Archive

Fitzroy Minerals Signs Exclusive Option to Acquire the Polimet Gold-Copper-Silver Project in Chile

| |||||||||

|  |  |  | ||||||

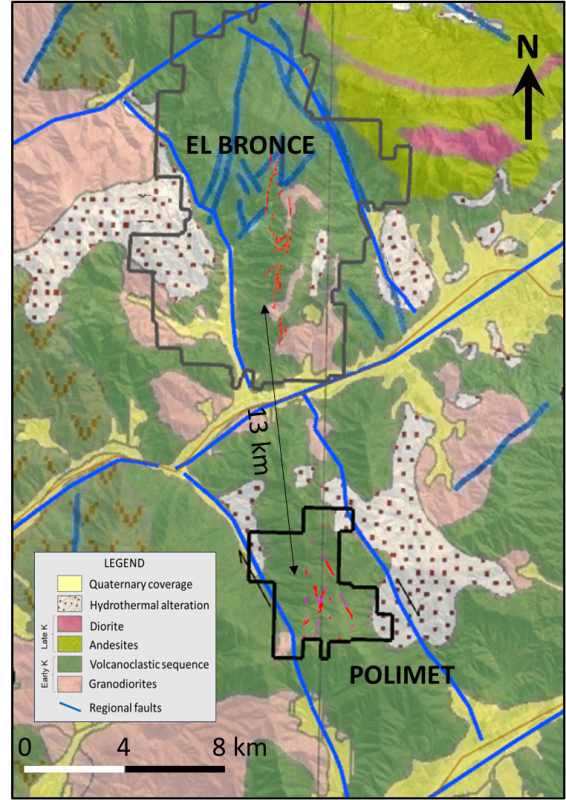

Vancouver, British Columbia – TheNewswire - February 6, 2024 – Fitzroy Minerals Inc. (TSXV:FTZ) (OTC:FTZFF) (“Fitzroy Minerals” or the “Company”) is pleased to announce it has secured an exclusive option (the “Polimet Option”) to acquire 100% of the Polimet Gold-Copper-Silver Project, located in the Valparaiso Region of Chile (“Polimet” or the “Polimet Project”), from Asesorias y Inversiones Sol SPA (“the Vendor”). The Polimet Project comprises 1,860 Ha of concessions, at an average altitude of 1,700 m. The Polimet Project is located 170 km by road to Santiago, and 13 km south of El Bronce 1 million ounce epithermal gold-silver deposit, near the town of Petorca.

Highlights:

-

Historic DSO ore sales of 117 tonnes grading 33.5 g/t Au, 55 g/t Ag, and 6.9% Cu

-

Fully-preserved low-sulfidation epithermal system with known mineralization

-

~5 km strike of vein system identified and ready for drill-testing

Campbell Smyth, Fitzroy Minerals' Chairman, commented:

“Polimet offers the opportunity to explore a high-grade gold-copper target that is uniquely well suited for development. The Polimet Project is located in a mining area dotted with many small processing plants. Minera El Bronce de Petorca is just 13 km to the north and Polimet is the natural next high-grade Au-Ag-Cu deposit in this mining district. The incised valleys mean that sub-vertical veins could be easily accessed by horizontal adits.

The high tenor of the target, coupled with unique infrastructure advantages means that significant value can be created within a compact package. Polimet is also accessed from the same logistical hub as the recently signed Caballos Copper project offering further logistical synergies.

Fitzroy Minerals now has two ideally located projects in a premier mining jurisdiction. There is a global shortage of copper and gold assets with good grade, clean metallurgy and simple geometry. We plan to drill Polimet in the second half of 2024 and are currently building up our local exploration team.”

Merlin Marr-Johnson, COO, Fitzroy Minerals, added:

“The geology at Polimet is a classic low-sulfidation epithermal vein system, complete with bonanza-grade ore shoots. Uniquely for this district the Polimet system consistently shows strong copper values of around 2% in the veins, even when the precious metal content varies. This copper content could potentially cover development costs which means that the gold and silver content would be essentially “free”.

Ore-grade mineralization in nearby deposits is well understood to start below 1,600 m in altitude and we believe that the core of the epithermal system is intact at Polimet. Our exploration work will focus on systematically identifying bonanza-grade shoots and the tenor of regular vein mineralization at Polimet.

Exploration will include mapping, soil sampling and geophysics prior to a drill program. The concessions host approximately 5 km of mapped veins to date and the aim will be to identify as many potential pay shoots as possible within the target area. Fitzroy Minerals anticipates drilling Polimet in the second half of 2024.”

Terms of the Transaction

In order to exercise the Polimet Option, the Company must:

-

Make a cash payment of US$ 80,000 on signing of a definitive option agreement, with a further US$80,000 on the first anniversary thereof;

-

Incur exploration expenditures of at least US$2.25 million over a three year period, with no consecutive 12 month period seeing less than US$500,000 of exploration expenditures.

Subject to the requisite investment having been met, Fitzroy Minerals can exercise the Polimet Option by making a US$1.2 million payment to the Vendor in Year Four. In addition, the Vendor is granted a 2% NSR, of which 1% can be purchased by Fitzroy Minerals for US$3 million at any point prior to commercial production. The acquisition of the Polimet Option is subject to execution of a definitive option agreement, and to the approval of the TSX Venture Exchange (the “Exchange”). The acquisition of the Polimet Option is an arm’s length transaction.

In connection with the acquisition of the Polimet Option, the Company has agreed to pay Marrad Limited (a company controlled by Mr. Merlin Marr-Johnson) (“Marrad”) a finder’s fee (the “Polimet Finder’s Fee”) comprised of: (i) an upfront payment to be paid on entry into a definitive agreement, to be comprised of (A) a cash payment of CAD$40,500; and (B) the issuance of 260,192 common shares of the Company at a deemed price of CAD$0.13 per share, being the last closing price of the Company’s common shares prior to the dissemination of this press release (the “Market Price”), for deemed consideration of CAD$33,825; and (ii) a second payment to be paid upon full exercise of the Polimet Option, to be comprised of the issuance of 644,038 common shares of the Company at the Market Price, for deemed consideration of CAD$83,725. The payment of the Polimet Finder’s Fee is also subject to the approval of the Exchange.

Location

The project comprises 1,860 Ha of concessions, at an average altitude of 1,700 m. Polimet is 170 km from Santiago, via the R5N Highway. The Polimet Project will be supported from the nearby towns of Petorca or Cabildo towns via internal roads. The Polimet Project area is well served with road access, power, and water.

Figure 1. Project Location

Project History

The concessions that comprise the Polimet Project have seen sporadic historic work, including development of two ore shoots called Santa Margaria and San Pedro respectively. In the mid-1990s a Chinese entrepreneur developed most of the present tunnels in the Santa Margarita mine and exploited the two main veins for several years. In the late 1990s the mine was bought by a local Chilean, who soon after discovered the San Pedro ore-shoot. The San Pedro ore-shoot produced very high-grade Au-Cu-Ag ore in the subsequent years. Some direct shipping ore (“DSO”) was sold to the state-owned (Enami) Ventanas smelter and a larger tonnage of sulphide ore was sold to Enami for toll-processing in a concentration plant. The partial records of sales to the state-owned Enami show weighted average grades of 33.5 g/t Au, 55 g/t Ag and 6.9 % Cu for the 117 tonnes of DSO material, and 4.7 g/t Au, 10 g/t Ag and 1.0 % Cu for the 618 tonnes of sulphide ore. The records show a total tonnage of 735 tonnes at an average grade of 9.3 g/t Au, 17 g/t Ag, and 2.0 % Cu.

Table 1. Historic Polimet (Santa Margarita adit) DSO sales certificates from Enami

|

Date of Lot Sale |

Kg |

Au (g/t) |

Ag (g/t) |

Cu (%) |

As (%) |

Sb (%) |

S (%) |

Pb (%) |

|

21/08/2003 |

4,510 |

60.3 |

325 |

29.4 |

1.33 |

0.230 |

32.00 |

0.36 |

|

25/06/2004 |

2170 |

3.3 |

280 |

28.5 |

0.04 |

0.001 |

3.60 |

0.01 |

|

14/03/2005 |

2310 |

42.8 |

390 |

29.9 |

1.01 |

0.120 |

37.70 |

0.18 |

|

18/04/2005 |

1700 |

19.8 |

739 |

34.1 |

1.07 |

0.420 |

30.20 |

0.07 |

|

30/10/2006 |

13260 |

42.5 |

25 |

6.2 |

0.08 |

0.001 |

6.15 |

0.01 |

|

28/11/2006 |

11510 |

23.8 |

17 |

4.3 |

0.07 |

0.002 |

3.66 |

0.01 |

|

26/12/2006 |

10980 |

40.0 |

23 |

4.3 |

0.06 |

0.002 |

3.71 |

0.01 |

|

16/02/2007 |

14220 |

40.8 |

22 |

4.6 |

0.08 |

0.004 |

4.10 |

0.02 |

|

19/03/2007 |

11010 |

48.0 |

19 |

5.0 |

0.08 |

0.003 |

4.54 |

0.01 |

|

03/04/2007 |

12860 |

31.8 |

16 |

4.2 |

0.06 |

0.003 |

3.65 |

0.01 |

|

17/07/2007 |

11300 |

26.0 |

28 |

4.8 |

0.09 |

0.005 |

4.50 |

0.01 |

|

02/08/2007 |

12220 |

14.8 |

13 |

3.0 |

0.05 |

0.001 |

2.80 |

0.01 |

|

Unreadable |

9000 |

27.2 |

20 |

5.1 |

0.07 |

0.002 |

5.45 |

0.01 |

|

TOTAL |

117,050 |

33.5 |

55 |

6.9 |

0.15 |

0.020 |

6.36 |

0.03 |

Table 2. Historic Polimet (Santa Margarita adit) sulphide ore sales certificates from Enami

|

Date of sale |

Weight (Kg) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

|

13/04/2010 |

41,656 |

4.1 |

7 |

0.8 |

|

05/07/2010 |

40,329 |

4.4 |

5 |

0.7 |

|

30/11/2010 |

14,651 |

4.9 |

6 |

1.3 |

|

10/01/2011 |

14,811 |

3.5 |

7 |

1.1 |

|

08/02/2011 |

16,330 |

4.3 |

7 |

1.2 |

|

28/02/2011 |

15,922 |

3.7 |

9 |

1.1 |

|

10/03/2011 |

28,892 |

4.7 |

10 |

0.9 |

|

23/03/2011 |

14,191 |

6.1 |

8 |

1.5 |

|

30/03/2011 |

17,150 |

5 |

9 |

1.6 |

|

14/04/2011 |

14,246 |

4 |

8 |

1.2 |

|

03/05/2011 |

14,199 |

5.1 |

13 |

1.2 |

|

18/05/2011 |

13,041 |

5.2 |

9 |

1.2 |

|

08/07/2011 |

12,598 |

4 |

8 |

1.2 |

|

30/01/2012 |

14,159 |

5.3 |

6 |

1 |

|

21/03/2012 |

17,757 |

6.4 |

10 |

0.2 |

|

29/03/2012 |

23,579 |

4.6 |

8 |

0.3 |

|

25/04/2012 |

17,603 |

7.3 |

8 |

1.1 |

|

30/10/2012 |

41,493 |

5 |

12 |

1.4 |

|

17/12/2012 |

16,572 |

5.3 |

6 |

0.3 |

|

17/01/2013 |

42,440 |

4 |

16 |

1.6 |

|

12/02/2013 |

21,598 |

4.6 |

23 |

2.1 |

|

28/03/2013 |

28,190 |

5.2 |

9 |

0.9 |

|

24/05/2013 |

38,585 |

4.4 |

22 |

1 |

|

22/08/2013 |

33,858 |

4.1 |

12 |

0.6 |

|

21/10/2013 |

41,613 |

3.6 |

6 |

0.7 |

|

28/03/2014 |

22,462 |

6 |

8 |

0.9 |

|

TOTAL |

617,925 |

4.7 |

10 |

1.0 |

Table 3. Combined historic Polimet (Santa Margarita adit) ore sales certificates from Enami

|

Weight (Kg) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

|

|

Sulphide |

617,925 |

4.7 |

10 |

1.0 |

|

DSO |

117,050 |

33.5 |

55 |

6.9 |

|

TOTAL |

734,975 |

9.3 |

17 |

2.0 |

At the turn of this century, Sinotec, a Chinese mining company, explored in the area. A large number of dirt roads were built, and wide-spaced RC drill-holes were completed. No technical information about this campaign is available.

The current owner of Polimet consolidated the concessions from 2015 to 2023. The Santa Margarita and Pia-Vaca concessions are held under a sub-option agreement, signed in 2023.

Geology

The region around Petorca is characterised by epithermal low sulfidation vein systems hosted by Cretaceous volcanic andesitic sequences (Camus et al., 1991) in the western foothills of the Andean Cordillera of central Chile. The area hosts nearly 90 ore bodies, mostly polymetallic veins, some copper veins, and one copper breccia pipe. The Polimet epithermal vein system is located thirteen kilometers to the south of El Bronce de Petorca.

Figure 2. Regional Geology

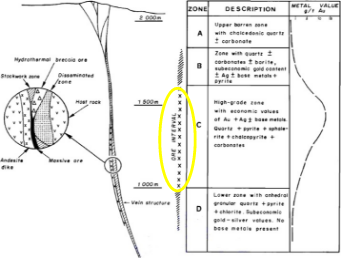

At El Bronce de Petorca, a 1 km vertical zonation is described, with a barren upper part followed by sub-economic gold plus base metals, then the main gold and base metals zone at an altitude of 1000 m to 1600 m above sea level. The majority of reported gold development in the region has taken place between 1000 m and 1600 m above sea level. Below the 1000 m level, lies a sub-economic-gold-plus-silver-without-base-metals zone.

Figure 3. Schematic cross-section of El Bronze de Petorca (from Camus et al. 1991)

The most significant occurrence is at El Bronce vein, emplaced in a seven kilometer long, roughly north-south-striking fault. At Polimet, approximately five kilometers of vein strike length have been identified to date. Much of the Polimet concession area is at an elevation of 1600 to 1950 m, which is high in the epithermal system.

Figure 4. Regional profile of elevation (vertically exaggerated)

At El Bronce the steeply-dipping lenses range 100-600 m in length, 200-400 m in depth, and 1-20 m in width (Camus et al., 1991). The vein mineralogy in El Bronce is comprised of quartz, pyrite, sphalerite, galena, tetrahedrite, barite and calcite. Ore shoots occur as massive sulfide fillings, stockworks and disseminations. One significant difference at Polimet is the abundance of chalcopyrite in the vein system, with an average of 3.4% copper content reported from the small number of point samples shown below in Table 4. The 3.4% Cu figure is higher than the recorded average sales figure showing 2.0% Cu from a much larger sample size, and the higher figure cannot be considered representative of the system as a whole. It appears that the surface geology of Polimet represents the highest part of a low-sulfidation epithermal system. It has very similar characteristics to El Bronce, but Polimet is better preserved from erosion.

Results to Date

Work carried out in recent years includes detailed mapping and geological reconnaissance, soil and rock chip geochemical, and LIDAR surveys of old workings. Thirteen channel samples were taken across structure in the old workings.

Table 4: Rock chip sample results, old workings at Polimet

|

Sample ID |

Area |

Weight (kg) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

|

SM-001 |

Sto Dom W |

4.4 |

10.7 |

6.6 |

491 |

|

SM-002 |

Sto Dom W |

4.9 |

0.2 |

2.7 |

4 |

|

SM-003 |

Sto Dom E |

5.4 |

0.1 |

1.4 |

6 |

|

SM-004 |

Sto Dom Sup |

6.4 |

0.2 |

2.9 |

185 |

|

SM-005 |

Pto Nuevo |

6.8 |

4.4 |

0.6 |

4 |

|

SM-006 |

Tunel No Entrar |

6.6 |

1.1 |

3.6 |

9 |

|

SM-007 |

La Garcia sup |

6.8 |

27.2 |

3.4 |

15 |

|

SM-008 |

La Garcia inf |

6.7 |

20.0 |

3.3 |

12 |

|

SM-009 |

S Pedro inf |

6.0 |

0.6 |

0.4 |

0 |

|

SM-010 |

S Pedro Med inicio |

4.8 |

0.6 |

1.5 |

5 |

|

SM-011 |

S Pedro Med Oreshoot |

5.3 |

43.3 |

7.8 |

32 |

|

SM-012 |

S Pedro Sup |

4.9 |

7.7 |

3.5 |

11 |

|

SM-013 |

S Antonio |

5.2 |

0.3 |

0.4 |

0 |

|

Average |

5.7 |

9.0 |

3.4 |

59 |

Mapping and sampling at surface has identified hydrothermal alteration correlated with multispectral anomalies. Several hydrothermal alteration/brecciation zones (silica-siderite- argilization) are coincident with spectral anomalies for Na, K and Mg minerals and Cu-sulfides. The surface anomalies are found at altitudes of 1600 m or higher. Rock chip samples at surface have returned values of up to 4.5 g/t Au and up to 3.6% Cu in otherwise untested hydrothermally altered and brecciated zones.

Exploration Target and Next Steps

The aim at Polimet is to systematically identify bonanza-grade shoots and the tenor of regular vein mineralization. Fitzroy Minerals will use the known mineralizing style that is found at El Bronce as a starting guide until the nature of the Polimet system is better understood. The main targets are lenticular, structurally controlled ore shoots along the fault. Fitzroy Minerals believes that the best grade material will be found at depths starting 100 to 250m below surface, at the altitude of the main ‘gold zone’ in the region.

During the course of 2024, Fitzroy Minerals intends to extend soil geochemistry grids and carry out an Induced Polarisation survey ahead of any potential drill program.

Update Regarding Caballos Property Option

Further to the Company’s news release dated November 30, 2023 regarding the Company’s acquisition of an exclusive option (the “Caballos Option”) to acquire 100 per cent of the Caballos copper project (“Caballos” or the “Caballos Project”), the Company also announces that in connection with the acquisition of the Caballos Project, the Company has agreed to pay Marrad (a company controlled by Mr. Merlin Marr-Johnson) a finder’s fee (the “Caballos Finder’s Fee”) comprised of: (i) an upfront payment to be paid on entry into the definitive agreement, to be comprised of (A) a cash payment of CAD$67,500; and (B) the issuance of 269,230 common shares of the Company at the Market Price, for deemed consideration of CAD$35,000; and (ii) a second payment to be paid upon full exercise of the Caballos Option, to be comprised of the issuance of 1,038,461 common shares of the Company at the Market Price, for deemed consideration of CAD$135,000.

The acquisition of the Caballos Option is subject to execution of a definitive option agreement, and to the approval of the Exchange. The payment of the Caballos Finder’s Fee is also subject to the approval of the Exchange.

The acquisitions of the Polimet Option and Caballos Option and the associated finder’s fees to be paid to Marrad were negotiated and agreed to by the Company prior to Mr. Marr-Johnson’s appointment to the Company’s board of directors and as the Company’s Chief Operating Officer. As such, at the time of the settlement of the option and finder’s fee terms, Mr. Marr-Johnson was not a Non-Arm’s Length Party (as defined under the policies of the Exchange) to the Company.

Qualified Person

The technical information in this news release was reviewed and approved by Gilberto Schubert, P. Geo., a qualified person as defined under National Instrument 43-101 (NI 43-101).

About Fitzroy Minerals

Fitzroy Minerals is focused on acquiring, exploring and developing mineral assets with substantial upside potential in the Americas. The Company’s current property portfolio includes the Taquetren gold asset located in Rio Negro, Argentina, as well as the Cariboo, Silver Vista, and Silver Switchback concessions in British Columbia, Canada. Fitzroy Minerals’ shares are listed on the TSX Venture Exchange under the symbol FTZ and on the OTCQB under the symbol FTZFF.

On behalf of Fitzroy Minerals Inc.

Merlin Marr-Johnson

Chief Operating Officer (“COO”)

For further information, please contact:

Merlin Marr-Johnson, COO

mmj@fitzroyminerals.com

+1 604-505-4554

For more information on Fitzroy Minerals, please visit the Company's website.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S under the United States Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Neither Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" which are not comprised of historical facts. Forward looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations, estimates of market conditions, and payment of finder’s fees. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, delays in obtaining or failures to obtain regulatory approvals, including the approval of the Exchange for the acquisition of each of the Polimet Option and the Caballos Option, and the finder’s fee associated therewith, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates, and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.