Archive

Ashley Gold Corp Acquires Santa Maria Property and Announces Financing

| |||||||||

|  |  |  | ||||||

August 3, 2022 – TheNewswire – Calgary, Alberta - Ashley Gold Corp. (CSE:ASHL) (“Ashley” or the “Company”) is pleased to announce that is has acquired 100% interest in 48 mining claims known as the Santa Maria Property located 40 km to the southeast of Dryden, Ontario in the Kawashegamuk Township. The acquired Santa Maria Property is comprised of 48 single cell mining claims over 2500 acres. The Kawashegamuk Lake area became known as the “New Klondike” after the 1896-1899 gold rush in Klondike, Yukon. The Santa Maria Property lies within the Eagle-Wabigoon-Manitou Lakes Greenstone Belt. This belt is peppered with granitic batholiths which are thought to be derived from the same magmas as the belt volcanics. The (EWMGB) is roughly 80 km long and 40 km wide. Several large regional faults cut the belt, but the northwest trending Kawashegamuk Lake Fault Zone passes along the edge of the Santa Maria Property.

This active mining area has been known to host several large-scale, multimillion ounce gold deposits, some of the most notable being the Rainy River Deposit, Cameron Lake, Goliath Gold Project, and the Shoal Lake Gold Project. The Santa Maria Property hosts structurally controlled lode gold style mineralization of Archean age, similar to the lode gold deposits located in Timmins, Kirkland Lake, and the Red Lake mining camps.

For a cash consideration of $10,000 CAD Ashley has fully acquired the Santa Maria claims subject to a 1.75% Net Smelter Royalty (NSR).

Figure 1: Santa Maria Project Location

“We are very excited to have expanded our exploration base with the acquisition of the Santa Maria Gold Project” Commented VP Operations Darcy Christian. He continued “This is an under-explored area with several known gold occurrences on the property with little known work completed in the north and east portion. I look forward to our September program designed to further evaluate the areas potential.

Financing Terms and Use of Proceeds

Up to $250,000 will be raised in a combination of Flow-Through Units and Hard Dollar Units. Hard Dollar Units will consist of one common share and one warrant to purchase an additional share for $0.20 for 24 months and will be offered at $0.10. Flow-Through Units will consist of one common share and one warrant to purchase an additional share for $0.20 for 24 months and will be offered at $0.12.

The funds will be used to advance the new Santa Maria Property with a September surface exploration program. The remainder of the funds will be allocated to a winter work program to be finalized based on the summer exploration results.

MI 61-101 DISCLOSURE

The transaction contemplated by the purchase agreement constitutes "related party transaction" for the purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101") of the Canadian securities regulators. Specifically, the Santa Maria Property is owned by an insider of the company and the transaction is therefore considered a "related party transaction" under MI 61-101 (the "Related Party Transactions").

MI 61-101 imposes certain requirements on "related party transactions" for the protection of minority shareholders. The company has relied on exemptions from the formal valuation and minority shareholder approval requirements of MI 61‑101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61‑101 in respect of related party participation in the transaction as neither the fair market value (as determined under MI 61-101) of the subject matter of, nor the fair market value of the consideration for the transaction, insofar as it involved the related parties, exceeded 25% of the company’s market capitalization (as determined under MI 61-101).

About the santa maria property

The property can be accessed just 10 km south of Trans-Canada Highway #17, the main access road from Thunder Bay, Ontario. The working season in this region is considered to be year-round with very few exceptions. There are at least four known gold showings reported to be on the property within the 48 mining claims. These showings include the Santa Maria Shaft Zone (Shaft #1), The Lee Lake South Occurrence, The Lee Lake North Shore Occurrence, and the Long Lake Gold – Quartz Vein.

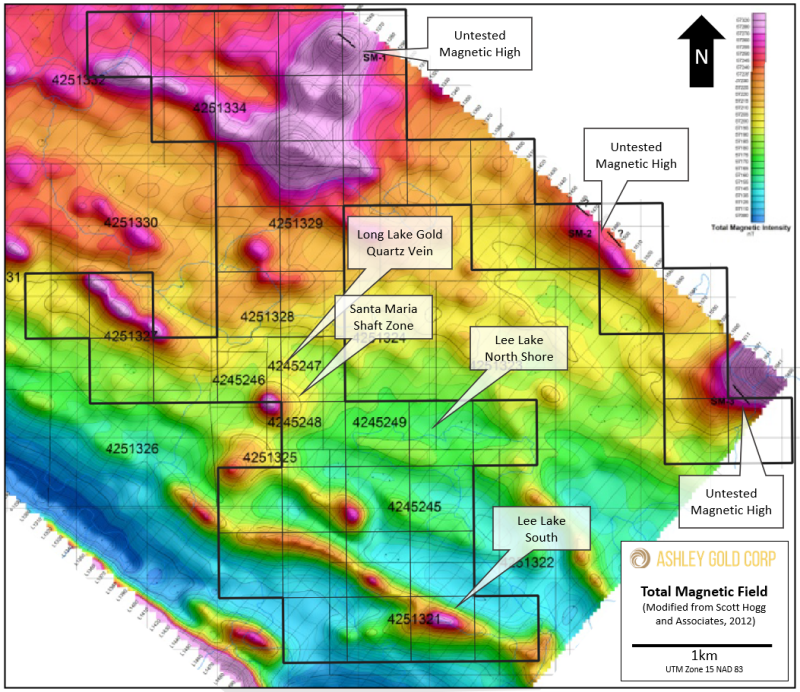

An Airborne EM & magnetic survey flown in 2012 by Geotech Ltd identified 3 distinct EM anomalies. Each anomaly is suggestive of bedrock conductivity and should be considered high priority areas for follow-up exploration work. (See Figure 2)

The Santa Maria #1 Shaft Zone consists of sheeted quartz veining and quartz stockwork veining that occurs along the contact between felsic dykes and intensely carbonate altered mafic volcanics. The quartz vein zone ranges from 0.3 to 1.2 meters wide. Numerous individuals and companies have collected grab samples from the prospect, including; 25.7 g/t Au (Parker, 1988), 16.8 g/t Au (Fairservice, R.J. 2009), and 9.26 g/t Au (Long Lake Gold Mines Ltd, 1902).

Figure 2: Magnetic Anomalies Derived from Total Magnetic Intensity

The Lee Lake South Occurrence is located south of the Santa Maria Shaft Zone and is described as being two intersecting ribbon-textured quartz veins (4cm and 56cm wide) that are exposed in an open cut. The veins are hosted within a sheared and carbonatized quartz-feldspar porphyry dyke which intrudes mafic volcanic rocks. Six samples were collected with reported assays up to 11.66 g/t Au.

The Lee Lake North Shore Occurrence is reported to be an east-west trending carbonatized and silicified felsic dyke, several meters wide, containing disseminated pyrite, galena, and chalcopyrite. Two grab samples were collected and assayed 0.7 g/t Au and 1.21 g/t Au (Parker 1989).

Long Lake Gold – Quartz Vein was discovered 90 meters north of the Santa Maria Shaft Zone. This vein was reported by Long Lake Gold Mining Company as being “very wide and returned gold values” (Kresz, 1984). This vein is 1.2 meters wide and was traced for approximately 58 meters in strongly sheared sediments. Trench samples were reported to assay from trace up to 8.23 g/t Au.

About ASHLEY GOLD

Ashley Gold is focused on creating substantive long-term value for its shareholders through the discovery and development of world class gold deposits. Ashley currently holds an option to earn 100% interest in the Ashley Mine Project, subject to a 2% royalty. In addition, Ashley has acquired 100% of the Santa Maria subject to a 1.75% royalty. Ashley is actively searching for additional high potential gold properties to add to its portfolio.

Ashley Gold Corp. is an early-stage natural resource company engaged primarily in the acquisition, exploration, and if warranted, development of mineral properties. The Corporation’s objective is to conduct efficient and economical exploration on its growing portfolio of high-quality gold projects, currently focused in northeastern and northwestern Ontario within the western Abitibi and the Eagle-Wabigoon-Manitou Lakes Greenstone Belts.

The responsibility of this release lies with Mr. George Stephenson, CEO and President +1 (403) 816-2262 • gstephenson@ashleygoldcorp.com, who, with Mr. Darcy Christian, Vice President, Operations • +1 (587) 777-9072 • dchristian@ashleygoldcorp.com , may be contacted for further information. www.ashleygoldcorp.com

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

DISCLAIMER & FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management’s expectations. Factors which cause results to differ materially are set out in the Company’s documents filed on SEDAR. Undue reliance should not be placed on “forward looking statements”.