Archive

Fidelity Announces the Filing of a NI 43-101 Technical Report for the Las Huaquillas Project, Northern Peru

| |||||||||

|  |  | |||||||

Vancouver, BC - TheNewswire - January 6th, 2022 - Fidelity Minerals Corp. (TSXV:FMN) (OTC:SAIDF) (FSE:S5GM) (SSE:MNYC) (“Fidelity” or the “Company”) is pleased announce that it has filed a National Instrument 43-101 Technical Report for the Las Huaquillas Project (the “Project”) in Northern Peru on January 4, 2022. The NI 43-101 report titled “NI 43-101 Technical Report on the Las Huaquillas Au, Ag, Cu Property, Cajamarca, Peru”, with an effective date of December 18, 2021, was authored by Luc Pigeon, B.Sc., M. Sc., P. Geo (the “Author”), who is an independent and qualified person under National Instrument 43-101.

The NI 43-101 technical report summarizes Project’s Location, Ownership, Geological Setting, Mineralization, Historical Exploration, Historical Resource Estimates, Conclusions, and Recommendations for future work. Confirmatory rock grab sampling, as reported in a press release issued by the Company on December 2, 2021, was completed by the Author as part of a site visit required to support the writing of the NI 43-101 technical report, and a description of this work is included in the report. The best result obtained was a sample collected from quartz veins exposed at the entrance of one of the underground working portals within the Los Socavones zone that returned a result of 9.653 g/t Au, 126 g/t Ag and 1.08 % Pb. The Project has not been the subject of a current resource estimate compliant with NI43-101.

The Project features extensive historical exploration completed by Sulliden Exploration Inc. (“Sulliden”) and others through 1999. This work included soil sampling, geophysics and over 5,700m of diamond drilling (26 drill holes), and the excavation of approx. 1,200m of underground development on three levels in the Los Socavones Zone. This work defined five (5) mineralised zones, consisting of four (4) mineralisation types including epithermal Au-Ag (Los Socavones), and porphyry Cu style mineralisation (Cementerio and San Antonio) at the Project.

The most recent historical resource estimate completed on the Project was prepared by Sulliden’s geologists Gariepy & Vachon (1999) who disclose what they call “geological resource” which is not a category accepted under section 2.2 of NI 43-101. It best corresponds to an Inferred Resource in today’s nomenclature. The estimate was performed using the vertical longitudinal section method using seventeen (17) mineralized intersections obtained through drilling. The parameters used were a specific gravity of 2.8 g/cm³ and a cut-off grade of 1.0 g/t Au over a minimum width of 3 metres. Gariepy & Vachon (1999) estimated that the Los Socavones zone hosts 6,570,000 metric tonnes grading 2.12 g/t Au and 25.2 g/t Ag; equivalent to 446,000

ounces of gold and 5.3 million ounces of silver. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves. Fidelity is not treating the historical estimates as current mineral resources. The Company has not conducted any work to establish the relevance & reliability of the historical resource estimate.

Location and Ownership

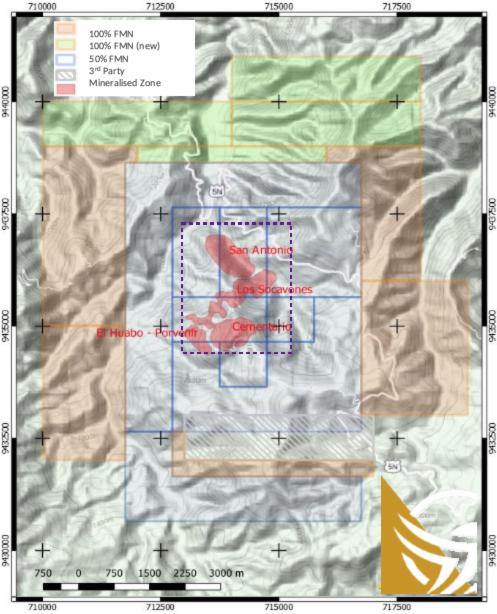

The Project is located within the Districts of San Ignacio and Nambelle, Province of San Ignacio, Department of Cajamarca in northern Peru, centred approximately 14 kilometres south of the Ecuador-Peru border. The Project comprises eighteen (18) Concessions and Claims divided into two (2) Concession groups based on Fidelity’s interest in the Concessions forming the groups.

The Las Huaquillas Core Group is comprised of nine (9) contiguous Concessions which cover a geographic area of 3600 hectares. The nine (9) Concessions are owned by Rial Minera S.A.C. for which Fidelity has secured a 44.5% interest. As announced on July 21, 2021, Fidelity acquired an option for an additional 5.5% interest in Rial Minera S. A. C. by agreeing to a total cash consideration of $500,000 US, and funding up to $3,000,000 US in underground sampling and exploration drilling to underwrite the publication of a new NI 43-101 technical report aimed at declaring inferred resources and to be completed within 18 months following receipt of drilling permit approvals. Fidelity has now paid the $500,000 US consideration and has finalized the $3,000,000 US exploration plan and budget for 2022 with its joint venture partners.

The Greater Las Huaquillas Group is comprised of three (3) WGS84 system concessions and six (6) WGS84 system claims that are currently in the registration process. The concessions and claims forming this group cover an area of 4800 hectares. These concessions and claims are owned 100% by Fidelity and are not part of the Rial Minera S. A. C. joint venture.

Significant Mineralised Zones – Historical

The Los Socavones anomaly is a major NE-SW trending mineralized fault zone that extends for at least 2.5km and has a width of approximately 100m. The anomalous zone consists of two distinct Au-enriched pyrite-sphalerite-galena quartz stock-work zones surrounded by a low-grade gold zone composed of disseminated and narrow stringers of pyrite with minor sphalerite and chalcopyrite. To date, 1,000m of its strike length has been drill tested and 1,200m of underground workings have been developed and sampled. Drilling has intersected the mineralization at a depth of approximately 200m. The mineralized zone average true thickness is approximately 19 m with a maximum thickness of 65m within the zone’s centre.

The Cementerio Cu-Au porphyry system is located 1,000m south of the Los Socavones zone. It comprises extensive argillic, phyllic and hematitic alteration partly visible along the road leading to the Las Huaquillas village. A 600m by 900m sub-circular multi-phase diorite intrusion characterized by equigranular and porphyritic textures is spatially related with the mineralization.

The San Antonio porphyry system is located 1,000m NW of the Los Socavones zone. It coincides with a prominent copper- gold soil geochemical anomaly and is hosted in a calc-alkaline quartz diorite intrusion measuring 500m x 900m. The host rock is massive, homogeneous and is composed of 15% well-formed 2-mm plagioclase phenocrysts lying in a finer groundmass composed of amphibole feldspar-quartz-chlorite- biotite-magnetite-sericite.

The El Huabo Au-Ag anomaly is located near the Los Socavones structure within altered plagioclase porphyritic volcanic rocks members of the Oyotún Formation.

The Las Huaquillas anomaly is located some 850m to the NE of the El Huabo anomaly. The mineralization is hosted in strongly sericitized and argillic altered Oyotún Formation rocks that are crosscut by narrow quartz veins and accompanied by fine quartz vug filling. The geological similarities between the Las Huaquillas and the El Huabo anomalies indicate that both are part of the same low-sulphidation epithermal system developed along the Los Socavones structure.

The Author reported that the Project has the requisite characteristics to host one or more structurally hosted

gold and/or copper-gold porphyry deposits. Fundamentally, these deposit types require appropriate host rocks, largescale structures, evidence of large-scale hydrothermal activity and evidence for concentration mechanisms for the minerals of interest. Historic mapping and exploration on the Project have demonstrated that these conditions exist. Various levels of structurally-controlled gold mineralization and porphyry-related copper mineralization are exposed. Intermediate level stockwork mineralization (potentially the roots of an epithermal system) are described in the Los Socavones zone within the Socavones structure. Elsewhere along the same Socavones structure, higher level epithermal targets have been identified. Historic drilling and underground sampling indicate that the Los Socavones surface mineralization continues at depth; however, new drilling within the main mineralized zones is required in order to confirm historical drilling data, build a computerized 3D deposit model, and to prepare a resource estimate to NI43-101 compliance.

Significant Intercepts– Historical

Historical drilling at the Los Socavones Zone report significant mineralized intercepts, the best of which is Sulliden DDH intersection (LH97-08): 67.5m core length (approximately 53m true width) grading 2.7 g/t Au and 15.3 g/t Ag. Hole LH-97-04, which returned 0.47% Cu, 0.11 g/t Au and 4.5 g/t Ag over 99.5m (drill length), demonstrated the size potential of Cementerio’s phyllic ring. Similarly, San Antonio drilling (LH97-17) also intersected significant mineralization; up to 0.32% Cu, 0.45 g/t Au and 3.0 g/t Ag over 69.0 m (drill length), including an interval grading 0.46 % Cu, 0.74 g/t Au and 4.9 g/t Ag over 21.0m.

Fig 1: Significant Mineralised Zones at Las Huaquillas

Historical Resource Estimates

Two historical resource estimates have been completed by others on the project.

