Archive

Jervois Quarterly Activities Report to 30 June 2022

| |||||||||

|  | ||||||||

|

Jervois Global Limited ACN: 007 626 575 ASX:JRV TSXV:JRV OTC:JRVMF Corporate Information: 1,519.7M Ordinary Shares 93.6M Options 3.8M Performance Rights Non-Executive Chairman Peter Johnston CEO and Executive Director Bryce Crocker Non-Executive Directors

Brian Kennedy

David Issroff Company Secretary Alwyn Davey Contact Details Suite 2.03,

1-11 Gordon Street Victoria 3121 Australia P: +61 (3) 9583 0498 E: admin@jervoisglobal.com W: www.jervoisglobal.com |

Highlights Jervois Finland:

Idaho Cobalt Operations (“ICO”):

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil:

Corporate:

|

Jervois Finland

Q2 results:

-

Quarterly revenue: US$91.2 million (Q1 2022: US$105.1 million)

-

EBITDA margin: 13.0% (Q1 2022: 14.2%)

-

Sales volume: 1,139 metric tonnes (Q1 2022: 1,446 metric tonnes)

-

Production volume: 1,145 metric tonnes (Q1 2022: 1,275 metric tonnes)

Sales and Marketing:

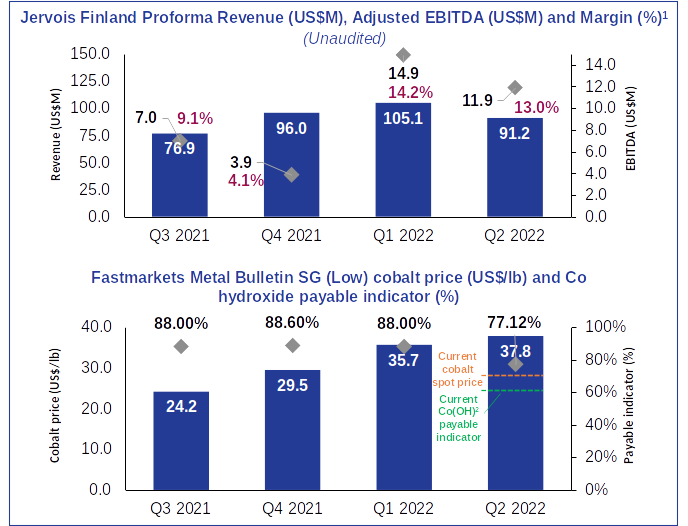

Jervois Finland achieved Q2 2022 revenue of US$91.2 million, generated via quarterly cobalt sales volumes of 1,139 metric tonnes, down on the previous quarter. Volatility in both end-user demand and cobalt feed supply impacted cobalt prices and revenue. Cobalt prices (Metal Bulletin (“MB”) Fastmarkets Standard Grade (“SG”) Low) trended down from nearly US$40.00/lb at the end of Q1 2022 to US$26.95/lb as at 20 July 2022. The MB Fastmarkets SG Low cobalt hydroxide payable indicator also trended downwards, sitting at 63.0% at the same date.

Quarterly production was 1,145 metric tonnes, a decrease of ~11% on the previous quarter. This reduction was in part due to the planned annual maintenance shutdown in June, with also reduced reliability experienced in global supply chains that impacted cobalt feed availability early in the quarter.

Due to a catch up of raw materials supply late in the quarter, along with weakened global market demand for cobalt largely associated with Covid-19 lockdowns in China, total inventory volumes increased across the quarter. Jervois expects cobalt inventory levels to remain temporarily above levels typically targeted, to ensure profitability is optimised and risk is managed relative to ongoing supply chain challenges. Working capital is expected to normalise during the second half of 2022, with management focussed on balancing supply chain risk, commercial objectives, and liquidity management.

Jervois’ outlook for key market segments is summarised below.

Batteries:

-

Short–term battery demand has softened, driven by Covid shutdowns in China.

-

In the current falling price environment there is very little spot demand for battery chemicals as customers wait for prices to stabilise.

-

Despite short term volatility and supply chain destocking initiated by China, the medium- and longer-term trend of significant demand growth remains intact, with significant OEM (automaker) interest in expanding delivery commitments over time.

Chemicals, Catalysts and Ceramics:

-

Catalysts: consumption at lower rates than previous, but stabilising. Jervois continues to see new opportunities, specifically in North America later this year.

-

Chemicals: consumption in key applications such as copper electrowinning, rubber chemicals, animal feed, plating and specialty chemicals remains stable, although regional demand dynamics vary. Supply chain adjustments activity has resulted in delayed shipments. In Asian markets, specifically Japan and Korea, premiums are lower due to increased competition associated with the previously mentioned Covid lockdowns in China triggering mass destocking of Chinese industry and cobalt trade.

-

Ceramics: demand for pigments production is slowing as producers mull the impact of significant energy cost increases and the falling cobalt price; pigment applications using cobalt are typically more elastic in nature, particularly relative to price inelasticity of other cobalt consuming industries. Cobalt usage in the smaller glass application segment remains stable.

Powder Metallurgy

-

Outlook for 2022 remains stable, but more customers are expressing concern regarding the last four months of the year as inflation rates increase and the possibility of a recession grows

-

All markets remain stable except automotive which is variable dependent upon customer and geography; the automotive sector is largely expected to remain this way until semiconductor and parts availability improves.

-

Aerospace continues to incrementally improve, as outside of China the rest of the world and associated movement of persons and goods normalises post Covid.

Financial Performance2

Jervois Finland achieved Q2 2022 revenue of US$91.2 million. The Q2 2022 adjusted EBITDA of US$11.9 million compared to US$14.9 million in the prior quarter.

