Royalty Generated on Toura Nickel-Cobalt Project, Cote d'Ivoire

| |||||||||

15 March 2022 – TheNewswire - Altus Strategies Plc (AIM:ALS), (TSXV:ALTS), (OTC:ALTUF) announces that it has executed a Sale and Purchase Agreement (“SPA”) with Firering Strategic Minerals Plc (“Firering”) for the sale of the Company’s wholly-owned Toura nickel-cobalt licence application located in western Côte d’Ivoire (“Toura” or the “Project”). In consideration for the Project, Firering will grant the Company a Gross Revenue Royalty (“GRR”) of up to 1.0% on nickel and cobalt sales from the Project and pay the Company €15,000.

Highlights:

-

SPA with Firering which will acquire a 100% interest in the Company’s local subsidiary

-

Royalty generated on the Toura nickel-cobalt Project application in western Côte d'Ivoire

-

Altus to receive a GRR of up to 1.0%, subject to prevailing nickel prices, and €15,000

-

Toura located in an emerging and highly prospective nickel-cobalt province

-

Potential for strong future demand for nickel and cobalt from growing electric vehicle sector

-

Altus’s business model includes the generation of low-cost royalties by staking and monetising projects

Steven Poulton, Chief Executive of Altus, commented:

“We are pleased to generate this new nickel-cobalt royalty on our Toura application in Côte d’Ivoire, which is strategically located in an emerging and highly prospective nickel-cobalt province. Altus will receive a gross revenue royalty of up to 1.0% on any future production from the project and a nominal cash consideration upfront. This transaction illustrates the value of our ‘boots on the ground’ approach, where Altus can generate royalties at low cost, by directly staking and monetising projects. We look forward to following Firering’s progress as it advances the Project.”

About the Toura Nickel-Cobalt Project

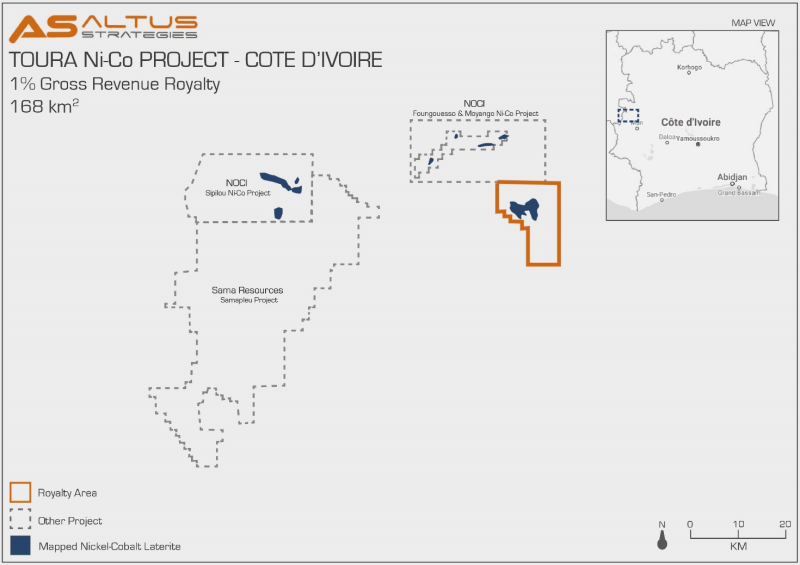

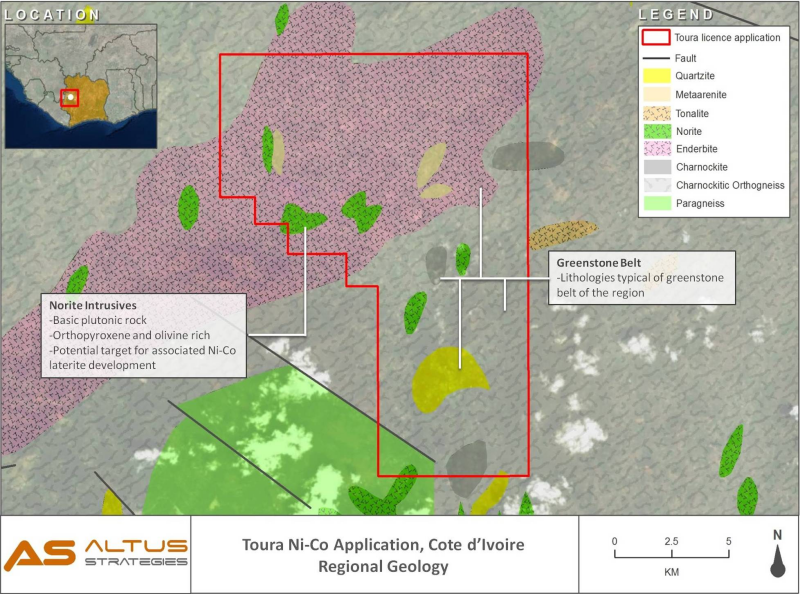

The Project comprises an application for a nickel-cobalt mineral prospecting licence with an area of approximately 168 km2, in western Côte d'Ivoire (“Application”). The Application targets potential nickel-cobalt mineralisation within the lateritic profile overlaying mafic and ultramafic intrusive rocks (see Figure 2). The region is considered prospective for such nickel-cobalt mineralisation, with several known deposits in the vicinity, including the Sipilou, Foungouesso and Moyango projects (located 0-35 km north-west of Toura) owned by Nickel de l’Ouest Côte d’Ivoire and the Samapleu and Grata projects (located 35 km west of Toura) owned by Sama Resources Inc (see Figure 1). Mineralisation hosted on these properties is not necessarily indicative of mineralisation hosted at Toura.

