New Parallel Gold Zone Confirmed at Tabakorole JV Project, Southern Mali

| |||||||||

01 September 2021 – TheNewswire - Altus Strategies Plc (AIM:ALS), (TSXV:ALTS), (OTC:ALTUF) announces that drilling has confirmed the discovery of a significant new parallel zone of gold mineralisation (“Parallel Zone”) from its Joint Venture (“JV”) at the Tabakorole gold project (“Tabakorole” or the “Project”) located in southern Mali. Altus holds a 49% equity interest and 2.5% Net Smelter Return (“NSR”) royalty on the Project. Exploration activities at Tabakorole are being funded by Marvel Gold Limited (ASX: MVL) (“Marvel”) under its JV with Altus. The current drilling programme is designed to test the potential to expand the Tabakorole deposit on which a Mineral Resource Estimate (“MRE”) has been modelled.

Highlights:

-

- Further highly encouraging drilling results from the Tabakorole gold project in southern Mali

- Results from 8 diamond drill (DD”) holes (1,296m) from Northwest Zone and Parallel Zone

- Multiple, shallow and high-grade intersections include (not true width of intervals):

-

- Northwest Zone: 3.6 g/t gold (Au”) over 16.5m from 3.2m

- Parallel Zone: 2.4 g/t Au over 24m from 35m 1.5 g/t Au over 20.6m from 26.4m

- Parallel Zone is outside of deposit and remains open beyond 120m strike and at depth

- Results are expected to increase the volume and grade of the MRE

- Upgraded MRE for Tabakorole expected to be prepared in September 2021

- Tabakorole hosts a mineral deposit for which an MRE has been generated (see Altus’ news release “Substantial Increase in Gold Resource at Tabakorole Project, Southern Mali” dated 30 September 2020), comprising:

-

- 16,600,000 tonnes at 1.2 g/t Au for 620,000 ounces in the Inferred category

- 7,300,000 tonnes at 1.2 g/t Au for 290,000 ounces in the Indicated category

- Altus holds 49% of the Project and a 2.5% NSR royalty on Tabakorole gold production

-

Steven Poulton, Chief Executive of Altus, commented:

“The discovery of this parallel, shallow and high-grade gold zone has significant implications for the potential of the Tabakorole gold project in southern Mali. Drilling results of 2.4 g/t Au over 24m from 35m depth in the Parallel Zone and 3.6 g/t Au over 16.5m from 3.2m depth from the Northwest Zone are excellent. Marvel Gold, our ASX-listed JV partner, has been aggressively advancing Tabakorole through its drilling programmes in 2021. These programmes have successfully extended the deposit’s strike length to the northwest and southeast and intersected new shallow and high-grade mineralisation outside of the current deposit model. The results are anticipated to contribute to an updated Mineral Resource Estimate, expected later this month. We look forward to updating shareholders on the results of this work in due course.”

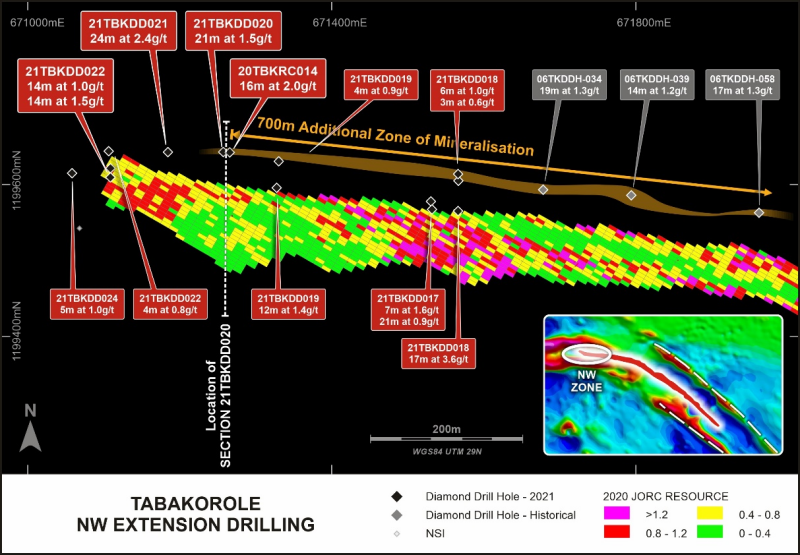

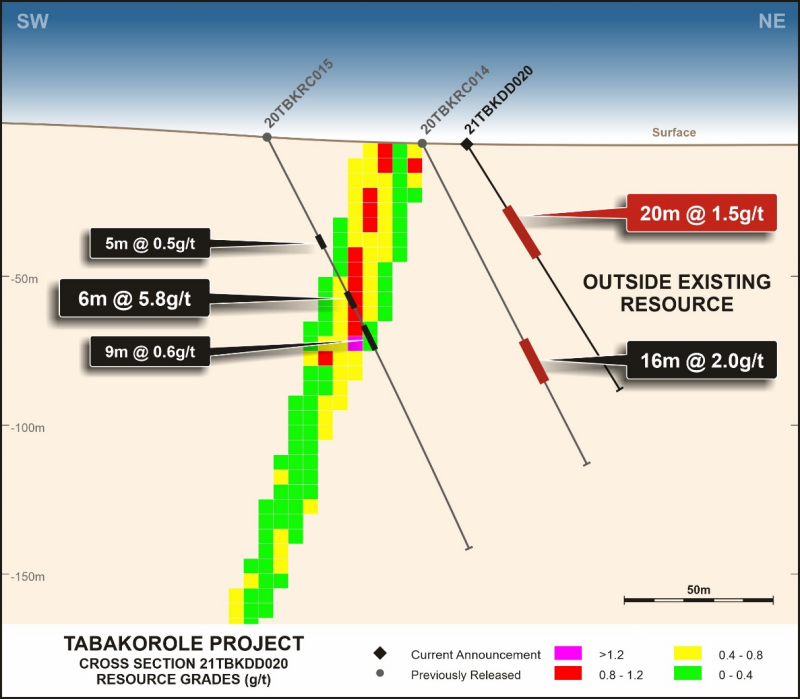

Results from drilling programmes

Marvel have recently completed 3,240m of DD designed to expand the current MRE in the Northwest Zone, define the Parallel Zone and as previously reported, infill the Central Zone. The targets in the Northwest Zone were designed to follow up on Reverse Circulation (“RC”) drill results from earlier in the year, which included 2.0 g/t Au over 16m from 75m and 5.8 g/t Au over 6m from 61m. The best new intersection from the current DD programme in the Northwest Zone is 3.6 g/t Au over 16.5m from 3.2m. Previous drilling in the Northwest Zone indicated the likelihood that the Parallel Zone existed. Drilling in the current programme has confirmed the presence of this new zone with results including 2.4 g/t Au over 24m from 35m and in the adjacent section 1.5 g/t Au over 21m from 26m (up dip from 2.0 g/t Au over 16m). The Parallel Zone is currently 120m long and remains open along strike and at depth. A summary of the results from the current drilling programme is set out in Table 1 below.

MRE to be updated

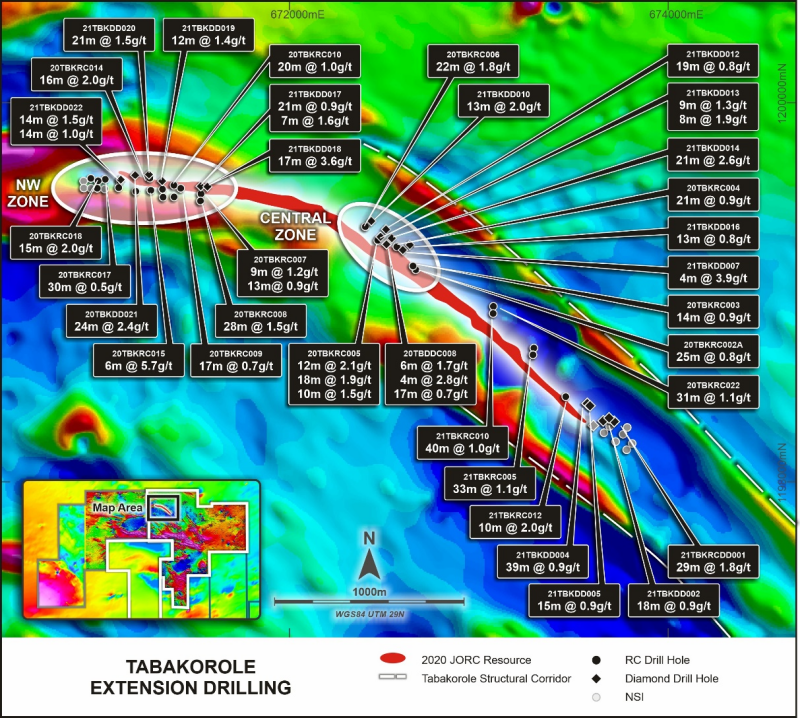

A total of 4,140m of DD and 5,400m of RC drilling has been undertaken by Marvel in 2021. The results of these programmes will feed into an updated resource statement (in accordance with the JORC code), which is expected to be completed in late September 2021. Key highlights from the 2021 drilling programmes are:

-

- Northwest Zone: Potential increase in strike length by 150m with potential improvement of grade in this zone;

- Parallel Zone: Discovery of shallow, high-grade mineralisation outside of the existing deposit;

- Central Zone: Discovery of further mineralisation outside of the existing deposit with potential improvement of grade in this zone; and

- Southeast Zone: Potential increase in strike length by 150m.

With the strike length of the deposit increased by a total of 300m (to 3.2km) to the southeast and northwest, and with multiple shallow intercepts having been made outside of the previously modelled deposit, the updated MRE is expected to see enhancements to both the volume and grade of the deposit.

Table 1. Significant drilling intersections from current drilling programme

|

Hole ID |

From (m) |

To (m) |

Intersection (m) |

Grade (g/t Au) |

Summary |

End of Hole (m) |

|

21TBKDD017 |

4.7 |

25.7 |

21.0 |

0.9 |

21.0m at 0.9 g/t |

185.3 |

|

31.7 |

38.3 |

6.6 |

1.6 |

6.6m at 1.6 g/t |

||

|

21TBKDD018 |

3.2 |

19.7 |

16.5 |

3.6 |

16.5m at 3.6 g/t |

180.0 |

|

96.0 |

99.0 |

3.0 |

0.6 |

3.0m at 0.6 g/t |

||

|

107 |

113.0 |

6.0 |

1.0 |

6.0m at 1.0 g/t |

||

|

21TBKDD019 |

9.0 |

21.0 |

12.0 |

1.4 |

12.0m at 1.4 g/t |

154.2 |

|

90.0 |

94.0 |

4.0 |

0.9 |

4.0m at 0.9 g/t |

||

|

21TBKDD020 |

26.4 |

47.0 |

20.6 |

1.5 |

20.6m at 1.5 g/t |

102.2 |

|

21TBKDD021 |

35.0 |

59.0 |

24.0 |

2.4 |

24.0m at 2.4 g/t |

159.6 |

|

21TBKDD022 |

19.9 |

34.0 |

14.1 |

1.5 |

14.1m at 1.5 g/t |

153.2 |

|

41.0 |

55.0 |

14.0 |

1.0 |

14.0m at 1.0 g/t |

||

|

87.0 |

91.0 |

4.0 |

0.8 |

4.0m at 0.8 g/t |

||

|

21TBKDD023 |

0.0 |

181.0 |

No significant intercept |

181.0 |

||

|

21TBKDD024 |

27.0 |

32.0 |

5.0 |

1.0 |

5.0m at 1 g/t |

180.6 |

Notes:

-

Based on 0.5 g/t Au cut off, minimum length of 3m and 5m maximum internal waste

-

Intersections are down-the-hole and do not represent true widths of mineralisation

-

No grade capping has been applied

Summary of Joint Venture with Marvel Gold

Marvel has the right to earn up to an 80% interest in Tabakorole by sole funding four stages of exploration, culminating in a definitive feasibility study, and by making certain cash (or cash plus Marvel shares) payments to Altus. Thereafter, Altus has the right to co-finance or dilute its 20% interest in the Project. Altus also retains a 2.5% NSR royalty on the Project. Marvel will have the right to reduce the royalty to 1.0% for a payment to Altus of between US$9.99 million and US$15.00 million (depending on the size of the resource at Tabakorole). Marvel has currently earned a 51% interest in the Project.

The following figures relate to the disclosures in this announcement and are visible in the version of this announcement on the Company's website (www.altus-strategies.com) or in PDF format by following this link: https://altus-strategies.com/site/assets/files/5349/altus_nr_-_tabakorole-_01_sept_2021.pdf

-

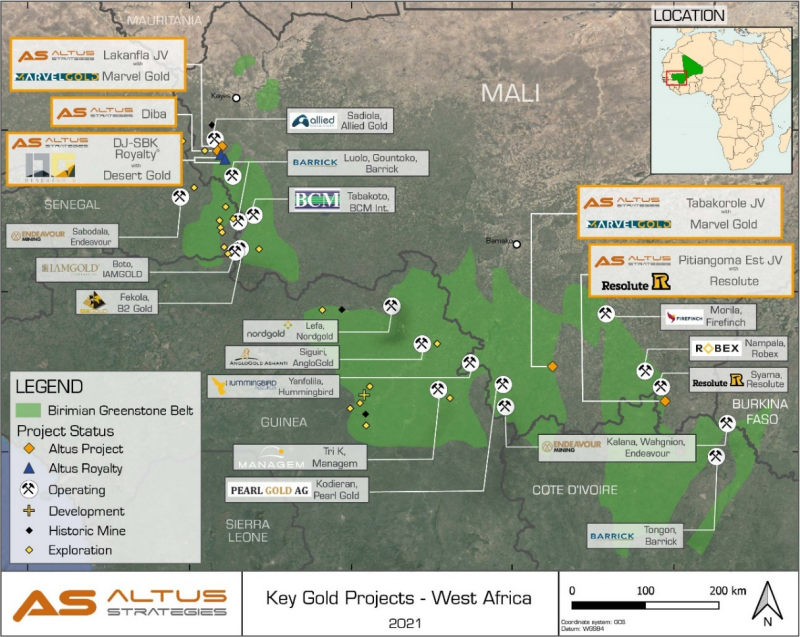

- Location of Tabakorole and Altus’ other projects in Mali are shown in Figure 1.

- Location of Tabakorole in southern Mali is shown in Figure 2.

- Diamond drill results from the Northwest Zone at Tabakorole are shown in Figure 3.

- Cross-section (21TBKDD020) of Parallel Zone at Tabakorole is shown in Figure 4.

- Summary plan of 2021 drilling results at Tabakorole is shown in Figure 5.

Figure 1: Location of Tabakorole and Altus’ other projects in Mali

Figure 2: Location of Tabakorole in southern Mali

Figure 3: Diamond drill results from Northwest Zone at Tabakorole

Figure 4: Cross-section (21TBKDD020) of Parallel Zone at Tabakorole

Figure 5: Summary plan of 2021 drilling results at Tabakorole

Tabakorole Project: Location

Tabakorole is a 292km2 gold project located in southern Mali, approximately 280km south of the capital city of Bamako. The Project sits on the Massagui Belt, which hosts the Morila gold mine (operated by Firefinch Limited, ASX: FFX), located approximately 100km to the north. The Project is 125km southeast of the Yanfolila gold mine (operated by Hummingbird Resources Plc, AIM: HUM) and 100km east of the Kalana gold project (operated by Endeavour Mining Plc, LSE and TSX: EDV). Mineralisation hosted on these properties is not necessarily indicative of mineralisation hosted at Tabakorole.

Tabakorole Project: Geology

Tabakorole comprises a 3.2km long shear zone which is up to 200m wide, hosted in the Archaean and Birimian aged Bougouni Basin of the Man Shield of southern Mali. The geology is dominated by clastic sediments, cut by northwest trending deformation zones which host gold mineralisation. At least two, possibly three, Eburnean deformation events are believed to have affected the geology of Tabakorole. The Project hosts the FT Prospect, comprised of mylonites, sheared diorite, gabbro, mafic dykes and late stage felsic dykes, within a folded and deformed metasedimentary package of meta-siltstone, meta-wacke and meta-sandstone. Mineralisation is locally most favourably associated where structures cut gabbro and along lithological contacts with gabbro.

Tabakorole: Mineral Resource Estimate

The FT Prospect at Tabakorole hosts a deposit for which an MRE of 290,000 ounces at 1.2 g/t Au (Indicated resources) and 620,000 ounces at 1.2 g/t Au (Inferred resources) in both oxide and fresh domains has been made as set out in Table 2 below. The MRE was prepared by International Resource Solutions Pty Ltd (Perth, Australia) under the JORC Code and was previously reported by the Company on 30 September 2020 (see Altus’ news release “Substantial Increase in Gold Resource at Tabakorole Project, Southern Mali”). Currently, 43% of the MRE is situated within 100m of surface. The FT Prospect remains open down-dip and along strike. A Qualified Person has not undertaken sufficient work to classify the MRE in accordance with NI 43-101, and the Company is not treating it as such.

Table 2: Mineral Resource Estimate Summary Table (JORC Code)

|

Domain |

Indicated |

Inferred |

||||

|

Tonnes (t) |

Grade (g/t) |

Contained gold (oz) |

Tonnes (t) |

Grade (g/t) |

Contained gold (oz) |

|

|

OXIDE |

1,000,000 |

1.3 |

40,000 |

1,500,000 |

1.3 |

60,000 |

|

FRESH |

6,300,000 |

1.2 |

250,000 |

15,100,000 |

1.2 |

560,000 |

|

Total |

7,300,000 |

1.2 |

290,000 |

16,600,000 |

1.2 |

620,000 |

Notes:

-

Cut-off grade was 0.6 g/t Au.

-

MRE is shown on a gross (100%) basis of the Project. Altus holds a 49% equity interest and Marvel holds a 51% equity interest in the Project.

-

Marvel is the operator of the JV.

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Steven Poulton, Chief Executive of Altus. A graduate of the University of Southampton in Geology (Hons), he also holds a Master's degree from the Camborne School of Mines (Exeter University) in Mining Geology. He is a Fellow of the Institute of Materials, Minerals and Mining and has over 20 years of experience in mineral exploration and is a Qualified Person under the AIM rules and NI 43-101.

For further information you are invited to visit the Company’s website www.altus-strategies.com or contact:

|

Altus Strategies Plc Steven Poulton, Chief Executive |

Tel: +44 (0) 1235 511 767 E-mail: info@altus-strategies.com |

|

SP Angel (Nominated Adviser) Richard Morrison / Adam Cowl |

Tel: +44 (0) 20 3470 0470 |

|

SP Angel (Broker) Grant Barker / Richard Parlons |

Tel: +44 (0) 20 3470 0471 |

|

Shard Capital (Broker) Isabella Pierre / Damon Heath |

Tel: +44 (0) 20 7186 9927 |

|

Yellow Jersey PR (Financial PR & IR) Charles Goodwin / Henry Wilkinson |

Tel: +44 (0) 20 3004 9512 E-mail: altus@yellowjerseypr.com |

About Altus Strategies Plc

Altus Strategies (AIM: ALS, TSX-V: ALTS & OTCQX: ALTUF) is a mining royalty company generating a diversified and precious metal focused portfolio of assets. The Company’s differentiated approach of generating royalties on its own discoveries in Africa and acquiring royalties globally through financings and acquisitions with third parties, has attracted key institutional investor backing. The Company engages constructively with all stakeholders, working diligently to minimise its environmental impact and to promote positive economic and social outcomes in the communities where it operates. For further information, please visit www.altus-strategies.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this announcement, including information relating to future financial or operating performance and other statements that express the expectations of the Directors or estimates of future performance constitute "forward-looking statements". These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the completion of planned expenditures, the ability to complete exploration programmes on schedule and the success of exploration programmes. Readers are cautioned not to place undue reliance on the forward-looking information, which speak only as of the date of this announcement and the forward-looking statements contained in this announcement are expressly qualified in their entirety by this cautionary statement.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. The forward-looking statements contained in this announcement are made as at the date hereof and the Company assumes no obligation to publicly update or revise any forward-looking information or any forward-looking statements contained in any other announcements whether as a result of new information, future events or otherwise, except as required under applicable law or regulations.

TSX Venture Exchange Disclaimer

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organisation of Canada accepts responsibility for the adequacy or accuracy of this release.

Market Abuse Regulation Disclosure

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

Glossary of Terms

“Au” means gold

“DD” means diamond drilling

“g” means grams

“g/t” means grams per tonne

“grade(s)” means the quantity of ore or metal in a specified quantity of rock

“JORC Code” means the 2012 edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia. The JORC Code is an acceptable foreign code for purposes of NI 43-101

“JV” means Joint Venture

“km” means kilometres

“m” means metres

“MRE” means Mineral Resource Estimate

“NI 43-101” means National Instrument 43-101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators

“Oz” means ounces

“Qualified Person” means a person that has the education, skills and professional credentials to qualify as a qualified person under NI 43-101

“NSR” means net smelter return

“RC” means reverse circulation

“t” means a metric tonne

**END**