Figure 1: Jervois Finland Financial Metrics and Market Price Indicators

Earnings Guidance

As a result of lower cobalt prices and sales volumes, Jervois has revised EBITDA full year 2022 guidance to US$35.0 million to US$40.0 million based on a US$27.50/lb forecast cobalt price assumption for the remainder of the year, from US$50 million to US$55 million which was based on a US$39.75/lb forecast cobalt price assumption at the end of Q1 2022.

Table 1: Updated 2022 EBITDA guidance for Jervois Finland.

|

CY 2022 guidance update |

Previous guidance |

|

|

2H 2022 Cobalt price (Metal Bulletin Fastmarkets Standard Grade) – US$/lb |

27.50 |

39.75 |

|

CY2022 sales volumes guidance – tonnes |

5,500 to 5,750 |

5,750 to 6,000 |

|

CY2022 EBITDA guidance – US$M |

35 to 40 |

50 to 55 |

Key factors that underpin the guidance update are as follows:

-

-

Guidance is based on actual cobalt price (MB Fastmarkets SG Low) of US$36.70/lb for 1H 2022, and a forecast price of US$27.50/lb price the second half of the year. The spot MB Fastmarkets SG Low price on 20 July 2022 was US$26.95/lb.

-

Lower sales guidance (previously 5,750 to 6,000 tonnes) principally due to weaker end use demand in key end use segments due to the factors detailed previously within the Jervois Finland cobalt market update.

-

Expected inventory profile for 2022 drives higher than average feed cost realisation in the profit and loss account in second half (lower than average in first half).

-

Recent declines in market cobalt hydroxide expected to take time to translate into cost and EBITDA benefits (new purchases recorded in inventory).

-

Guidance assumes constant prices for 2H 2022 – price volatility in the period will impact actual EBITDA outcome.

-

Jervois Finland Expansion Plans

In May, Jervois announced the commencement of a Bankable Feasibility Study (“BFS”) to assess the expansion of its production of refined cobalt to at least 6,000 metric tonnes of additional annual cobalt refining capacity at Kokkola Industrial Park, Finland. Current finished product capacity is 11,000 metric tonnes per annum of contained cobalt, significantly higher than the refining tolling capacity available to Jervois at Umicore’s refinery.

An expansion of refining capacity is expected to be available in conjunction with forecast increased cobalt demand in the second half of this decade, largely associated with rising electric vehicle penetration.

The expansion advances the Company’s strategy to become a globally significant supplier of speciality chemicals and advanced manufactured cobalt products into battery and other industries.

Initial commercial discussions with both final product customers and refinery feed suppliers (including recyclers) are underway.

Expansion timing will be determined in conjunction with key customers and will not require any near-term material financial investment for Jervois. Technical partner selection processes in Finland are underway, covering key workstreams such as flowsheet piloting, process engineering and environmental and other permitting.

Idaho Cobalt Operations (“ICO”), United States

In June, Jervois announced it expected to commence commissioning the plant at ICO in September 2022 with first ore through the mill in October 2022 and sustainable, full rate ore processing forecast by February 2023.

With detailed engineering, procurement, and commitments all more than 90% complete, Jervois revised final forecast capital expenditure to bring ICO into production to US$107.5 million (from US$99.1 million), an increase of ~7.5%. Project construction experienced cost pressures due to the significant United States inflationary environment, compounded in recent months due to contractor shortages and poor weather conditions across May and June. Weather-related delays have affected site installation for the accommodation camp, which is now expected to be operable in August.

In July, ICO completed the second and final draw down of the US$100.0 million Senior Secured Bonds (“Bonds”). The second draw down, of US$51 million, follows the July 2022 visit to site by RPM Global, engaged in its capacity as Independent Engineer on behalf of the Bondholders. RPM Global submitted an affirmed Cost to Complete test to the Bonds trustee, confirming ICO is fully funded to completion.

ICO Construction and Mine Development Progress

As of June, mine development continued at ~27 feet per day. Planned increases to underground working faces, improved water management and road conditions, as well as additional personnel and greater utilisation of existing and future mining equipment on site are expected to continue to improve mine development productivity. Jervois and its mining contractor, Small Mine Development, remain confident in the revised mining production targets that underpin the capital cost update.

The SAG mill, ball mill and crusher are each in place, and work continues with facilities construction and equipment placement.

An official opening ceremony is scheduled at site for 7 October 2022 with expected participation of United States political leadership and Australian government delegates.

At end June, Jervois had spent US$66.9 million of the total capital expenditure budget. Capital expenditure in Q2 2022 was US$25.6 million.

Drilling at ICO

The previously announced initial US$1.2 million infill programme, commenced in Q1 2022, is set to be complete in August this year. Infill drilling rates over 200 feet per day are being achieved as part of a 19,000 feet underground campaign to decrease hole space aiming to enhance ore body knowledge and de-risk early mining.

In June, Jervois approved an additional US$3.6 million for drilling to complete additional infill and first expansion drilling from both surface and underground platforms to further define and expand its RAM deposit within ICO. This will take total planned drilling footage in 2022 to 46,000 feet.

Both drilling campaigns will improve ICO’s resource model and will be used to develop a production block model for both short- and medium-term mining operations and will target expansion down dip of the currently defined and known deposit. The RAM deposit remains open at depth and along strike, and Jervois has confidence that there exists a strong potential of both resource and reserve expansion. Consistent with this expectation, planning is underway in relation to Jervois’ neighbouring Sunshine deposit and historical mineral resource, with preparations for a 2023 summer drill programme well underway. The historical Sunshine cobalt resource is located a short traverse to the ICO mill and concentrator currently under construction.

ICO is a key asset in delivering Jervois’ strategy to become a leading independent cobalt and nickel company providing metals and minerals for the world’s energy transition through a western supply chain. When commissioned in Q3 2022, ICO will be the United States’ only domestic mine supply of cobalt, a critical mineral used in applications across industry, defence, energy, and electric vehicles.