Terms of the SPA & Gross Revenue Royalty

Upon closing of the SPA, Altus will transfer to Firering a 100% interest in the Company’s wholly-owned Seychelles subsidiary, Altar Resources Limited (“Altar”). Altar is the 100% owner of Apalex SARL, an Ivorian incorporated company which has submitted the Application. In addition to the GRR, Firering will also pay Altus €15,000. The SPA follows and replaces an option agreement in respect of the Project previously agreed with Firering (see Company announcement on 25 July 2019).

Altus will receive a GRR from the Project, linked to the United States dollar nickel price (as quoted per tonne (“t”) by the London Metal Exchange) at the time of the metal sales as follows:

-

When the nickel price is less than or equal to US$12,000/t: no royalties will be payable;

-

When the nickel price is between US$12,000/t and US$18,000/t the Company will receive a 0.5% GRR; and

-

When the nickel price is higher than US$18,000/t the Company will receive a 1.0% GRR.

The London Metal Exchange currently quotes a cash price for nickel of approximately US$48,000/t.

The GRR will be calculated as the gross proceeds received from sales from the Project, less transportation costs. The GRR will be subject to a separate agreement, which will be entered into between the Company and Firering, within six months of the grant of the Application.

Illustrations

The following figures relate to the disclosures in this announcement and are visible in the version of this announcement on the Company's website (www.altus-strategies.com), or in PDF format by following this link: https://altus-strategies.com/site/assets/files/5445/altus_nr_-_firering_spa_15_mar_2022.pdf

-

Location of the Toura nickel-cobalt project in Côte d’Ivoire is shown in Figure 1.

-

Regional geology of the Toura nickel-cobalt project in Côte d’Ivoire is shown in Figure 2.

Figure 1: Location of the Toura nickel-cobalt project in Côte d’Ivoire

Figure 2:

Regional geology of the Toura nickel-cobalt project in Côte d’Ivoire

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Steven Poulton, Chief Executive of Altus. A graduate of the University of Southampton in Geology (Hons), he also holds a Master's degree from the Camborne School of Mines (Exeter University) in Mining Geology. He is a Fellow of the Institute of Materials, Minerals and Mining and has over 20 years of experience in mineral exploration and is a Qualified Person under the AIM rules and NI 43-101.

For further information you are invited to visit the Company’s website www.altus-strategies.com or contact:

|

Altus Strategies Plc Steven Poulton, Chief Executive |

Tel: +44 (0) 1235 511 767 E-mail: info@altus-strategies.com |

|

SP Angel Corporate Finance LLP (Nominated Adviser) Richard Morrison / Adam Cowl |

Tel: +44 (0) 20 3470 0470 |

|

SP Angel Corporate Finance LLP (Broker) Grant Barker Rob Rees |

Tel: +44 (0) 20 3470 0471 Tel: +44 (0) 20 3470 0535 |

|

Shard Capital Partners LLP (Broker) Isabella Pierre / Damon Heath |

Tel: +44 (0) 20 7186 9927 |

|

Yellow Jersey PR (Financial PR & IR) Charles Goodwin / Henry Wilkinson |

Tel: +44 (0) 20 3004 9512 E-mail: altus@yellowjerseypr.com |

About Altus Strategies Plc

Altus Strategies (AIM: ALS, TSX-V: ALTS & OTCQX: ALTUF) is a mining royalty company generating a diversified and precious metal focused portfolio of assets. The Company’s differentiated approach of generating royalties on its own discoveries in Africa and acquiring royalties globally through financings and acquisitions with third parties, has attracted key institutional investor backing. The Company engages constructively with all stakeholders, working diligently to minimise its environmental impact and to promote positive economic and social outcomes in the communities where it operates. For further information, please visit www.altus-strategies.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this announcement, including information relating to future financial or operating performance and other statements that express the expectations of the Directors or estimates of future performance constitute "forward-looking statements". These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the completion of planned expenditures, the ability to complete exploration programmes on schedule and the success of exploration programmes. Readers are cautioned not to place undue reliance on the forward-looking information, which speak only as of the date of this announcement and the forward-looking statements contained in this announcement are expressly qualified in their entirety by this cautionary statement.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. The forward-looking statements contained in this announcement are made as at the date hereof and the Company assumes no obligation to publicly update or revise any forward-looking information or any forward-looking statements contained in any other announcements whether as a result of new information, future events or otherwise, except as required under applicable law or regulations.

TSX Venture Exchange Disclaimer

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organisation of Canada accepts responsibility for the adequacy or accuracy of this release.

Market Abuse Regulation Disclosure

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR. Upon publication of this announcement, the inside information is now considered to be in the public domain for the purposes of MAR.

**END**