Bitcoin Well Reports 2023 Q4 and Year End Financial Results

| |||||||||

|  |  |  | ||||||

Edmonton, Alberta – April 24, 2024 – TheNewswire – Bitcoin Well Inc. (“Bitcoin Well” or the “Company”) (TSXV: BTCW; OTCQB: BCNWF), the non-custodial bitcoin business on a mission to enable independence, today announced financial and operating results for the fourth quarter and year ended December 31, 2023.

-

Gross profit

-

$1.4 million for the 3-months ended December 31, 2023 (Q4 2022: $1.2 million, +17%)

-

$4.8 million for the fiscal year ended December 31, 2023 (fiscal year 2022: $4.4 million, +9%)

-

-

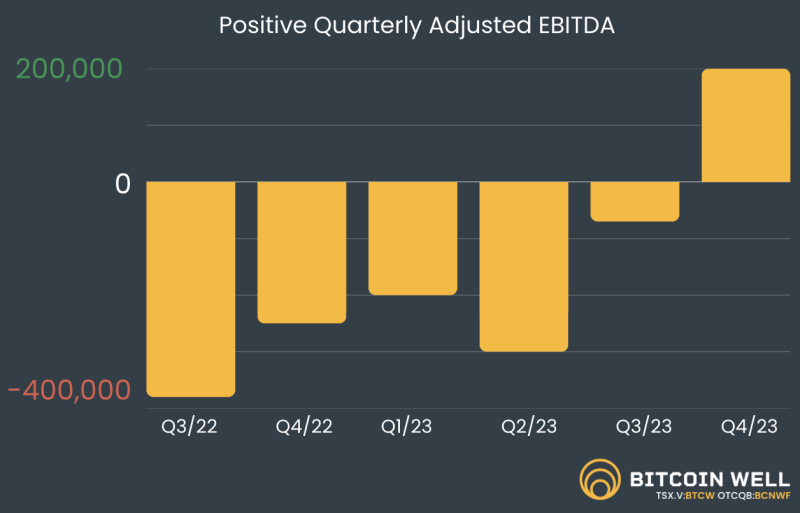

Adjusted EBITDA

-

Positive $0.2 million for the 3-months ended December 31, 2023 (Q4 2022: negative $0.2 million, an improvement of 202%)

-

Negative $0.4 million for the fiscal year ended December 31, 2023 (2022: negative $3.4 million, an improvement of 87%)

-

-

Adjusted cash flow

-

Negative $0.1 million for the 3-months ended December 31, 2023 (Q4 2022: negative $0.6 million, an improvement of 78%)

-

Negative $2.1 million for the fiscal year ended December 31, 2023 (2022: negative $4.9 million, an improvement of 58%)

-

-

Bitcoin Portal

-

Over 11,000 unique user signups as of December 31, 2023

-

Over 16,000 unique signups as of April 15, 2024.

-

Bitcoin Portal Revenues exceeded $5.4 million for the 3-months ended December 31, 2023 (Q3 2023: $3.4 million, improvement of 58%)

-

Bitcoin Portal Revenues are expected to exceed $8.5 million in Q1 2024 (improvement of 57% over Q4, 2023)

-

-

Subsequent to year-end, in March 2024, completed an oversubscribed private placement of an aggregate of 13,352,797 units of the Company at a price of $0.175 per unit for aggregate gross proceeds of over $2.3 million.

|

For the three months ended, |

For the year ended, |

|||||||

|

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||

|

Revenue |

$ 13,590,048 |

$ 18,262,082 |

$ 54,531,838 |

$ 66,731,242 |

||||

|

Gross Profit |

1,427,803 |

1,215,897 |

4,826,169 |

4,424,226 |

||||

|

Adjusted EBITDA(1) |

177,360 |

(173,201) |

(440,794) |

(3,416,889) |

||||

|

Adjusted cash flow(1) |

(138,489) |

(622,957) |

(2,102,581) |

(4,948,835) |

||||

|

Total comprehensive loss |

(1,264,707) |

(3,268,948) |

(5,303,177) |

(11,661,337) |

||||

-

(1) See Non-IFRS Measures.

“We are pleased to have made more gross profit, on less revenue and fewer expenses,” said Adam O’Brien, Founder & CEO of Bitcoin Well. “Not only did we achieve positive adjusted EBITDA, our cash flow is heading in the right direction and I am confident we will see positive adjusted cash flow in 2024.

We also continued to see significant growth on our Online Bitcoin Portal which has now exceeded 16,000 unique signups. We anticipate revenue growth from the Bitcoin Portal will continue to accelerate in 2024.

At the same time, we have managed to increase our Bitcoin ATM gross margins and lower costs. With the release of Cash Vouchers earlier this month we are starting to see the rewards the Bitcoin Well ecosystem can deliver.”

Overall revenue in the fourth quarter of 2023 was $13.6 million, compared to $18.3 million in Q4 2022 (-26%). The decrease of $4.7 million was driven by a decline in Bitcoin Well Infinite (OTC) volumes, as the Company transitioned these services into the Online Bitcoin Portal during fiscal 2023, as well as a strategic decision to charge a higher fee at the ATM which resulted in less revenue per machine, but with a higher gross profit margin and less expenses.

Total operational expenses (excluding financing fees, depreciation and accretion) improved to $1.2 million in Q4 2023 (compared to $1.4 million during the same period in 2022) due to cost containment in areas across the business, including a reduction in the number of full time employees.

Adjusted EBITDA was positive $0.2 million in Q4 2023, reflecting a $0.4 million improvement over Q4 2022. The improved Adjusted EBITDA was due to the higher gross profit and lower operating expenses as discussed above.

The Company confirms that further to the Company’s press release dated February 29, 2024, the Company has issued 571,428 common shares of the Company at a deemed price of $0.105 per share to an arm’s length party as payment for past services rendered to the Company. Bitcoin Well also confirms that further to the Company’s press release dated November 14, 2023, the Company has issued 1,333,333 common shares of the Company at a deemed price of $0.03 per share to an arm’s length party as payment for past services rendered to the Company.

The Common Shares issued are subject to a hold period of four months and one day pursuant to TSX Venture Exchange policies and applicable securities laws.

The Company uses certain terms in this news release, such as ‘Adjusted EBITDA’ and ‘Adjusted cash flow’, which do not have a standardized or prescribed meaning under International Financial Reporting Standards (IFRS), and accordingly, these measurements may not be comparable with the calculation of similar measurements used by other companies.

See the table below for a reconciliation of each non-IFRS measure to its nearest IFRS measure or refer to the "Non-GAAP Measures” and “Selected Financial Information” sections in the Company’s Management Discussion & Analysis for the period ended December 31, 2023 (“MD&A”) for applicable definitions, calculations, rationale for use and reconciliations to the most directly comparable measure under IFRS. Non-IFRS measures are provided as supplementary information by which readers may wish to consider the Company's performance, but should not be relied upon for comparative or investment purposes.

Reconciliation of Adjusted EBITDA & Adjusted cash flow to net loss

|

Three months ended |

Year ended |

|||||||

|

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||

|

Net loss |

$ |

(5,204,590) |

$ |

(1,851,949) |

$ |

(12,024,324) |

$ |

(5,991,501) |

|

Financing fees |

683,513 |

449,756 |

2,285,183 |

1,531,946 |

||||

|

Depreciation and accretion |

297,084 |

361,547 |

1,416,882 |

2,159,814 |

||||

|

Fair value change – crypto loans(1) |

4,328,718 |

(1,215,750) |

7,421,089 |

(5,954,260) |

||||

|

Impairment |

- |

(24,423) |

- |

3,163,599 |

||||

|

Fair value change – investments |

337,635 |

585,066 |

337,635 |

585,066 |

||||

|

Share based compensation |

(19,633) |

110,203 |

483,430 |

313,889 |

||||

|

Loss on disposal of fixed assets |

- |

- |

7,991 |

- |

||||

|

Foreign exchange (gain) loss |

(8,568) |

(1,750) |

9,846 |

- |

||||

|

Loss (gain) on debt settlement |

10,779 |

4,305 |

14,703 |

(118,993) |

||||

|

Fair value change – crypto inventory |

- |

12,106 |

(12,401) |

58,703 |

||||

|

Realized gain on digital assets |

(247,578) |

- |

(622,535) |

- |

||||

|

Business acquisition costs |

- |

24,367 |

- |

56,681 |

||||

|

Income tax expense |

- |

1,373,321 |

241,707 |

778,167 |

||||

|

Adjusted EBITDA |

$ |

177,360 |

$ |

(173,201) |

$ |

(440,794) |

$ |

(3,416,889) |

|

Less: financing fees |

(683,513) |

(449,756) |

(2,285,183) |

(1,531,946) |

||||

|

Add: non-cash interest items(2) |

367,664 |

- |

623,396 |

- |

||||

|

Adjusted cash flow |

$ |

(138,489) |

$ |

(622,957) |

$ |

(2,102,581) |

$ |

(4,948,835) |

-

(1)Non-cash, fair value change on the revaluation of cryptocurrency loans, which are offset by a revaluation gain on digital assets recorded in Other Comprehensive Income.

-

(2)Non-cash interest items include the amortization of prepaid interest on cryptocurrency loans that were funded in conjunction with an equity financing as well as non-cash interest on the line of credit where the accrued interest is added to the principal balance of the loan.

This news release should be read in concert with the full disclosure documents. The Bitcoin Well consolidated financial statements and MD&A for the year ended December 31, 2023 will be available on the Bitcoin Well website (www.bitcoinwell.com), via SEDAR+ (www.sedarplus.ca) or can be requested from the Company.

About Bitcoin Well

Bitcoin Well is on a mission to enable independence. We do this making bitcoin useful to everyday people to give them the convenience of modern banking and the benefits of bitcoin. We like to think of it as future-proofing money. Our existing Bitcoin ATM and Online Bitcoin Portal business units drive cash flow to help fund this mission.

Join our investor community and follow us on Nostr, LinkedIn, Twitter and YouTube to keep up to date with our business.

Bitcoin Well contact information

To book a virtual meeting with our Founder & CEO Adam O’Brien please use the following link: https://bitcoinwell.com/meet-adam

For additional investor & media information, please contact:

Adam O’Brien

Tel: 1 888 711 3866

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements contained in this news release may constitute forward-looking information. Forward-looking information is often, but not always, identified by the use of words such as "anticipate", "plan", "estimate", "expect", "may", "will", "intend", "should", or the negative thereof and similar expressions.

All statements herein other than statements of historical fact constitute forward-looking information including, but not limited to statements in respect of: the Company’s cash flow improving; the Company achieving positive adjusted cash flow in 2024; revenue growth from the Bitcoin Well Portal in 2024; delivery of rewards from the Bitcoin Well ecosystem; Bitcoin Well’s business plans, strategy and outlook.

Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information, including, but not limited to the following: economic and financial conditions, volatility in the capital or credit markets; the level of demand and financial performance of the cryptocurrency and digital asset industry, the occurrence of force majeure events; the extent to which the Company is successful on gaining new long-term users or retaining existing users; developments and changes in laws and regulations, disruptions to the Company’s technology network; inability to obtain financing; competitive factors; and such other factors as discussed in the “Risk Factors” section of the Company’s MD&A for the year ended December 31, 2023. Bitcoin Well actual results could differ materially from those anticipated in this forward-looking information as a result of the foregoing risk factors and other factors, many of which are beyond the control of Bitcoin Well.

Bitcoin Well believes that the expectations reflected in the forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Any forward-looking information contained in this news release represents Bitcoin Well expectations as of the date hereof, and is subject to change after such date. Bitcoin Well disclaims any intention or obligation to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable securities legislation.

For more information, see the Cautionary Note Regarding Forward Looking Information found in the Bitcoin Well Management Discussion and Analysis.