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil

In July, Jervois completed the acquisition from Companhia Brasileira de Alumínio (“CBA”) of 100% of the São Miguel Paulista nickel cobalt refinery (“SMP”) in São Paulo, Brazil. SMP is Latin America’s only electrolytic class 1 nickel and cobalt refinery, and operated successfully for over 30 years prior to being placed on care and maintenance by CBA when its vertically integrated mine was also closed due to low metal prices.

Total consideration to be paid for the acquisition is R$125.0 million in cash. Jervois paid the initial R$15.0 million payment in late 2020 when the acquisition was publicly announced and a further R$47.5 million on closing in accordance with the previously announced terms of the purchase agreement. The remaining R$62.5 million is to be paid on the earlier to occur of commencement of commercial production at SMP and June 2023, per the purchase agreement (which Jervois expects to be June 2023 based on SMP’s current restart schedule).

A Jervois technical and commercial team is currently working onsite at SMP undertaking detailed planning for the expected restart.

In April, Jervois released a BFS for Stage 1 of the SMP restart to process mixed nickel hydroxide (“MHP”) and cobalt hydroxide through to metal.

Jervois forecasts to produce 10,000 metric tonnes per annum (“mtpa”) and 2,000 mtpa of refined nickel and cobalt metal cathode respectively in Stage 1, with Net Present Value (“NPV”) of US$228 million and US$141 million at an 8% (real) discount rate on a pre-tax and post-tax basis respectively; nominal Internal Rate of Return (“IRR”) of 47% (pre-tax) and 35% (post-tax).3

The supplemental Stage 1 BFS, including POX for sulphide concentrates, is due at the end Q3 2022. Engineering is currently focused on debottlenecking, accelerating the restart and enhancing nickel through-put capacity associated with Stage 1. Jervois is targeting a return to the full 25,000mtpa refined nickel production, but not at the expense of accelerated restart timing, risk optimisation and a staged, capital efficient approach.

Nico Young Nickel-Cobalt Project, New South Wales, Australia

Jervois’s 100%-owned Nico Young nickel and cobalt project envisages heap leaching nickel and cobalt laterite ore to produce either an intermediate MHP or refining through to battery grade nickel sulphate and cobalt in refined sulphide.

Planning for Jervois’s drilling campaign at Nico Young is well underway, with an initial focus on converting inferred resources into the indicated category.

Corporate Activities

Liquidity

Jervois ended the June 2022 quarter with US$57.6 million in cash (excluding restricted cash associated with the US$100 million ICO Senior Secured Bond). The US$51 million in the Escrow Account (restricted cash) was subsequently released on 20 July 2022 once requisite conditions were met.

In June, Jervois announced its subsidiaries, Jervois Suomi (Holding) Oy and Jervois Finland Oy, increased the secured loan facility (the “Facility”) with Mercuria Energy Trading SA, a wholly-owned subsidiary of Mercuria Energy Group Limited, by US$75 million to US$150 million.

Key terms of the Facility remain consistent with Jervois’ announcement to the market on 29

October 2021.

Jervois elected to draw US$25.0 million of this additional facility in June, taking the total balance out to US$100.0 million. Up to US$50.0 million is permitted to be transferred out of the Jervois Finland group of companies for other general purposes in the Jervois group including, for example, funding of the Group’s development activities in the United States and Brazil.

At June period end total debt was US$150 million; as of this release date, it has increased to US$200 million associated with full drawdown of the ICO Senior Secured Bond. Cash (all unrestricted) on hand had also increased to US$110 million associated with the final drawdown of the ICO Senior Secured Bond, leading to net debt of US$90 million.

Jervois Annual General Meeting

At its Annual General Meeting held on 6 May 2022, all resolutions passed via poll.

Investor Relations

Management hosted investor and equity analyst visits at its ICO and Jervois Finland sites during the quarter as well as participating in Canaccord Genuity’s virtual Cobalt Conference and Morgan Stanley Australia’s Battery Materials & Clean Tech Investor Day, both held in June.

In August, Jervois’ Chief Executive Officer, Mr. Bryce Crocker, will present at the Diggers & Dealers Mining Forum in Kalgoorlie, Australia.

Environmental, Social, Governance and Compliance

Jervois-Idaho Conservation League Partnership

In May, Jervois announced it had awarded US$0.15 million to three restoration projects as part of the Upper Salmon Conservation Action Program (“USCAP”), created in partnership with the Idaho Conservation League (“ICL”). Recipients were:

-

The Idaho Department of Fish and Game in collaboration with Salmon-Challis National Forest, US$0.08 million, to remove two problematic culverts blocking fish access to an important tributary of the Salmon River, which will allow endangered fish species back into a 10-mile section of prime river habitat.

-

White Clouds Preserve, US$0.06 million, to expand ongoing riparian restoration work along the East Fork of the Salmon River, an important habitat for ESA-listed Chinook salmon, steelhead and bull trout.

-

Western Rivers Conservancy, US$0.02 million, to assist with the acquisition of a key parcel of land along Panther Creek, a major tributary of the Salmon River.

The USCAP supports protection and restoration of fish and wildlife habitats, including water quality and biodiversity within the Upper Salmon River basin. Jervois will contribute US$0.15 million annually to USCAP throughout the operational life of ICO.

Jervois-HALO Trust Partnership

Following Russia’s invasion of Ukraine, Jervois commenced a dollar-for-dollar matching funds programme with its employees to support United Kingdom charity The HALO Trust (“HALO”; www.halotrust.org). HALO is internationally respected and renowned as the oldest and largest humanitarian landmine clearance organisation in the world, and has been entrenched in Eastern Ukraine since 2016. HALO’s 400+ personnel based in Ukraine are trained paramedics, many of whom have been providing medical treatment, supporting evacuations, and providing emergency assistance under dangerous conditions. HALO has a central role in in enabling safe delivery of humanitarian aid and passage of aid workers, evacuees and returnees by assessing explosives risks and clearing munitions along transport corridors and among affected communities.

Jervois and its matched employees’ donations are ringfenced to Ukraine, with US$0.1 million made during the quarter.

Diversity and Inclusion

During the quarter, Jervois established a Diversity and Inclusion Working Group which will develop a roadmap of strategies and actions to support an inclusive culture and diverse workplace. This in line with Jervois’ core values and principles and aims to bring out the best within our workforce, create a pipeline for promotion from within and conditions to attract talent from outside while more broadly yielding enhanced productivity, innovation, decision-making and motivation.

Industry Engagement

During the quarter, Jervois participated in the Cobalt Institute Annual Cobalt Conference in Zurich, Switzerland. Key outcomes included training to enhance the company’s capacity to meet the requirements of EU legislation concerning human rights and environmental justice expectations of companies working within or with supply chain links to EU-based companies.

Also during the quarter, Jervois joined the United States’ Critical Materials Initiative and the National Mining Association.

In June, Jervois took part in a panel discussion at the prestigious SelectUSA Investment Summit in Washington, DC., with over 3,600 participants from more than 70 countries. Dr. Jennifer Hinton, Jervois’ Group Manager – ESG, shared insights into Jervois’ experience operating in Salmon, Idaho, in a panel moderated by Ms. Alejandra Castillo, Assistant Secretary of Commerce for Economic Development.

Management Updates

In June, Ms. Alicia Brown joined as Jervois’ Group Manager – External Affairs at the Company’s corporate office in Melbourne, Australia.

Ms. Brown has more than 25 years of experience, including three years with the Australian Government Department of Defence in Canberra, and 12 years in leadership roles at global mining company MMG Ltd (“MMG”), where she was responsible for leading acquisition and divestment transactions, including management of all key stakeholder relationships and associated regulatory approvals. Prior to her role leading mergers and acquisitions projects, Ms. Brown spearheaded strategy and country and political analysis for MMG and its predecessor companies in Australia.

In her role as Group Manager – External Affairs, Ms. Brown will lead global co-ordination of government relations for Jervois, maximising effectiveness and alignment of activities to group strategy and management of key relationships. The role also provides Jervois with additional leadership support for the evaluation of future acquisition opportunities or other corporate transactions as circumstances require.

Exploration and Development Expenditure

No material cash expenditure on exploration and development was incurred during the quarter. Activities at ICO are now classified as Assets Under Construction and incurred cash expenditure of US$25.6 million in the quarter.

Insider Compensation Reporting

During the quarter, US$nil was paid to Non-Executive Directors and US$0.1 million was paid to the CEO (Executive Director).

NON-CORE ASSETS

Jervois’ non-core assets are summarised on the Company’s website.

ASX WAIVER INFORMATION

On 6 June 2019, the ASX granted a waiver to Jervois in respect of extending the period to 8 November 2023 in which it may issue new Jervois shares to the eCobalt option holders as part of the eCobalt transaction.

As at 30 June 2022, the following Jervois shares were issued in the quarter on exercise of eCobalt options and the following eCobalt options remain outstanding:

|

Jervois shares issued in the quarter on exercise of eCobalt options: |

Nil |

|

eCobalt options expired in the quarter: |

1,344,750 |

|

eCobalt options remaining* |

|

|

1,179,750 1,980,000 |

eCobalt options exercisable until 28 June 2023 at C$0.61 each eCobalt options exercisable until 1 October 2023 at C$0.53 each |

|

3,159,750 |

|

-

The number of options represent the number of Jervois shares that will be issued on exercise. The exercise price represents the price to be paid for the Jervois shares when issued.

By Order of the Board

Bryce Crocker

Chief Executive Officer

For further information, please contact:

|

Investors and analysts: James May Chief Financial Officer Jervois Global Limited |

Media: Nathan Ryan NWR Communications nathan.ryan@nwrcommunications.com.au Mob: +61 420 582 887 |

BASIS OF PREPARATION OF FINANCIAL INFORMATION

Historical financial information for Jervois Finland prior to acquisition by Jervois Global Limited on 1 September 2022 is based on unaudited financial statements that have been prepared in accordance with US GAAP and accounting principles applied under its ownership by Freeport McMoRan Inc. Financial information presented for the period prior to acquisition by Jervois Global on 1 September 2021 is presented on a proforma basis for illustrative purposes only.

Financial information presented for periods after acquisition on 1 September 2021 is prepared under Jervois group accounting policies, which conform with Australian Accounting Standards (“AASBs”) and International Financial Reporting Standards (“IFRS”). The Jervois Finland financial results for the period post-acquisition are consolidated into the Jervois Global consolidated financial statements. Information presented is unaudited.

EBITDA for historical periods is presented as net income after adding back tax, interest, depreciation and extraordinary items and is a non-IFRS/non-GAAP measure.

The Jervois Finland 2022 guidance consists of actual results for January to June and forecast results for July to December. The forecast period includes an assumption of a forecast quoted cobalt price of US$27.50/lb. Other forecast assumptions, including production, sales plans, costs and exchange rates are based on Jervois’ internal estimates.

Adjusted EBITDA represents EBITDA attributable to Jervois, adjusted to exclude items which do not reflect the underlying performance of the company’s operations. Exclusions from adjusted EBITDA are items that require exclusion in order to maximise insight and consistency on the financial performance of the company’s operations. Exclusions include gains/losses on disposals, impairment charges (or reversals), certain derivative items, and one-off costs related post-acquisition integration. A reconciliation of EBITDA to Adjusted EBITDA for Jervois Finland is included in the Investor Presentation dated 22 July 2022.

