Archive

Alturas Signs LOI for the Resguardo Copper-Gold Project in the Paleocene-Eocene Metallogenic Belt of Northern Chile

| |||||||||

Toronto – TheNewswire - June 29, 2012 – Alturas Minerals Corp. (Alturas or the “Company”) (TSXV:ALT), (BVL:ALT) is pleased to announce that it has entered into a Letter of Intent (“LOI”) with Sociedad Contractual Minera Resguardo (“Minera Resguardo” or the “Optionor”), a Chilean mining exploration company, to lease and acquire 100% of its Resguardo Copper-Gold Project (the “Concessions” or “Resguardo”), located about 95 km northeast of Copiapo, in Region III of northern Chile, referred to as “Región de Atacama”.

Miguel Cardozo, President & CEO of Alturas commented, “The Resguardo project represents a key strategic development for the Company in Chile, one of Latin America’s premier mining jurisdictions. Alturas will resume its exploration activities in Chile’s mineral-rich Andes Mountain chain. The LOI also includes a 5-year mining lease agreement that allows the Company to explore and commercially mine 18 contiguous mining concessions covering a total of 3,891 hectares. Alturas intends to establish a firm presence in the Paleocene-Eocene Metallogenic Belt of northern Chile, immediately west of the Miocene age Maricunga Metallogenic Belt”.

The Transaction

The Company will have a period of three (3) months, from the signing date of the LOI, to complete a due diligence review on the Concessions, the Optionor, all applicable technical studies, and on any other matter deemed appropriate by the Company (the “Due Diligence”). The Parties further agree that upon the execution of this LOI, a Definitive Agreement (the “Agreement”) will be executed not later than thirty (30) days from completion of the Due Diligence.

With the execution of the Agreement, the Optionor shall grant Alturas a mining option (the “Option”) to acquire a one hundred percent (100%) undivided interest in the Concessions. The Option will be valid as from the Effective Date and will expire four (4) years after the signing of the Agreement. The term of the Option shall be mandatory for the Optionor and voluntary for Alturas.

The aggregate purchase price for the Concessions is structured as cash payments totaling US$2.75 Million (all taxes inclusive), to be paid in five (5) installments, with US$50,000 within fifteen days of the execution of the Agreement (the “Effective Date”) and four (4) installments payable as follows:

-

On or prior to the first anniversary of the Effective Date, the amount of US$100,000;

-

On or prior to the second anniversary of the Effective Date, the amount of US$150,000;

-

On or prior to the third anniversary of the Effective Date, the amount of US$300,000; and,

-

On or prior to the fourth anniversary of the Effective Date, the amount of US$2,150,000.

If, as a result of the mining activities performed by Alturas on the Concessions, a porphyry is confirmed, the purchase price for acquiring title over the Concessions payable by Alturas to the Optionor will be increased by ten percent (10%) of the selling price obtained by Alturas for the transfer of the Concessions to a third party, or US$30 Million, whichever is greater.

Once the Company exercises the Option, a 1.5% Net Smelter Return (“NSR”) Royalty will be applicable (the “NSR Royalty”) as an additional consideration for the transfer of the Concession to be effective as from commencement of Commercial Production on the Concessions. Until up two (2) years after the commencement of Commercial Production, the Company may buy five tenths’ percent (0.5%) of the NSR Royalty (the “Purchased NSR”) at a price between US$2 Million and US$6 Million depending on the size, grade, and type of mineralization as determined in accordance with National Instrument 43-101 (“NI 43-101”). The Optionor also grants a right of first refusal for the acquisition of the remaining NSR Royalty.

Mining Lease:

During the term of the Option, the Optionor shall also lease the Concessions (the “Mining Lease”) to the Company, as result of which Alturas will be conferred all the rights and obligations of the Optionor related to the Concessions, including the right to exploit the Concessions.

The Mining Lease shall be for a period of five (5) years and begins on the Effective Date or, whichever arrives first, when Alturas notifies the Optionor of its decision to exercise the Option.

Once the Mining Lease is in force, Alturas shall have the right to operate the Concessions at its own sole cost and risk, subject to compliance with applicable laws, shall have the right to initiate commercial production of the existing high-grade copper mineralization.

