Archive

Ashley Gold Acquires Additional Claims at Tabor with Historical Sample of 33g/t Au*

| |||||||||

|  |  |  | ||||||

CALGARY, ALBERTA, June 19, 2024 – TheNewswire – Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) announces the addition of four claims to the Sakoose Option Agreement just east of the Tabor Lease. These claims have never been drilled however a high-grade surface sample was acquired in 1980 grading 33 g/t Au*. In addition the Company is happy to report a safe conclusion to the field acquisition of the Howie Gradient IP Survey with data expected next month.

Highlights

-

Historical sampling grading 33g/t Au* on new claims

-

On trend with Tabor deposit with 2023 drill program hitting 5g/t Au over 8m including 41 g/t over 1m

-

Completion of Howie Gradient IP survey with data expected July

*Historical sample non-43-101 compliant

Darcy Christian, CEO of Ashley comments “These new claims show a similar high-grade quartz vein hosted in a Quartz Feldspar Porphyry as seen at the Tabor deposit and we are excited to get out and confirm the historical results. This sample is located almost 2km from our 2023 drill program and adds additional indications for a sizeable strike-length to the Tabor system. Also, the data acquisition at Howie went excellent with no environmental or personnel issues. We look forward to the processed data next month.”

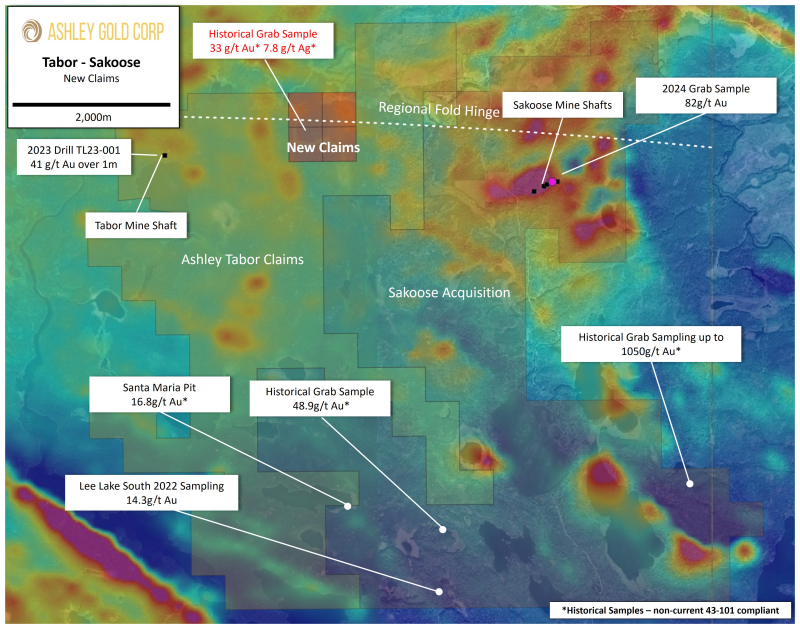

Figure 1. Location of New Sakoose Option Claims

About the Additional Claims

The additional claims are located just east of the Tabor Lease and contain the Star Apple occurrence sampled in 1980 by Sulpetro Metals in 1980. It is described in historical reports as a quartz vein in a QFP and a single sample was taken as chips across 25cm. The historic sample graded 33 g/t Au* and 8.7 g/t Ag* (1.18 oz/t Au* and 0.31 oz/t Ag*). The Tabor vein is also hosted in QFP located on trend with the Star Apple occurrence and is likely the same system to be confirmed by 2024 field work.

The claims were added into the Sakoose Option as an amendment and will have the same terms and conditions as the original Sakoose claims. A cash consideration of $1,250 was paid to the optionors to add to amendment. Terms of Original Option Agreement are as follows:

-

$8,000 cash payment and 200,000 shares on execution of agreement

-

stAnniversary – $12,000 cash payment

-

nd Anniversary – $18,000 cash payment

-

rd Anniversary – $30,000 cash payment or,at election of Ashley, $14,000 cash payment and $20,000 payable in shares based on previous 20-day Volume Weighted Average Price (VWAP)

-

1.5% Net Smelter Royalty (NSR) with option to purchase 0.5% back at $600,000 reducing NSR to 1%

About the Howie Gradient IP Survey

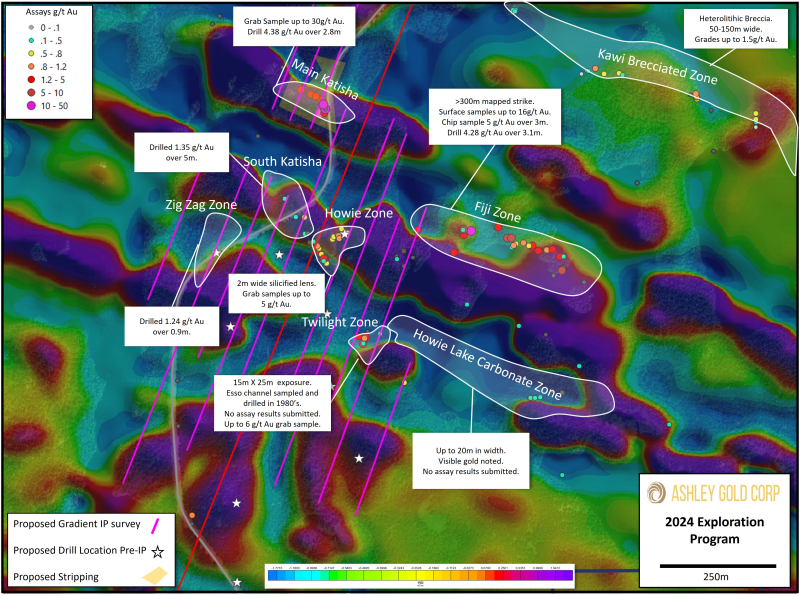

The field acquisition of the Howie Gradient IP survey has been completed with no environmental concerns or Personnel concerns. The field data will now be processed by Abitibi Geophysics into a final interpretive product for identifying potential drill targets at depth.

Figure 2. Location of Howie gradient IP Survey Lines

Samples in this news release denoted with an Asterix (*) are historical in nature and are not 43-101 compliant.

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Darcy Christian, P.Geo., President of Ashley, who is a Qualified Person as defined by NI 43-101.

About Ashley Gold

Ashley Gold is focused on creating substantive, long-term value for its shareholders through the discovery and development of world class gold deposits. Ashley has acquired, 100% of the Tabor Lake Lease subject to a 1.5% royalty, 100% of the Santa Maria Project subject to a 1.75% royalty, 100% interest in the Howie Lake Project subject to a 0.5% royalty, 100% interest in the Alto-Gardnar Project subject to a 0.5% royalty, 100% interest in the Burnthut Property subject to a 1.5% NSR, and an option to earn 100% of the Sakoose claims subject to a 1.5% NSR. In addition, Ashley has entered into an option agreement to earn 100% of the Sahara Uranium-Vanadium property in Emery County, Utah subject to a 2% NSR.

Ashley Gold Corp. is an early-stage natural resource company engaged primarily in the acquisition, exploration, and development of mineral projects. The Corporation’s objective is to conduct efficient and economical exploration on its growing portfolio of high-quality gold projects as well as moving the Sahara Uranium-Vanadium project towards near-term production.

The responsibility of this release lies with Mr. Darcy Christian, President and CEO • +1 (587) 777-9072 • dchristian@ashleygoldcorp.com , may be contacted for further information. www.ashleygoldcorp.com

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

DISCLAIMER & FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management’s expectations. Factors which cause results to differ materially are set out in the Company’s documents filed on SEDAR. Undue reliance should not be placed on “forward looking statements”.