have ever seen. The bigger picture is that inflammation is the key basis of atherosclerosis, and several pro-inflammatory agents have been examined as potential mediators of the biochemical pathways of lesion formation. Other ‘common' diseases or disorders associated with chronic inflammation include fatty liver disease; Type 1 & 2 diabetes mellitus; inflammatory bowel disease; asthma; lung diseases chronic kidney disease; rheumatoid arthritis and obesity. Part of the reason why many of these diseases lead to cardiovascular disease is via chronic inflammation."

Cholesterol, Triglyceride and Weight Loss Management. In March 2023 we released news detailing the results from an 8-week study in 32 rodents wherein a new, unique version of DehydraTECH-CBD had impressive results related to diabetes and weight loss. In that study – planned and executed mostly before the world was deluged with information regarding weight loss from the GLP-1 drug classes – we demonstrated that this specific version of DehydraTECH-CBD lowered triglyceride levels, and surprisingly, body weight differential during the 8-week study period. Lexaria shareholders know that we are a data-driven company: instead of following narrow “top-down” mandates, we follow the data. In this case, the discovery that DehydraTECH processing of cannabidiol enabled previously-unknown benefits of great interest to diabetics caused well-founded excitement within the Lexaria management and scientific teams. This was the birth of our interest in the fields of diabetes and weight loss and sparked our subsequent work in the GLP-1 sector, noted below.

Human Hormones. In May 2023 we informed the world that DehydraTECH processing of the human estrogen hormones estradiol and estrone greatly enhanced their ability to be absorbed into the bloodstream in a study of 20 rodents. Delivery improvements of 900% through to 12,500% were achieved; highlighting the dramatic improvements that DehydraTECH processing can offer to the normally poor bioavailability of orally-delivered hormones. Although these early-stage results were compelling, we lacked the budgets to conduct follow-on studies. However, when budgetary constraints lessen we hope to pursue additional studies to further validate these exceptional results.

Blood Glucose and Diabetes. We had continued to process the data from our March 2024 animal diabetes study, and in June we were delighted to be able to report that our uniquely formulated DehydraTECH-CBD was also able to reduce blood sugar by a statistically significant level of 19.9%. According to the Center for Disease Control, managing your blood sugar levels is important to avoid diabetes-related conditions such as vision loss, heart disease, and kidney disease.

As if that was not enough, we also examined kidney function in the animals and discovered that we had reduced the ratio of blood urea nitrogen to creatinine by a statistically significant 55.1%. This is yet another area of investigation where we will have to conduct additional research at some later date, give the significance this discovery could have to those suffering from kidney diseases.

Reduced Risk Oral Nicotine. Last summer we reported results from our long-anticipated human oral nicotine study. That study demonstrated that when Lexaria’s technology is applied to oral nicotine, the speed of absorption into the bloodstream is faster than the #1 brand of oral nicotine in the world, Zyn®, and also faster than the #3 brand in the USA, On!®. That study also carefully evaluated subjective performance, and the study participants rated DehydraTECH-nicotine as #1 for experiences such as euphoria, tolerability, pleasure; with DehydraTECH-nicotine generating the lowest incidences of mouth and throat burn, nausea, and hiccups; compared to Zyn and On!.

Glucagon-like Peptides (GLP-1)

In the summer of 2023, Lexaria quietly launched our own top-priority and unpublicized early-stage work program into the drug categories known as GLP-1 for weight loss and diabetes control. This was a high-risk program, not least because this class of drugs are known as “large molecules” whereas all of Lexaria’s previous investigations had concentrated on “small molecules”. As we didn’t know whether DehydraTECH would have any positive effect on large molecule drugs, we wanted to avoid implying publicly that it might work before we had evidence either way.