As compensation required for the Mining Lease, Alturas will pay the Optionor a NSR Royalty over all the minerals extracted and marketed from the Concessions (the “Lease NSR Royalty”). If the mineral extracted has an average ore grade that is lower than 2.5%, the Lease NSR Royalty will be equivalent to 7.0% of the price at which said mineral is marketed; and, if the mineral extracted has an average ore grade that is equal to or higher than 2.5%, the Lease NSR Royalty will be equivalent to 9.0% of such price.

The transaction remains subject to regulatory and TSX-V approvals as well as the above-mentioned due diligence

Resguardo Geology and Mineralization

Copper structures on the Resguardo consist of sub-vertical and tabular stockwork bodies (in parts hydrothermal breccia) that host disseminated and vein copper mineralization exceeding 2.0% Cu, along with sub-parallel copper-gold veins. The main mineralized copper body, which has been historically mined, has an average width of 50 to 100 m and is about 1.5 km in length. Historical open pit and underground mine workings are scattered along the 1.5 km length with areas of mineralization that often exceed 2.0% Cu-equivalent grade.

Besides exploring the high-grade copper structures and the potential copper porphyry system, the Company intends to undertake an initial small-scale mining operation of the high-grade material. The maximum tonnage allowed by Chilean regulations is 5,000 tonnes per month. This activity will be of great help in defining the actual extension and quality of the high-grade copper mineralization with the view of a future mid-size operation and will generate significant cash-flow to the Company to support its activities in the Concessions and future exploration projects in Chile.

Given the already known copper mineralization at or near surface and the extensive and intense hydrothermal alteration covering kilometres of area, there is a high probability that known copper oxide and sulphide mineralization is genetically connected to an as yet unconfirmed porphyry system (i.e., Late Eocene-Early Oligocene) located topographically lower and therefore deeper in the mineralized system.

Evidence for the possibility of a porphyry system is supported by recent induced polarization and magnetic geophysical surveys which have delineated a deep-seated chargeability high overlapping the edge of a magnetic low, the latter which was likely produced by magnetite destruction as a result of hydrothermal fluid movement.

The following has been extracted from a NI 43-101 technical Reports authored by Dr. Scott Jobin-Bevans, Principal geoscientist with Caracle Creek International Consulting Inc.

The Resguardo Copper-(Gold) Project and the Paleocene-Eocene Metallogenic Belt (“PEMB”)

The Resguardo Project is located about 45 km southwest of La Coipa Au-Ag Mine (Kinross Gold Corp: Compañía Minera Mantos de Oro) and about 85 km northeast of Candelaria Copper Mine (Lundin Mining)”. Access to the Resguardo Copper Project is excellent, starting from the southeast end of the City of Copiapó, travelling northeast on highway 31 for about 85 km to the Quebrada Cortadera access road. Heading northwest on the Quebrada Cortadera access road for about 5.5 km brings you to the central area of the Project and the historical workings at the historical mine site. The Project is currently at the exploration stage and Optionorship of surface rights are usually not contemplated or necessary until a decision to mine has been made. The Mining Code of Chile guarantees the Optionor of mining concessions the right-of-access to the surface area required for their exploration and exploitation.

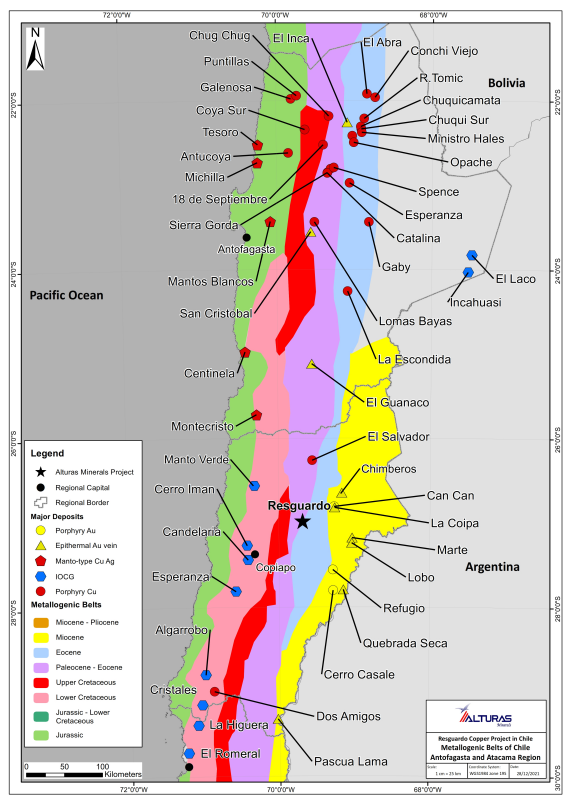

The Resguardo Copper Project lies within Paleocene-Eocene Metallogenic Belt of northern Chile, immediately west of the Miocene age Maricunga Metallogenic Belt (see Figure 1). The Project is within the morphostructural zone known as the Cordillera Domeyko (aka Andean Pre-Cordillera), a region underlain by Paleocene, Eocene and Early Oligocene Epoch magmatic arc rocks comprising a north-south linear belt. Rocks consist of basaltic to rhyolitic lavas and tuffs, subvolcanic porphyritic intrusions, and granitoid stocks, which extend from southern Peru to central Chile.

The Paleocene-Eocene porphyry and epithermal Metallogenic Belt hosts a diverse range of mineral deposits and occurrences, including large-scale porphyry Cu-Mo deposits like BHP Billiton’s Spence Mine (e.g., Sillitoe and McKee, 1996) and Codelco’s El Salvador Mine (e.g., Gustafson and Hunt, 1975) and low sulphidation epithermal deposits like Yamana Gold’s El Peñon (e.g., Warren et al., 2004, 2008).

On the Property, in the areas around the historical underground and open pit mines, rocks have experienced pervasive and intense hydrothermal alteration that includes sericitic, silicic-argillic and propylitic alteration. In the copper mineralized zones, the host rock generally shows a hydrothermal alteration of the silicic-argillic type that grades laterally to an aureole of weak and irregular propylitic alteration (with epidote and chlorite). Hydrothermal alteration (both silicic-argillic and propylitic) of the host rock in the extreme western parts of the Property is much less intense and locally non-existent.

A complex mineralized system dominated by copper but with ancillary gold and silver mineralization exists on the Resguardo Copper Project, with much of the known mineralization focused in the area of the historical workings and underground mine. Most copper mineralization occurs as disseminated and veinlet copper oxide species but stockworks, hydrothermal breccias and larger vein systems are also known to occur (Frutos, 2014).

The main east-west mineralized trend, referred to as the Cerro Fraga Mineralized System (“CFMS”), extends for more than 2 km and with widths from 300 to 500 metres (Frutos, 2014). This copper zone is characterized by areas of intense hydrothermal alteration with upper areas of oxidized and leached lithologies, hydrothermal breccias, and veins and stockworks. The main mineralization that has been historically targeted consists of copper oxides and copper sulphides which in some areas carry important concentrations of silver and gold in structurally controlled veins that have been historically worked by artisanal miners.

Within the CFMS, principal copper structures consist of sub-vertical and tabular stockworks bodies (in parts hydrothermal breccia) that are interpreted to be structurally controlled (east-west and sub-vertical), with disseminated and vein copper mineralization, and sub-parallel veins of copper-gold trending N70-100E (Frutos, 2014). The main mineralized copper body which has been historically mined has an average width of 50 to 100 m and is about 1.5 km in length, with good outcrops and several historical open pit and underground mine workings scattered along its length.

The principal deposit type being explored for on the Property is Porphyry Copper Deposit or “PCD”. Mineralized systems associated with a PCD system commonly include polymetallic skarn, carbonate replacement and stratabound (i.e., Manto-style copper), sediment-hosted gold silver, and high, intermediate and low sulphidation epithermal silver-gold-base metal deposit types (Sillitoe and Perello, 2005; Sillitoe, 2010).

Mineralization styles (replacement Manto-style copper with pervasive disseminated copper oxides and sulphides and veining) and intense hydrothermal alteration (alunite, kaolinite, illite, lesser propylitic) observed in the historical workings on the Property, coupled with recent evidence from geophysical surveys support the PCD model and provide targets for a future exploration program.

The Project area has sufficient size to accommodate a mining operation without any negative impact on the environment. The area corresponds to the high desert climate of the Atacama Region with only trace rainfall most of the year and with most precipitation as minor snow in winter months (June-September). Given its excellent accessibility and climate, all types of exploration activities can be performed year-round.

The Resguardo Copper Project does not have any current mineral resources or mineral reserves and despite having some historical copper production, is best described as an early-stage exploration project. Historical exploration work (geological mapping, trenching, geophysical surveys, drilling) and small-scale copper mining is known to have been completed within the Project area, dating back decades and most recently in 2020. Most of the information and data available from historical exploration work on the Property begins with SCM’s Optionorship in 2012:

Table 1-1. Summary of known historical mineral exploration programs conducted in the Project area.

|

Period |

Company |

Description |

Comments |

|

1970-1995 |

"Candelaria Mine" |

small-scale mining; mine referred to as Candelaria Mine |

no information or data available |

|

2004 |

Hochschild Mining PLC |

diamond drilling; 6 holes (80-100 m long); area of open pit |

no information or data available; core location unknown (pers. comm. Jose Frutos, 2021) |

|

2005-2006 |

Araya Hermanos de Copiapó S.A. |

small-scale mining of Cu oxides; ~5,000 tpm |

mineralized material sold to ENAMI |

|

2007-2011 |

Mantos Candelaria |

small-scale mining |

mining ended after 7 years due to internal disagreements |

|

2011 |

Sociedad de Inversiones Gema Limitada |

acquired 3 main mining concessions |

acquired Resguardo 1, 3 and 4 |

|

2012 |

Sociedad Contractual Minera Resguardo |

company formed to hold 3 main mining concessions |

Resguardo 1, 3 and 4 and expand the property to a total of 18 contiguous concessions |

|

2012 |

Castillo Copper Chile SpA/Kingsgate Consolidated Ltd |

optioned property; 2 diamond drill holes (~200 m each) |

terminated option in 2014 |

|

2018 |

Orestone Mining Corp. |

optioned property; 2 RC drill holes; geophysical survey |

terminated option in 2020 |

|

2014-2020 |

Sociedad Contractual Minera Resguardo |

geological mapping study; geophysical survey along 2 N-S profiles (P1 and P2) |

financed by SCM |

Figure 1. Resguardo Cu-Au Project location and Metallogenic belts of Northern Chile, Atacama & Antofagasta regions

Photos taken from the NI 43-101 Technical Report on the Resguardo Copper-Gold Property, that Alturas has in preparation through its independent contractor Caracle Creek International Consulting Inc.

About Sociedad Contractual Minera Resguardo and Non Arm’s Length Party Disclosure

Sociedad Contractual Minera Resguardo (“Minera Resguardo”) was incorporated in 2012 to acquire additional concessions in the Resguardo project area. It is controlled by Sociedad de Inversiones Gema Limitada (52%), with partners Inversiones Mineras El Refugio S.A. (30%) and CP Group Chile Limitada (18%), both owned by Peruvian investors. CP Group Chile Limitada is a Chilean subsidiary of the family-owned CP Group S.A.C. Peruvian company, which shareholders are Mr. Miguel Cardozo, CEO and Director of Alturas Minerals Corp. (the Issuer) and his wife Mrs. Sara Pajares, owning 50% of this company each.

About Alturas Minerals

Alturas is a Canadian corporation, and is the indirect parent of the Peruvian company, Alturas Minerals S.A. (“Alturas Peru”) and of the Chilean company, Alturas Chile Limitada (“Alturas Chile”). Alturas had been exploring various mineral projects in Peru between January 2004 and 2020 and between 2012 and 2014 in Chile through its subsidiaries. After interrupting its exploration activities in Chile and Peru due to financial constraints, Alturas is now focusing in new business opportunities. Alturas has approximately $1.2 million in cash and cash equivalents and approximately $0.5 million in other securities, as of December 31, 2020.

Qualified Person

Scott Jobin-Bevans (PhD, PMP, P.Geo.), an independent qualified person (“QP”) as defined in National Instrument 43-101, has reviewed, and approved the technical contents of this news release on behalf of the Company. The QP as part of his involvement as Principal Geoscientist with Caracle Creek International Consulting Inc. has visited the Resguardo Copper Project and has completed sufficient work to verify the historic information on the Concessions, particularly regarding historical exploration, neighboring companies, and government geological work.

ALTURAS MINERALS CORP.

“Miguel Cardozo” Chief Executive Officer

Contact: Mario Miranda

Phone: (416) 363-4900

Alturas Minerals Corp. (TSX-V: ALT)

372 Bay Street, Suite 301 Toronto, Ontario M5H 2W9

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE U.S.

Neither TSX Venture Exchange nor its Regulation Services Provider (as defined in the policies of the TSX Venture Exchange) nor the Bolsa de Valores de Lima accepts responsibility for the adequacy or accuracy of this release.