The first historical resource estimate was written by Stephan (1992) and commissioned by Corporacion Minera Peruano-Alemana (“CMPA”) who conducted early exploration on the property from 1989 to 1993.Stephan (1992) discloses what he calls “mineral potential” which is not a category accepted by the Canadian Institute of Mining, Metallurgy and Petroleum and therefore is not allowed under section 2.2 of NI 43-101. It best corresponds to an Inferred Resource in today’s nomenclature. The CMPA estimate is based on sampling results from the 1200 meters of workings plus 830 m of diamond drilling. A rock density of 2.9 g/cm³ was used. No cut-off grade was indicated. Two estimates were given: (i) structure-hosted mineral and

(ii) stockwork-hosted mineral. The structure-hosted mineral resource estimate includes results from the S1, S2, and Caterina/Pilar structures. A true width of 2.41 m was assigned to the S2 structure whereas a true width of 1.26 m was used for structure S1. A true width of 2.65 m was used for the Caterina/pilar structure.

The total mass estimated by CMPA is 2,600,000 metric tonnes with weighted average grades of 2.69 g/t Au, 27 g/t Ag, 0.18 % Cu, 0.34 % Pb and 1.09 % Zn. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves. Fidelity is not treating the historical estimates as current mineral resources. The Company has not conducted any work to establish the relevance & reliability of the historical resource estimate.

In 1999 Sulliden revised the CMPA historical resource with another historical resource (Gariepy and Vachon, 1999). Both Gariepy and Vachon are experienced registered Canadian geologists and/or engineers and therefore the historical resource given was considered relevant and most likely reliable. Gariepy & Vachon (1999) disclose what they call “geological resource” which is not a category accepted by the Canadian Institute of Mining, Metallurgy and Petroleum and therefore is not allowed under section 2.2 of NI 43-101. It best corresponds to an Inferred Resource in today’s nomenclature. Note that unlike CMPA, Sulliden did not estimate the zinc, lead or copper contained within the Socavones zone. The estimate was performed using the vertical longitudinal section method. Seventeen (17) mineralized intersections were included in this estimate. The parameters used to establish the resource were a specific gravity of 2.8 g/cm3 and a cut off grade of 1.0 g/t Au over a minimum width of 3 metres. The CMPA DDH assay results were also used for the estimation. In some cases, a mean value for grade and thickness from close intersections was used. Gariepy & Vachon (1999) estimated that the Los Socavones zone hosts 6,570,000 metric tonnes grading 2.12 g/t Au and 25.2 g/t Ag; equivalent to 446,000 ounces of gold and 5.3 million ounces of silver at a 1 g/t Au cut-off. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves. Fidelity is not treating the historical estimates as current mineral resources. The Company has not conducted any work to establish the relevance & reliability of the historical resource estimate.

Conclusions and Recommendations

Both the CPMA and Sulliden exploration campaigns, including diamond drilling, were successful in finding significant mineralization on the Project. To date, a significant structurally-controlled gold zone and two prospective porphyry targets have been identified.

A historical resource of 6,570,000 metric tonnes grading 2.12 g/t Au and 25.2 g/t Ag, equivalent to 446,000 ounces of gold and 5.3 million ounces of silver has been estimated by Sulliden, using a 1 g/t gold cut-off, in the Los Socavones zone to a depth of 200 meters. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves. Fidelity is not treating the historical estimates as current mineral resources. The Company has not conducted any work to establish the relevance & reliability of the historical resource estimate. Base metal potential within this zone was not included in this historic resource estimate. The Los Socovones Zone is open down dip and along strike in both directions (northeast and southwest). The mineralized zone appears to have been offset by faults.

The Author conducted a site visit during 2021 and indicated that field observations are consistent with the occurrence of a large hydrothermal system in this area and are consistent with the epithermal Au-Ag-Cu mineralization information given in Gariepy & Vachon (1999) and with the porphyry Cu ± Mo ± Au deposit model. The Author is not aware of any other significant risks and uncertainties that could reasonably be expected to affect the reliability or confidence in the exploration information disclosed in the NI 43-101 technical report. The Author concludes that further exploration work is needed on the Project in order to verify and upgrade historical results to NI 43-101 standards.

The author recommended that a phase one exploration program be completed that includes the following activities;

-

Community relations program and obtain surface access to exploration areas

-

In-fill soil sampling surveys over anomalous areas

-

IP geophysical survey over the Property with a focus on Cementerio and San Antonio zones.

-

The historic underground workings within the Los Socavones zones are recommended to be re-opened by an experienced mining engineering company to allow safe sampling. The new sampling should be precisely surveyed to 10cm accuracy using WGS84 17S coordinate system. Metallurgical test samples should also be performed to support a future resource estimate.

-

A 5000m drilling program is recommended to be carried out at Los Socavones where historical drilling suggest that significant gold mineralization occurs at depth. A similar amount of drilling should also be carried out at the Cementerio zone where significant Cu mineralization was intersected by Sulliden however Fidelity’s current priority is the gold mineralized Los Socavones zone. The drilling project consists of twenty (20) platforms; nineteen (19) located within the Los Socavones zone and one (1) within the Cementerio zone. The Los Socavones main zone proposed drilling includes sixteen (16) platforms with seventeen (17) DDH totalling 4560m to confirm the best historical results and also to confirm the lateral and down dip continuity of the mineralization. The main zone drilling is designed to allow carrying out an inferred resource estimate once the

drilling is completed. Three (3) platforms containing three (3) DDH total 580m will also be drilled to confirm the Los Socavones mineralization’s northwest continuity.

-

Issuance of an updated NI 43-101 Technical report at the conclusion of the phase one exploration program reporting results from the exploration activities and drilling. An inferred resource estimate compliant with NI 43-101 would be included in this updated technical report.

As reported on November 3, 2021, the Company has commenced the exploration program by engaging Ximena Mining Group S.A.C (“XMG”) to permit an exploration drilling program on the Project. XMG is a Peruvian environmental and technical engineering consultancy company, with over 18 years of experience, with 12 environmental instruments approved over the last five years. XMG will carry out the environmental monitoring DIA, water use permit, CIRA archaeological report, and all other activities to obtain the permit required to conduct drilling operations at the Project. It is anticipated that permits will be available for drilling during late Q2- early Q3 2022. Fidelity continues to support permitting initiatives by maintaining its community relations program which has been operating on the Project since early 2021.

Luc Pigeon B.Sc., M.Sc., P.Geo., a Qualified Person in the context of National Instrument 43-101, has read and approved the technical content of this News Release.

About Fidelity Minerals Corp.

Fidelity Minerals Corp. has assembled a portfolio of high-quality mining assets in Peru and aims to delineate major deposits on these properties that could attract the interest of mid-tier and major mining companies. Fidelity has a portfolio of four key assets in Peru and is currently focused on progressing its two most advanced projects – Las Huaquillas and Las Brujas. Fidelity is also looking to opportunistically expand its project portfolio with accretive acquisitions. The company is backed by an experienced management team with diverse technical, market, and commercial expertise and is supported by committed and sophisticated investors focused on building long term value.

On behalf of the Board of Fidelity Minerals.

Dean Pekeski

CEO, President and Director

Email: dean@fidelityminerals.com

For more information, please visit the corporate website at http://www.fidelityminerals.com or contact:

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Disclaimer & Forward-Looking Statements: This news release contains forward-looking statements. Forward-looking statements are statements that relate to future events or future financial performance. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements speak only as of the date of this news release. This news release may also contain inferences to future oriented financial information (“FOFI”) within the meaning of applicable securities laws. The information in this news release has been prepared by our management to provide a context to provide the reader with an outlook for our future activities and anticipated key milestones and may not be appropriate for other purposes. Forward-looking statements in this announcement include, (but are not limited to) advancing certain key project activities that could represent important milestones which the Company expects may represent material valuation catalysts, such as the expectation that through the assembling of a portfolio of high-quality mining assets in Peru, the Company aims to delineate major deposits on these properties that could attract the interest of mid-tier and major mining companies. Further, forward-looking statements in this release include that Fidelity Minerals Corp. is also looking to opportunistically expand its project portfolio with accretive acquisitions.

There has not been sufficient drilling and/or sufficient previous exploration at Las Huaquillas upon which to base a mineral resource or mineral reserve estimate compliant to the standards of National Instrument 43-101. It should be noted that the historical resource related information outlined has been derived from: “NI 43-101 Technical Report on the Las Huaquillas Au, Ag, Cu Property, Cajamarca, Peru”, with an effective date of December 18, 2021, authored by Luc Pigeon, B.Sc., M. Sc., P. Geo, who is an independent and qualified person under National Instrument 43-101. The historical estimate is based upon Gariepy and Vachon (both registered in 1999) and the estimate was performed using the vertical longitudinal section method including seventeen mineralized intersections where a specific gravity of 2.8 g/cm3 and a cut-off grade of 1.0 g/t Au over a minimum width of 3 metres were applied. Gariepy & Vachon (1999) disclosed what they call a “geological resource” which is not a category accepted by prevailing disclosure standards, and at best corresponds to an Inferred Resource in today’s nomenclature. The work did not estimate the zinc, lead or copper contained within the Socavones zone. No more recent estimates or data is available to the issuer; at a minimum, several holes would need to be twinned, and certain historical intercepts re-assayed, to verify the historical estimate as a current mineral resource. For clarity, a qualified person has not done sufficient work to classify the historical estimate as a current mineral resources or mineral reserve, and the Company is not treating the historical estimate as a current mineral resource or mineral reserve.