Archive

Jervois Global Limited Quarterly Activities Report to 31 December 2023

| |||||||||

|  | ||||||||

|

Highlights Jervois Finland:

Idaho Cobalt Operations (“ICO”), United States (“U.S.”):

São Miguel Paulista (“SMP”) nickel and cobalt refinery, Brazil:

Corporate:

|

Advancing on business priorities

30 January 2024 – TheNewswire – Australia - Jervois Global Limited (“Jervois” or the “Company”) (ASX:JRV) (TSXV:JRV) (OTC:JRVMF) continued to implement a refocused strategy to ensure the business can be financially sustainable and self-funding at historically low cobalt prices caused by the People’s Republic of China (“PRC”) oversupply from the Democratic Republic of the Congo and Indonesia.

Priorities and key milestones delivered in the quarter:

-

Maximise margin and cash flow at Jervois Finland, and deliver operational improvements:

-

-

-

US$4.7 million cash flow from operations in Q4 2023; US$46.1 million for 2023 year.

-

Wide-ranging cost reduction and improvement programme launched to deepen resilience to current weakness in cobalt prices.

-

-

-

Support the advancement of U.S. Government policy and regulatory framework as it pertains to strengthening critical mineral supply chains underpinning Americas’ energy transition and national security.

-

-

Engagement with U.S. Department of Treasury and the Internal Revenue Service as they seek industry input regarding implementation of investment and production tax credits under the Inflation Reduction Act of 2022 (IRA”).

-

In December, the U.S. Congressional Select Committee on the Chinese Communist Party proposed a reserve to sustain a floor cobalt price for American producers. In 2024, Jervois will continue to work in Washington, D.C. toward passage of legislation that puts this recommendation into force.

-

-

-

Execute U.S. DoD funded US$15.0 million ICO drilling programme and U.S. cobalt refinery BFS:

-

-

Surface drilling completed at the Sunshine deposit and results released alongside this quarterly report.

-

Preparatory underground drift mine development for extension drilling of the RAM deposit are underway.

-

Activities continued on Basic Engineering and preparation of an accompanying BFS for a U.S. cobalt refinery, led by engineering firm AFRY USA LLC.

-

U.S. cobalt refinery site selection has reached short listing phase.

-

-

-

Advance debt and partner financing process at SMP:

-

-

Engagement with multiple parties for project-level funding for the SMP restart capital project advanced in Q4 2023 and is continuing in Q1 2024.

-

SMP hosted due diligence site visits for qualified parties during the quarter.

-

-

-

Review partnership opportunities to crystalise and demonstrate value:

-

-

Active engagement with potential partners is continuing in Q1 2024.

-

-

Jervois Finland

-

Quarterly revenue: US$38.7 million (Q3 2023: US$42.2 million)

-

Cash flow from operations: US$4.7 million (Q3 2023: US$8.2 million)

-

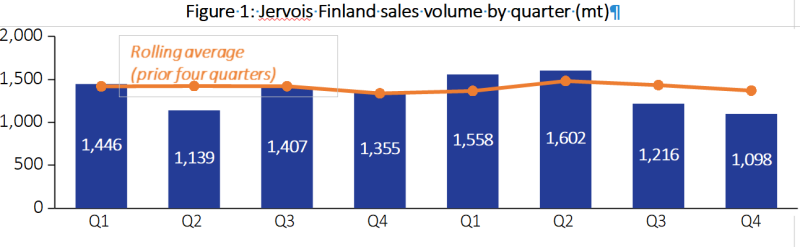

Sales volume: 1,098 metric tonnes (Q3 2023: 1,216 metric tonnes)

-

Production volume: 1,102 metric tonnes (Q3 2023: 1,285metric tonnes)

Jervois Finland continued to generate positive operating cash flow in the quarter, including through the continued release of working capital. As outlined above, Jervois Finland has generated US$46.1 million in operating cash flow over 2023 under difficult market conditions. As outlined earlier, Company earnings, including Adjusted EBITDA for Jervois Finland, will be released with the annual audited financial statements.

Sales and marketing

Jervois Finland produced 1,102 metric tonnes and sold 1,098 metric tonnes of cobalt in the quarter.

The decrease in sales volumes relative to the prior quarter reflected continued cyclical softness in demand in end-use segments, and variability in shipment and customer order timing. Sales volumes to 31 December 2023 were 5,474 mt, +2% higher than 2022 volumes of 5,347 mt, and within the sales volume guidance range for the 2023 calendar year of 5,300 mt to 5,600 mt. Production volumes and product mix remains subject to continuous review and adjustment based on an assessment of end-use demand and considering target inventory levels. Production levels in the quarter were lower than capacity to achieve alignment with current market demand.

Jervois Finland’s sales performance and outlook for key market segments under which Jervois Finland operates are summarised below.

Batteries:

-

There is increasing optimism that destocking rates in the battery sector have subsided and customer inventory levels have reduced. Recovery from current Jervois customers is expected over the course of 2024.

-

Interest continues from both European and U.S. based EV OEMs (automakers) for long-term cobalt supply but with volumes starting in 2025 and beyond.

-

U.S. IRA continues to drive interest in U.S. and other Western supply of battery raw materials, providing a key advantage to Kokkola as the leading global cobalt refinery outside of China.

Chemicals, Catalysts, and Ceramics:

-

Chemicals: Demand continues to be stable in the main chemical applications (copper electrowinning, coatings, and rubber adhesion).

-

Catalysts: Oil and gas segment (processing / refining) remains steady, and outlook remains positive.

-

Ceramics: Continue to see reduced demand and rising competition (especially ex PRC) in this sector, linked to lower end-use demand in the housing and construction sector. In particular, weak construction markets in China are causing Chinese cobalt suppliers to aggressively access export markets, driving down prices. Demand is volatile, and consumers often wait for favourable market pricing. Prices in ceramics look to remain under pressure through the coming months, with limited ESG impacts on buyer behaviour.

Powder Metallurgy:

-

Lower demand and competition have limited volumes into all powder metallurgy applications.

-

Automotive, oil and gas production (drilling), general engineering, and construction all remain soft.

-

Aerospace remains positive with solid demand from both civilian and military sectors.

Sales volume guidance for the 2024 calendar year of 5,300 mt to 5,600 mt aligns with 2023 guidance and outcomes. Guidance takes account of current expectations on near-term market conditions. Production levels are expected to also be broadly consistent with sales volumes. Jervois maintains significant optionality for future increases in sales volumes when the cobalt market recovers.

Financial performance

Jervois Finland achieved revenue of US$38.7 million in the quarter, a decline of 8% relative to the prior quarter. The decrease was principally due to lower sales volumes, partially offset by a modest improvement in realised pricing. The cyclical weakness in cobalt prices that persisted in the quarter was in part due to continued market oversupply conditions instigated by the PRC, as outlined earlier.

Cash flow performance

Cash flow from operations (before interest payments) was US$4.7 million in the quarter, bringing cumulative year to date cash flow from operations from Jervois Finland to US$46.1 million. Positive cash flow resulted from the continued stabilisation of the Jervois Finland business and working capital improvements. Physical cobalt inventories reduced by US$3.8 million from US$44.5 million at 30 September 2023 to US$40.7 million at 31 December 2023. This represented a reduction from 1,353 mt and ~81 days at 30 September 2023 to 1,297 mt ~78 days at 31 December 2023 (based on a normalised 6,000 mt annual production rate). Jervois is continuing to execute an inventory management strategy aligned to a near-term target range below 90 days, in a manner that balances liquidity and risk management objectives.

Jervois launched a wide-ranging cost reduction and improvement programme in Q4 2023, aiming to deepen business resilience to current weakness in cobalt prices, and to deliver benefits to profitability and cash flow in 2024 and beyond. Jervois is implementing this in Q1 2024.

Jervois made a voluntary repayment of US$4.8 million to Mercuria in early October 2023 to meet deleveraging objectives and to reduce financing costs. The current loan balance at the date of this report is US$44.1 million.

Jervois USA

Idaho Cobalt Operations (“ICO”), U.S.

Jervois successfully completed initial surface drilling of the Sunshine historic resource during the quarter. The Sunshine deposit is a historic resource located a short distance from the mill and concentrator facilities at ICO. Jervois drilled seven holes from surface topography, comprising 1,100 metres (3,700 feet) in total.

Results for the Sunshine campaign were received, reviewed, and delivered to Apex Geoscience for incorporation within an updated MRE in Q1 2024. Seven of nine drillholes were successful in reaching the targeted depth. Analytical results from ALS Laboratories indicate the presence of cobalt, copper, and gold mineralisation within proximity to historic drillholes completed within the Sunshine deposit with varying grade continuity, as expected from prior investigations.

Results from the programme are outlined below:

-

2.9m calculated true width (“CTW”) @ 0.01% cobalt (“Co”), 0.27% copper (“Cu”), 0.03 grams per metric tonne (“g/t”) gold (“Au”) (Drillhole SS23-01A)

-

1.2m CTW @ 0.34% Co, 10.05% Cu, 13.68 g/t Au (Drillhole SS23-02)

-

1.7m CTW @ 0.68% Co, 0.35% Cu, 0.51 g/t Au (Drillhole SS23-03)

-

0.5m CTW @ 1.55% Co, 0.02% Cu, 1.30 g/t Au (Drillhole SS23-04)

-

2.6m CTW @ 0.78% Co, 0.12% Cu, 0.41 g/t Au (Drillhole SS23-05)

-

3.2m CTW @ 0.05% Co, 0.89% Cu, 0.07 g/t Au (Drillhole SS23-06A)

-

0.9m CTW @ 0.07% Co, 1.10% Cu, 0.03 g/t Au (Drillhole SS23-07)

Detailed geological modelling and geostatistical estimation is underway.

Following completion of drilling at Sunshine, Jervois commenced an underground resource extension programme at the RAM deposit, via its local mining contractor Small Mine Development. The RAM resource extension programme includes the commenced construction of an underground exploration drift as well as the extensional drilling to define potential step-outs from the existing RAM MRE which the commenced construction will enable3. The extensional drilling is expected to start in late Q1 2024.

Based on the existing U.S. DoD US$15.0 million funding agreement (the “Agreement Funding”), Jervois anticipates its costs for these exploration programmes, up to the end of Q3 2024 for exploration development, drilling, logging, assaying, MRE modelling and other related costs, to be fully reimbursed.

The Agreement Funding is under the Manufacturing Capability Expansion and Investment Prioritization office of Industrial Base Policy using the U.S. Defense Production Act Title III authorities and utilises funds from the Additional Ukraine Supplemental Appropriations Act. The resource extension programme direct expenditure and associated Jervois programme supervision are fully refundable by the DoD.

During the quarter, Jervois welcomed a bipartisan proposal of the U.S. Congress’ Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party (the “Congressional Select Committee”) to create a critical mineral reserve (“Resilient Resource Reserve”) to sustain the cobalt price (among other critical minerals) for U.S. producers when the price dips below a floor, and for producers to recontribute during periods of high prices. The proposed Resilient Resource Reserve is designed to insulate U.S. critical mineral producers, including cobalt producers, from the current price volatility resulting from China’s dominance of global critical mineral supply chains.

The Congressional Select Committee also proposed that the U.S.’ Export-Import Bank (“EXIM”) would expand and extend its risk appetite under the China and Transformational Exports Program (“CTEP”) for the financing of mining and critical minerals activities, including cobalt. EXIM has previously advised Jervois that ICO is eligible for potential financing support under both CTEP and the Make More in America (“MMIA”) initiative. CTEP and MMIA enable EXIM to extend its existing medium- and long-term loan and loan guarantee programmes to support projects that reduce Chinese dominance in strategic sectors, such as ICO, whose mineral resource and reserve is the largest and highest grade confirmed cobalt orebody in the U.S. EXIM is the official export credit agency of the U.S. Government.

These extensive bipartisan legislative proposals are included in the Congressional Select Committee’s report entitled Reset, Prevent, Build: A Strategy to Win America’s Economic Competition with the Chinese Communist Party, which will be introduced for consideration by the full U.S. Congress in 2024.

As a result of continued suspension of operations at ICO, together with external factors, including current cobalt pricing and updates to commodity price forecasts, Jervois has commenced a review of ICO’s carrying value as of 31 December 2023. The review is ongoing, and a further update will be provided with the release of the annual financial results. Based on work completed to date, Jervois is likely to record an impairment of the carrying value of ICO at 31 December 2023.

U.S. cobalt refinery study

Progress continued on site selection and the study for a U.S. domestic cobalt refinery, with works fully reimbursed under the Agreement Funding. The site selection process has reached a shortlisting phase, with the preferred site expected to be selected in Q1 2024. Jervois is targeting completion of Basic Engineering and the BFS by mid-2024.

São Miguel Paulista (“SMP”) nickel and cobalt refinery, Brazil

Partner financing opportunities at SMP progressed, with several parties continuing to engage in detailed due diligence during the quarter, including visits to the SMP facility. Engagement with multiple parties for project-level funding for the SMP restart capital project is continuing in Q1 2024.

Sales of Mixed Hydroxide Precipitate (“MHP”) from remediation activities commenced over the quarter-end, with deliveries from early January 2024. These sales provide valuable experience and confirmation of export logistics at SMP for the planned restart.

Jervois has continued to review opportunities to optimise the SMP restart project, and stress-tested the project’s economics against spot pricing scenarios in view of the recent volatility in nickel markets. The project’s economics remain resilient at current spot pricing levels for LME nickel prices and MHP feed supply.

Nico Young nickel-cobalt project, New South Wales, Australia

Jervois continued to pursue a divestment process to sell all or part of its interest in the Company’s 100%-owned Nico Young nickel and cobalt project. Several base metals exploration and development companies expressed interest in the asset in 2023, but engagement was suspended due to the limited ability of the parties to finance a transaction.

Jervois has now concluded the formal divestment process but will continue to review strategic options to move the project forward. Jervois has historically invested >A$20 million in Nico Young. It is a strategic future source of Western nickel and cobalt.

Corporate activities

Liquidity and portfolio optimisation

A key strategic objective for Jervois is to de-risk the path to establishing a multi-asset platform underpinned by a durable capital structure. Jervois is pursuing initiatives across its asset portfolio to meet this objective, including in response to inbound interest. Jervois is focussed on delivering initiatives in a timely manner, and the quality of any transactions that the Company may elect to pursue. Notwithstanding the weakening of investor sentiment toward battery materials, active engagement with high-quality potential counterparties is continuing in Q1 2024. Jervois will continue to update the market on progress.

Jervois ended the December 2023 quarter with US$45.4 million in cash, US$40.7 million in physical cobalt inventories in Jervois Finland, and total drawn senior debt of US$144.1 million4.

2023 financial results

As previously indicated, Jervois will report full financial results for the year ending 31 December 2023, including earnings (and EBITDA), once its financial statement audit has been completed during March 2024.

Environmental, social, governance (“ESG”)

In the quarter, Jervois Finland received results from its EcoVadis assessment and received a Gold Medal rating. This places Jervois Finland in the top 2% of all companies assessed in the past 12 months (over 40,000 companies).

Jervois engaged in several ESG-related events during the quarter, co-ordinated by the Responsible Minerals Initiative and the Cobalt Institute, focussed on engagement with stakeholders on ESG industry standards.

Jervois also continued its engagement with the National Mining Association, including its ESG Task Force, and through participation in an International Energy Agency Industry Roundtable on Critical Minerals.

Finally, Jervois presented on a panel for the EiTRaw Materials Expert Forum on “Responsible Sourcing, Driving Sustainable Change”, held between 7 and 8 December 2023 in Prague, Czechia.

Exploration and development expenditure

In relation to the DoD funded surface drilling campaign at ICO, US$1.4 million was incurred during the quarter. No other material cash expenditure on exploration and development was spent during the quarter.

Insider compensation reporting

During the quarter, US$0.1 million was paid to Non-Executive Directors and US$0.1 million was paid to the CEO (Executive Director).

Non-core assets

The non-core assets are summarised on the Company’s website.

By order of the Board

Bryce Crocker

Chief Executive Officer

For further information, please contact:

|

Investors and analysts: Alicia Brown Group Manager External Affairs Jervois Global Limited |

Media: Nathan Ryan NWR Communications nathan.ryan@nwrcommunications.com.au Mobile: +61 420 582 887 |

Corporate Information

2,703M Ordinary Shares

72.1M Options

23.4M Performance Rights

Non-Executive Chairman

Peter Johnston

CEO and Executive Director

Bryce Crocker

Non-Executive Directors

Brian Kennedy

Michael Callahan

David Issroff

Daniela Chimisso dos Santos

Company Secretary

Alwyn Davey

Contact Details

Suite 2.03,

1-11 Gordon Street

Cremorne

Victoria 3121

Australia

P: +61 (3) 9583 0498

E: admin@jervoisglobal.com

W: www.jervoisglobal.com

Forward-Looking Statements

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to partnership for group operations, operations at Jervois Finland, drilling to be undertaken at ICO, U.S. refinery studies, reimbursement of funds to Jervois Mining USA Limited by the DoD, timing of restart of SMP refinery, and the reliability of third-party information, and certain other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules, and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Tenements

Australian Tenements

|

Description |

Tenement number |

Interest owned % |

|

|

Ardnaree (NSW) |

EL 5527 |

100.0 |

|

|

Thuddungra (NSW) |

EL 5571 |

100.0 |

|

|

Nico Young (NSW) |

EL 8698 |

100.0 |

|

|

West Arunta (WA) |

E80 4820 |

17.9 |

|

|

West Arunta (WA) |

E80 4986 |

17.9 |

|

|

West Arunta (WA) |

E80 4987 |

17.9 |

|

Uganda Exploration Licences |

|||

|

Description |

Exploration Licence number |

Interest owned % |

|

|

Kilembe Area |

EL0292 |

100.0 |

|

|

SUN 1 |

222991 |

174156 |

|

SUN 2 |

222992 |

174157 |

|

SUN 3 Amended |

245690 |

174158 |

|

SUN 4 |

222994 |

174159 |

|

SUN 5 |

222995 |

174160 |

|

SUN 6 |

222996 |

174161 |

|

SUN 7 |

224162 |

174628 |

|

SUN 8 |

224163 |

174629 |

|

SUN 9 |

224164 |

174630 |

|

SUN 16 Amended |

245691 |

177247 |

|

SUN 18 Amended |

245692 |

177249 |

|

Sun 19 |

277457 |

196394 |

|

SUN FRAC 1 |

228059 |

176755 |

|

SUN FRAC 2 |

228060 |

176756 |

|

TOGO 1 |

228049 |

176769 |

|

TOGO 2 |

228050 |

176770 |

|

TOGO 3 |

228051 |

176771 |

|

DEWEY FRAC Amended |

248739 |

177253 |

|

Powder 1 |

269506 |

190491 |

|

Powder 2 |

269505 |

190492 |

|

LDC-1 |

224140 |

174579 |

|

LDC-2 |

224141 |

174580 |

|

LDC-3 |

224142 |

174581 |

|

LDC-5 |

224144 |

174583 |

|

LDC-6 |

224145 |

174584 |

|

LDC-7 |

224146 |

174585 |

|

LDC-8 |

224147 |

174586 |

|

LDC-9 |

224148 |

174587 |

|

LDC-10 |

224149 |

174588 |

|

LDC-11 |

224150 |

174589 |

|

LDC-12 |

224151 |

174590 |

|

LDC-13 Amended |

248718 |

174591 |

|

LDC-14 Amended |

248719 |

174592 |

|

LDC-16 |

224155 |

174594 |

|

LDC-18 |

224157 |

174596 |

|

LDC-20 |

224159 |

174598 |

|

LDC-22 |

224161 |

174600 |

|

LDC FRAC 1 Amended |

248720 |

175880 |

|

LDC FRAC 2 Amended |

248721 |

175881 |

|

LDC FRAC 3 Amended |

248722 |

175882 |

|

LDC FRAC 4 Amended |

248723 |

175883 |

|

LDC FRAC 5 Amended |

248724 |

175884 |

|

RAM 1 |

228501 |

176757 |

|

RAM 2 |

228502 |

176758 |

|

RAM 3 |

228503 |

176759 |

|

RAM 4 |

228504 |

176760 |

|

RAM 5 |

228505 |

176761 |

|

RAM 6 |

228506 |

176762 |

|

RAM 7 |

228507 |

176763 |

|

RAM 8 |

228508 |

176764 |

|

RAM 9 |

228509 |

176765 |

|

RAM 10 |

228510 |

176766 |

|

RAM 11 |

228511 |

176767 |

|

RAM 12 |

228512 |

176768 |

|

RAM 13 Amended |

245700 |

181276 |

|

RAM 14 Amended |

245699 |

181277 |

|

RAM 15 Amended |

245698 |

181278 |

|

RAM 16 Amended |

245697 |

181279 |

|

Ram Frac 1 Amended |

245696 |

178081 |

|

Ram Frac 2 Amended |

245695 |

178082 |

|

Ram Frac 3 Amended |

245694 |

178083 |

|

Ram Frac 4 Amended |

245693 |

178084 |

|

HZ 1 |

224173 |

174639 |

|

HZ 2 |

224174 |

174640 |

|

HZ 3 |

224175 |

174641 |

|

HZ 4 |

224176 |

174642 |

|

HZ 5 |

224413 |

174643 |

|

HZ 6 |

224414 |

174644 |

|

HZ 7 |

224415 |

174645 |

|

HZ 8 |

224416 |

174646 |

|

HZ 9 |

224417 |

174647 |

|

HZ 10 |

224418 |

174648 |

|

HZ 11 |

224419 |

174649 |

|

HZ 12 |

224420 |

174650 |

|

HZ 13 |

224421 |

174651 |

|

HZ 14 |

224422 |

174652 |

|

HZ 15 |

231338 |

178085 |

|

HZ 16 |

231339 |

178086 |

|

HZ 18 |

231340 |

178087 |

|

HZ 19 |

224427 |

174657 |

|

Z 20 |

224428 |

174658 |

|

HZ 21 |

224193 |

174659 |

|

HZ 22 |

224194 |

174660 |

|

HZ 23 |

224195 |

174661 |

|

HZ 24 |

224196 |

174662 |

|

HZ 25 |

224197 |

174663 |

|

HZ 26 |

224198 |

174664 |

|

HZ 27 |

224199 |

174665 |

|

HZ 28 |

224200 |

174666 |

|

HZ 29 |

224201 |

174667 |

|

HZ 30 |

224202 |

174668 |

|

HZ 31 |

224203 |

174669 |

|

HZ 32 |

224204 |

174670 |

|

HZ FRAC |

228967 |

177254 |

|

JC 1 |

224165 |

174631 |

|

JC 2 |

224166 |

174632 |

|

JC 3 |

224167 |

174633 |

|

JC 4 |

224168 |

174634 |

|

JC 5 Amended |

245689 |

174635 |

|

JC 6 |

224170 |

174636 |

|

JC FR 7 |

224171 |

174637 |

|

JC FR 8 |

224172 |

174638 |

|

JC 9 |

228054 |

176750 |

|

JC 10 |

228055 |

176751 |

|

JC 11 |

228056 |

176752 |

|

JC-12 |

228057 |

176753 |

|

JC-13 |

228058 |

176754 |

|

JC 14 |

228971 |

177250 |

|

JC 15 |

228970 |

177251 |

|

JC 16 |

228969 |

177252 |

|

JC 17 |

259006 |

187091 |

|

JC 18 |

259007 |

187092 |

|

JC 19 |

259008 |

187093 |

|

JC 20 |

259009 |

187094 |

|

JC 21 |

259010 |

187095 |

|

JC 22 |

259011 |

187096 |

|

CHELAN NO. 1 Amended |

248345 |

175861 |

|

GOOSE 2 Amended |

259554 |

175863 |

|

GOOSE 3 |

227285 |

175864 |

|

GOOSE 4 Amended |

259553 |

175865 |

|

GOOSE 6 |

227282 |

175867 |

|

GOOSE 7 Amended |

259552 |

175868 |

|

GOOSE 8 Amended |

259551 |

175869 |

|

GOOSE 10 Amended |

259550 |

175871 |

|

GOOSE 11 Amended |

259549 |

175872 |

|

GOOSE 12 Amended |

259548 |

175873 |

|

GOOSE 13 |

228028 |

176729 |

|

GOOSE 14 Amended |

259547 |

176730 |

|

GOOSE 15 |

228030 |

176731 |

|

GOOSE 16 |

228031 |

176732 |

|

GOOSE 17 |

228032 |

176733 |

|

GOOSE 18 Amended |

259546 |

176734 |

|

GOOSE 19 Amended |

259545 |

176735 |

|

GOOSE 20 |

228035 |

176736 |

|

GOOSE 21 |

228036 |

176737 |

|

GOOSE 22 |

228037 |

176738 |

|

GOOSE 23 |

228038 |

176739 |

|

GOOSE 24 |

228039 |

176740 |

|

GOOSE 25 |

228040 |

176741 |

|

SOUTH ID 1 Amended |

248725 |

175874 |

|

SOUTH ID 2 Amended |

248726 |

175875 |

|

SOUTH ID 3 Amended |

248727 |

175876 |

|

SOUTH ID 4 Amended |

248717 |

175877 |

|

SOUTH ID 5 Amended |

248715 |

176743 |

|

SOUTH ID 6 Amended |

248716 |

176744 |

|

South ID 7 |

306433 |

218216 |

|

South ID 8 |

306434 |

218217 |

|

South ID 9 |

306435 |

218218 |

|

South ID 10 |

306436 |

218219 |

|

South ID 11 |

306437 |

218220 |

|

South ID 12 |

306438 |

218221 |

|

South ID 13 |

306439 |

218222 |

|

South ID 14 |

306440 |

218223 |

|

OMS-1 |

307477 |

218904 |

|

Chip 1 |

248956 |

184883 |

|

Chip 2 |

248957 |

184884 |

|

Chip 3 Amended |

277465 |

196402 |

|

Chip 4 Amended |

277466 |

196403 |

|

Chip 5 Amended |

277467 |

196404 |

|

Chip 6 Amended |

277468 |

196405 |

|

Chip 7 Amended |

277469 |

196406 |

|

Chip 8 Amended |

277470 |

196407 |

|

Chip 9 Amended |

277471 |

196408 |

|

Chip 10 Amended |

277472 |

196409 |

|

Chip 11 Amended |

277473 |

196410 |

|

Chip 12 Amended |

277474 |

196411 |

|

Chip 13 Amended |

277475 |

196412 |

|

Chip 14 Amended |

277476 |

196413 |

|

Chip 15 Amended |

277477 |

196414 |

|

Chip 16 Amended |

277478 |

196415 |

|

Chip 17 Amended |

277479 |

196416 |

|

Chip 18 Amended |

277480 |

196417 |

|

Sun 20 |

306042 |

218133 |

|

Sun 21 |

306043 |

218134 |

|

Sun 22 |

306044 |

218135 |

|

Sun 23 |

306045 |

218136 |

|

Sun 24 |

306046 |

218137 |

|

Sun 25 |

306047 |

218138 |

|

Sun 26 |

306048 |

218139 |

|

Sun 27 |

306049 |

218140 |

|

Sun 28 |

306050 |

218141 |

|

Sun 29 |

306051 |

218142 |

|

Sun 30 |

306052 |

218143 |

|

Sun 31 |

306053 |

218144 |

|

Sun 32 |

306054 |

218145 |

|

Sun 33 |

306055 |

218146 |

|

Sun 34 |

306056 |

218147 |

|

Sun 35 |

306057 |

218148 |

|

Sun 36 |

306058 |

218149 |

|

Chip 21 Fraction |

306059 |

218113 |

|

Chip 22 Fraction |

306060 |

218114 |

|

Chip 23 |

306025 |

218115 |

|

Chip 24 |

306026 |

218116 |

|

Chip 25 |

306027 |

218117 |

|

Chip 26 |

306028 |

218118 |

|

Chip 27 |

306029 |

218119 |

|

Chip 28 |

306030 |

218120 |

|

Chip 29 |

306031 |

218121 |

|

Chip 30 |

306032 |

218122 |

|

Chip 31 |

306033 |

218123 |

|

Chip 32 |

306034 |

218124 |

|

Chip 33 |

306035 |

218125 |

|

Chip 34 |

306036 |

218126 |

|

Chip 35 |

306037 |

218127 |

|

Chip 36 |

306038 |

218128 |

|

Chip 37 |

306039 |

218129 |

|

Chip 38 |

306040 |

218130 |

|

Chip 39 |

306041 |

218131 |

|

Chip 40 |

307491 |

218895 |

|

DRC NW 1 |

307492 |

218847 |

|

DRC NW 2 |

307493 |

218848 |

|

DRC NW 3 |

307494 |

218849 |

|

DRC NW 4 |

307495 |

218850 |

|

DRC NW 5 |

307496 |

218851 |

|

DRC NW 6 |

307497 |

218852 |

|

DRC NW 7 |

307498 |

218853 |

|

DRC NW 8 |

307499 |

218854 |

|

DRC NW 9 |

307500 |

218855 |

|

DRC NW 10 |

307501 |

218856 |

|

DRC NW 11 |

307502 |

218857 |

|

DRC NW 12 |

307503 |

218858 |

|

DRC NW 13 |

307504 |

218859 |

|

DRC NW 14 |

307505 |

218860 |

|

DRC NW 15 |

307506 |

218861 |

|

DRC NW 16 |

307507 |

218862 |

|

DRC NW 17 |

307508 |

218863 |

|

DRC NW 18 |

307509 |

218864 |

|

DRC NW 19 |

307510 |

218865 |

|

DRC NW 20 |

307511 |

218866 |

|

DRC NW 21 |

307512 |

218867 |

|

DRC NW 22 |

307513 |

218868 |

|

DRC NW 23 |

307514 |

218869 |

|

DRC NW 24 |

307515 |

218870 |

|

DRC NW 25 |

307516 |

218871 |

|

DRC NW 26 |

307517 |

218872 |

|

DRC NW 27 |

307518 |

218873 |

|

DRC NW 28 |

307519 |

218874 |

|

DRC NW 29 |

307520 |

218875 |

|

DRC NW 30 |

307521 |

218876 |

|

DRC NW 31 |

307522 |

218877 |

|

DRC NW 32 |

307523 |

218878 |

|

DRC NW 33 |

307524 |

218879 |

|

DRC NW 34 |

307525 |

218880 |

|

DRC NW 35 |

307526 |

218881 |

|

DRC NW 36 |

307527 |

218882 |

|

DRC NW 37 |

307528 |

218883 |

|

DRC NW 38 |

307529 |

218884 |

|

DRC NW 39 |

307530 |

218885 |

|

DRC NW 40 |

307531 |

218886 |

|

DRC NW 41 |

307532 |

218887 |

|

DRC NW 42 |

307533 |

218888 |

|

DRC NW 43 |

307534 |

218889 |

|

DRC NW 44 |

307535 |

218890 |

|

DRC NW 45 |

307536 |

218891 |

|

DRC NW 46 |

307537 |

218892 |

|

DRC NW 47 |

307538 |

218893 |

|

DRC NW 48 |

307539 |

218894 |

|

EBatt 1 |

307483 |

218896 |

|

EBatt 2 |

307484 |

218897 |

|

EBatt 3 |

307485 |

218898 |

|

EBatt 4 |

307486 |

218899 |

|

EBatt 5 |

307487 |

218900 |

|

EBatt 6 |

307488 |

218901 |

|

EBatt 7 |

307489 |

218902 |

|

EBatt 8 |

307490 |

218903 |

|

OMM-1 |

307478 |

218905 |

|

OMM-2 |

307479 |

218906 |

|

OMN-2 |

307481 |

218908 |

|

OMN-3 |

307482 |

218909 |

|

BTG-1 |

307471 |

218910 |

|

BTG-2 |

307472 |

218911 |

|

BTG-3 |

307473 |

218912 |

|

BTG-4 |

307474 |

218913 |

|

BTG-5 |

307475 |

218914 |

|

BTG-6 |

307476 |

218915 |

|

NFX 17 |

307230 |

218685 |

|

NFX 18 |

307231 |

218686 |

|

NFX 19 |

307232 |

218687 |

|

NFX 20 |

307233 |

218688 |

|

NFX 21 |

307234 |

218689 |

|

NFX 22 |

307235 |

218690 |

|

NFX 23 |

307236 |

218691 |

|

NFX 24 |

307237 |

218692 |

|

NFX 25 |

307238 |

218693 |

|

NFX 30 |

307243 |

218698 |

|

NFX 31 |

307244 |

218699 |

|

NFX 32 |

307245 |

218700 |

|

NFX 33 |

307246 |

218701 |

|

NFX 34 |

307247 |

218702 |

|

NFX 35 |

307248 |

218703 |

|

NFX 36 |

307249 |

218704 |

|

NFX 37 |

307250 |

218705 |

|

NFX 38 |

307251 |

218706 |

|

NFX 42 |

307255 |

218710 |

|

NFX 43 |

307256 |

218711 |

|

NFX 44 |

307257 |

218712 |

|

NFX 45 |

307258 |

218713 |

|

NFX 46 |

307259 |

218714 |

|

NFX 47 |

307260 |

218715 |

|

NFX 48 |

307261 |

218716 |

|

NFX 49 |

307262 |

218717 |

|

NFX 50 |

307263 |

218718 |

|

NFX 56 |

307269 |

218724 |

|

NFX 57 |

307270 |

218725 |

|

NFX 58 |

307271 |

218726 |

|

NFX 59 |

307272 |

218727 |

|

NFX 60 Amended |

307558 |

218728 |

|

NFX 61 |

307274 |

218729 |

|

NFX 62 |

307275 |

218730 |

|

NFX 63 |

307276 |

218731 |

|

NFX 64 |

307277 |

218732 |

|

OMN-1 revised |

315879 |

228322 |

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

|

Jervois Global Limited |

||

|

52 007 626 575 |

31 December 2023 |

|

|

Current quarter |

Year to date (12 months) $US’000 |

||

|

1. |

Cash flows from operating activities |

42,487 |

234,616 |

|

1.1 |

Receipts from customers |

||

|

1.2 |

Payments for |

- |

- |

|

|||

|

(3,006) |

(11,589) |

|

|

(38,009) |

(187,632) |

|

|

(1,674) |

(13,228) |

|

|

(1,087) |

(3,919) |

|

|

1.3 |

Dividends received (see note 3) |

- |

- |

|

1.4 |

Interest received |

264 |

1,338 |

|

1.5 |

Interest and other costs of finance paid |

(870) |

(19,646) |

|

1.6 |

Income taxes refunded / (paid) |

64 |

(1,018) |

|

1.7 |

Other |

- |

- |

|

1.9 |

Net cash (used in) from operating activities |

(1,831) |

(1,078) |

|

2. |

Cash flows from investing activities |

- |

- |

|

2.1 |

Payments to acquire or for: |

||

|

|||

|

- |

- |

|

|

(3,395) |

(81,770) |

|

|

(1,374) |

(1,999) |

|

|

- |

- |

|

|

- |

- |

|

|

- |

- |

|

|

2.2 |

Proceeds from the disposal of: |

- |

- |

|

|||

|

- |

- |

|

|

280 |

1,349 |

|

|

- |

- |

|

|

- |

- |

|

|

2.3 |

Cash flows from loans to other entities |

- |

- |

|

2.4 |

Dividends received (see note 3) |

- |

- |

|

2.5 |

Other |

- |

- |

|

2.6 |

Net cash used in investing activities |

(4,489) |

(82,420) |

|

3. |

Cash flows from financing activities |

- |

24,985 |

|

3.1 |

Proceeds from issues of equity securities (excluding convertible debt securities) |

||

|

3.2 |

Proceeds from issue of convertible debt securities |

- |

25,000 |

|

3.3 |

Proceeds from exercise of options |

- |

- |

|

3.4 |

Transaction costs related to issues of equity securities or convertible debt securities |

(6) |

(3,270) |

|

3.5 |

Proceeds from borrowings |

- |

- |

|

3.6 |

Repayment of borrowings |

(4,788) |

(70,926) |

|

3.7 |

Transaction costs related to loans and borrowings |

- |

- |

|

3.8 |

Dividends paid |

- |

- |

|

3.9 |

Other – incl. lease liabilities |

(714) |

(2,119) |

|

Other - Government grants and tax incentives |

2,293 |

2,468 |

|

|

Other |

- |

- |

|

|

3.10 |

Net cash from (used in) financing activities |

(3,215) |

(23,862) |

|

4. |

Net increase / (decrease) in cash and cash equivalents for the period |

||

|

4.1 |

Cash and cash equivalents at beginning of period |

54,851 |

152,647 |

|

4.2 |

Net cash from / (used in) operating activities (item 1.9 above) |

(1,831) |

(1,078) |

|

4.3 |

Net cash from / (used in) investing activities (item 2.6 above) |

(4,489) |

(82,420) |

|

4.4 |

Net cash from / (used in) financing activities (item 3.10 above) |

(3,215) |

(23,862) |

|

4.5 |

Effect of movement in exchange rates on cash held |

52 |

81 |

|

4.6 |

Cash and cash equivalents at end of period |

45,368 |

45,368 |

|

8. |

$US’000 |

|

|

8.1 |

Net cash from / (used in) operating activities (item 1.9) |

(1,831) |

|

8.2 |

(Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) |

(1,374) |

|

8.3 |

Total relevant outgoings (item 8.1 + item 8.2) |

(3,205) |

|

8.4 |

Cash and cash equivalents at quarter end (item 4.6) |

45,368 |

|

8.5 |

Unused finance facilities available at quarter end (item 7.5 and see item 7.6 – footnote 3) |

- |

|

8.6 |

Total available funding (item 8.4 + item 8.5) |

45,368 |

|

8.7 |

Estimated quarters of funding available (item 8.6 divided by item 8.3) |

14.16 |

|

Note: if the entity has reported positive relevant outgoings (i.e., a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. |

||

|

8.8 |

If item 8.7 is less than 2 quarters, please provide answers to the following questions: |

|

|

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

||

|

Answer: N/A |

||

|

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? |

||

|

Answer: N/A |

||

|

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

||

|

Answer: N/A |

||

|

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. |

||

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 30 January 2024

Authorised by: Disclosure Committee

(Name of body or officer authorising release – see note 4)

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – e.g., Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

1 Before interest payments.

2 Drawn senior debt represents the aggregate of amounts drawn under the Company’s senior debt facilities (excludes Unsecured Convertible Notes that mature in July/August 2028). Amounts represent the nominal loan amounts; balances recorded in Jervois’ financial statements under International Financial Reporting Standards will differ.

3 See ASX announcement “Updated RAM resource offers opportunity to extend ICO mine life” dated 19 April 2023 (Australia).

4 Drawn senior debt represents the aggregate of amounts drawn under the Company’s senior debt facilities (excludes Unsecured Convertible Notes that mature in July/August 2028). Amounts represent the nominal loan amounts; balances recorded in Jervois’ financial statements under International Financial Reporting Standards will differ.

5 Excludes Jervois Finland staff costs which are included in 1.2(c) production.