Archive

Norsemont Expands Footprint at Choquelimpie with Latest Positive Drill Results Which Intercepted 170 Meters of 1.57 G/T AuEq And 95 Meters of 1.92 G/T AuEq

| |||||||||

|  |  | |||||||

Vancouver, B.C. - TheNewswire - March 31st, 2022 - Norsemont Mining Inc. (CSE:NOM) (CNSX:NOM.CN) (OTC:NRRSF) (FWB:LXZ1) (“Norsemont” or the “Company”) is pleased to announce the third tranche of results from its 2021 maiden diamond drilling program at the company’s Choquelimpie high sulphidation epithermal gold-silver project in northern Chile.

Highlights:

-

Hole MV21-009 returned notable intercepts that include long gold-silver intervals that remain open along strike and to depth, as well as near-surface oxide, that expand the known footprint of mineralisation in the Choque Pit area:

-

170.0 m grading 1.35 grams per tonne (“g/t”) gold (“Au”), 18.3 g/t silver (“Ag”), (1.57 g/t AuEq*),

-

And 47.0 m grading 0.56 g/t Au,

-

And 15.0 m grading 0.84 g/t Au, 8.4 g/t Ag (0.94 g/t AuEq) as oxide

-

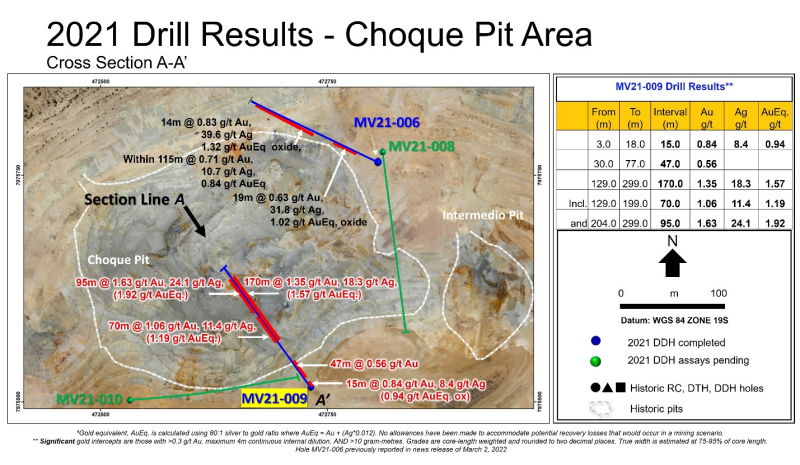

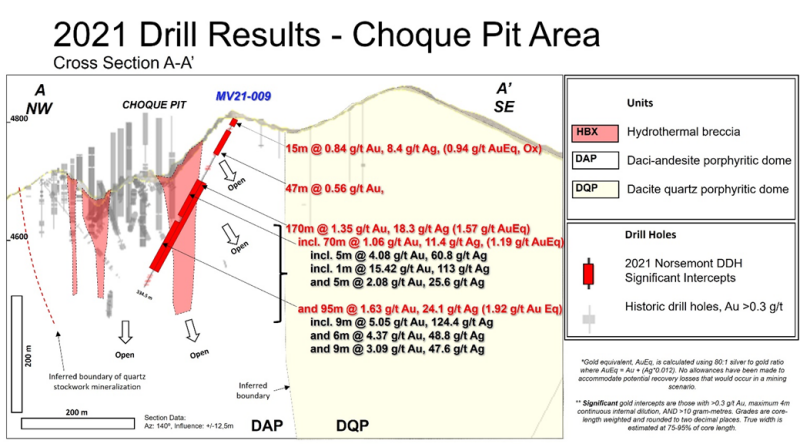

The third batch of analytical results for the program have been received from Andes Analytical Laboratories and correspond to diamond drill holes MV21-001, MV21-007 and MV21-009. A detailed plan map of holes in the Choque Pits area is shown in Figure 1 and a section through the hole with a table of significant gold intercepts** is shown in Figure 2.

*Gold equivalent (AuEq) is used for illustrative purposes, to express the combined value of Au and Ag as a percentage of Au. AuEq is calculated using 80:1 silver to gold ratio where AuEq = Au + (Ag*0.012). No allowances have been made to accommodate potential recovery losses that would occur in a mining scenario.

** Significant gold intercepts are those with >0.3 g/t Au, maximum 4.0 m continuous internal dilution; Grades are core-length weighted and rounded to two decimal places. True width is estimated at 75-95% of core length.

Marc Levy, Norsemont’s CEO comments, "This exciting drill hole, MV21-009 beneath the Choque Pit is potentially transformational for the company. The 170m interval grading 1.57g/t AuEq remains open along strike and at depth. The fact that precious metals grades increase to 1.92 g/t AuEq in the lower 100m of this hole along with the presence of copper mineralization supports our thesis of potential porphyry Au-Cu mineralization beneath this hole. Similarly, we need additional drill testing to determine what our new porphyry discovery at Vizcacha looks like at depth. In both locations we have demonstrated significant mineralization extends beyond historic drilling, to depths of at least 300m vertically below surface”.

Figure 1: Plan Map of the Choque Pit with location of significant gold intercepts in drill hole MV21-009 (this news release, red text). Results of hole MV21-006 were reported in a news release on March 2, 2022. Results of hole MV21-008 and MV21-010 are pending.

Figure 2: Cross-section A-A’ through drill hole MV21-009 showing significant gold intercepts and preliminary geological interpretation. Mineralisation is open along strike and to depth.

MV21-009 was sited to test for extensions of mineralisation to the south-east and beneath the Choque Pit, Figure 1 and 2. The hole intersected grey silica matrix hydrothermal breccias with pyrophyllite-dickite advanced argillic alteration and disseminated and crackle-hosted pyrite (±enargite-sphalerite) mineralisation. Notable mineralised intervals include 15.0 m of near surface oxide gold followed by 170.0 m of highly significant gold-silver mineralisation.

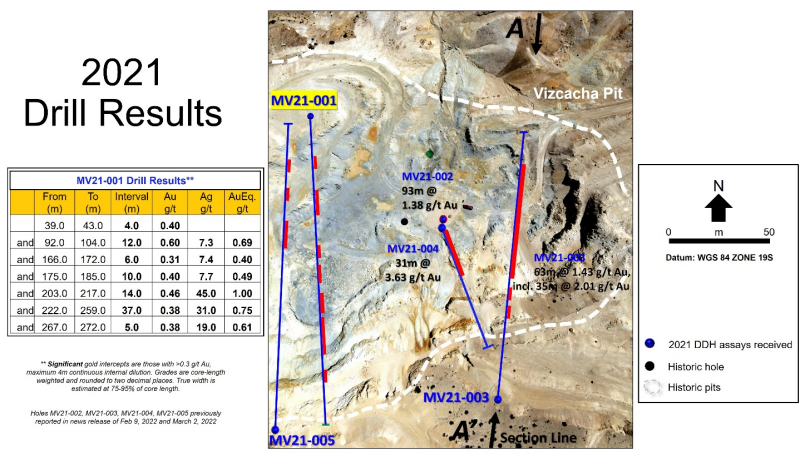

Drillhole MV21-001 was planned to test for extensions of the hydrothermal breccias seen in the Vizcachas pit to the north and to depth (Figure 3). The hole cut a multi-pulse breccia complex made up of chaotic matrix, tuffisite matrix and hydrothermal matrix breccias with advanced argillic alteration (dickite-pyrophyllite, illite-pyrophyllite) and silicification thought to represent the transition from the upper epithermal environment to the deeper porphyry environment. Mineralisation occurs as sulphides of pyrite (± enargite-galena-sphalerite) with gold grades open in all directions.

Figure 3: Plan Map of the Vizcacha Pit with location of significant gold intercepts in drill hole MV21-001. Results of holes MV21-002, 003, 004 and 005 were previously reported on Feb 9, 2022 and March 2, 2022.

