Archive

Belmont's Option Partner Commences Drilling Lone Star Copper-Gold Project

| |||||||||

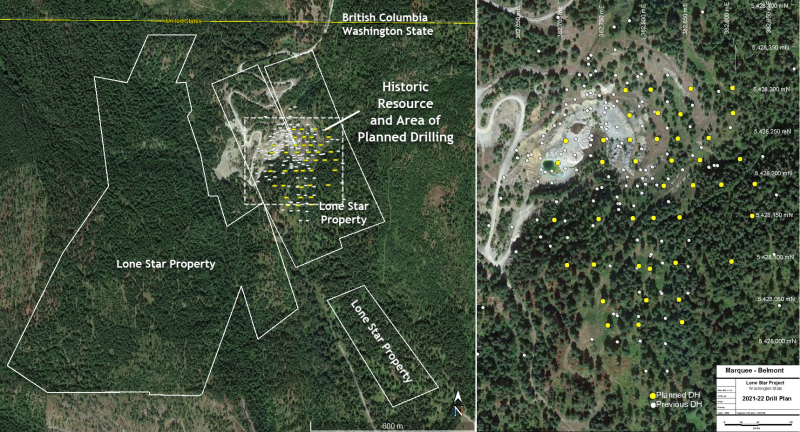

Vancouver, B.C. Canada - TheNewswire - November 17, 2021 - Belmont Resources Inc. (“Belmont”), (or the “Company”), (TSXV:BEA) (FSE:L3L2) announces its option partner Marquee Resources Ltd. (ASX:MQR) has commenced a 5,800 meter (“m”) drill program to further develop the known copper-gold deposit at its Lone Star Copper-Gold Project situated in the prolifically mineralized Republic Graben in Washington State.

Drill Program

-

- Initiation of a 5,800 meter drill program to supplement data from 252 historical drill holes.

- 42 holes are planned to depths from 50 to 270 m with the following program objectives:

1) Confirm grade, width and tenor of mineralisation.

2) Achieve a drill hole spacing that is appropriate for:

a) advancing the historic inferred mineral resource to a current indicated resource category.

b) producing a Preliminary Economic Assessment (“PEA”)

3) Investigate for nearby resource extensions to the east and south.

Belmont’s President & CEO, George Sookochoff, commented: “Management at Belmont are delighted that drilling has started on the Lone Star project by Marquee. This is the beginning of a very aggressive drill program that will eventually advance the project to a “production ready stage” within a relatively short time line. We look forward to receiving and announcing assay results in the near future.”

Lone Star Option/JV

Belmont and Marquee entered into an Option Agreement (the “Agreement”) whereby Marquee has an earn-in option to acquire up to an 80% working interest in the Lone Star Property. Under the Agreement, Marquee will issue 3,000,000 listed common shares and will contribute cash and exploration expenditure consideration totaling CAD $3,054,000 over a two year period in exchange for up to 80% of the property. Of the $3,054,000 in project consideration, $504,000 will be in cash payments to Belmont, as well as $2,550,000 in exploration expenditures over the two year period.

Marquee will also be required to produce a Preliminary Economic Assessment report on the project.

Upon completion of the earn in agreement, a joint venture is to be formed and based on the recommendations of the PEA, a decision will be made in regards to bringing the Lone Star into production.

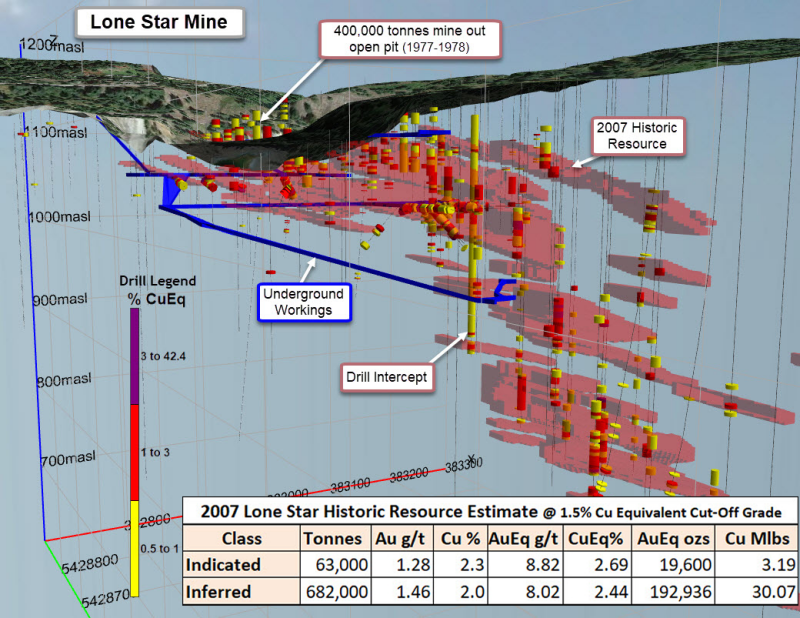

The past producing Lone Star Mine operated over two time periods; from 1897-1918 producing 146,540 tonnes, and from 1977-1978 by Granby Mining Co. when 400,000 tonnes of ore were transported from the Lone Star open pit to its Phoenix mill in B.C, 11km to the north.

*The 2007 historic resource estimation was based on US$593/oz gold and US$2.84/lb copper.

The Lone Star deposit has an historic resource estimate which was reported in a “Technical Report and Resource Estimate on the Lone Star Deposit, Ferry County Washington (September 23, 2007)” for Merit Mining Corp. and authored by P&E Mining Consultants Inc.

Based on today’s higher copper and gold prices, Belmont geologists have reconsidered the high-grade Cu +/- Au drillhole intercepts in the area of the historic resource for the potential to support both an open pit an underground operation.

The Lone Star property is situated only 13 kilometers from Golden Dawn Mineral’s 200 tpd toll mill.

About Belmont Resources

Belmont Resources is engaged in the business of acquiring and re-developing past producing copper-gold-silver mines in southern British Columbia and Northern Washington State. This region is considered to have the highest concentration of mineralization and past producing mines in western North America.

By utilizing new exploration technology, geological modelling and specialized 3D data analysis, the company is successfully identifying new areas of mineralization beneath and/or in the near vicinity of the past producing mines.

The Belmont project portfolio:

-

- Athelstan-Jackpot, B.C. – * Gold-Silver mines

- Come By Chance, B.C. – * Copper-Gold mine

- Lone Star, Washington – * Copper-Gold mine

- Pathfinder, B.C. – * Gold–Silver mines

- Black Bear, B.C. – Gold

- Pride of the West, B.C.- Gold

- Kibby Basin, Nevada – Lithium

- Crackingstone, Sask. – Uranium

* past producing mine

NI 43-101 Disclosure:

Technical disclosure in this news release has been approved by Jim Ebisch. P.Geo, SME., a Qualified Person as defined by National Instrument 43-101.

A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or mineral reserves. As such the issuer, Belmont Resources, is not treating this historical estimate as current mineral resources or mineral reserves.

Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Gold equivalent (AuEq) grade was calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb., based on the 24 month (at July 31, 2007) trailing average of gold and copper prices, to obtain a conversion factor of % copper x 3.284 + gold g/t = Au Eq g/t. Metallurgical recoveries and smelting/refining costs were not factored into the gold equivalent calculation.

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President

Ph: 604-505-4061

Email: george@belmontresources.com

Website: www.BelmontResources.com

We seek safe harbor. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange has not approved nor disapproved of the information contained herein.