Archive

Star Royalties Highlights Increased Mineral Resources at Gold Mountain's Elk Gold Mine

| |||||||||

|  | ||||||||

December 9, 2021 - TheNewswire - Toronto, ON - Star Royalties Ltd. (the “Company” or “Star Royalties”) (TSXV:STRR) (OTC:STRFF), is pleased to highlight an announcement by Gold Mountain Mining Corp. (“Gold Mountain”) (TSX: GMTN, OTCQB: GMTNF, FRA: 5XFA), dated December 7, 2021, regarding updated mineral resources at its Elk Gold Mine (“Elk Gold”) in British Columbia, Canada.

Updated Mineral Resources Highlights

-

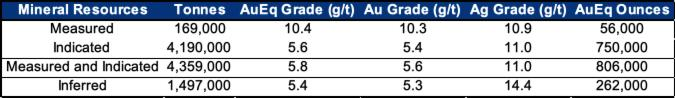

Measured and Indicated Resources at Elk Gold increased by 24% to 806,000 gold equivalent (AuEq”) ounces in 4,359,000 tonnes at 5.8 g/t AuEq, and Inferred Resources increased by 65% to 262,000 AuEq ounces in 1,497,000 tonnes at 5.4 g/t AuEq, for a total 32% increase in AuEq ounces across all mineral resource categories.

-

Vein models in the Siwash North Zone were incrementally expanded along strike and down dip by 37 new diamond drill holes. This drilling has connected the Siwash North Zone with the Gold Creek Zone which was historically viewed as a satellite deposit.

-

Elk Gold’s multiple zone potential was further demonstrated by 10 diamond drill holes into the Lake and South Zones, which led to a maiden Mineral Resource estimate in these satellite deposits.

Alex Pernin, Chief Executive Officer of Star Royalties, commented: “Only two months have passed since Star Royalties acquired a 2% net smelter return royalty on the Elk Gold Mine. Our expectation of continued and significant drilling success has been quickly realized. The updated mineral resource demonstrates the exceptional wealth creation potential of our business model. Indeed, this increase in resources grows Star Royalties’ attributable ounces in the Elk Gold Mine by 32% since our acquisition of the royalty. We look forward to the results of Gold Mountain’s Phase 3 drill program in 2022.”

Elk Gold: Updated Mineral Resource Estimate

Source: Gold Mountain disclosures.

Notes:

-

CIM definitions were followed for classification of Mineral Resources.

-

Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

-

Results are presented in-situ and undiluted.

-

Mineral resources are reported at a cut-off grade of 0.3 g/t AuEq for pit-constrained resources and 3.0 g/t AuEq for underground resources.

-

The number of tonnes and metal ounces are rounded to the nearest thousand.

-

The Resource Estimate includes both gold and silver assays. The formula used to combine the metals is: AuEq = ((Au_Cap*53.20*0.96) + (Ag_Cap*0.67*0.86))/(53.20*0.96).

-

The Resource Estimate is effective as of October 21, 2021.

Retains Investor Relations Consultant

Star Royalties is also pleased to announce that it has retained Galt Advisory Services Inc. (“Galt Advisory”), an investor relations and strategy consultancy based in Toronto, Canada. Galt Advisory will provide investor relations services for the Company with the aim of increasing Star Royalties’ visibility in the investment community and will engage with analysts and investors and communicate key events to shareholders.

The fees incurred by the Company, in consideration for the services provided by Galt Advisory, consist of cash consideration of $8,333 per month, effective December 1, 2021, and each month thereafter during the six month contract period. The Company and Galt Advisory act at arm's length, and Galt Advisory has no present direct interest in the Company or its securities. Certain employees of Galt Advisory, hold in aggregate, less than 0.05% interest in the Company or its securities. The fee paid by the Company to Galt Advisory are for services only. The engagement of Galt Advisory by Star Royalties is subject to approval of the TSX Venture Exchange.

CONTACT INFORMATION

For more information, please visit our website at starroyalties.com or contact:

Alex Pernin, P.Geo. Dmitry Kushnir, CFA

Chief Executive Officer and Director Head of Investor Relations

apernin@starroyalties.com dkushnir@starroyalties.com

+1 647 801 3549 +1 647 287 3846

ABOUT STAR ROYALTIES LTD.

Star Royalties Ltd. is a precious metals and green royalty and streaming investment company. The Company created the world’s first carbon negative gold royalty platform and offers investors gold exposure with an increasingly negative carbon footprint. The Company’s objective is to provide wealth creation through accretive transaction structuring and asset life extension with superior alignment to both counterparties and shareholders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute "forward-looking statements", including those regarding the strategies and business plans of the Company. Forward-looking statements are statements that address or discuss activities, events or developments that the Company expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved. A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, changes in business plans and strategies, market conditions, share price, best use of available cash, risks inherent to royalty and streaming companies, title and permitting matters, metal and mineral commodity price volatility, discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty or streaming payments, regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global social and economic climate, natural disasters and global pandemics, including COVID-19, dilution, and competition. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.