Archive

Abitibi Metals Unveils 2024 Exploration Strategy for the High-Grade B26 Deposit (Ind: 7.0MT @ 2.94% Cu Eq & Inf: 4.4MT @ 2.97% Cu Eq), Focused on Growth and Discovery

| |||||||||

|  | ||||||||

November 23, 2023 – TheNewswire - London, Ontario – Abitibi Metals Corp. (CSE:AMQ) (OTC:GSKKF) (FSE:4KG) (“Abitibi” or the “Company”), is pleased to unveil its 2024 exploration strategy for the high-grade B26 Polymetallic Copper Deposit (“B26” or the “Project”). Located within the prolific Abitibi Greenstone Belt, B26 represents a substantial opportunity to develop a copper, zinc, gold, and silver Polymetallic Deposit in a region with a rich history of base and precious metal production, which includes the Detour and Casa Berardi Mines. On November 16, 2023 the Company announced that it had signed a Definitive Agreement to acquire up to 80% of the B26 Deposit (“B26” or the “Project”) from SOQUEM Inc. (“SOQUEM”), a subsidiary of Investissement Québec, and an entity at arms’ length to the Company.

Abitibi is the first public company with the option to earn into the B26 Deposit. With a strike length of 1 km and depth extent of 0.8 km, both of which are open to expansion, Abitibi will focus on delivering shareholder value with a 3-phased approach, which includes a minimum targeted 10,000 metres of drilling that will focus on both growing the resource and testing the expansion potential.

Abitibi Metals will launch a fully financed 2,750-metre drilling program in January 2024. The initial focus will be to delineate the open-pit potential of the B26 Deposit while concurrently advancing and expanding the existing underground resource.

Property Highlights

-

The Project’s 2018 resource included 254 holes over 115,311 meters, advancing the asset to a significant resource that includes, across all categories, 400 million pounds of copper, 286,000 ounces of gold, and significant zinc silver exposure.

-

-

Indicated: 6.97 Mt at 2.94% Cu Eq (1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag)

-

Inferred: 4.41 Mt at 2.97% Cu Eq (2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag)

-

-

Deposit remains open at depth and laterally with strong historical intercepts* including:

-

2.32% Cu Eq over 89.5 metres (1274-13-117)

-

3.05% Cu Eq over 48.1 metres (1274-16-224)

-

8.95% Cu Eq over 11.5 metres (1274-14-152)

-

-

Within 7 km of the historical Selbaie Mine, a similar Polymetallic Copper Deposit with a variety of mineralization styles and element combination, that had a historical resource of 56.9 Mt @ 0.87% Cu, 1.85% Zn, 0.55 g/t Au, 39 g/t Ag (CONSOREM 2012).

Jonathon Deluce, CEO of Abitibi Metals, stated, "We're thrilled to unveil our first-year strategy for the B26 Polymetallic Copper Deposit. We are focused on growth and discovery and will leverage the extensive work already completed to drill existing high-priority targets in the near-term while systematically building a robust 3D model that provides additional high-value targets to grow and expand the resource in our follow-up programs throughout the rest of the first year.

We believe that the initial 10,000 metres of drilling we have planned is only the tip of the iceberg and that B26 will deserve much larger programs as this Project progresses.”

Mr. Deluce continued: “We are confident that our two dynamic projects, the B26 Deposit and the Beschefer Gold Project (known historically as B14), located just 7 km apart, create a district-scale metals opportunity in the Abitibi Greenstone Belt. The standout historical intercept at B26 of 2.32% Cu Eq over 89.5 metres, coupled with Beschefer's impressive 55.63 g/t gold over 5.57 metres, exemplifies the high-grade potential of both Projects.

As countries increasingly seek to secure critical metals, we take pride in being a Canadian company focused on developing home-grown assets. Our year one exploration strategy is designed with clear objectives: to de-risk, expand, and aim to make new discoveries outside of this significant resource. As the first public company to have the opportunity to option B26, we fully intend on pairing our aggressive exploration program with an equally aggressive marketing and awareness strategy in order to deliver B26 the attention it deserves."

