South Atlantic Gold Updates Phase II Exploration Program: Trenching Program Completed and Mineralization Extends Throughout Pedra Branca Trend

| |||||||||

|  |  | |||||||

Kelowna, British Columbia – TheNewswire - May 6, 2022 - SOUTH ATLANTIC GOLD INC. (TSXV:SAO) (“South Atlantic” or the “Company”) announces the completion of the trenching program of the Phase II exploration program at its Pedra Branca project, located in Ceará state, northeastern Brazil. The trenching program assayed over 200 mineralized intersections, including the highest grading intersection at surface identified so far with 3 meters (“m”) grading 38 grams per tonne (“g/t”) gold (“Au”).

The Relatório Final de Pesquisa (“RFP”) report was submitted to the Agencia Nacional de Mineração (“ANM”), the Brazilian mining agency, on time and in compliance with the deadline as set by Brazilian mining regulations. In addition, the northern portion of the drone geophysical magnetic survey (news release dated April 8, 2022 and located here) is on-going and the results of this study should identify exploration targets to support the exploration strategies with the goal of continuously adding mineral resources.

Douglas Meirelles, CEO stated, “The Company has successfully completed all trenches for the Phase II exploration program at Pedra Branca. The results have arrived and are being reported as we work to consolidate the data. We have now completed a major milestone and have filed all the final required exploration reports with ANM and expect that these 15 tenements will be approved for the next phases in the process and will be converted from exploration into mining concessions. As shown with the Phase I exploration program, we continue to achieve our objectives on time and on budget.”

Trenching Program for ANM Final Exploration Report

The required exploration schedule included a detailed trenching program that outlined 48 trenches totaling 9,880 meters and minimal supportive RC drilling for each tenement. The program was successful in extending the current known mineralized trends south in the Pedra Branca tenement package and supported the previously defined Mineral Resources report (RFP) filed with the Brazilian mining agency, ANM. This work had the objective to convert 15 of the tenements that comprise the Pedra Branca project from exploration to mining concession tenements. The map below highlights the best trench intercepts from the Phase II trenching.

Trench results are listed in the following table:

Highlights of Trenching Results from Phase II Trenching Program

|

Trenches (TR) and Reverse Circulation (RC) Drilling Ore Intercepts |

|||||||

|

>= 0.4 g/t Au |

Id |

Type |

Intercepts |

From |

To |

Target |

ANM Process |

|

PBTR047 |

TR |

3 m @ 32.63 g/t Au incl. 1 m @ 96.04 g/t Au |

21 |

23 |

Barra Nova |

801.059/2011 |

|

|

PBTR048 |

TR |

1 m @ 1.58 g/t Au |

139 |

140 |

Barra Nova |

801.059/2011 |

|

|

PBTR106 |

TR |

8 m @ 0.94 g/t Au incl. 2 m @ 3.3 g/t Au |

12 |

20 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR108 |

TR |

6 m @ 0.78 g/t Au incl. 2 m @ 1.75 g/t Au |

176 |

182 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR098 |

TR |

2 m @ 0.59 g/t Au |

18 |

20 |

Moquem Norte |

800.605/2012 |

|

|

PBTR098 |

TR |

2 m @ 0.54 g/t Au |

350 |

352 |

Moquem Norte |

800.605/2012 |

|

|

PBTR096 |

TR |

2 m @ 0.47 g/t Au |

118 |

120 |

Moquem Norte |

800.605/2012 |

|

|

PBTR097 |

TR |

2 m @ 0.45 g/t Au |

114 |

116 |

Moquem Norte |

800.605/2012 |

|

|

PBTR099 |

TR |

2 m @ 0.41 g/t Au |

246 |

248 |

Moquem Norte |

800.605/2012 |

|

|

PBTR105 |

TR |

2 m @ 0.475 g/t Au |

104 |

106 |

Cachoeirinha |

801.054/2011 |

|

|

>= 0.1 g/t Au |

Id |

Intercepts |

From |

To |

Target |

ANM Process |

|

|

PBTR108 |

TR |

8 m @ 0.16 g/t Au incl. 2 m @ 0.38 g/t Au |

94 |

102 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR108 |

TR |

8 m @ 0.18 g/t Au incl. 2 m @ 0.29 g/t Au |

62 |

70 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR121 |

TR |

16 m @ 0.11 g/t Au incl. 4 m @ 0.302 g/t Au |

150 |

166 |

Mundo Novo |

801.049/2011 |

|

|

PBTR095 |

TR |

8 m @ 0.17 g/t Au incl. 2 m @ 0.28 g/t Au |

102 |

110 |

Moquem Norte |

800.605/2012 |

|

|

PBTR094 |

TR |

4 m @ 0.22 g/t Au |

202 |

206 |

Moquem Norte |

800.605/2012 |

|

|

PBTR105 |

TR |

4 m @ 0.23 g/t Au |

92 |

96 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR126 |

TR |

2 m @ 0.17 g/t Au |

44 |

46 |

Dedezinho |

800.602/2012 |

|

|

PBTR115 |

TR |

8 m @ 0.17 g/t Au |

78 |

86 |

Barra Nova |

801.054/2011 |

|

|

PBTR120 |

TR |

2 m @ 0.15 g/t Au |

240 |

242 |

Mundo Novo |

801.049/2011 |

|

|

PBTR108 |

TR |

2 m @ 0.12 g/t Au |

198 |

200 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR095 |

TR |

8 m @ 0.116 g/t Au |

134 |

138 |

Moquem Norte |

800.605/2012 |

|

|

PBTR105 |

TR |

2 m @ 0.11 g/t Au |

78 |

80 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR106 |

TR |

8 m @ 0.105 g/t Au |

32 |

36 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR108 |

TR |

8 m @ 0.11 g/t Au |

148 |

156 |

Cachoeirinha |

801.054/2011 |

|

|

PBTR095 |

TR |

2 m @ 0.1 g/t Au |

150 |

152 |

Moquem Norte |

800.605/2012 |

|

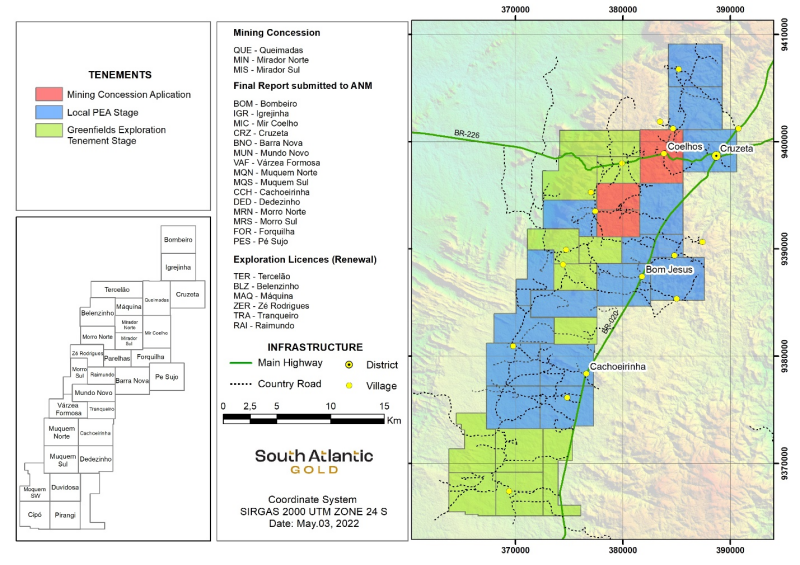

The current status of the tenements of Pedra Branca can be seen on the graphic below. We have successfully submitted the final exploration report of 15 tenements and are advancing it to a PEA stage within ANM (“Agencia Nacional de Mineração”) as required by local legislation. We have also identified high grade results and several continuously mineralized samples over the entire south portion of the Pedra Branca asset as seen on the table of trench assay results.

Map of Tenement License Status

Drone Geophysical Survey Update

The next milestone in the Phase II program will be to conclude the airborne geophysical magnetic survey (drone survey). The magnetic survey results will be compiled with the assay results to provide a more comprehensive database and will be reported accordingly with all new assay results that will be received, including previous pending assay results from Phase I exploration program. Although the rainy weather has presented a constant challenge to the drone survey team, results are expected still within May 2022, and these geophysical results will be paramount in defining the proper Phase III exploration program strategy for Pedra Branca.

Qualified Person’s Statement

The scientific and technical information that forms the basis for parts of this news release was reviewed and approved by Marcelo Antonio Batelochi (P.Geo.), MAUSIMM (CP), the Company’s Exploration Manager who is a Qualified Person as defined by NI 43-101.

About South Atlantic Gold

South Atlantic Gold is an exploration company engaged in acquiring and advancing mineral properties located in the Americas. Our flagship asset is the 100%-owned Pedra Branca project, located 280 km southwest of Fortaleza, Ceará State, Brazil. South Atlantic Gold is focused on creating value for its shareholders by engaging in the development and acquisition of high-quality mineral assets located in stable and mining-friendly jurisdictions. South Atlantic Gold is based in Kelowna, British Columbia, and is listed on the TSX-V under the symbol “SAO”.

ON BEHALF OF THE BOARD

Douglas Meirelles, President and CEO

For more information regarding this news release, please contact:

Anne Hite, Vice President, Investor Relations

T: 250-762-5777

Email: ir@southatlanticgold.com

Cautionary Note Regarding Forward-Looking Information

This news release contains statements that constitute "forward-looking Information", as such term is used in applicable Canadian securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. There can be no assurance that the Fundamental Acquisition will be completed as proposed or at all.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the Covid-19 pandemic; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that the Company maintains good relationships with the communities in which it operates or proposes to operate, future legislative and regulatory developments in the mining sector; the Company’s ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of the Company to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company’s expectations, as well as other assumptions risks and uncertainties applicable to mineral exploration and development activities and to the Company, including as set forth in the Company’s public disclosure documents filed on the SEDAR website at www.sedar.com.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.