Forward-Looking Statements

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to future EBITDA for the group, operations at Jervois Finland, construction work to be undertaken at ICO, timing of production at ICO, preparation of studies on the SMP refinery, timing of restart of SMP refinery, utilisation of the working capital facility and the reliability of third party information, and certain other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

|

Tenements

|

|

SUN 1 |

222991 |

174156 |

|

|

SUN 2 |

222992 |

174157 |

|

|

SUN 3 Amended |

245690 |

174158 |

|

|

SUN 4 |

222994 |

174159 |

|

|

SUN 5 |

222995 |

174160 |

|

|

SUN 6 |

222996 |

174161 |

|

|

SUN 7 |

224162 |

174628 |

|

|

SUN 8 |

224163 |

174629 |

|

|

SUN 9 |

224164 |

174630 |

|

|

SUN 16 Amended |

245691 |

177247 |

|

|

SUN 18 Amended |

245692 |

177249 |

|

|

Sun 19 |

277457 |

196394 |

|

|

SUN FRAC 1 |

228059 |

176755 |

|

|

SUN FRAC 2 |

228060 |

176756 |

|

|

TOGO 1 |

228049 |

176769 |

|

|

TOGO 2 |

228050 |

176770 |

|

|

TOGO 3 |

228051 |

176771 |

|

|

DEWEY FRAC Amended |

248739 |

177253 |

|

|

Powder 1 |

269506 |

190491 |

|

|

Powder 2 |

269505 |

190492 |

|

|

LDC-1 |

224140 |

174579 |

|

|

LDC-2 |

224141 |

174580 |

|

|

LDC-3 |

224142 |

174581 |

|

|

LDC-5 |

224144 |

174583 |

|

|

LDC-6 |

224145 |

174584 |

|

|

LDC-7 |

224146 |

174585 |

|

|

LDC-8 |

224147 |

174586 |

|

|

LDC-9 |

224148 |

174587 |

|

|

LDC-10 |

224149 |

174588 |

|

|

LDC-11 |

224150 |

174589 |

|

|

LDC-12 |

224151 |

174590 |

|

|

LDC-13 Amended |

248718 |

174591 |

|

|

LDC-14 Amended |

248719 |

174592 |

|

|

LDC-16 |

224155 |

174594 |

|

|

LDC-18 |

224157 |

174596 |

|

|

LDC-20 |

224159 |

174598 |

|

|

LDC-22 |

224161 |

174600 |

|

|

LDC FRAC 1 Amended |

248720 |

175880 |

|

|

LDC FRAC 2 Amended |

248721 |

175881 |

|

|

LDC FRAC 3 Amended |

248722 |

175882 |

|

|

LDC FRAC 4 Amended |

248723 |

175883 |

|

|

LDC FRAC 5 Amended |

248724 |

175884 |

|

|

RAM 1 |

228501 |

176757 |

|

|

RAM 2 |

228502 |

176758 |

|

|

RAM 3 |

228503 |

176759 |

|

|

RAM 4 |

228504 |

176760 |

|

|

RAM 5 |

228505 |

176761 |

|

|

RAM 6 |

228506 |

176762 |

|

|

RAM 7 |

228507 |

176763 |

|

|

RAM 8 |

228508 |

176764 |

|

|

RAM 9 |

228509 |

176765 |

|

|

RAM 10 |

228510 |

176766 |

|

|

RAM 11 |

228511 |

176767 |

|

|

RAM 12 |

228512 |

176768 |

|

|

RAM 13 Amended |

245700 |

181276 |

|

|

RAM 14 Amended |

245699 |

181277 |

|

|

RAM 15 Amended |

245698 |

181278 |

|

|

RAM 16 Amended |

245697 |

181279 |

|

|

Ram Frac 1 Amended |

245696 |

178081 |

|

|

Ram Frac 2 Amended |

245695 |

178082 |

|

|

Ram Frac 3 Amended |

245694 |

178083 |

|

|

Ram Frac 4 Amended |

245693 |

178084 |

|

|

HZ 1 |

224173 |

174639 |

|

|

HZ 2 |

224174 |

174640 |

|

|

HZ 3 |

224175 |

174641 |

|

|

HZ 4 |

224176 |

174642 |

|

|

HZ 5 |

224413 |

174643 |

|

|

HZ 6 |

224414 |

174644 |

|

|

HZ 7 |

224415 |

174645 |

|

|

HZ 8 |

224416 |

174646 |

|

|

HZ 9 |

224417 |

174647 |

|

|

HZ 10 |

224418 |

174648 |

|

|

HZ 11 |

224419 |

174649 |

|

|

HZ 12 |

224420 |

174650 |

|

|

HZ 13 |

224421 |

174651 |

|

|

HZ 14 |

224422 |

174652 |

|

|

HZ 15 |

231338 |

178085 |

|

|

HZ 16 |

231339 |

178086 |

|

|

HZ 18 |

231340 |

178087 |

|

|

HZ 19 |

224427 |

174657 |

|

|

Z 20 |

224428 |

174658 |

|

|

HZ 21 |

224193 |

174659 |

|

|

HZ 22 |

224194 |

174660 |

|

|

HZ 23 |

224195 |

174661 |

|

|

HZ 24 |

224196 |

174662 |

|

|

HZ 25 |

224197 |

174663 |

|

|

HZ 26 |

224198 |

174664 |

|

|

HZ 27 |

224199 |

174665 |

|

|

HZ 28 |

224200 |

174666 |

|

|

HZ 29 |

224201 |

174667 |

|

|

HZ 30 |

224202 |

174668 |

|

|

HZ 31 |

224203 |

174669 |

|

|

HZ 32 |

224204 |

174670 |

|

|

HZ FRAC |

228967 |

177254 |

|

|

JC 1 |

224165 |

174631 |

|

|

JC 2 |

224166 |

174632 |

|

|

JC 3 |

224167 |

174633 |

|

|

JC 4 |

224168 |

174634 |

|

|

JC 5 Amended |

245689 |

174635 |

|

|

JC 6 |

224170 |

174636 |

|

|

JC FR 7 |

224171 |

174637 |

|

|

JC FR 8 |

224172 |

174638 |

|

|

JC 9 |

228054 |

176750 |

|

|

JC 10 |

228055 |

176751 |

|

|

JC 11 |

228056 |

176752 |

|

|

JC-12 |

228057 |

176753 |

|

|

JC-13 |

228058 |

176754 |

|

|

JC 14 |

228971 |

177250 |

|

|

JC 15 |

228970 |

177251 |

|

|

JC 16 |

228969 |

177252 |

|

|

JC 17 |

259006 |

187091 |

|

|

JC 18 |

259007 |

187092 |

|

|

JC 19 |

259008 |

187093 |

|

|

JC 20 |

259009 |

187094 |

|

|

JC 21 |

259010 |

187095 |

|

|

JC 22 |

259011 |

187096 |

|

|

CHELAN NO. 1 Amended |

248345 |

175861 |

|

|

GOOSE 2 Amended |

259554 |

175863 |

|

|

GOOSE 3 |

227285 |

175864 |

|

|

GOOSE 4 Amended |

259553 |

175865 |

|

|

GOOSE 6 |

227282 |

175867 |

|

|

GOOSE 7 Amended |

259552 |

175868 |

|

|

GOOSE 8 Amended |

259551 |

175869 |

|

|

GOOSE 10 Amended |

259550 |

175871 |

|

|

GOOSE 11 Amended |

259549 |

175872 |

|

|

GOOSE 12 Amended |

259548 |

175873 |

|

|

GOOSE 13 |

228028 |

176729 |

|

|

GOOSE 14 Amended |

259547 |

176730 |

|

|

GOOSE 15 |

228030 |

176731 |

|

|

GOOSE 16 |

228031 |

176732 |

|

|

GOOSE 17 |

228032 |

176733 |

|

|

GOOSE 18 Amended |

259546 |

176734 |

|

|

GOOSE 19 Amended |

259545 |

176735 |

|

|

GOOSE 20 |

228035 |

176736 |

|

|

GOOSE 21 |

228036 |

176737 |

|

|

GOOSE 22 |

228037 |

176738 |

|

|

GOOSE 23 |

228038 |

176739 |

|

|

GOOSE 24 |

228039 |

176740 |

|

|

GOOSE 25 |

228040 |

176741 |

|

|

SOUTH ID 1 Amended |

248725 |

175874 |

|

|

SOUTH ID 2 Amended |

248726 |

175875 |

|

|

SOUTH ID 3 Amended |

248727 |

175876 |

|

|

SOUTH ID 4 Amended |

248717 |

175877 |

|

|

SOUTH ID 5 Amended |

248715 |

176743 |

|

|

SOUTH ID 6 Amended |

248716 |

176744 |

|

|

South ID 7 |

306433 |

218216 |

|

|

South ID 8 |

306434 |

218217 |

|

|

South ID 9 |

306435 |

218218 |

|

|

South ID 10 |

306436 |

218219 |

|

|

South ID 11 |

306437 |

218220 |

|

|

South ID 12 |

306438 |

218221 |

|

|

South ID 13 |

306439 |

218222 |

|

|

South ID 14 |

306440 |

218223 |

|

|

OMS-1 |

307477 |

218904 |

|

|

Chip 1 |

248956 |

184883 |

|

|

Chip 2 |

248957 |

184884 |

|

|

Chip 3 Amended |

277465 |

196402 |

|

|

Chip 4 Amended |

277466 |

196403 |

|

|

Chip 5 Amended |

277467 |

196404 |

|

|

Chip 6 Amended |

277468 |

196405 |

|

|

Chip 7 Amended |

277469 |

196406 |

|

|

Chip 8 Amended |

277470 |

196407 |

|

|

Chip 9 Amended |

277471 |

196408 |

|

|

Chip 10 Amended |

277472 |

196409 |

|

|

Chip 11 Amended |

277473 |

196410 |

|

|

Chip 12 Amended |

277474 |

196411 |

|

|

Chip 13 Amended |

277475 |

196412 |

|

|

Chip 14 Amended |

277476 |

196413 |

|

|

Chip 15 Amended |

277477 |

196414 |

|

|

Chip 16 Amended |

277478 |

196415 |

|

|

Chip 17 Amended |

277479 |

196416 |

|

|

Chip 18 Amended |

277480 |

196417 |

|

|

Sun 20 |

306042 |

218133 |

|

|

Sun 21 |

306043 |

218134 |

|

|

Sun 22 |

306044 |

218135 |

|

|

Sun 23 |

306045 |

218136 |

|

|

Sun 24 |

306046 |

218137 |

|

|

Sun 25 |

306047 |

218138 |

|

|

Sun 26 |

306048 |

218139 |

|

|

Sun 27 |

306049 |

218140 |

|

|

Sun 28 |

306050 |

218141 |

|

|

Sun 29 |

306051 |

218142 |

|

|

Sun 30 |

306052 |

218143 |

|

|

Sun 31 |

306053 |

218144 |

|

|

Sun 32 |

306054 |

218145 |

|

|

Sun 33 |

306055 |

218146 |

|

|

Sun 34 |

306056 |

218147 |

|

|

Sun 35 |

306057 |

218148 |

|

|

Sun 36 |

306058 |

218149 |

|

|

Chip 21 Fraction |

306059 |

218113 |

|

|

Chip 22 Fraction |

306060 |

218114 |

|

|

Chip 23 |

306025 |

218115 |

|

|

Chip 24 |

306026 |

218116 |

|

|

Chip 25 |

306027 |

218117 |

|

|

Chip 26 |

306028 |

218118 |

|

|

Chip 27 |

306029 |

218119 |

|

|

Chip 28 |

306030 |

218120 |

|

|

Chip 29 |

306031 |

218121 |

|

|

Chip 30 |

306032 |

218122 |

|

|

Chip 31 |

306033 |

218123 |

|

|

Chip 32 |

306034 |

218124 |

|

|

Chip 33 |

306035 |

218125 |

|

|

Chip 34 |

306036 |

218126 |

|

|

Chip 35 |

306037 |

218127 |

|

|

Chip 36 |

306038 |

218128 |

|

|

Chip 37 |

306039 |

218129 |

|

|

Chip 38 |

306040 |

218130 |

|

|

Chip 39 |

306041 |

218131 |

|

|

Chip 40 |

307491 |

218895 |

|

|

DRC NW 1 |

307492 |

218847 |

|

|

DRC NW 2 |

307493 |

218848 |

|

|

DRC NW 3 |

307494 |

218849 |

|

|

DRC NW 4 |

307495 |

218850 |

|

|

DRC NW 5 |

307496 |

218851 |

|

|

DRC NW 6 |

307497 |

218852 |

|

|

DRC NW 7 |

307498 |

218853 |

|

|

DRC NW 8 |

307499 |

218854 |

|

|

DRC NW 9 |

307500 |

218855 |

|

|

DRC NW 10 |

307501 |

218856 |

|

|

DRC NW 11 |

307502 |

218857 |

|

|

DRC NW 12 |

307503 |

218858 |

|

|

DRC NW 13 |

307504 |

218859 |

|

|

DRC NW 14 |

307505 |

218860 |

|

|

DRC NW 15 |

307506 |

218861 |

|

|

DRC NW 16 |

307507 |

218862 |

|

|

DRC NW 17 |

307508 |

218863 |

|

|

DRC NW 18 |

307509 |

218864 |

|

|

DRC NW 19 |

307510 |

218865 |

|

|

DRC NW 20 |

307511 |

218866 |

|

|

DRC NW 21 |

307512 |

218867 |

|

|

DRC NW 22 |

307513 |

218868 |

|

|

DRC NW 23 |

307514 |

218869 |

|

|

DRC NW 24 |

307515 |

218870 |

|

|

DRC NW 25 |

307516 |

218871 |

|

|

DRC NW 26 |

307517 |

218872 |

|

|

DRC NW 27 |

307518 |

218873 |

|

|

DRC NW 28 |

307519 |

218874 |

|

|

DRC NW 29 |

307520 |

218875 |

|

|

DRC NW 30 |

307521 |

218876 |

|

|

DRC NW 31 |

307522 |

218877 |

|

|

DRC NW 32 |

307523 |

218878 |

|

|

DRC NW 33 |

307524 |

218879 |

|

|

DRC NW 34 |

307525 |

218880 |

|

|

DRC NW 35 |

307526 |

218881 |

|

|

DRC NW 36 |

307527 |

218882 |

|

|

DRC NW 37 |

307528 |

218883 |

|

|

DRC NW 38 |

307529 |

218884 |

|

|

DRC NW 39 |

307530 |

218885 |

|

|

DRC NW 40 |

307531 |

218886 |

|

|

DRC NW 41 |

307532 |

218887 |

|

|

DRC NW 42 |

307533 |

218888 |

|

|

DRC NW 43 |

307534 |

218889 |

|

|

DRC NW 44 |

307535 |

218890 |

|

|

DRC NW 45 |

307536 |

218891 |

|

|

DRC NW 46 |

307537 |

218892 |

|

|

DRC NW 47 |

307538 |

218893 |

|

|

DRC NW 48 |

307539 |

218894 |

|

|

EBatt 1 |

307483 |

218896 |

|

|

EBatt 2 |

307484 |

218897 |

|

|

EBatt 3 |

307485 |

218898 |

|

|

EBatt 4 |

307486 |

218899 |

|

|

EBatt 5 |

307487 |

218900 |

|

|

EBatt 6 |

307488 |

218901 |

|

|

EBatt 7 |

307489 |

218902 |

|

|

EBatt 8 |

307490 |

218903 |

|

|

OMM-1 |

307478 |

218905 |

|

|

OMM-2 |

307479 |

218906 |

|

|

OMN-2 |

307481 |

218908 |

|

|

OMN-3 |

307482 |

218909 |

|

|

BTG-1 |

307471 |

218910 |

|

|

BTG-2 |

307472 |

218911 |

|

|

BTG-3 |

307473 |

218912 |

|

|

BTG-4 |

307474 |

218913 |

|

|

BTG-5 |

307475 |

218914 |

|

|

BTG-6 |

307476 |

218915 |

|

|

NFX 17 |

307230 |

218685 |

|

|

NFX 18 |

307231 |

218686 |

|

|

NFX 19 |

307232 |

218687 |

|

|

NFX 20 |

307233 |

218688 |

|

|

NFX 21 |

307234 |

218689 |

|

|

NFX 22 |

307235 |

218690 |

|

|

NFX 23 |

307236 |

218691 |

|

|

NFX 24 |

307237 |

218692 |

|

|

NFX 25 |

307238 |

218693 |

|

|

NFX 30 |

307243 |

218698 |

|

|

NFX 31 |

307244 |

218699 |

|

|

NFX 32 |

307245 |

218700 |

|

|

NFX 33 |

307246 |

218701 |

|

|

NFX 34 |

307247 |

218702 |

|

|

NFX 35 |

307248 |

218703 |

|

|

NFX 36 |

307249 |

218704 |

|

|

NFX 37 |

307250 |

218705 |

|

|

NFX 38 |

307251 |

218706 |

|

|

NFX 42 |

307255 |

218710 |

|

|

NFX 43 |

307256 |

218711 |

|

|

NFX 44 |

307257 |

218712 |

|

|

NFX 45 |

307258 |

218713 |

|

|

NFX 46 |

307259 |

218714 |

|

|

NFX 47 |

307260 |

218715 |

|

|

NFX 48 |

307261 |

218716 |

|

|

NFX 49 |

307262 |

218717 |

|

|

NFX 50 |

307263 |

218718 |

|

|

NFX 56 |

307269 |

218724 |

|

|

NFX 57 |

307270 |

218725 |

|

|

NFX 58 |

307271 |

218726 |

|

|

NFX 59 |

307272 |

218727 |

|

|

NFX 60 Amended |

307558 |

218728 |

|

|

NFX 61 |

307274 |

218729 |

|

|

NFX 62 |

307275 |

218730 |

|

|

NFX 63 |

307276 |

218731 |

|

|

NFX 64 |

307277 |

218732 |

|

|

OMN-1 revised |

315879 |

228322 |

|

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

|

Jervois Global Limited |

|

|

52 007 626 575 |

|

|

30 June 2022 |

|

|

Current quarter |

Year to date (6 months) $US’000 |

||

|

1. |

Cash flows from operating activities |

98,274 |

194,107 |

|

1.1 |

Receipts from customers |

||

|

1.2 |

Payments for |

- |

- |

|

|||

|

- |

- |

|

|

(120,628) |

(213,999) |

|

|

(1,295) |

(3,319) |

|

|

(1,310) |

(2,809) |

|

|

1.3 |

Dividends received (see note 3) |

- |

- |

|

1.4 |

Interest received |

6 |

7 |

|

1.5 |

Interest and other costs of finance paid |

(1,547) |

(8,847) |

|

1.6 |

Income taxes paid |

(539) |

(4,125) |

|

1.7 |

Government grants and tax incentives |