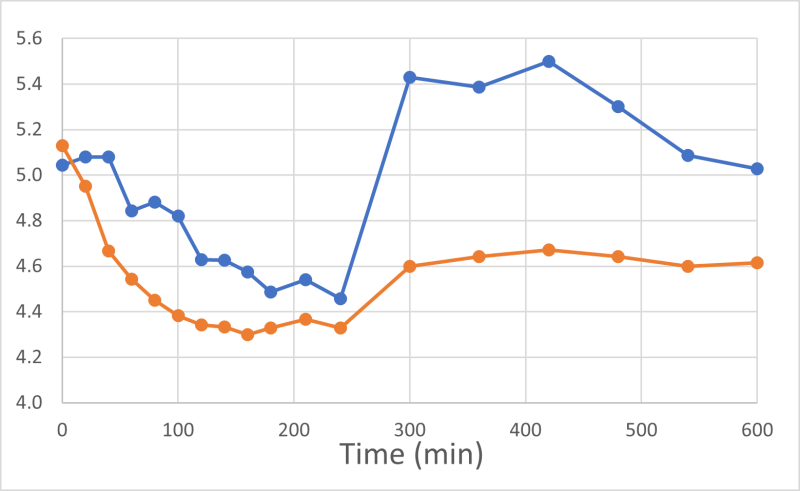

At the end of November and again in early January, 2024, we were delighted to report positive interim and final human pilot study results respectively, using a DehydraTECH formulation prepared using crushed Rybelsus® semaglutide tablets. This investigator-initiated study represented our foray into the GLP-1 space, performed by a university research center. Frankly, the results surprised us with their level of positivity. It was found that DehydraTECH processing: delivered a statistically-significant higher proportion of the semaglutide, and did so more quickly (very typical results for our technology); reduced the quantity and severity of unwanted side effects; and had a statistically-significant impact on blood sugar in general and much more effectively after eating a meal, than did Rybelsus.

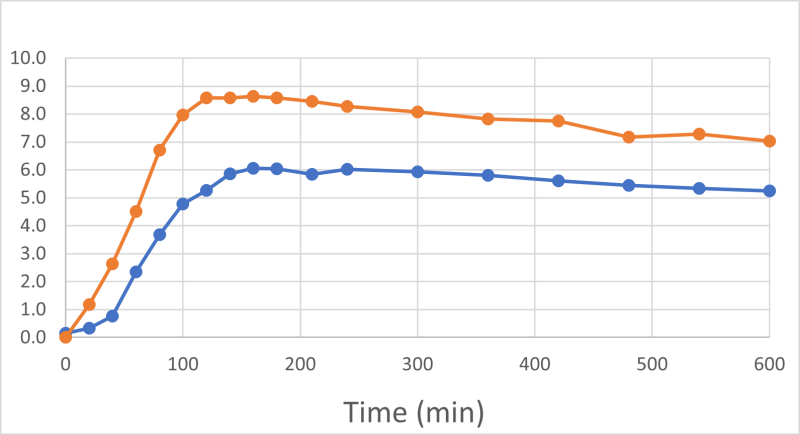

Blood Semaglutide Levels (mmol/L)

Rybelsus Control (blue) 7mg (n=7) DehydraTECH (orange) GLP-1 7mg (n=7)

To be clear: these were the results of a very small pilot study of only 7 people and there are risks in drawing too strong a conclusion from such a small group of healthy volunteers. The main purpose of the study was to provide direction as to whether or not DehydraTECH would even work in the large molecule GLP-1 sector, and it more than met that objective with the noteworthy achievement of statistically significant results. As before, we are “following the data”, and DehydraTECH GLP-1 investigation will be an area of primary focus for our R&D investigation during 2024, given the positive momentum and need in that market sector.

Blood Glucose Levels (mmol/L)

Rybelsus Control (blue) 7mg (n=7) DehydraTECH (orange) GLP-1 7mg (n=7)

About GLP-1 Drugs.

Rybelsus (semaglutide) is the only GLP-1 drug approved by the FDA for oral dosing to treat diabetes and weight loss. The FDA has also approved semaglutide marketed as Ozempic® and Wegovy®, administered by injection, to treat diabetes and weight loss. All three of these drugs are owned and manufactured by Novo Nordisk®.

GLP-1 drugs have recently been approved by the FDA for type two diabetes and weight loss management. Weight loss of between 10 pounds to 33 pounds, or more, has been widely reported. One 68-week study of 667 people reported an average loss of 15% of body weight.

Anecdotal commentary also suggests that some patients are experiencing reduced cravings for alcohol, nicotine and opioids while taking GLP-1 drugs. Other trials are examining their effects on heart disease and even dementia in part because of evidence that GLP-1 drugs may reduce the build-up of the proteins amyloid and tau in the brain, thought to be partly responsible for Alzheimer’s disease.

Side effects of GLP-1 drugs vary but can include nausea, vomiting, diarrhea and more. A small number of GLP-1 drugs have already been tested or approved in oral format but some studies have reported worse side effects with the oral form. The drugs are also being investigated for their relationship to bone density, muscle loss and more. Because of potential serious side effects, it may be beneficial to treat patients with lower oral doses of the drugs, something that Lexaria’s DehydraTECH technology may enable if it can improve the PK performance of GLP-1 drugs through oral capsules.

Because GLP-1 drugs have experienced FDA approvals as recently as 2021 and 2022, and because the health benefits of this drug class are still being discovered and understood, the potential market size is unknown. Published reports are widely estimating $100 billion in sales per year, by 2030. At least one analyst from Guggenheim Partners published a note on September 12, 2023 in which he explained how “the total addressable market for these so-called incretin drugs could balloon to $150 billion to $200 billion.”

We had a successful, active year of R&D. For some shareholders that has been overshadowed by the dismal performance of our stock – and I can assure you that no one is more frustrated by that occurrence than I am. Our talented team remains focused on what we do best and we believe that our hard work, innovation, vision, and determination to continue in the face of challenges will culminate in success. Lexaria has beaten the odds so many times that I have lost count. We’ve been poked at by some who are not eager for us to succeed. But we will continue to focus on the hard work of producing hard, factual scientific information that, sooner or later, will prove its worth.

And, though I’ve been wrong before, I think 2024 will be that year.

2024 R&D Plans

Our R&D plans for 2024 are very tightly focused and will be concentrated mainly on GLP-1 investigations. This annual letter is meant to be a guide, and we reserve the right to “change course” in our plans that are current as of the day I write them – but they might change, and they might change significantly based on any number of factors including our need to raise additional capital.

For 2024, the GLP-1 drug category will be our primary area of focus. The good early-stage results achieved in 2023 need to be followed up thoroughly and we expect to perform some or all of these studies in 2024:

-

Human pilot study #2

-

Human pilot study #3

-

Multi-arm, 12-week animal chronic study

-

Human chronic weight-loss and diabetes study

-

Multi-month stability testing of DehydraTECH GLP-1

We will generate a lot of data from all these GLP-1 studies. Our intention is to demonstrate the superior pharmacokinetics and safety/efficacy performance of GLP-1 drugs when formulated and processed with DehydraTECH, to such a degree that we attract a large pharmaceutical partner. Our historical work with other classes of molecules is helpful to guide us along this new path with more knowledge and rapidity than we were ever capable of in the past.

In the hypertension category we expect to focus on trying to achieve FDA approval asap for our Phase I(b) DehydraTECH-CBD study. Doing so would represent the culmination of nearly 18 months of work and give us the regulatory clearance to begin this all-important registrational human study designed to evidence safety, tolerability, and efficacy of DehydraTECH-CBD in reducing blood pressure.

A lot has happened in the last ~18 months since we started working on the IND project, including a big downturn in the small-cap biotech sector. As a result, our valuation today is less than it was when we started the IND process. We want to balance our desire to initiate and complete the hypertension study as soon as possible, with our shareholders’ desire to not dilute the Company more than necessary, especially while we are in this temporary situation of depressed stock prices and valuations sector wide. As a result, we plan to wait for stronger market conditions and a hoped-for improvement in our valuation before we finance the hypertension study so as to minimize dilution for you, our shareholders. Thus, we do not know at this moment when we will begin the study following expected FDA “approval”, as this largely depends on market conditions.

That said, we DID make real progress during 2023 including performing certain pre-study preparatory tasks in order to proceed as quickly as possible with study initiation, when funds permit.

Given the overwhelming interest in the GLP-1 sector, we are not at this time planning additional 2024 research in the antiviral, nicotine, or PDE5 sectors. We have solid early-stage data in each of those areas that will allow us to build upon those at the right time. That is a gentle reminder to all that our data does not have any practical “shelf life,” per se. When we conduct early-stage R&D it often serves a primary purpose of allowing us to more confidently apply for patent protection using the study-dependant data. Those patents, when granted, can form the foundation upon which future commercial relationships are built. And so, even if we do not immediately follow up with more advanced or broader R&D in a particular category, the advancement of our ever widening intellectual property portfolio continues.

COMMERCIAL RESULTS AND COLLABORATION

We had great hopes last year that the new customers signed during 2022 would have a significant impact on our revenues during 2023 and beyond. Chief among these was Premier Wellness Science Co., Ltd. (“Premier”) of Japan – our first client in Asia. Premier was a subsidiary of a Tokyo Stock Exchange-listed company, Premier Anti-Aging Co., Ltd. and this year was amalgamated into the parent company. Premier failed to launch any products under our agreement together during 2023 and we are unsure of their direction going forward. As well, our other licensees who are focused on non-pharmaceutical CBD have not made the progress we had expected.

We have pursued opportunities within the CPG sectors for a long time and have learned that, in part because profit margins are generally so tight in most ultra-competitive CPG sectors, convincing these companies to pay to use an enabling technology like DehydraTECH is no easy task. Many of the young companies fail to get traction whereas most of the established companies are resistant to any change. While we expect to remain opportunistic within the CPG sector we will do so without overly devoting resources to this sector where positivity is elusive.

Instead, as we expect our IND to be filed and as we also pursue R&D outcomes in the GLP-1 sector, our corporate focus is continuing the transition towards the biotech and pharmaceutical sectors which we embarked upon some years ago.

The pharmaceutical industry values drug delivery technology more wholesomely than does the CPG industry. This is apparent in the 2020/21 transaction whereby Novo Nordisk paid US$1.8 billion to acquire Emisphere Technologies Inc. Emisphere® developed a drug delivery technology now known as SNAC, “which facilitates the enhanced oral absorption of molecules without altering their chemical form, biological integrity or pharmacological properties,” which, as far as we have been able to determine, are properties also enjoyed using DehydraTECH.

What makes this transaction of even more intriguing interest, is that this is the technology now in use in the Rybelsus® tablet delivering Novo Nordisk’s blockbuster GLP-1 drug, semaglutide. And as showcased above, the Rybelsus® tablet incorporating the SNAC technology is the exact material that Lexaria improved upon the delivery characteristics with DehydraTECH in our recent human pilot study.

Lexaria will continue pursuing all commercial opportunities wherever they may lie. But our focus has shifted to those markets that are willing to recognize the excellence that DehydraTECH delivers.

INTELLECTUAL PROPERTY

Lexaria received 10 new granted patents during 2023: more than in any previous year, with a total of 38 patents now granted worldwide. Our patent portfolio provides vital support to our commercialization efforts.

Our international patent portfolios in the USA (3 new) and Canada (5 new) experienced notable growth. In the USA we received particularly important patent grants for treating hypertension and, in both the USA and in Canada, important patents were granted for sublingual delivery of nicotine.

We currently have patents granted in the following countries:

|

Patent Families |

Patents Granted |

|

|

Australia |

5 |

10 |

|

Canada |

6 |

6 |

|

European Union |

1 |

1* |

|

India |

1 |

1 |

|

Japan |

4 |

5 |

|

Mexico |

2 |

2 |

|

USA |

4 |

13 |

* validated in 10 EU countries

We continue to expect additional patents to be awarded in the future although we have already achieved significant intellectual property protection through our existing patent portfolio. Regardless of the number of patents granted it is impossible to achieve “perfect” protection.

We also retain many valid patent applications throughout the world, some of which are likely to advance to granted patent status. Although we do not receive a granted patent for each application we submit, and while we expect the growth in our patent portfolio to slow, Lexaria’s intellectual property is as well protected as we have been able to achieve.

SUMMARY

2023 was an “interesting” year: we successfully completed a number of important research projects and we were awarded more new patents than during any other year in our history. We had no choice but to raise capital and were severely punished because of it. That said, we have since received roughly $800,000 from the exercise of warrants associated with that financing, and the additional working capital is welcome. Our revenue generation is a welcome additional to our income statement but remains mostly insignificant and irrelevant to our much more ambitious goals of seeing DehydraTECH actively in use by a “Fortune-500”-type company.

