Archive

Belmont Resources Provides Drill Update for Lone Star JV with Marquee Resources

| |||||||||

Significant zones of mineralisation intersected include:

-

LS21-005: 6.85m @ 0.56% CuEq from 43.0m

-

LS21-005: 7.93m @ 1.25% CuEq from 84.1.1m

-

LS21-017: 16.77m @ 0.66% CuEq from 80.2m

-

LS21-017: 3.65m @ 2.35% CuEq from 112.8m

-

LS21-017: 32.01m @ 0.60% CuEq from 142.3m

-

LS21-020: 13.11m @ 0.92% CuEq from 5.2m

-

LS21-020: 7.62m @ 0.55% CuEq from 106.4m

-

LS21-021: 7.31m @ 2.62% CuEq from 6.1m

-

LS21-021: 2.75m @ 2.05% CuEq from 39.0m

-

LS21-021: 50.91m @ 0.54% CuEq from 53.6m (incl. 18.29m @ 0.75% CuEq

-

LS21-021: 29.57m @ 0.89% CuEq from 120.7m

-

LS21-022: 35.05m @ 1.04% CuEq from 41.2m

-

LS21-022: 56.69m @ 0.71% CuEq from 97.5m

note: 50% of assays for LS21-022 still outstanding

Vancouver, B.C. Canada – TheNewswire - May 5, 2022 - Belmont Resources Inc. (“Belmont”), (or the “Company”), (TSXV:BEA); (FSE:L3L2) is pleased to provide an update on exploration activities being carried out by Marquee Resources. (ASX: MQR) (“Marquee”) at the Company’s Lone Star property in North Eastern Washington State, where Marquee has an option to earn up to an 80% interest in the Lone Star property by completing a Preliminary Economic Assessment Study.

Results from this batch of assays continue to intersect wide zones (up to 60m) of significant copper mineralisation which further extend the mineralisation envelope The wide zones of mineralisation are interpreted to be related to sub-vertical feeder dyke that has been the conduit for upwelling magmas during rhyolite dome emplacement and mineralization.

George Sookochoff, President & CEO commented, “33 of the original 42 proposed holes have been completed, and 6 additional infill holes in the pit itself have now been added to help firm up the new resource calculation and provide further support for a potential initial open pit mining scenario. Drilling continues 24/7 and we remain on schedule for producing a new 43-101 resource estimate in H1 2022.”

Lone Star Drill Plan

Cross-section 5428215N

|

Hole_ID |

From (m) |

To (m) |

Width (m) |

CuEq % |

Cu % |

Au g/t |

Ag g/t |

|

LS21-005 |

42.98 |

49.83 |

6.85 |

0.56 |

0.4 |

0.2 |

2.1 |

|

LS21-005 |

84.1 |

92.1 |

7.93 |

1.25 |

1.1 |

0.2 |

4.7 |

|

LS21-017 |

80.2 |

96.9 |

16.77 |

0.66 |

0.4 |

0.4 |

2.7 |

|

LS21-017 |

112.8 |

116.4 |

3.65 |

2.35 |

1.8 |

0.8 |

4.4 |

|

LS21-017 |

142.3 |

174.4 |

32.01 |

0.60 |

0.5 |

0.2 |

1.4 |

|

LS21-020 |

5.2 |

18.3 |

13.11 |

0.92 |

0.7 |

0.4 |

1.6 |

|

LS21-020 |

106.4 |

114.0 |

7.62 |

0.55 |

0.4 |

0.2 |

|

|

LS21-021 |

6.1 |

13.4 |

7.31 |

2.62 |

2.1 |

0.7 |

19.1 |

|

LS21-021 |

39.0 |

41.8 |

2.75 |

2.05 |

1.2 |

1.3 |

3.5 |

|

LS21-021 |

53.6 |

104.6 |

50.91 |

0.54 |

0.5 |

0.1 |

0.9 |

|

incl. |

53.6 |

71.9 |

18.29 |

0.75 |

0.7 |

0.1 |

1.7 |

|

LS21-021 |

120.7 |

150.3 |

29.57 |

0.89 |

0.8 |

0.1 |

3.7 |

|

LS21-022 |

41.2 |

76.2 |

35.05 |

1.04 |

0.8 |

0.3 |

5.6 |

|

LS21-022 |

97.5 |

154.2 |

56.69 |

0.71 |

0.5 |

0.3 |

1.7 |

|

note: 50% of assays for LS21-022 still outstanding |

|||||||

Table of significant intercepts in latest batch of results

1.True widths of the reported mineralized intervals have not been determined.

2.Assumptions used in USD for the copper equivalent calculation were metal prices of $4.00/lb. Copper, $1,800/oz Gold, $20/oz Silver, and recovery is assumed to be 100% given the level of metallurgical test data available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.656) + (Silver (g/t) x 0.00729).

The Lone Star deposit is interpreted to have elements of structural and stratigraphic control with an overprinting porphyry copper system. Structurally stacked ‘tectonic’ lenses of east dipping, closely spaced, overlapping en echelon zones of VMS-style massive sulphide have been structurally emplaced during thrusting over the basal serpentinite unit. At least eight individual zones have been interpreted and these zones range from 1-18 metres thick. Porphyry and hydrothermal fluids utilised the pre-existing structural architecture to deposit copper-gold mineralisation subsequent to the earlier thrusting event. Structurally controlled epithermal gold mineralisation, discordant with early base metal mineralisation, has also been identified hosted in veins, shear veins and breccia zones and is interpreted to have been deposited syn-porphyry emplacement. At least three separate rhyolite sills, are fed by sub-vertical, structurally controlled, feeder dykes/zones. The mineralised sub-vertical dykes/zones are estimated to be approx. 20-40m wide, extend laterally for tens to hundreds of metres, and are vertically extensive. Identification of the mineralised dykes opens up the possibility of defining significant additional mineralisation outside the flat-lying, structurally remobilised base metal mineralisation that has been historically identified.

The objective of the drill program is to:

1) Validate the historical 252 drill hole database and resource model;

2) Test for extensions of the historical resource both laterally and at depth;

3 Deliver a 43-101/JORC compliant mineral resource estimate and Preliminary Economic Assessment/Scoping Study.

Additionally, Mining Plus Pty Ltd have begun resource modelling studies as the Company pushes towards delivering a 43-101/2022 JORC-compliant resource in 1H-2022.

About the Lone Star

The Lone Star is a past producing open pit and underground mine situated on the north end of the prolific Republic Graben of Washington State. The project has 252 historic drill holes. The former owner Merrit Mining, completed a 2007 resource estimate as reported in a “Technical Report and Resource Estimate on the Lone Star Deposit, Ferry County Washington (September 23, 2007)” for Merit Mining Corp. and authored by P&E Mining Consultants Inc. The company went into receivership shortly after due to the 2008 economic crisis.

Belmont acquired the Lone Star property in July 2021 and is the first company to continue where Merit Mining left off, in advancing the Lone Star to production.

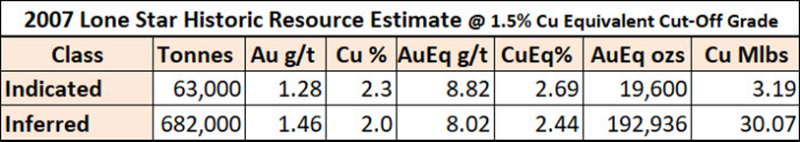

Lone Star 2007 Historical Resource

Calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb.

(1) Mineral resources which are not mineral reserves do not have demonstrated economic viability.

(2) Gold equivalent (AuEq) grade was calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb., based on the 24 month (at July 31, 2007) trailing average of gold and copper prices, to obtain a conversion factor of % copper x 3.284 + gold g/t = Au Eq g/t. Metallurgical recoveries and smelting/refining costs were not factored into the gold equivalent calculation.

(3) The Cu equivalent (CuEq) cut-off value of 1.5% was calculated and rounded utilizing the following: Cu price US$2.84/lb, $US exchange rate $0.88, process recovery $95%, smelter payable 95%, smelting and refining charges C$7/tonne mined, mining cost C$62/tonne mined, process cost $C28/tonne processed, G&A cost $7.50/tonne processed.

(4) A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or mineral reserves. As such the issuer, Belmont Resources, is not treating this historical estimate as current mineral resources or mineral reserves.

Belmont-Marquee Joint Venture

Marquee Resources (ASX:MQR) is earning the right to acquire an 80% interest in the Lone Star property (NR Nov. 4, 2021 – Belmont Signs Option/JV Agreements With Marquee Resources On Lone Star Property) by committing to the following:

• $504,000 cash payments

• $2,550,000 Work Program

• 3,000,000 MQR Shares

• Produce a 43-101 & JORC Resource and Preliminary Economic Assessment (PEA) on the project

• Within a 24 month term.

About Belmont Resources

Belmont Resources has assembled a portfolio of highly prospective copper-gold-lithium & uranium projects located in British Columbia, Saskatchewan, Washington and Nevada States. Its holdings include the Come By Chance (CBC), Athelstan-Jackpot (AJ) and Pathfinder situated in the prolific Greenwood mining camp in southern British Columbia. The Crackingstone Uranium project in the uranium rich Athabaska Basin of northern Saskatchewan. The Lone Star copper-gold mine in the mineral rich Republic mining camp of north central Washington State. The Kibby Basin Lithium project located 60 kilometers north of the lithium rich Clayton Valley Basin.

-

Athelstan-Jackpot, B.C. – * Gold-Silver mines

-

Come By Chance, B.C. – * Copper-Gold mine

-

Lone Star, Washington – * Copper-Gold mine

-

Pathfinder, B.C. – * Gold–Silver mines

-

Black Bear, B.C. – Gold

-

Pride of the West, B.C.- Gold

-

Kibby Basin, Nevada – Lithium

-

Crackingstone, Sask. – Uranium

* past producing mine

NI 43-101 Disclosure:

Technical disclosure in this news release has been approved by James Ebisch P.Geo, a Qualified Person as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President

Ph: 604-505-4061

Email: george@belmontresources.com

Website: www.BelmontResources.com

We seek safe harbor. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange has not approved nor disapproved of the information contained herein.