Archive

AbraSilver Reports Best Intercept to Date From Current Drill Program at Diablillos 140 Metres Grading 301 g/t AgEq (4.3 g/t AuEq)

| |||||||||

|  | ||||||||

Includes Impressive 13 Metre Interval Grading 1,029 g/t AgEq (14.7 g/t AuEq) in Oxides

Toronto – TheNewswire - April 11, 2022: AbraSilver Resource Corp. (TSXV:ABRA); (OTC:ABBRF) ("AbraSilver" or the “Company”) is pleased to announce assay results from three new diamond drill holes from the ongoing Phase II drill program on the Company’s wholly owned Diablillos property in Salta Province, Argentina. Highlight intercepts include:

-

Hole DDH 22-004 returned the thickest, high-grade intercept on record at the project with 140 metres at 301 g/t AgEq (219 g/t Ag and 1.17 g/t Au), including 13 metres at 1,029 g/t AgEq (951 g/t Ag and 1.12 g/t Au) in the Tesoro Zone; and

-

Hole DDH 22-002 intersected multiple zones of shallow gold and silver mineralization, with 44 metres at 256 g/t AgEq (116 g/t Ag and 2.00 g/t Au); including 10 metres at 669 g/t AgEq (197 g/t Ag and 6.74 g/t Au) in the southwestern extension of the Main Breccia.

John Miniotis, President and CEO, commented, “We are delighted to continue to receive additional wide, high-grade intercepts from our ongoing exploration program. Hole 22-004 is the thickest high-grade intercept ever recorded on the Diablillos project and will serve to augment the Measured Mineral Resources associated with the Tesoro Zone. Additionally, holes 22-001 and 22-002 will add to the shallow Mineral Resources within the conceptual open pit which should result in further improvement to the economics of the project. All of our Phase II drill results will be incorporated into an updated Mineral Resource estimate which remains on schedule for the third quarter of this year.”

The latest assay result highlights are summarized in Table 1 below.

Table 1 – Drill Result Highlights

(Intercepts greater than 2,000 gram-meters AgEq shown in bold text):

|

Drill Hole |

From (m) |

To (m) |

Type |

Interval (m) |

Ag g/t |

Au g/t |

AgEq1 g/t |

AuEq1 g/t |

||

|

DDH-22-001 |

54 |

78.5 |

Oxides |

24.5 |

57.8 |

0.71 |

107.5 |

1.54 |

||

|

DDH-22-001 |

103.5 |

149 |

Oxides |

45.5 |

59.2 |

0.31 |

80.9 |

1.16 |

||

|

DDH-22-001 |

Including |

103.5 |

123 |

Oxides |

19.5 |

98.4 |

0.19 |

111.7 |

1.60 |

|

|

DDH-22-002 |

75.5 |

83.5 |

Oxides |

8.0 |

35.4 |

2.30 |

196.4 |

2.81 |

||

|

DDH-22-002 |

92.5 |

136.5 |

Oxides |

44.0 |

115.8 |

2.00 |

255.8 |

3.65 |

||

|

DDH-22-002 |

Including |

104.5 |

125.5 |

Oxides |

21.0 |

162.3 |

3.73 |

423.4 |

6.05 |

|

|

DDH-22-002 |

Including |

106.5 |

116.5 |

Oxides |

10.0 |

196.7 |

6.74 |

668.5 |

9.55 |

|

|

DDH-22-002 |

138.5 |

144.5 |

Oxides |

6.0 |

326.8 |

0.12 |

335.2 |

4.79 |

||

|

DDH-22-004 |

31 |

38 |

Oxides |

7.0 |

20.8 |

0.83 |

78.9 |

1.13 |

||

|

DDH-22-004 |

131 |

271 |

Oxides |

140.0 |

219.0 |

1.17 |

300.9 |

4.30 |

||

|

DDH-22-004 |

Including |

146 |

203 |

Oxides |

57 |

368.8 |

0.81 |

425.5 |

6.08 |

|

|

DDH-22-004 |

Including |

176 |

189 |

Oxides |

13 |

950.9 |

1.12 |

1,029.3 |

14.70 |

|

|

DDH-22-004 |

278.5 |

284 |

Oxides |

5.5 |

207.5 |

0.44 |

238.3 |

|||

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths.

1 AgEq & AuEq calculations for reported drill results are based on USD $1,750/oz Au and $25.00/oz Ag. The calculations assume 100% metallurgical recovery and are indicative of gross in-situ metal value at the indicated metal prices.

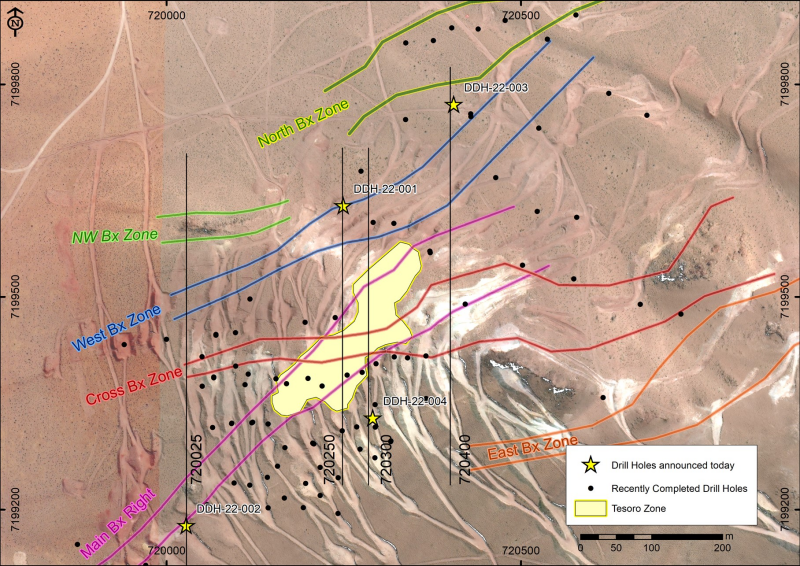

Figure 1 – Drill Hole Location Map

Discussion of Drill Hole Results

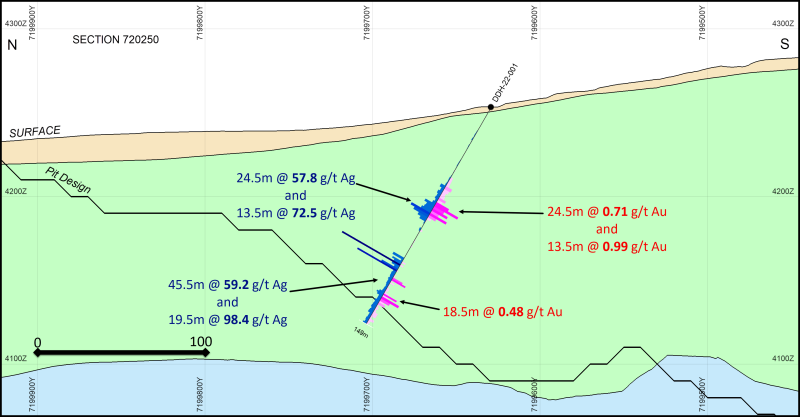

Hole DDH 22-001 was drilled to test for shallow oxide mineralisation in the northern part of the Oculto zone (West Breccia). The hole successfully intersected two mineralised zones, with 24.5 metres at 58 g/t Ag and 0.71 g/t Au from 54 to 78.5 meters, and 45.5 metres at 59 g/t Ag and 0.31 g/t Au from 103.5 to 149.0 meters.

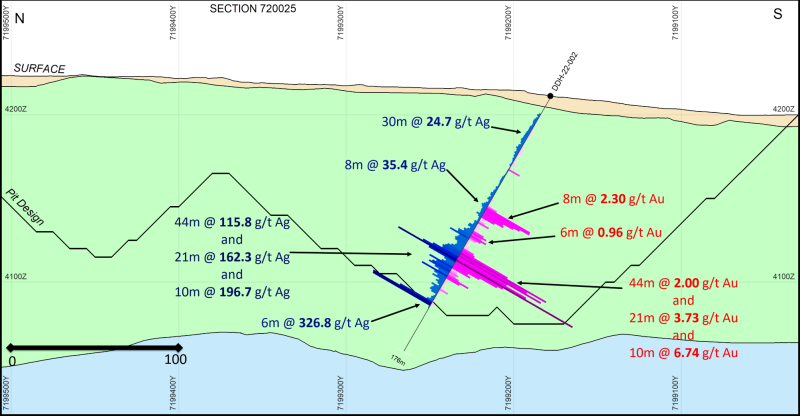

Hole DDH 22-002 was drilled to test for shallow oxide mineralization at Oculto in the southwestern part of the Main Breccia. The hole intersected several mineralised zones, with 44.0 metres at 116 g/t Ag and 2.00 g/t Au from 92.5 to 136.5 metres, including 10.0 metres at 197 g/t Ag and 6.74 g/t Au from 106.5 to 116.5 meters. A further intercept was encountered totaling 6.0 metres at 327 g/t Ag and 0.12 g/t Au from 138.5 to 144.5 meters.

The intercepts in holes DDH 22-001 and DDH 22-002 are expected to help further expand shallow Mineral Resources within the proposed open pit and reduce the overall stripping ratio.

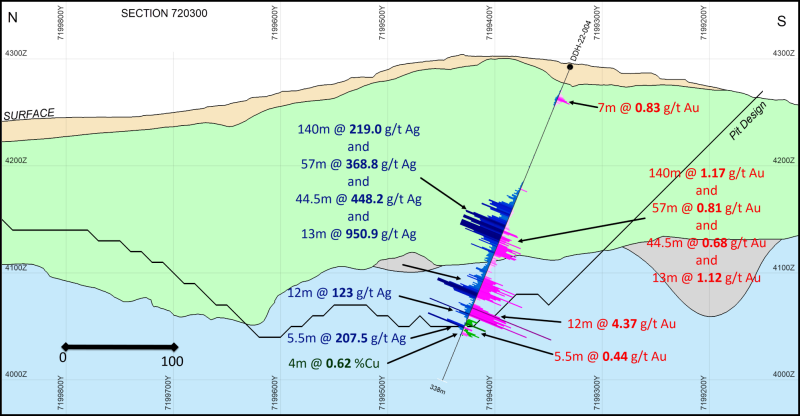

Hole DDH 22-004 was drilled perpendicular to the intersection of the Main and Cross Breccias to test the true thickness of the high-grade Tesoro Zone. The hole encountered several high-grade mineralised zones including 140 metres at 219 g/t Ag and 1.17 g/t Au from 131.0 to 271.0 meters, including 57 metres at 369 g/t Ag and 0.81 g/t Au, as well as 13 metres at 951 g/t Ag and 1.12 g/t Au. This wide high-grade intercept of gold and silver mineralization is expected to add substantially to the Measured Mineral Resources at Oculto.

Exploration Outlook

A total of 15,668 metres has now been completed as part of the Company’s 20,000 metre Phase II exploration program at Diablillos. Drills are focused on expanding mineralization for inclusion in the next Mineral Resource Estimate, anticipated in the third quarter 2022, as well as in-fill drilling (estimated 25 metre spacing) to reclassify existing Indicated Mineral Resources to the Measured category. To date, our Phase II drill results reveal the exceedingly high-grade nature of the Diablillos project and validates the Company’s geological model. The best results to date are summarized in Table 1, below.

Table 1 – Diablillos Project – Top Phase II Drill Intercepts Reported To Date

|

Hole |

From (m) |

To (m) |

Type |

Interval (m) |

Ag (g/t) |

Au (g/t) |

AgEq1 (g/t) |

AuEq1 (g/t) |

|

22-004 |

131 |

271 |

Oxides |

140.0 |

219.0 |

1.17 |

300.9 |

4.30 |

|

21-038 |

112 |

221.3 |

Oxides |

109.3 |

176.8 |

1.53 |

283.9 |

4.06 |

|

21-067 |

242 |

308 |

Oxides |

66.0 |

57.0 |

1.90 |

190.0 |

2.71 |

|

21-068 |

89 |

146 |

Oxides |

57.0 |

108.0 |

1.47 |

210.9 |

3.01 |

|

21-022 |

192 |

245 |

Oxides |

53.0 |

33.3 |

2.49 |

207.6 |

2.97 |

1 AgEq & AuEq calculations for reported drill results are based on USD $1,750/oz Au and $25.00/oz Ag. The calculations assume 100% metallurgical recovery and are indicative of gross in-situ metal value at the indicated metal prices.

Figure 2 – Cross Section (Looking East) with Highlighted intercepts in Hole DDH 22-001

Figure 3 - Cross Section (Looking East) with Highlighted intercepts in Hole DDH 22-002

Figure 4 - Cross Section (Looking East) with Highlighted intercepts in Hole DDH 22-004

Collar Data

|

Hole Number |

UTM Coordinates |

Elevation |

Azimuth |

Dip |

Depth |

|

|

DDH 22-001 |

E720249 |

N7199629 |

4,253 |

0 |

-60 |

149 |

|

DDH 22-002 |

E720028 |

N7199178 |

4,211 |

0 |

-60 |

176 |

|

DDH 22-003 |

E720405 |

N7199772 |

4,259 |

180 |

-60 |

374 |

|

DDH 22-004 |

E720291 |

N7199330 |

4,292 |

315 |

-60 |

338 |

About Diablillos

The 80 km2 Diablillos property is located in the Argentine Puna region - the southern extension of the Altiplano of southern Peru, Bolivia, and northern Chile - and was acquired from SSR Mining Inc. by the Company in 2016. There are several known mineral zones on the Diablillos property, with the Oculto zone being the most advanced with over 90,000 meters drilled to date. Oculto is a high-sulphidation epithermal silver-gold deposit derived from remnant hot springs activity following Tertiarty-age local magmatic and volcanic activity. Comparatively nearby examples of high sulphidation epithermal deposits include: Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina).

The Mineral Resource for the Oculto Deposit is shown in Table 2 below:

Table 2 - 2021 Mineral Resource Estimate for the Oculto Deposit, Diablillos Project

|

Category |

Tonnage (000 t) |

Ag (g/t) |

Au (g/t) |

Contained Ag (000 oz Ag) |

Contained Au (000 oz Au) |

|

Measured |

8,235 |

124 |

0.98 |

32,701 |

259 |

|

Indicated |

32,958 |

54 |

0.70 |

57,464 |

744 |

|

Measured & Indicated |

41,193 |

68 |

0.76 |

90,165 |

1,002 |

|

Inferred |

2,884 |

34 |

0.70 |

3,181 |

66 |

Effective September 8, 2021. The Mineral Resource estimate and supporting Technical Report are N.I. 43-101 compliant. Full details of the Mineral Resources are available in a Company news release dated September 15, 2021. For additional information please see Technical Report on the Diablillos Project, Salta Province, Argentina, dated October 28, 2021, completed by Mining Plus, and available on www.SEDAR.com.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company’s geologists in accordance with industry practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals; these include blanks and certified reference materials as well as duplicate core samples which are collected in order to measure sample representivity. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are received by the SGS offices in Salta who then dispatch the samples to the SGS preparation facility in San Juan. From there, the prepared samples are sent to the SGS laboratory in Lima, Peru where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four acid digestion followed by ICP/AES detection, and gold is analyzed by 50g Fire Assay with an AAS finish. Silver results greater than 100g/t are reanalyzed using four acid digestion with an ore grade AAS finish.

Qualified Persons

David O’Connor P.Geo., Chief Geologist for AbraSilver, is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical information in this news release.

About AbraSilver

AbraSilver is a well-funded silver-gold focused advanced-stage exploration company. The Company is rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina, which has a current Measured and Indicated Mineral Resource of over 90 million ounces of silver and 1.0 million ounces of gold. The updated PEA study completed in November 2021 demonstrates that Diablillos has the potential to be a highly economic project. The Company is led by an experienced management team and has long-term supportive shareholders including Mr. Eric Sprott and SSR Mining. In addition, AbraSilver owns a portfolio of earlier-stage copper-gold projects including the La Coipita copper-gold project in the San Juan province of Argentina. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. under the symbol “ABBRF”.

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively please contact:

John Miniotis, President and CEO

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release