- |

- |

|

1.8 |

Other – incl. business development costs and SMP BFS costs |

(1,312) |

(2,568) |

|

1.9 |

Net cash from / (used in) operating activities |

(28,351) |

(41,553) |

|

2. |

Cash flows from investing activities |

- |

- |

|

2.1 |

Payments to acquire or for: |

||

|

|||

|

- |

- |

|

|

(28,111) |

(49,056) |

|

|

(42) |

(50) |

|

|

- |

- |

|

|

- |

- |

|

|

- |

- |

|

|

2.2 |

Proceeds from the disposal of: |

- |

- |

|

|||

|

- |

- |

|

|

1,230 |

1,230 |

|

|

- |

- |

|

|

- |

- |

|

|

2.3 |

Cash flows from loans to other entities |

- |

- |

|

2.4 |

Dividends received (see note 3) |

- |

- |

|

2.5 |

Other – SMP Refinery Purchase: lease payment |

- |

- |

|

2.6 |

Net cash from / (used in) investing activities |

(26,923) |

(47,876) |

|

3. |

Cash flows from financing activities |

- |

- |

|

3.1 |

Proceeds from issues of equity securities (excluding convertible debt securities) |

||

|

3.2 |

Proceeds from issue of convertible debt securities |

- |

- |

|

3.3 |

Proceeds from exercise of options |

- |

221 |

|

3.4 |

Transaction costs related to issues of equity securities or convertible debt securities |

- |

(847) |

|

3.5 |

Proceeds from borrowings |

25,000 |

98,750 |

|

3.6 |

Repayment of borrowings |

- |

- |

|

3.7 |

Transaction costs related to loans and borrowings |

- |

- |

|

3.8 |

Dividends paid |

- |

- |

|

3.9 |

Other |

- |

- |

|

3.10 |

Net cash from / (used in) financing activities |

25,000 |

98,124 |

|

4. |

Net increase / (decrease) in cash and cash equivalents for the period |

||

|

4.1 |

Cash and cash equivalents at beginning of period |

88,225 |

49,181 |

|

4.2 |

Net cash from / (used in) operating activities (item 1.9 above) |

(28,351) |

(41,553) |

|

4.3 |

Net cash from / (used in) investing activities (item 2.6 above) |

(26,923) |

(47,876) |

|

4.4 |

Net cash from / (used in) financing activities (item 3.10 above) |

25,000 |

98,124 |

|

4.5 |

Effect of movement in exchange rates on cash held |

(391) |

(316) |

|

4.6 |

Cash and cash equivalents at end of period |

57,560 |

57,560 |

|

8. |

$US’000 |

|

|

8.1 |

Net cash from / (used in) operating activities (item 1.9) |

(28,351)OTCQX: JRVMF |

|

8.2 |

(Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) |

(42) |

|

8.3 |

Total relevant outgoings (item 8.1 + item 8.2) |

(28,393) |

|

8.4 |

Cash and cash equivalents at quarter end (item 4.6) |

57,560 |

|

8.5 |

Unused finance facilities available at quarter end (item 7.5) |

100,000 |

|

8.6 |

Total available funding (item 8.4 + item 8.5) |

157,560 |

|

8.7 |

Estimated quarters of funding available (item 8.6 divided by item 8.3) |

5.55 |

|

Note: if the entity has reported positive relevant outgoings (i.e., a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. |

||

|

8.8 |

If item 8.7 is less than 2 quarters, please provide answers to the following questions: |

|

|

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

||

|

Answer: N/A |

||

|

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? |

||

|

Answer: N/A |

||

|

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

||

|

Answer: N/A |

||

|

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. |

||

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 21 July 2022

Authorised by: Disclosure Committee

(Name of body or officer authorising release – see note 4)

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – e.g., Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

1 Debt drawn down represents aggregate of amounts drawn under US$150M working capital facility and amounts drawn down from Escrow Account under terms of US$100M Senior Secured Bonds. Net debt is debt drawn down less unrestricted cash. For current net debt cash balance is based on the Company’s most recent internal cash report prior to the date of release. Amounts represent the nominal loan amounts; balances recorded in the Company’s financial statements under International Financial Reporting Standards will differ.

2 Information on the basis of preparation for the financial information included in this Quarterly Activities report is set out on page 13 below.

3 See ASX Announcement “BFS for Sao Miguel Paulista refinery restart” dated 29 April 2022