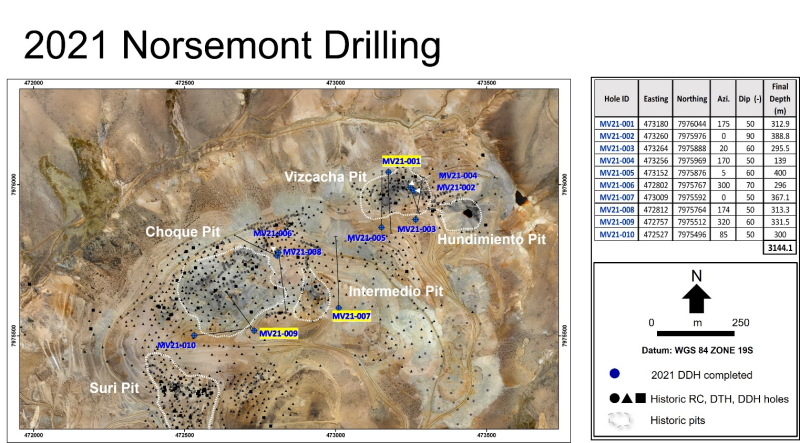

MV21-007 was sited to extend mineralisation between the Intermedio pit and the open mineralisation intercepted in historic drillhole R144 (69m @ 2.76 g/t Au, 21.9 g/t Ag), Figure 4. The hole cut a daci-andesite dome with argillic and advanced argillic alteration. Oxide mineralisation extends to 18.7 m before entering the sulphide zone with pyrite (±sphalerite-galena). The alteration and mineralisation, which returned sporadic intercepts, is interpreted as being typical of the peripheral “halo” to the high-grade zones seen in the Intermedio Pit.

John Currie, Norsemont’s VP of Exploration states “These new diamond drilling results continue to provide us with highly significant gold and silver grades over broad intervals and to depth in the Choque Pit area, below historic drilling. The upside potential of the Choquelimpie epithermal deposit is becoming better understood and this knowledge in combination with the discovery of proximal porphyry-style mineralisation, suggests excellent exploration potential going forward. Now, we await the final tranche of assay results from the drilling, and the results of surface mapping and sampling of the Vizcacha Porphyry”.

In the Q4 2021 drill campaign Norsemont completed ten diamond drill holes for a total of 3,144.1 m, (Figure 4).

Click Image To View Full Size

Figure 4: Choquelimpie historic open pits and drill holes, with Norsemont’s 2021 drill hole locations. Holes with results reported here are highlighted in yellow.

Drill core for the Choquelimpie 2021 drill program is collected directly from the drill site by company staff and taken to the core shack at the Choquelimpie camp. Drill core is logged, photographed, and sampled by staff who insert certified reference materials into the sampling sequence when/where appropriate. Sample lengths are marked at 1.0 metre intervals and the core is cut by a diamond blade rock saw, with half of the cut core placed in individual bar-code numbered polyurethane bags and half placed back in the original core box for permanent storage. The sample bags are sealed, placed in security-sealed sacks, and then delivered by company staff to the Andes Analytical Laboratory (AAA) sample receiving facilities in Arica, Chile.

All drill core splits reported in this news release were analysed at AAA in Santiago, Chile utilising their ICP_AES_HF38m1 analytical package. This comprises a four-acid digestion followed by a 38-element ICP-MS scan, in conjunction with the AEF_AAS_1E42 40g Fire Assay with AAS finish for gold on all samples. Samples that return values >10 ppm gold from fire assay and AAS are determined by using fire assay and a gravimetric finish (lab code AEF_GRV_1E43). Samples that return values >5,000 ppm for copper and >400 ppm silver by ICP analysis are determined by four acid digestion AAS finish assay (lab codes 4A-HF_AAS_1E13_ppm and 4A-HF_AAS_1E08_0.25-100 respectively).

The information presented in this news release was collected and prepared by SCM Vilacollo staff in accordance with Canadian regulatory requirements as set out in National Instrument 43-101. QA/QC for the analytical results was reviewed by Mr. Enrique Grez, an independent qualified person, registration number 0015 of the Comisión Calificadora de Recursos y Reservas Mineras de Chile, and a Qualified Person as defined in National Instrument 43-101, Standards for Disclosure for Mineral Projects.

Mr. Art Freeze, P.Geo, Director of Norsemont Mining as well as a qualified person as defined by National Instrument 43-101, has supervised the preparation of the technical information in this news release.

About Norsemont Mining Inc.

Norsemont comprises experienced natural resource professionals focused on growing shareholder value and developing its flagship project through to bankable feasibility. Norsemont Mining owns a 100-per-cent interest in the Choquelimpie gold-silver project in northern Chile, a previously permitted gold and silver mine. Choquelimpie has over 1,710 drill holes, with significant existing infrastructure, including roads, power, water, camp and a 3,000 TPD mill.

On behalf of the Board of Directors,

NORSEMONT MINING INC.

Marc Levy

CEO & Chairman

For more information, please contact the Company at:

Telephone: (604) 669-9788; Facsimile: (604) 669-9768

Investor Relations:

Paul Searle (778) 240-7724 (psearle@citygatecap.com)

Forward-Looking Information

This release includes certain statements that are deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address events or developments that Norsemont expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include changes to commodity prices, mine and metallurgical recovery, operating and capital costs, foreign exchange rates, ability to obtain required permits on a timely basis, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.