The Company will advance B26 through a first-year exploration plan focused on 3 milestones:

1. 10,000+ Metres of Drilling:

-

he Company anticipates commencing drilling upon permit approval, targeting the completion of at least 10,000 metres in the first year. This phase will concentrate on high-priority infill drilling in areas with higher metal factors within the resource, roughly from surface down to 300 metres and exploring mineralized lenses continuity and geometry, and expansion possibilities.

-

The Company is confident that the Project will warrant much larger annual drill budgets for expanding the resource and developing new targets. The Company will be ready to scale up drilling once valuation and financing goals are met.

-

Abitibi Metals will launch a fully financed 2,750-metre drilling program in January 2024. The initial focus will be to delineate the open-pit potential of the B26 deposit while concurrently advancing and expanding the existing underground resource.

2. Updated Internal Resource & 3D Model:

-

Through the review of the 2018 resource, we have identified opportunities for improvement, which will strengthen our drill plan and a potential increase of current tonnage without further drilling. These areas include:

-

Geological Modeling: Better define high-grade lenses to generate strong resource growth-focused drilling

-

Density Factor: Review and analyze additional samples to determine the correct density factor to include in the updated internal resource / 3D model. The Company believes the density factor could be currently understated, which could result in the correct factor contributing additional tonnage above the 2018 resource numbers.

-

Gold Silver Grades: Review and analyze metal grade variability for resource estimation update.

-

Resource Estimation (open-pit and underground): To complete a robust 3D and internal resource model which will provide a strong basis for evaluating economic potential.

-

3. Gravity Survey:

-

The Company is planning a Gravity Survey grid to cover extensions of the VMS contact to help model the geology, primarily the mafic-felsic contacts and sulphide-rich environment, in order to target new mineralized extensions close to the surface and at a moderate depth (300-600 metres). This is aligned with our first-year objective of improving our understanding and model of the open-pit potential of the Project.

About the B26 Deposit:

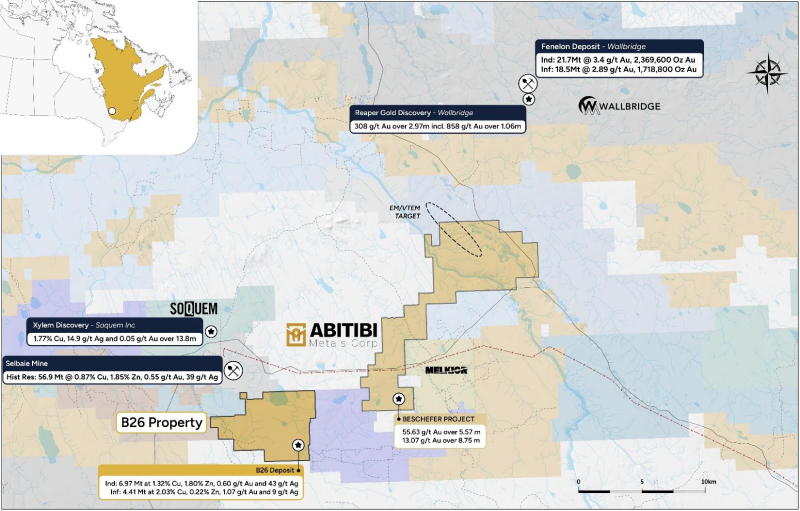

Figure 1 – Project outline and area map.

The B26 Deposit is located 7 kilometres to the South-East of the historical Selbaie Mine. The Selbaie Mine had a historical resource of 56.9 Mt @ 0.87% Cu, 1.85% Zn, 0.55 g/t Au, 39 g/t Ag (CONSOREM 2012) and was in production for over 20 years. Reference to this nearby property is for information only, and there are no assurances that the Company will achieve the same results at the B26 Deposit.

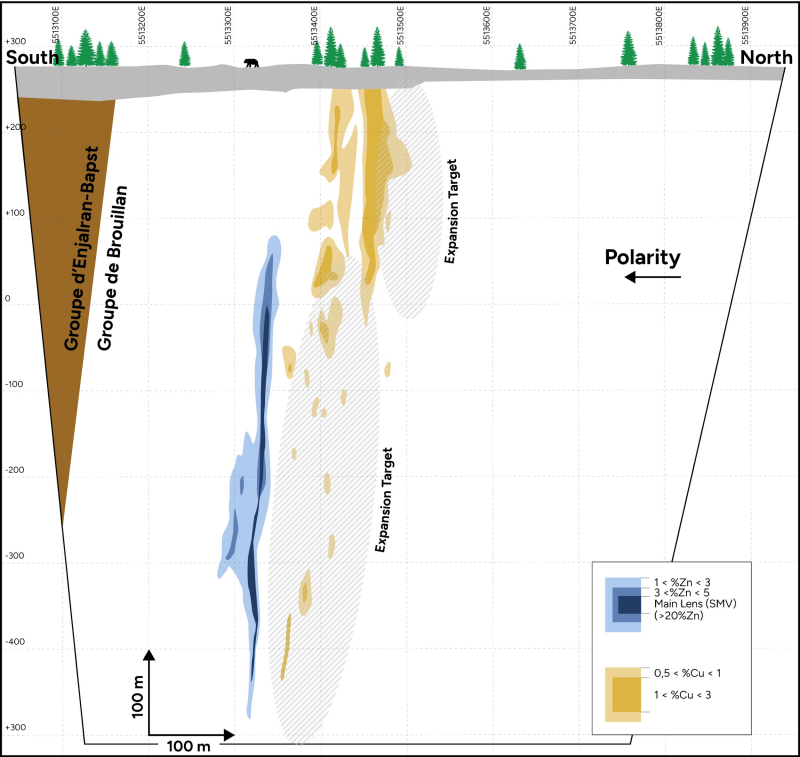

The B26 mineralization is composed of a stacking of massive polymetallic and semi-massive polymetallic sulfide lenses extending over a kilometric strike length within a strongly dipping basin filled by felsic volcanism products. Sulfide-rich mineralization is mostly hosted in rhyolite and associated tuffs. Two main types of mineralization characterize the B26 Deposit. The northern part of the mineralized system is characterized by chalcopyrite veins and veinlets hosted in sericitized and chloritized rhyolite. The southern portion of the system contains mostly disseminated to massive sphalerite, pyrite and galena mineralization, hosted in a dome of massive rhyolite. The zones are stacked in a sub-parallel pattern, oriented generally east-west, and dip 87° to the south. Prior drilling has established the continuity down to a vertical depth of 800 meters.

Project Summary:

Location: The Project comprises 66 claims covering 3,328 hectares in the Eeyou Istchee Baie-James territory, Nord du Québec region. There is year-round road access with a power line running through the Project.

History: In 1997, SOQUEM drilled discovery hole B26-03, which intercepted 1.87 g/t Au and 2.89% Cu over 11.3 metres. Since that time, the project has been systematically explored by SOQUEM by drilling 254 holes over 115,311 meters, which was included in their 2018 resource update.

Resource: On March 4, 20182, SOQUEM announced its’ updated resource on the B26 deposit prepared by SGS Canada Inc. (N.I. 43-101 Compliant), which consisted of indicated resources totaling 6.97 Mt grading 1.32 % Cu, 1.80 % Zn, 0.60 g/t Au and 43 g/t Ag and inferred resources totaling 4.41 Mt grading 2.03 % Cu, 0.22 % Zn, 1.07 g/t Au and 9 g/t Ag.

Drill Results:

A summary of selected historical drill results is reported in Table 2:

|

Table 2 – Summary of Selected Historical Drill Results |

||||||||

|

Drill Hole |

From (m) |

To (m) |

Length (m) |

Cu Eq |

Cu (%) |

Gold (g/t) |

Zn (%) |

Ag (g/t) |

|

1274-13-117 |

269.5 |

359 |

89.5 |

2.32 |

1.95 |

0.46 |

0.08 |

5.47 |

|

1274-16-224 |

113.4 |

161.5 |

48.1 |

3.05 |

2.66 |

0.52 |

0.03 |

5.75 |

|

1274-16-238 |

583.8 |

628 |

44.2 |

2.55 |

0.07 |

0.05 |

3.45 |

158.33 |

|

1274-14-152 |

71.8 |

83.3 |

11.5 |

8.95 |

3.8 |

7.72 |

0.03 |

10.18 |

|

1274-14-174 |

482.5 |

532 |

49.5 |

1.90 |

1.63 |

0.25 |

0.14 |

6.94 |

|

1274-14-208 |

218 |

230 |

12 |

7.2 |

5.40 |

2.62 |

0.03 |

8.86 |

|

Notes: 1. The intercepts above are not necessarily representative of the true width of mineralization. 2. Copper Equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Metal recoveries of 100% are applied in the copper equivalent calculation. |

||||||||

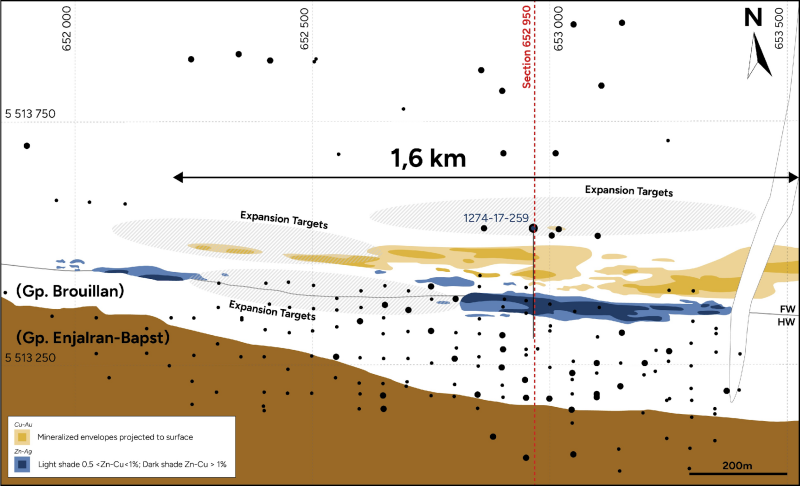

Expansion Potential: The B26 Deposit has a continuous strike length of 1 km with additional mineralization drilled up to a strike length of 1.6 km and to a depth of 0.8 km. The deposit shows expansion potential laterally within the down dip inside the felsic unit hosting the deposit as highlighted in geoscientific works produced by SOQUEM and research partners; UQAC (University of Québec at Chicoutimi) and GSC (Geological Survey of Canada).

Given the nature of the VMS systems typically observed in the Abitibi, which are both deep-seated and occur in clusters and the proximal location of Selbaie, the Company, therefore, believes that the growth potential is significant and will provide further details in upcoming releases to highlight its exploration plan and the expansion opportunities laterally and at depth.

The following plan view and central section provide an overview of the current mineralization and expansion potential:

Figure 3 - Plan View showing lateral expansion targets laterally and along strike3.

Figure 4 - Central Section showing expansion targets at depth3.

Qualified Person

This press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, who is a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

About Abitibi Metals Corp.:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the high-grade B26 Polymetallic Copper Deposit (Ind: 7.0MT @ 2.94% Cu Eq & Inf: 4.4MT @ 2.97% Cu Eq) and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modelled zones. With approximately 45% insider ownership and a market cap under $15M, the Company is tightly structured for potential positive developments.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD

Jonathon Deluce

Chief Executive Officer

For more information, please call 226-271-5170, email info@abitibimetals.com, or visit https://www.abitibimetals.com.

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Source 1: Fayard, Q, Mercier-Langevin, P., Wodicka, N., Daigneault, R., & Perreault, S. (2020). The B26 Cu-Zn-Ag-Au Project, Brouillan Volcanic Complex, Abitibi Greenstone Belt, Part 1: Geological Setting and Geochronology.

Source 2: Rapport Technique NI 43-101 Estimation des Ressources Projet B26, Québec, For SOQUEM Inc., By SGS Canada Inc., Yann Camus, ing., Olivier Vadnais-Leblanc, géo., SGS Canada – Geostat., Effective Date: April 18, 2018, Date of Report : May 11, 2018

Source 3: Fayard, Q. (2020). CONTRÔLES VOLCANIQUES, HYDROTHERMAUX ET STRUCTURAUX SUR LA NATURE ET LA DISTRIBUTION DES MÉTAUX USUELS ET PRÉCIEUX DANS LES ZONES MINÉRALISÉES DU PROJET B26, COMPLEXE VOLCANIQUE DE BROUILLAN, ABITIBI, QUÉBEC.

Forward-looking statement:

This news release contains certain statements, which may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company’s behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi’s forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects,” “estimates,” “anticipates,” or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results “may,” “could,” “might” or “occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations.