Archive

West Red Lake Gold: "The Gold Traps We Discovered in The Madsen Mill Are Fixable"

| |||||||||

|  |  |  | ||||||

May 6, 2024 – TheNewswire – Global Stocks News – In a press release dated May 2, 2024, West Red Lake Gold Mines (TSXV:WRLG) (OTC:WRLGF) revealed that, during a ball mill cleanup, it recovered 415 troy ounces of gold worth about $750,000.

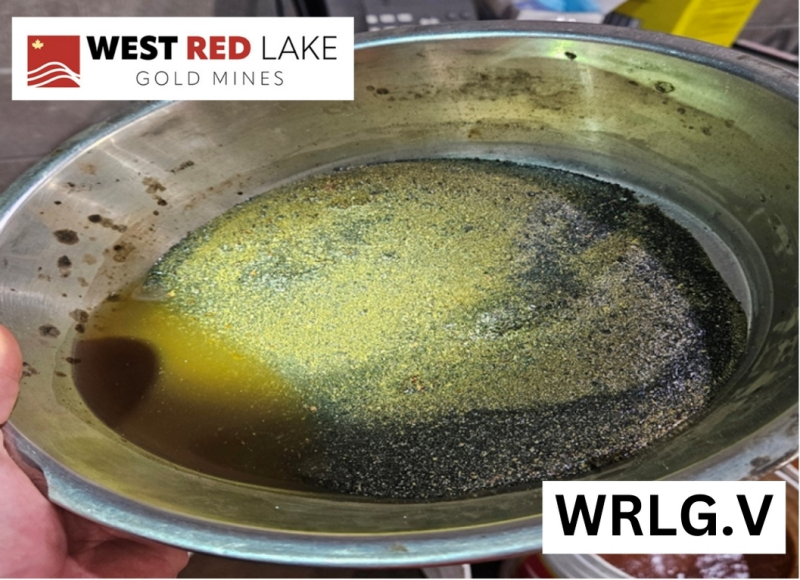

Above photograph of sample concentrate material with coarse visible gold collected as part of the cleanup program.

It is anticipated that WRLG may recover 2,500 oz of gold from the clean up, worth a total of USD $5.75 million @$2,300 gold.

The May 2, 2024 PR supports WRLG’s mine-restart thesis: the previous operator made significant mistakes building the mine and mill, which are fixable.

“It was known that the previous operator had reconciliation issues between the mined ore and the milled ore at the Madsen Mine,” states WRLG.

“Mining reconciliation is a crucial process that connects the theoretical aspects of mining planning with the actual on-ground operations,” writes Anglo American geologist Sriratna Oliveira.

“Mills are mechanical entities,” Maurice Mostert, WRLG VP of Technical Services told Guy Bennett, the CEO of Global Stocks News. “They crush and grind rocks, mix in reagents, and then extract the targeted metal utilizing chemical and physical processes.”

“The goal is for every grain of rock that enters the mill to come out the other side, either as gold or waste,” Mostert continued. “Initially, some gold will get trapped in a mill’s nooks and crannies. Once these are filled, or ‘packed’ with rock, the process becomes more efficient, more gold makes it out the business end of the mill.”

An experienced operator understands how to smooth out and minimize these traps so that gold losses are minimal.

“Gold losses can happen in all kinds of ways,” confirmed Mostert. “From wind blowing ore dust off the tops of mine haul trucks, to ore falling out when dumped and reloaded in transit, to mill traps and poor recoveries. Failing to fix these problems can create major problems for an operating mine.”

“The previous operators only ran the mill for a short time before shutting down. They did not have the opportunity to optimize the mill process or sort out the gold traps. We realized that we could capitalize on those inefficiencies. Our objective was to capture the value of the gold and to better understand the traps and how to fix them,” stated Mostert.

“After finding substantial gold locked up in the circuits during the preliminary phase of the Gold Recovery Program,” reports WRLG. “The Company launched a thorough technical investigation of the mill and mill workings to understand the degree to which this contributed to the previous operator’s reconciliation issues”.

“In certain locations on site,” continued WRLG. “Installation errors had created sizeable ‘gold traps’, resulting in a notable amount of gold remaining in these physical gold traps instead of making it through the mill. Gold was found physically trapped in Ill-fitting liners in the ball mill, the SAG mills, uncleaned filters.”

FIGURE 2. Photograph of material to be processed from the mill cleanup program.

WRLG’s flagship asset - The Madsen Gold Mine in Ontario – was targeted for acquisition by Canadian philanthropist and financier Frank Giustra who formed Wheaton River Minerals which was sold to Newmont for USD $10 billion in 2019.

WRLG’s previous operator was under-capitalised. Debt repayment obligations forced the company into a quick-to-cash-flow mine model that was expensive and inefficient and lead to sub-economic production.

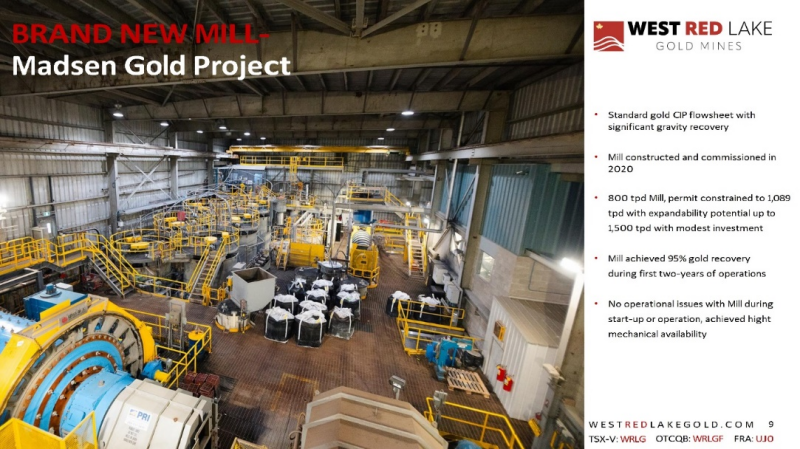

The Madsen Gold Mine is fully permitted and has a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [1]

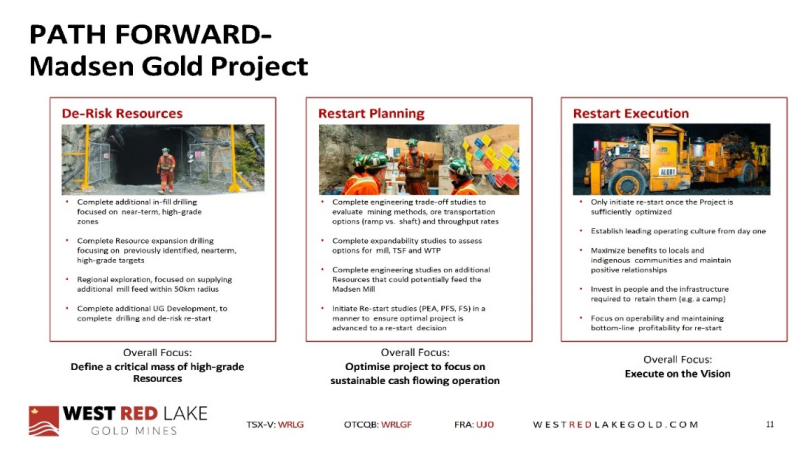

The strategy for the Madsen Mine Restart is: 1. De-risk Resources (in-fill and expansion drilling, UG development 2. Restart Planning (engineering, mill expansion assessment, optimisation 3. Restart Execution (assembling team, community relations, focus on operability and profitability).

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

Based on the significant amount of gold recovered during the initial investigation, a second and more comprehensive phase of the Gold Recovery Program was initiated in early 2024 with a focus on the ball mills and the semi-autogenous grinding (SAG) mills.

In the following video, JXSC Mine Machinery Factory (JXSC) gives an overview of the functioning of a typical ball mill.

“The SAG mills are the primary or first stage grinder for material entering the mill,” confirms WRLG. “Which is then followed by the secondary ball mills”.

As part of the second phase of the Gold Recovery Program, WRLG has engaged a firm in February 2024 which specializes in gold mill cleanup and recovery. The Gold Recovery Program is expected to be completed by the end of May 2024.

“Less than a year after acquiring the Madsen Mine we are already seeing real value being uncovered from this asset,” states Shane Williams, WRLG President & CEO.

“Our immediate focus has been recovering gold throughout the Madsen processing plant with our second cleanup program nearing completion. With gold prices over US$2,300/oz, this material could be a potential one-off source of cash flow during 2024.”

“The gold traps we discovered in the Madsen mill are fixable” concluded Mostert. “We will install the right mill liners. We will clear filters regularly. We will reduce mechanical tolerances to the correct specifications. Reducing inefficiencies and optimizing the mill processes will be central to how we operate the Madsen mill when we restart this gold mine.”

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid GSN $1,500 CND for the research, writing and dissemination of this content.

References:

-

SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

-

Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

-

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca