Archive

Tocvan Discovers Broad Zone of Gold at El Picacho. Drills 27.5m at 0.5 g/t Au, including 12.2m at 1.1 g/t Au Releases Results for First Three Drill Holes at El Picacho Gold-Silver Project

| |||||||||

|  |  |  | ||||||

Highlights

-

Hole SRA-22-003 returned 27.5-meters of 0.5 g/t Au, including 12.2-meters of 1.1 g/t Au, from 21.4-meters depth

-

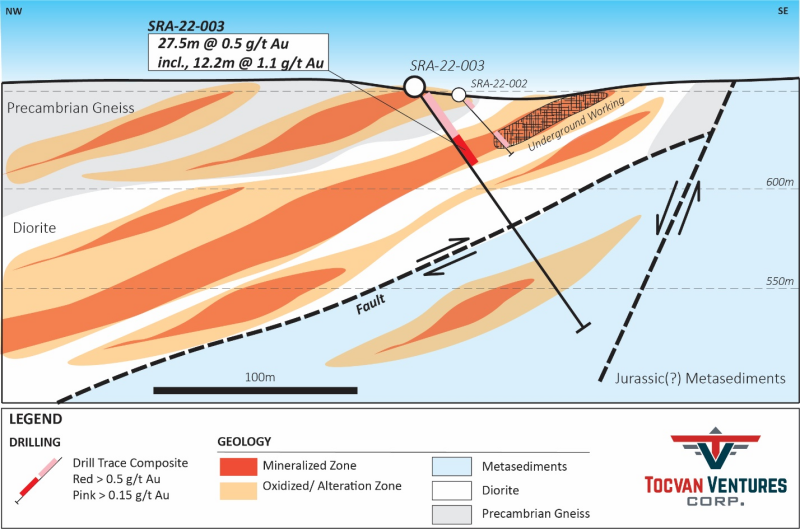

Confirms exploration model of at and near-surface oxide gold mineralization connected to underground workings

-

All three drill holes contain quartz veining and alteration associated with robust mineralized systems

-

Seven drill holes are pending results from two separate areas, 200-meters apart

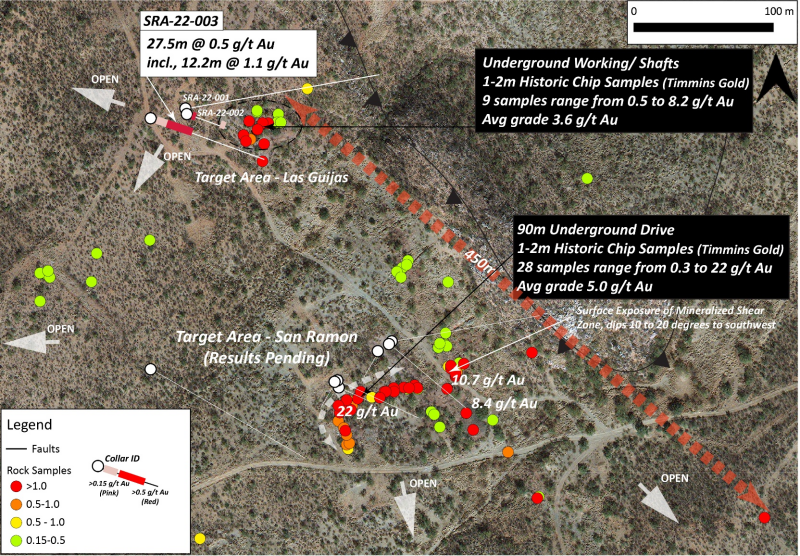

Calgary, Alberta – TheNewswire - January 10, 2023 Tocvan Ventures Corp. (the “Company”) (CSE:TOC); (OTC:TCVNF); (FSE:TV3), is pleased to announce drill results for the first three drill holes completed at its El Picacho Gold-Silver project in Sonora, Mexico. Ten drill holes totalling 1,075.1-meters were completed at the San Ramon Prospect testing for low-grade mineralization adjacent to historic underground workings that have returned high-grade gold with silver. Results for the first three drill holes are provided in this release. These holes focused on the northern-most area of historic workings called Las Guijas. All three drill holes intersected oxidized quartz vein zones with alteration indicating the potential for gold and silver mineralization. Hole SRA-22-003 yielded the best result to date, returning 27.5-meters of 0.5 g/t Au, including 12.2-meters of 1.1 g/t Au starting at a downhole depth of 21.4-meters (approx. 10-meters from surface). The Company is extremely pleased in having intersected significant oxide gold mineralization so soon in its efforts to understand the potential for a significant mineralized system at El Picacho. Results for the remaining seven drillholes are pending. The remaining drill holes tested two separate areas both 200-meters to the south and southeast of Las Guijas. Analysis and interpretation of this data will be used to plan follow-up drilling. El Picacho is host to several other target areas permitted for drilling that span across the 24 km2 project area.

Table 1. Summary of SRA-22-003 Results

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

|

SRA-22-003 |

0.0 |

48.8 |

48.8 |

0.30 |

0.5 |

|

including |

21.4 |

48.8 |

27.5 |

0.51 |

0.8 |

|

including |

29.0 |

48.8 |

19.8 |

0.71 |

1.0 |

|

including |

35.1 |

47.3 |

12.2 |

1.14 |

1.4 |

|

including |

35.1 |

36.6 |

1.5 |

4.73 |

2.0 |

For a detailed discussion on these 3 drill holes, view here:

"To hit significant mineralization in the first round of drilling at El Picacho is a massive achievement and there is still more to come,” stated Brodie Sutherland, CEO. “We have now confirmed that the San Ramon Prospect has the potential to host a sizable near-surface bulk oxide-gold target and we look forward to reviewing the remaining drill holes to plan our next steps at El Picacho. It is important to note the significance of hitting mineralization of this style with a relatively modest drill program. We have essentially started to prove our model is correct within the first 400-meters of drilling. Part of our objective with this program is to test different orientations to better understand which drill direction yields the best results related to higher grade vein hosted gold and silver. With the similarities to the local San Francisco Mine (18 kilometers to the northeast) which was discovered from very similar surface characteristics and substantial artisanal workings. We look forward to evaluating these results and data to further unlock the potential of El Picacho.”

Figure 1. El Picacho Project, San Ramon Prospect Target Map.

Figure 2. El Picacho Project, San Ramon Prospect SRA-22-003 Cross-Section.

Discussion

SRA-22-001 – Azimuth 080, Dip -45o, Total Depth 198.3m

This hole targeted the northern flank of the Las Guijas underground workings. Although no significant mineralization was intersected, an anomalous zone from surface to 9.2-meters depth was encountered followed by an oxidized quartz vein zone from 36.6-meters to 45.8-meters. This vein zone returned anomalous Au, Ag, As, Sb and W, averaging 0.1 g/t Au, 3 g/t Ag, 339 ppm As, 134 ppm Sb and 60 ppm W. A large fault zone was encountered at 64.1-meters to 77.8-meters followed by an oxidized vein zone to 102.2-meters. Altered and oxidized metasediments were found in the footwall of the fault zone transitioning to less oxidized quartzites and metasandstones to the end of the hole.

SRA-22-002 – Azimuth 110, Dip -45o, Total Depth 41.23m

This hole targeted the down dip projection of mineralization seen at the Las Guijas underground workings. Anomalous gold was intersected from surface to 7.6-meters depth with values up to 0.5 g/t Au over 1.5-meters. A quartz vein zone was intersected starting at 33.6-meters with coinciding elevated Au and pathfinder elements (As, Ab and W), at 36.6-meters a large void was encountered thought to be an unknown extension of the underground workings. The hole was stopped at 41.2-meters at the other side of the void to avoid complications with RC drilling.

SRA-22-003 – Azimuth 110, Dip -55o, Total Depth 149.5m

This hole was placed as a step back to SRA-22-002 to avoid hitting underground workings and test the down-dip projection of mineralization, thought to be shallowly dipping in a western direction from the exposed workings. A zone of anomalous gold was intersected from surface to 13.7-meters depth. At 21.4-meters anomalous values of gold were again encountered transitioning into a quartz vein zone from 35.1-meters to 50.3-meters depth. The quartz vein zone returned the highest gold values averaging 12.2-meters of 1.1 g/t Au from 35.1-meters depth, including 1.5-meters of 4.7 g/t Au. Through the vein zone anomalous pathfinder elements were recorded averaging 1 g/t Ag, 315 ppm As, 79 ppm Sb and 50 ppm W. Below the vein zone altered diorite continued until 76.3-meters where a fault zone was followed by altered metasediments until the end of hole. Elevated zones of Au, Ag, As, and Sb suggest the metasedimentary units have the potential to host mineralization.

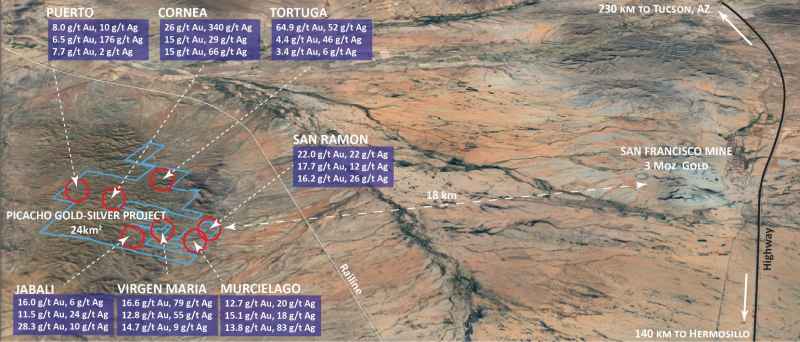

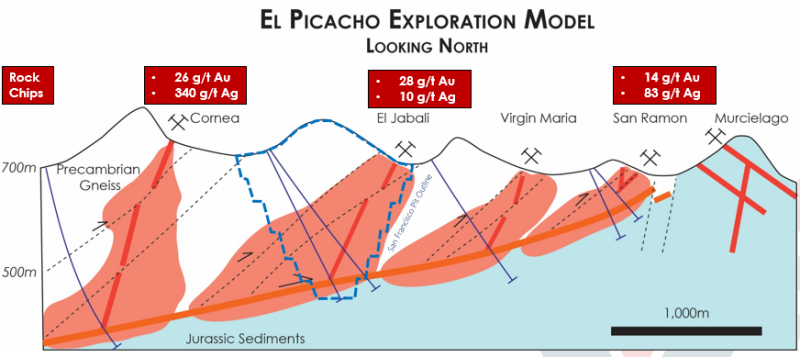

About the El Picacho Property

The El Picacho Gold-Silver property is interpreted as an orogenic gold system within the regional Caborca Orogenic Gold Belt known for producing gold mines that include La Herradura (>10 Moz Au) and San Francisco (>3 Moz Au). The project is 140 kilometers north of Hermosillo and only 18 kilometers southwest of the producing San Francisco Mine. The Project totals 24 square kilometers. Five primary zones of mineralization have been identified across the property totalling over six kilometers of prospective trends. Surface sampling and historic workings have identified high-grade gold and silver values. The project has only seen widely spaced reconnaissance drilling with no follow-up. Tocvan believes this provide an excellent opportunity for discovery of a muti-million ounce district.

Figure 3. Overview map of the El Picacho Gold-Silver Project.

Figure 4. Schematic Cross-Section of The El Picacho Exploration Model.

San Francisco Pit outline shown as size reference only

About the Pilar Property

The Pilar Gold-Silver property has recently returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Three primary zones of mineralization have been identified in the north-west part of the property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. The Main Zone and 4-T trends are open to the southeast and new parallel zones have been recently discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. To date, over 22,000 m of drilling has been completed.

-

2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

-

116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

-

108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

-

63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

-

-

2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

-

2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses

-

94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

-

41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

-

24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

-

-

15,000m of Historic Core RC drilling. Highlights include:

-

61.0m @ 0.8 g/t Au

-

16.5m @ 53.5 g/t Au and 53 g/t Ag

-

13.0m @ 9.6 g/t Au

-

9.0m @ 10.2 g/t Au and 46 g/t Ag

-

Figure 5. Map of Sonora, Mexico with the location of Tocvan’s Projects relative to other major Sonora projects

About Tocvan Ventures Corp.

Tocvan is a well-structured exploration development company. Tocvan was created in order to take advantage of the prolonged downturn in the junior mining exploration sector, by identifying and negotiating interest in opportunities where management feels they can build upon previous success. Tocvan has approximately 37 million shares outstanding and is earning 100% into two exciting opportunities in Sonora, Mexico: the Pilar Gold-Silver project and the El Picacho Gold-Silver project. Management feels both projects represent tremendous opportunity to create shareholder value.

Brodie A. Sutherland, P.Geo., CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Quality Assurance / Quality Control

RC chips and core samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s robust quality assurance / quality control protocol.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company’s business, the Company’s formative stage of development and the Company’s financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

820-1130 West Pender St.

Vancouver, BC V6E 4A4

Telephone: 1 888 772 2452

Email: ir@tocvan.ca