Archive

Headwater Gold Commences Drilling on the Midas North Project, Nevada

| |||||||||

|  |  | |||||||

Vancouver, British Columbia - TheNewswire - August 22, 2023 - Headwater Gold Inc. (CSE:HWG) (OTC:HWAUF) (the "Company" or "Headwater") is pleased to announce the commencement of an approximate 3,500 metre (“m”) maiden drill program on its Midas North project, Nevada. Drilling is fully funded by Newcrest Mining Limited (“Newcrest”) (ASX, TSX, PNGX: NCM) pursuant to the option and earn-in agreement (the “Earn-In Agreement”) announced on August 16, 2022.

Highlights:

-

Approximately 3,500 m of initial drilling is planned, utilizing a combination of reverse circulation (“RC”) and diamond core drilling;

-

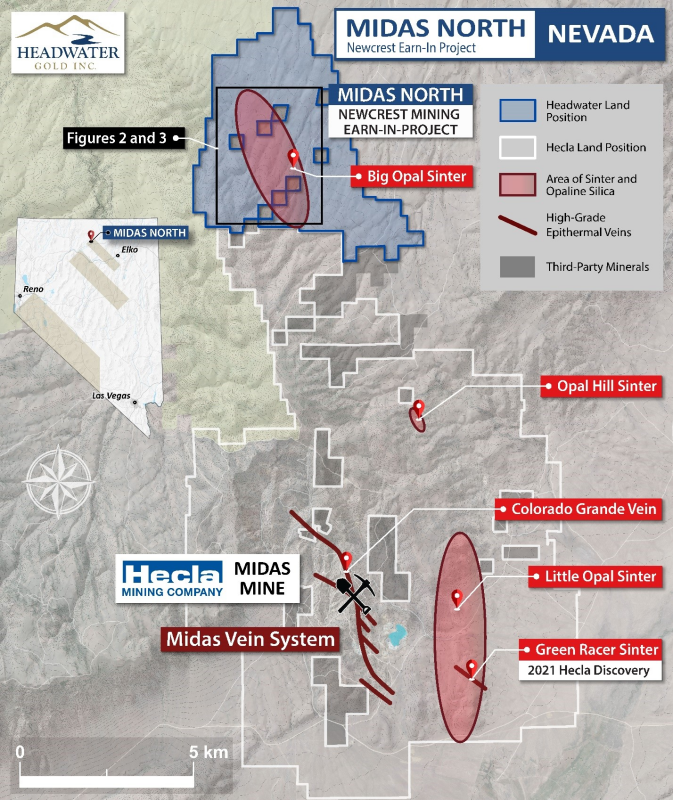

The Midas North project hosts a large, un-drilled epithermal alteration cell in the northern Midas District, approximately 13 km north of Hecla Mining Company’s (“Hecla”, NYSE: HL) past-producing Midas Mine;

-

The goal of the program is to drill multiple structural targets at depth in the inferred epithermal boiling zone and test for the presence of high-grade gold and silver mineralization; and,

-

Midas North represents the fourth drill program of 2023 across the Headwater portfolio. More information on the other drill programs is available here.

-

Midas North: ~3,500 metres (this release)

-

Spring Peak: ~11,500 metres (in progress)

-

Katey: ~3,500 metres (in progress)

-

Mahogany: ~1,500 metres (assays pending)

-

Caleb Stroup, the President and CEO of the Company, states: “This maiden Midas North drill program presents Headwater shareholders with a rare opportunity to be the first to explore the northern extension of the famous high-grade Midas District, which hosts multiple past producing gold and silver veins immediately to the south. Our team is confident that the Midas North project has the potential to yield a new discovery and we are committed to utilizing the very best exploration techniques to unlock its full potential. Since acquiring the project, our technical team has assembled a comprehensive geologic and geophysical dataset that has allowed us to generate numerous high-priority drill targets which will be tested with this initial maiden drill program. The commencement of the Midas North drilling marks the fourth drill program in the Headwater portfolio this year, demonstrating a scale of activity that sets the Company apart from most of our peers. Our partnership with Newcrest provides our shareholders with exposure to a substantial amount of high-impact exploration while minimizing dilution at a corporate level.”

Figure 1: Map of the Midas high-grade vein district in northern Nevada. Headwater Gold’s Midas North project adjoins Hecla’s past producing Midas Mine complex, encompassing another large epithermal alteration cell along trend and directly north of the Midas Mine.

