Archive

Cullinan to Acquire Past Producing Copper Mines

| |||||||||

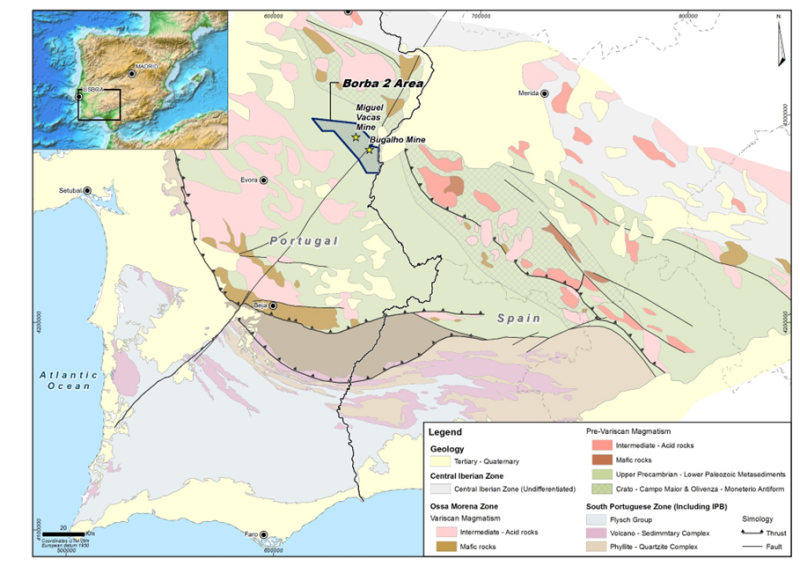

Vancouver, B.C. - TheNewswire - June 13th, 2022 – Cullinan Metals Corp. (CSE:CMT) (CNSX:CMT.CN) (“Cullinan” or the “Company”) is pleased to announce that it has signed a letter of intent to assume the obligations of PanAm Copper and the right to acquire a 100% interest in the Borba 2 property comprising three copper projects and one gold project from GoldPlay Mining (“GoldPlay”)(TSXV: AUC). The Borba 2 permit covers an area of 328.5 square km in the Ossa Morena of Central Southern Portugal. There are three past-producing copper mines within the project and several well-developed copper-gold prospects.

The four projects are located 160 km east of Lisbon and approximately 70 km east of Evora, the district capital. The four projects encompass the past producing Miguel Vacas Copper Mine, the Bugalho Copper Mine, Amagreira Gold prospect, and the Mostardeira Copper-Gold Mine. These projects are recognized to host precious metal and base metal mineralization in shear zones and epithermal systems associated with intra-Ordovician volcanism.

Portugal is known to be one of the safest jurisdictions in the European Union. The country remains among the largest European producers of copper, tungsten, and tin concentrates.

Highlights:

-

Miguel Vacas Copper Mine is hosted by Silurian sediments, close to a contact with a lenticular belt of Ordovician rocks including shale, quartzite, and limestone. The mine was closed in 1986, having produced 464,100 tonnes of ore at an average grade of 2.1% copper. The opportunity exists to extend mineralization at depth and along strike for up to 2.2 km.

-

Mostardeira Copper Gold MineThe vein system at Mostardeira is hosted by Silurian and Devonian metasediments. The mine operation was focused on a wide (up to 10 meters thick) anastomosing WSW-ESE trending vein system, developed over 700 m long and is open in both directions along strike and at depth. The shear zone was historically mined for Cu, with most of the mining focused on at least two high-grade veins (approx. 2m) with grades of up to 5% Cu. Reliable records on gold production are not available. Channel sampling by Rio Narcea Gold Mines returned values of 18.6 meters grading 0.8 g/t Au, 0.3% Cu, and 20 g/t Ag, including 4.9 meters grading 2.1 g/t Au, 0.76% Cu, and 64 g/t Ag.

-

Bugalho Copper-Gold Mine is hosted within Silurian dark grey shales with intercalations of black chert, quartzite, and graphitic phyllites, adjacent to a major NE-SW deep-seated fault zone. Mineralization occurs as chalcopyrite and pyrite within a quartz-carbonate breccia matrix with accessory arsenopyrite with occasionally elevated gold assays. Dump samples of silicified and sheared acid tuffs assayed up to 9.14 g/t Au and 0.35% Cu.

-

Amagreira Gold Project is an epithermal gold system where mineralization occurs in altered volcanics and carbonates, controlled by an E-W structure that extends at least 400 meters along strike and is interpreted to be open at depth. Previous drill intercept PAM-1 comprised of 5.45 m of 1.53 g/t Au, including 2.47 m at 2.44 g/t Au. Pam-2, intercepted 17 m of 0.5 g/t Au, including 2 m of 3.7 g/t Au.

Marc Enright-Morin, President of Cullinan commented: “We are pleased to have secured these four projects with multiple opportunities in copper and gold. Portugal offers everything a modern exploration company needs. With copper prices at historic highs and supply and demand deficits plaguing the market, any new supply will be welcomed. ”

Terms of the Agreement

Cullinan has the right to earn a 100% interest in the Borba 2 concession by making cash payments totalling $750,000, issuing stock or cash up to a value of $3 M, at Cullinan’s election, and completing aggregate work expenditures totalling $1.5 M over 4 years. A 1% NSR is payable to the property vendors, with a buyback provision of $500,000 for 0.5%. All funds are in Canadian dollars.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. Jose Mario Castelo Branco, Cullinan’s consulting geologist and Qualified Person within the context of Canadian Securities Administrators' National Instrument 43-101; Standards of Disclosure for Mineral Projects.

The Company is also pleased to announce that it intends to raise gross proceeds of up to $2 million pursuant to a non-brokered private placement of 6,670,000 units (the “Offering”). Each unit will consist of one common share of the Company (a “Share”) and one-half of one transferrable share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will entitle the holder to acquire one Share at a price of $0.60 per Share for a period of 2 years from the date of closing of the Offering (the “Closing”), subject to an acceleration provision whereby if the Shares trade at a price on the Canadian Securities Exchange (or such other exchange on which the Shares may be traded at such time) (the “Exchange”) of $1.00 or greater per Share for a period of 10 consecutive trading days after four months and one day from the Closing, the Company may accelerate the expiry of the Warrants by giving notice to the holders thereof (by disseminating a news release advising of the acceleration of the expiry date of Warrants) and, in such case, the Warrants will expire on the 31st day after the date of such notice.

The proceeds from the Offering will be used for general working capital requirements. All securities under the Offering will be subject to a statutory hold period of four months and one day from the date of issuance in accordance with applicable securities legislation.

About Cullinan Metals Corp.

Cullinan Metals Corp. is a Canadian mining and exploration company focused on high quality copper and gold assets in Europe. The company’s Borba 2 property, which contains four projects, consists of several advanced mineral occurrences and past producing copper and gold mines. The concession covers an area of 328.5 square km in one of the most mining friendly areas in Portugal. All the projects are off main roads and highways with excellent infrastructure.

On behalf of the Company,

CULLINAN METALS CORP.

Marc Enright-Morin, President

For more information, please contact the Company at:

CULLINAN METALS CORP.

Suite 2200, 885, West Georgia Street

Vancouver, BC, V6C 3E8

Tel: 403 852-4869

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain information contained in this news release, including any information relating to future financial or operating performance, may be considered “forward-looking information” (within the meaning of applicable Canadian securities law). These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Actual results could differ materially from the conclusions, forecasts and projections contained in such forward-looking information.

These forward-looking statements reflect Cullinan’s current internal projections, expectations or beliefs and are based on information currently available to Cullinan. In some cases forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “potential”, “scheduled”, “forecast”, “budget” or the negative of those terms or other comparable terminology. Certain assumptions have been made regarding the Letter of Intent, the Offering and the Company, including the expectation whether the acquisition will be consummated, including whether conditions to the consummation of the acquisition will be satisfied including, but not limited to, the necessary board and regulatory approvals, completion of the proposed Offering and use of proceeds, and the Company’s plans for the copper and gold projects. Many of these assumptions are based on factors and events that are not within the control of Cullinan and there is no assurance they will prove to be correct.

Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to materially differ from those reflected in the forward-looking information, and are developed based on assumptions about such risks, uncertainties and other factors including, without limitation: receipt of all required stock exchange and regulatory approvals; the scope, duration and impact of the COVID-19 pandemic; the scope, duration and impact of regulatory responses to the pandemic on business and operations; uncertainties related to actual capital costs, operating costs and expenditures; uncertainties associated with exploration activities; uncertainties related to current global economic conditions; fluctuations in precious and base metal prices; uncertainties related to the availability of future financing; potential difficulties with joint venture partners; risks that Cullinan’s title to its property could be challenged; political and country risk; risks associated with Cullinan being subject to government regulation; risks associated with surface rights; environmental risks; Cullinan’s need to attract and retain qualified personnel; risks associated with potential conflicts of interest; uncertainties related to the competitiveness of the mining industry; uninsured risks and inadequate insurance coverage; and foreign currency risks. Any and all of the forward-looking information contained in this news release is qualified by these cautionary statements.

Although Cullinan believes that the forward-looking information contained in this news release is based on reasonable assumptions, readers cannot be assured that actual results will be consistent with such statements. Accordingly, readers are cautioned against placing undue reliance on forward-looking information. Cullinan expressly disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, events, or otherwise, except as may be required by, and in accordance with, applicable securities laws.