Archive

BQE Water Reports Unaudited 2021 Year End Results

| |||||||||

|  | ||||||||

April 22, 2022 - TheNewswire - Vancouver, BC – BQE Water Inc. (TSXV:BQE) (OTC:BTQNF), a leader in the treatment and management of mine impacted waters, is pleased to release its unaudited consolidated financial results for the year ended December 31, 2021. Following the completion of the audit process, BQE Water will issue further disclosure for the audited results and the material differences (if any) compared to the unaudited annual results contained herein. While management has reviewed the unaudited figures below, until the audited results are released and approved by the board, shareholders and interested investors of BQE Water are advised to exercise caution with the following unaudited financial results.

“Our fiscal year 2021 was exceptional in many ways. Not only did we deliver our strongest financial performance with record Adjusted EBITDA of $4.1 million despite the challenges of a global pandemic, we also realized several key technical milestones. During the year, we brought online two SART plants for metallurgical facilities in China, completed commissioning of the first selenium removal plant in the power industry, advanced several selenium removal treatment plants to late stages, and acquired IP in cyanide destruction to provide a complete suite of cyanide management for our clients,” stated David Kratochvil, President & CEO of BQE Water.

1.FINANCIAL HIGHLIGHTS

-

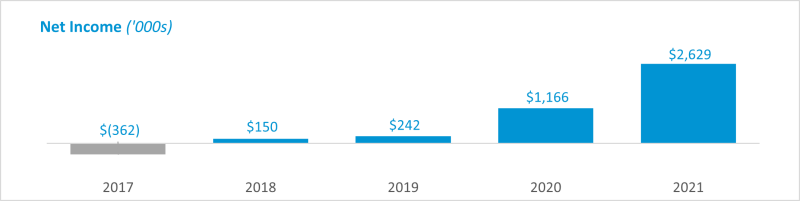

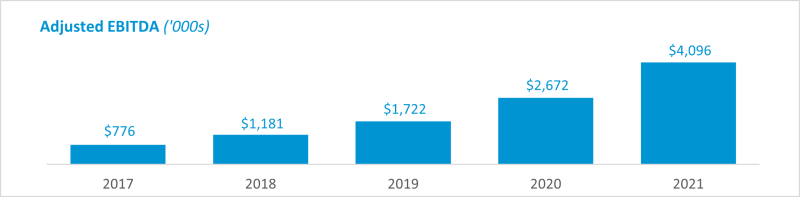

Increased Adjusted EBITDA by 53%, from $2.7 million in 2020 to $4.1 million in 2021.

-

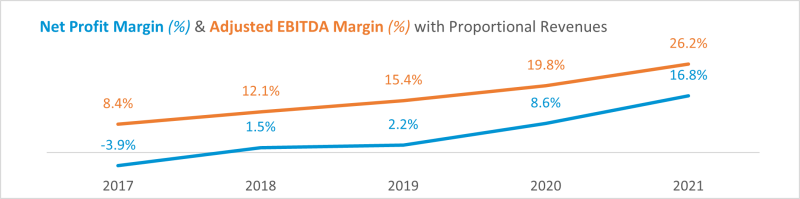

Grew Proportional Revenues by 16%, from $13.5 million in 2020 to $15.6 million in 2021.

-

Recorded new historic high net income of $2.6 million in 2021, a 125% increase from $1.2 million in 2020.

-

Grew diluted Earnings Per Share by 122%, from $0.95 in 2020 to $2.11 in 2021.

-

Increased working capital by 29% year-over-year, from $3.5 million to $4.5 million as of December 31, 2021.

-

Increased net cash by 22% over the 12-month period, from $3.2 million to $3.9 million at the end of 2021.

Selected financial results and margins with Proportional Revenues for the last 5 years are as follows:

Other selected financial results for the 3 and 12 months ended December 31, 2021 are as follows:

|

(in ’000s) |

3 months ended Dec. 31 |

12 months ended Dec. 31 |

|||

|

2021 |

2020 |

2021 |

2020 |

||

|

Revenues under GAAP |

2,570 |

1,609 |

7,511 |

7,696 |

|

|

Proportional Revenues |

4,389 |

3,085 |

15,616 |

13,497 |

|

|

Net income (loss) |

800 |

(202) |

2,629 |

1,166 |

|

|

Adjusted EBITDA |

754 |

133 |

4,096 |

2,672 |

|

2.OPERATIONAL SERVICES HIGHLIGHTS

Our operational services consist of the operation or technical supervision of water treatment plants, which generates recurring revenues from three main sources: sales of recovered metals, water treatment fees and operations support fees. The Company’s active operations for the 12 months ended December 31, 2021 and 2020 are as follows:

|

Operations |

Location |

Revenue Source |

|

JCC-BQE Joint Venture |

China |

Sales of recovered metals |

|

MWT-BQE Joint Venture |

China |

Sales of recovered metals |

|

Raglan Mine for Glencore |

Canada |

Water treatment fees |

|

Kemess Property for Centerra |

Canada |

Water treatment fees |

|

Eastern China Metallurgical Facilities for MWT |

China |

Operations support fees |

JCC-BQE Joint Venture Operations

Our 50/50 joint venture with partner Jiangxi Copper Company (“JCC”) operates three water treatment plants at Dexing Mine and at Yinshan Mine in Jiangxi province of China. The volume of water treated and pounds of copper recovered by the plants fluctuate seasonally depending on precipitation levels in the region. The operating results for the 12 months ended December 31, 2021 are as follows:

|

(in ’000s) |

2021 |

2020 |

|

Water treated (cubic metres) |

21,552 |

21,094 |

|

Copper recovered (pounds) |

3,337 |

3,312 |

During 2021, all three plants met mechanical availability and process performance set by the Company. Both the volume of water treated and the mass of copper recovered increased year-over-year by 2% and 1% respectively. Changes in water volume and feed grade are largely the result of environmental conditions beyond the control of the joint venture. The minimal variances between 2020 and 2021 indicate very stable operations.

MWT-BQE Joint Venture Operations

Our 20% share of MWT-BQE is with our 80% partner Beijing MWT Water Treatment Project Limited Company (“MWT”) and together we operate a water treatment plant at a smelter in Shandong province of China. MWT-BQE generates revenues from the sale of zinc and copper recovered from smelter wastewater. The operating results for the 12 months ended December 31, 2021 are as follows:

|

(in ’000s pounds) |

2021 |

2020 |

|

Zinc recovered |

845 |

1,254 |

|

Copper recovered |

237 |

226 |

The mass of zinc recovered decreased by 33% while copper recovery increased by 5%. The smelter periodically operated their production lines with ores from different sources which led to varying concentrations of zinc and copper in the feed composition and a fluctuation in the volume of wastewater treated by the plant. The joint venture has no control in the composition and volume of the feed that flows into the plant.

BQE Water Operations

The Company operates four treatment plants at Raglan Mine for Glencore Canada Corporation (“Glencore”). In April 2021, we mobilized our operations team to site to commence our 18th operating season and began discharging water in June 2021. During 2021, the total water treated across all four plants at Raglan Mine increased by 50%.

In 2020, we completed the commissioning of the first industrial scale plant utilizing our patented and award-winning Selen-IX™ process for selenium management at the Kemess property owned by Centerra Gold (“Centerra”). In 2021, the Kemess property was not operating as it was declared to be in an extended state of care and maintenance, with water treatment not required under this status.

The Zhongkuang SART plant began operations in January 2021 and the Zhaojin SART plant in April 2021. Both SART plants are under BQE Water’s technical supervision since beginning full production. During 2021, the Zhongkuang SART plant was put into care and maintenance temporarily from March to October due to the metallurgical circuit shutdown at the Zhongkuang leaching plant.

The volume of water treated for the 12 months ended December 31, 2021 are as follows:

|

(in ’000s cubic metres) |

2021 |

2020 |

|

Glencore water treatment plants |

2,327 |

1,555 |

|

MWT-BQE joint venture water treatment plant |

617 |

637 |

|

Centerra water treatment plant |

- |

119 |

|

Eastern China SART plants |

336 |

- |

4.TECHNICAL SERVICES HIGHLIGHTS

BQE Water’s technical expertise and IP are applicable globally across broad areas of water management. The highlights of technical services provided to clients and technical innovation projects during 2021 are summarized below.

Commercial Deployment of Selen-IX™ and Direct Selenium Electro-Reduction (ERC) Technology

-

Initiated pre-commissioning activities for a second large scale Selen-IX™ plant to be installed at a mine in the US.

-

Continued to provide engineering services for the first commercial scale direct selenium ERC plant at a mine in the US.

-

Completed the commissioning of the first Selen-IX™ plant, outside of the mining industry, at an ash pond in the US.

Cyanide Recovery, Destruction, and Thiocyanate Management

-

Completed field assessments of several cyanide destruction plants in Canada.

-

Completed laboratory testing of cyanide destruction for projects in Canada and Mexico.

-

Completed feasibility studies for SART implementation at metallurgical facilities in China.

-

Completed a study to review the potential relocation and re-use of existing SART plant equipment in Latin America.

-

Completed lab scale testing and scoping level engineering for cyanide recovery from thiocyanate at an active mine in North America.

Water Consulting Services – Management, Treatability, Permitting Assistance, Toxicity Mitigation

-

Completed engineering design of water treatment system for permitting of a new mine in BC.

-

Completed comprehensive review of water treatment requirements and independent review of engineering design of a water treatment plant for an existing mining operation in Peru.

-

Completed feasibility level engineering for water treatment to support permitting and development of a new mine in Central America.

-

Provided troubleshooting and optimization services for an existing ammonia removal plant in Ontario.

-

Completed prefeasibility level engineering for a new ammonia removal plant in Ontario.

-

Completed laboratory treatability studies to support permitting of new mining operations in Canada and Chile.

-

Initiated a 2-year pilot demonstration program for sulphate removal and copper recovery for Codelco in Chile.

5.COMMENTARY AND OUTLOOK

Overall, 2021 was a year dominated by strong profitable growth and the achievement of several important technical and commercial milestones. These include:

-

New records for net income, Adjusted EBITDA and Proportional Revenues, growing these by 125%, 53% and 16% respectively year-over-year, and improving working capital year-over-year by 29%.

-

Completed commissioning and began operations of the first treatment plant in the power industry, using our patented and award-winning Selen-IX™ process to remove selenium from ash pond water in the Eastern US.

-

Advanced two selenium removal projects in mining with one entering plant pre-commissioning and the other having completed the procurement of long lead equipment. We signed long-term operating agreements with both projects.

-

Growing acceptance by industry and regulators of our Selen-IX™ process for selenium removal with our inclusion as a treatment option in the most recent draft of the Canadian Coal Mining Effluent Regulations.

-

Acquired IP in cyanide destruction and began integrating the world-leading knowledge and experience of one of the co-inventors of the cyanide destruction process into the Company. This arrangement gives us the ability to offer a complete suite of cyanide management services and has already generated new projects and clients in 2021 and expanded the sales pipeline for 2022.

-

Signed a 2-year contract with Codelco, the world’s largest copper producer, to provide pilot demonstrations of our sulphate removal and copper recovery technologies at multiple locations in Chile.

-

Initiated work on four new projects in Eastern Canada, expanding geographically into new mineral rich areas.

-

Expanded the in-house technical team and capabilities at all our locations: Canada, US, Chile and China.

Looking ahead, we anticipate momentum of the last few years will continue into 2022, supported by:

-

Sales pipeline growth from:

-

World leading cyanide destruction expertise complementing our expertise with cyanide recycling in SART.

-

Large number of permitting and feasibility studies expected to advance to the next project phase.

-

The KSM project in BC advancing to substantial start where we are the lead for water treatment.

-

Increasing industry recognition and credibility as the trusted subject matter expert.

-

-

Additional recurring revenues generated from the operation of treatment plants in the US.

-

Active ongoing projects in Latin America: pilots with Codelco, Trafigura and water management at El Mirador.

We are also excited for our growth prospects beyond 2022 as the demand for our technical expertise and commercial business model aligns with key long-term trends:

-

Global de-carbonization that demands critical metals and base metals for a green economy.

-

Need for mining projects to be environmentally responsible and socially acceptable with water being one of the key elements determining both.

-

Tightening government regulations and enforcement for water quality.

-

Obligation for positive engagement and active involvement with indigenous communities where our focus on clean water production provides opportunities for bringing local communities on board with mining projects.

-

Outsourcing of innovation by mining companies to service providers combined with our track record of bringing technology innovation to market.

-

Clean-up and closure of ash ponds is one of the largest environmental liabilities faced by power utilities.

Despite these trends and our optimistic outlook for 2022, readers need to be cautioned about the risks that may create sudden and potentially significant headwinds for us and our business. First, although the COVID-19 pandemic appears to be entering the endemic phase, the success of our continued growth relies on travel and free movement of key personnel between countries. Second, geopolitical tensions between China and the West may complicate our ongoing China operations and any future business. Lastly, a global recession may lead to a drop in commodity prices that could put resource projects on hold. For these reasons, we remain focused on fiscal prudence and maintaining our working capital at a level that would shield us from these exogenous impacts. Our financial results for 2021 and the current outlook for 2022 underpin our view that we are on track for profitable growth and have sufficient cash reserves to mitigate these risks.

6.SELECTED FINANCIAL INFORMATION

|

$ |

$ |

|

|

Revenues |

7,511 |

7,696 |

|

Operating expenses |

(3,949) |

(4,431) |

|

Operating margin |

3,562 |

3,265 |

|

Share of income from joint ventures |

2,803 |

1,139 |

|

General and administration |

(1,823) |

(1,622) |

|

Sales and development |

(1,374) |

(971) |

|

Share-based payments |

(303) |

(387) |

|

Depreciation and amortization |

(168) |

(148) |

|

Income from operations and joint ventures |

2,697 |

1,276 |

|

Other expenses, net |

(33) |

(8) |

|

Bad debt recovery |

95 |

- |

|

Income tax expenses |

(130) |

(102) |

|

Net income for the year |

2,629 |

1,166 |

|

Earnings per share (basic) |

2.13 |

0.96 |

|

Earnings per share (diluted) |

2.11 |

0.95 |

|

Proportional Revenues1 |

15,616 |

13,497 |

|

Adjusted EBITDA1 |

4,096 |

2,672 |

|

Comprehensive income |

2,934 |

1,394 |

|

at Dec 31 |

at Dec 31 |

|

|

2021 |

2020 |

|

|

Cash |

3,944 |

3,240 |

|

Working capital |

4,557 |

3,543 |

|

Total assets |

13,803 |

10,464 |

|

Total non-current liabilities |

778 |

821 |

|

Shareholders’ equity |

11,313 |

8,088 |

|

Proportional cash1 |

8,089 |

5,241 |

Notes:

-

Non-GAAP measures

About BQE Water

BQE Water is a service provider specializing in water treatment and management for metals mining, smelting and refining. We are helping to transform the way the industry thinks about water in the context of natural resource projects by offering services and expertise which enables more sustainable water management practices and improved overall project performance at reduced risks. BQE Water invests in innovation and has developed unique intellectual property through the commercialization of several new technologies at mine sites around the world for organizations including Glencore, Jiangxi Copper, Freeport-McMoRan and the US EPA. BQE Water is headquartered in Vancouver, Canada and trades on the TSX Venture Exchange under the symbol BQE. Visit www.bqewater.com for more information.

****

The Toronto Venture Exchange has not reviewed and does not accept responsibility for the adequacy or the accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained herein may not be based on historical fact and therefore constitutes "forward-looking information" under applicable Canadian securities legislation. This includes without limitation statements containing the words "plan", "expect", "project", "estimate", "intend", "believe", "anticipate", "may", "will" and other similar words or expressions. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks, uncertainties and other factors that may cause actual events or results to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the Company’s dependence on key personnel and contracts, uncertainty with respect to the profitability of the Company’s technologies, competition, technology risk, the Company’s ability to protect its intellectual property and proprietary information, fluctuations in commodity prices, currency risk, environmental regulation and the Company’s ability to manage growth and other factors described in the Company’s filings with the Canadian securities regulators at www.sedar.com (including without limitation the factors described in the section entitled "Risks and Uncertainties" in the Company's MD&A for the year ended December 31, 2020). Given these risks and uncertainties, the reader is cautioned not to place undue reliance on forward-looking statements. All forward-looking information contained herein is based on management’s current expectations and the Company undertakes no obligation to revise or update such forward-looking information to reflect subsequent events or circumstances, except as required by law.

For further information please contact:

BQE Water Inc.

Suite 250 – 900 Howe Street Vancouver BC Canada V6Z 2M4

David Kratochvil, President & CEO

dkratochvil@bqewater.com

Heman Wong, CFO

hwong@bqewater.com

604-685-1243 or 1-800-537-3073