2023 Drill Program:

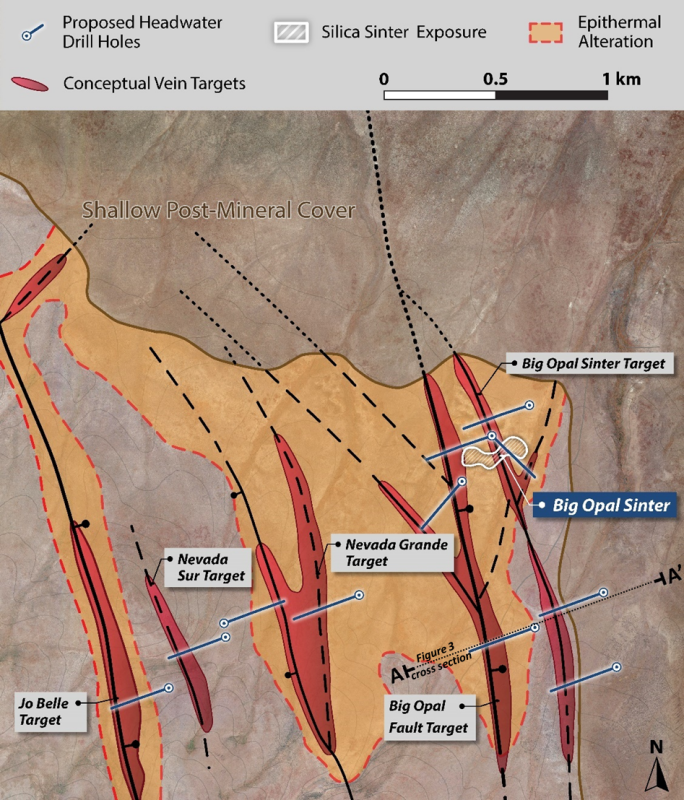

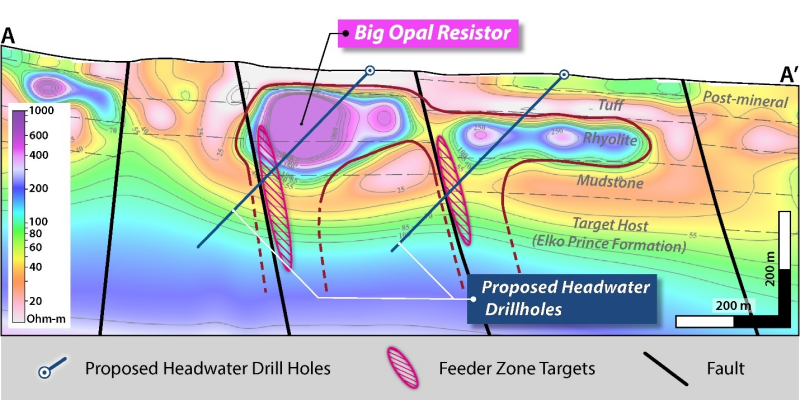

The drill program is expected to consist of approximately eight to ten holes comprising 3,500 m of drilling. A combination of RC and diamond core drilling will be utilized to test five principal target areas where potential feeder structures have been identified through the integration of geologic mapping and controlled-source audio-frequency magnetotelluric (“CSAMT”) resistivity geophysical interpretation. The presence of steam heated alteration, outcropping vent facies silica sinter, and collapse structures suggests the epithermal alteration cell is fully preserved with potential for high-grade gold and silver mineralization in an interpreted epithermal boiling zone, approximately 150 to 250 m below surface.

Figure 2: Geological map showing drill targets and planned drill holes for the maiden drill program at Midas North which is interpreted to represent a fully preserved epithermal system. Cross-section A-A’ corresponds to Figure 3 below.

Figure 3: Interpretive cross section through section A-A’ with CSAMT geophysics apparent resistivity profile, modelled geology and planned drill holes.

About the Midas North Project:

Headwater’s 100% owned and royalty-free Midas North project adjoins Hecla Mining Company’s past producing Midas Mine complex to the north and covers a large hydrothermal alteration cell, extending at least 4 kilometres in strike and 1 kilometre in width. Geologic mapping, surface sampling and geophysics completed by the Company in the project area have highlighted several priority areas to explore for high-grade epithermal veins at depth. Extensive epithermal alteration exists on the project, including widespread zones of high-level chalcedonic to opaline silica flooding, clay alteration and local sinter formation with fossilized geyser vents. The project has seen very limited historic exploration with no documented exploration drilling. Midas North is subject to Newcrest’s option to acquire up to 75% of the project following expenditures totaling US$30,000,000 and the completion of a Pre-Feasibility Study within a designated timeframe.

About Headwater Gold:

Headwater Gold Inc. (CSE: HWG, OTCQB: HWAUF) is a technically-driven mineral exploration company focused on the exploration and discovery of high-grade precious metal deposits in the Western USA. Headwater is aggressively exploring one of the most well-endowed and mining-friendly jurisdictions in the world with a goal of making world-class precious metal discoveries. Headwater has a large portfolio of epithermal vein exploration projects and a technical team comprised of experienced geologists with diverse capital markets, junior company and major mining company experience. The Company is systematically drill testing several projects in Nevada, Idaho, and Oregon and in August 2022 and May 2023 announced significant transactions with Newcrest Mining Limited where Newcrest acquired a 9.9% strategic equity interest in the Company and entered into several earn-in agreements on Headwater’s projects.

For more information, please visit the Company's website at www.headwatergold.com.

On Behalf of the Board of Directors

Caleb Stroup

President and CEO

+1 (775) 409-3197

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

Qualified Person:

The technical information contained in this news release has been reviewed and approved by Scott Close, P.Geo (158157), a “Qualified Person” (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, exploration activities and the specifications, targets, results, analyses, interpretations, benefits, costs and timing of them, Newcrest’s anticipated funding of the earn-in projects and the timing thereof, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as “pro forma”, “plans”, “expects”, “may”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, risks related to the anticipated business plans and timing of future activities of the Company, including the Company’s exploration plans and the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, the risk that Newcrest will not elect to obtain any additional interest in the earn-in projects in excess of the minimum commitment, the ability of the Company to obtain the required permits, changes in laws, regulations and policies affecting mining operations, the Company’s limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading “Risk Factors” in the Company’s prospectus dated May 26, 2021 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR website at www.sedar.com. In addition, on May 14, 2023 Newcrest and Newmont Corporation (“Newmont”) entered into a binding scheme implementation deed in relation to a proposal for Newmont to acquire 100% of the issued shares in Newcrest by way of an Australian scheme of arrangement. If the proposed merger receives shareholder and regulatory approval and is completed within the budget period outlined above, there is no certainty that the new combined entity will commit to the contemplated exploration activities approved by Newcrest.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements, except as otherwise required by law.