Late in 2023 we discovered that, against all odds, DehydraTECH seems to have a dramatic and positive effect on the oral delivery of a GLP-1 drug known as semaglutide. That drug, owned by Novo Nordisk and sold under the brand names Ozempic®, Rybelsus®, and Wegovy®, has propelled Novo Nordisk to become the most highly valued public company in all of Europe.

This was also our first-ever evidence that DehydraTECH could enhance delivery performance of so-called “large molecules”.

I am more positive than ever before about our chances of establishing a commercial relationship with a significant pharmaceutical company in the year to come. Why? Because: we have never been more confident in our intellectual property portfolio; we have witnessed consistent drug delivery improvements with a variety of molecules; we have established a foundation for our studied molecules to better qualify them for commercial use and have learned what must be done in advance of gaining a corporate partnership; and we have now demonstrated DehydraTECH’s superiority with one of the most valuable molecule classes in the world (GLP-1).

Our 2024 research program for GLP-1 drugs is ambitious but logical. It is well within our ability to execute (subject to some financing needs). And, if it continues to deliver results similar to those we’ve already seen, together with our ever-advancing progress on DehydraTECH-related intellectual property, I’m just not aware of what else we would need to do in order to find a strong commercial partner.

I have been a shareholder of Lexaria for a very long time: I know how our shareholders feel as you watch our progress because I feel most of the same things you do. I’ve always tried to be straight-up with you even as we’ve juggled some daunting challenges. We have new shareholders in 2023 who have enthusiastically supported our most recent corporate strategies – to you I offer a special “thank you” for your support and I pledge that I will do all that I can to turn 2024 into the year that Lexaria leaps forward.

Thank you for giving us this opportunity to work our way forward.

Chris Bunka

About Lexaria Bioscience Corp.

Lexaria Bioscience Corp.’s patented drug delivery technology, DehydraTECH™, improves the way active pharmaceutical ingredients (APIs) enter the bloodstream by promoting more effective oral delivery. Since 2016, DehydraTECH has repeatedly demonstrated the ability to increase bio-absorption with cannabinoids, antiviral drugs, GLP-1 and more. DehydraTECH has also evidenced an ability to deliver some drugs more effectively across the blood brain barrier. Lexaria operates a licensed in-house research laboratory and holds a robust intellectual property portfolio with 38 patents granted and many patents pending worldwide. For more information, please visit www.lexariabioscience.com.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements. Statements as such term is defined under applicable securities laws. These statements may be identified by words such as "anticipate," "if," "believe," "plan," "estimate," "expect," "intend," "may," "could," "should," "will," and other similar expressions. Such forward-looking statements in this press release include, but are not limited to, statements by the Company relating to the Company’s ability to carry out research initiatives, receive regulatory approvals or grants or experience positive effects or results from any research or study. Such forward-looking statements are estimates reflecting the Company's best judgment based upon current information and involve a number of risks and uncertainties, and there can be no assurance that the Company will actually achieve the plans, intentions, or expectations disclosed in these forward-looking statements. As such, you should not place undue reliance on these forward-looking statements. Factors which could cause actual results to differ materially from those estimated by the Company include, but are not limited to, government regulation and regulatory approvals, managing and maintaining growth, the effect of adverse publicity, litigation, competition, scientific discovery, the patent application and approval process, potential adverse effects arising from the testing or use of products utilizing the DehydraTECH technology, the Company’s ability to maintain existing collaborations and realize the benefits thereof, delays or cancellations of planned R&D that could occur related to pandemics or for other reasons, and other factors which may be identified from time to time in the Company's public announcements and periodic filings with the US Securities and Exchange Commission on EDGAR. The Company provides links to third-party websites only as a courtesy to readers and disclaims any responsibility for the thoroughness, accuracy or timeliness of information at third-party websites. There is no assurance that any of Lexaria’s postulated uses, benefits, or advantages for the patented and patent-pending technology will in fact be realized in any manner or in any part. No statement herein has been evaluated by the Food and Drug Administration (FDA). Lexaria-associated products are not intended to diagnose, treat, cure or prevent any disease. Any forward-looking statements contained in this release speak only as of the date hereof, and the Company expressly disclaims any obligation to update any forward-looking statements or links to third-party websites contained herein, whether as a result of any new information, future events, changed circumstances or otherwise, except as otherwise required by law.

INVESTOR CONTACT: