Archive

Golden Ridge Continues to Confirm Robust Mineralization at the Williams Gold Property with Intercepts of 24.65 Meters of 2.22 g/t Au Including 0.65 Meters of 77.40 g/t

| |||||||||

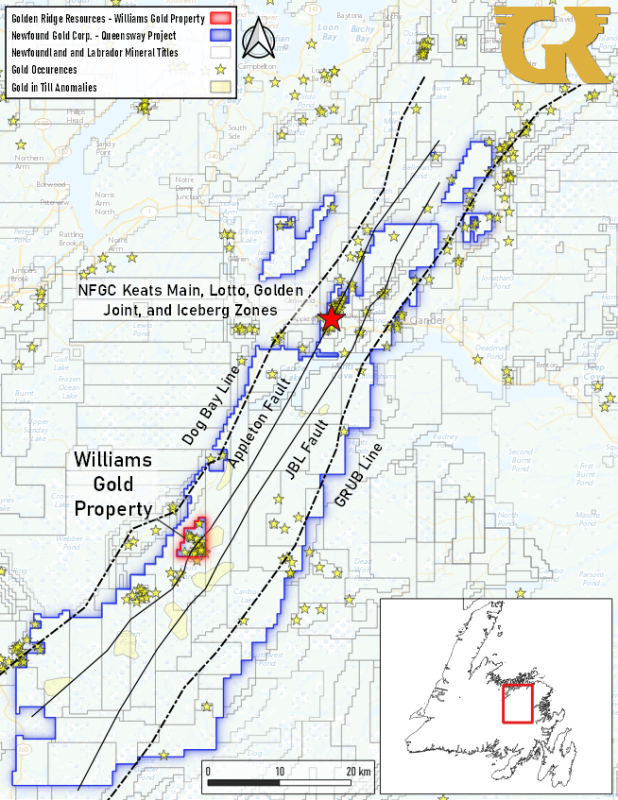

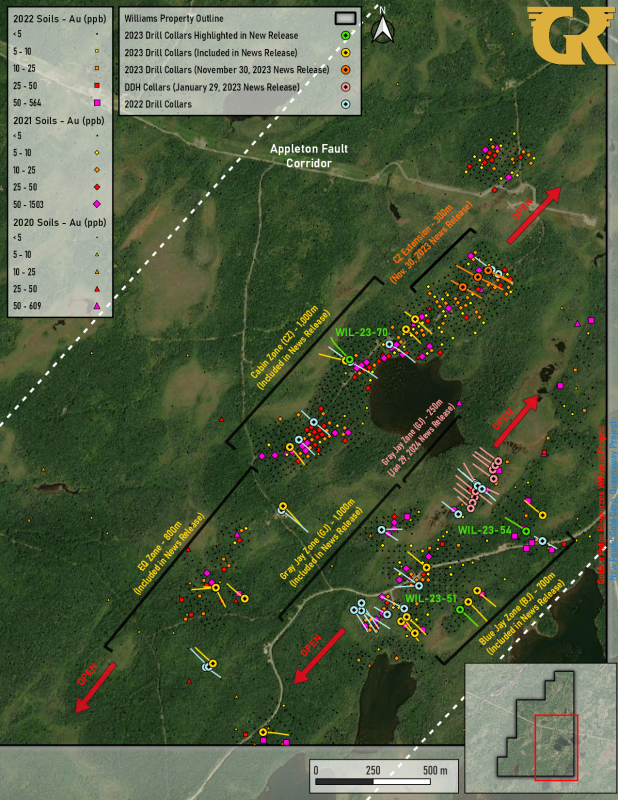

Kelowna, British Columbia – TheNewswire - April 2, 2024 - Golden Ridge Resources Ltd. (“Golden Ridge” or “the Company”) (TSXV: GLDN) is pleased to announce the final assay results from the 2023 Phase II drilling campaign at the Williams Gold Property (“Williams” or “the Property”) within the Appleton and Dog Bay Fault Corridors (Figure 1). Golden Ridge has continued to generate encouraging results at the Property with recent assays recording mineralization up to 24.65 meters grading 2.22 g/t Au. The Williams Project is surrounded by New Found Gold Corp (NFGC)’s Queensway Gold Property where NFGC is currently undertaking a 650,000 meter drill program (Figure 2).1

Highlights

-

WIL-23-54 intersected 24.65 meters of 2.22 g/t Au from 78.50 meters: including 0.65 meters of 77.40 g/t Au from 101.90 meters (Table 1).

-

WIL-23-51 intersected 12.30 meters of 0.67 g/t Au from 21.90 meters: including 5.45 meters of 1.00 g/t Au from 22.55 meters (Table 1).

-

WIL-23-70 intersected 22.60 meters of 0.46 g/t Au from 58.40 meters: including 5.50 meters of 1.10 g/t Au from 71.40 meters (Table 1).

-

In-fill drilling between the Cabin Zone and Cabin Zone Extension has established continuity of Au-mineralization between these prospects increasing the strike length by 200 meters to 1,300 meters.

-

Drilling at the Blue Jay Zone reveals a potential 550-meter strike length of Au-mineralization.

“The Williams Gold Property continues to deliver multiple zones of broad gold mineralization and pervasive alteration. The 2023 drill program has increased grades, width, and strike length of both the Gray Jay Zone and Cabin Zone Extension. Assays continue to validate the more robust alteration and veining in the 41 holes of Phase II. An increased focus on second order structures is the next step to continue the evolution of the project. The Williams Gold Property is an important piece in the Appleton Fault Corridor story.” stated Mike Blady, CEO and Director of Golden Ridge.

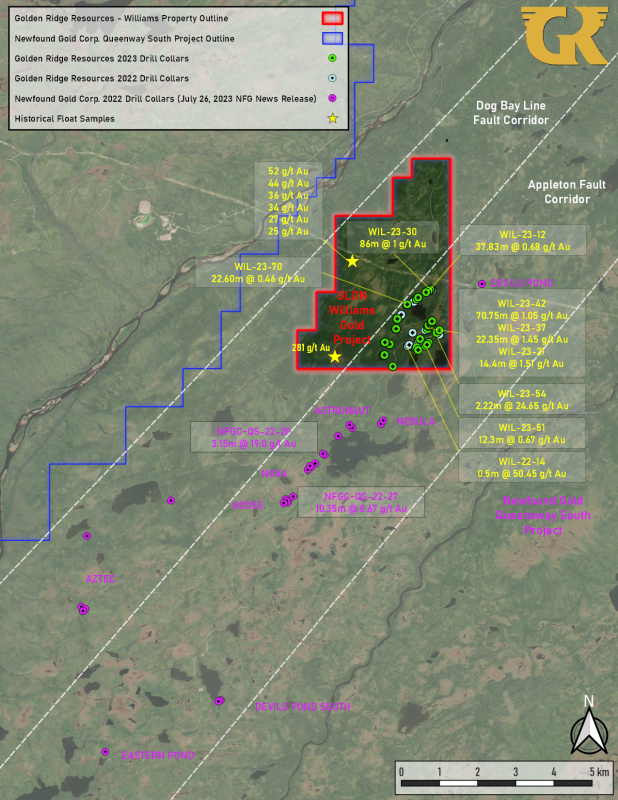

Phase II drilling at the Williams Project was focused on the five mineralized zones as identified by earlier prospecting, soil sampling and drilling programs. These mineralized zones (Figure 3) are known as the: Cabin Zone (CZ), Cabin Zone Extension (CZX), EQ Zone (EQZ), Gray Jay Zone (GJZ) and the Blue Jay Zone (BJZ) all of which are open along strike and down-dip. Although these zones were first identified during the 2020 – 2021 surficial sampling and trenching programs, several other prospects remain to be targeted. Upon completion of in-fill drilling at the Grey Jay Zone (January 29, 2024 – News Release), the 2024 drilling campaign switched gears and began to target outlying prospects. The final phase of the 2023 drilling program returned to the Cabin Zone. Its purpose was to follow-up on exciting results obtained in 2022, with the objective of increasing the strike length of the prospect and connecting the Cabin Zone to the Cabin Zone Extension.

Excitingly, Phase II drilling was not only successful in confirming the presence of Au-mineralization at the Blue Jay and EQ Zones it also increased the strike length of the Cabin Zone and established along strike continuity between it and Cabin Zone Extension. Mineralization at these locations is characterized by a broad sericite-chlorite alteration halo that is associated with a complex system of quartz-carbonate veins like those identified by earlier trenching and drilling. This is exemplified by WIL-23-51, at the Blue Jay Zone, which intersected a 12.30-meter section grading 0.67 g/t Au including a 5.45-meter section which yielded 1.00 g/t Au. Additionally, WIL-23-54 (located 450 meters NE of WIL-23-51) intersected a 24.65-meter section grading 2.22 g/t Au including a 11.7-meter section which yielded 4.46 g/t Au. WIL-23-54 also intersected 0.65-meter zone grading 77.40 g/t representing a potential high-grade target at this prospect. Mineralization was also identified in outlying targets located at the southwestern extension of the Gray Jay Zone and EQ Zones. Drilling at these prospects once more revealed broad zones of Au-mineralization such as those observed in WIL-23-63 which contained 3.10-meters yielding 1.29 g/t Au.

In-fill drilling at the Cabin Zone was centered around WIL-22-09 and WIL-22-08 which intersected 46.50 meters at 0.39 g/t Au and 10.00 meters grading 0.50 g/t respectively. Drilling at this location continued defining broad zones of mineralization as documented by WIL-23-68 (a 300-meter step-out from WIL-22-08) which contained a 21.70-meter section grading 0.44 g/t Au including an 8.55-meter section at 0.74 g/t Au. Additionally, WIL-23-70 (a 12.5-meter step-out from WIL-22-09) intersected a 58.40-meter section grading 0.46 g/t Au including a 5.50-meter section which yielded 1.10 g/t Au. Importantly, drilling at the Cabin Zone indicates along strike continuity of Au-mineralization between the Cabin Zone and Cabin Zone Extension. Ultimately, the 2023 drilling campaign increasing the total strike length of the Cabin Zone Prospect by 200-meters.

Interestingly, mineralization throughout the project area is often associated with fault/rubble zones most commonly occurring along the eastern margin of the system. This is especially apparent at the EQ Zone, Cabin Zone and Cabin Zone Extension where these faults/rubble zones contain clay and graphite. These zones also display variable amounts of vein fragments and anomalous Au concentrations indicating syn-mineralization to post-mineralization movement along these structures. A structural analysis of these zones is currently underway to determine the exact relationship between them and the mineralized system.

It is important to note that all prospects at Williams Property are currently still open along strike and down dip, and further drilling will be required to delineate the overall size and grade of the Au mineralization system.

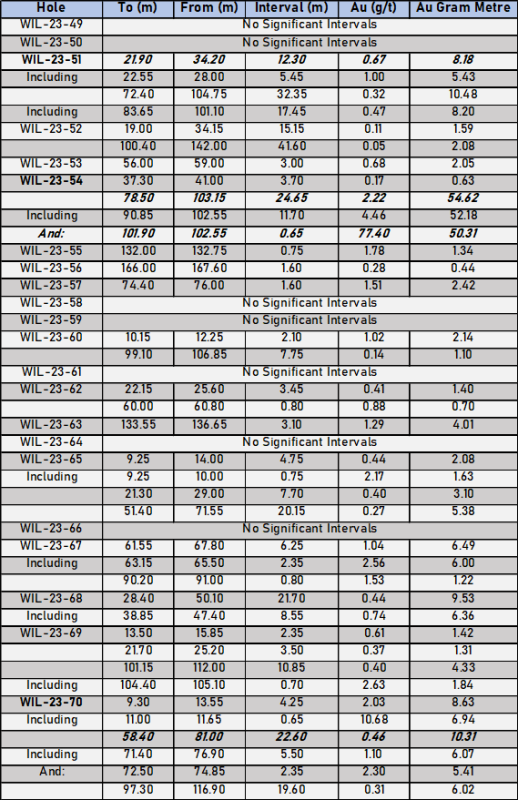

Table 1 – 2023 Significant Intercepts WIL-23-49 to WIL-23-702

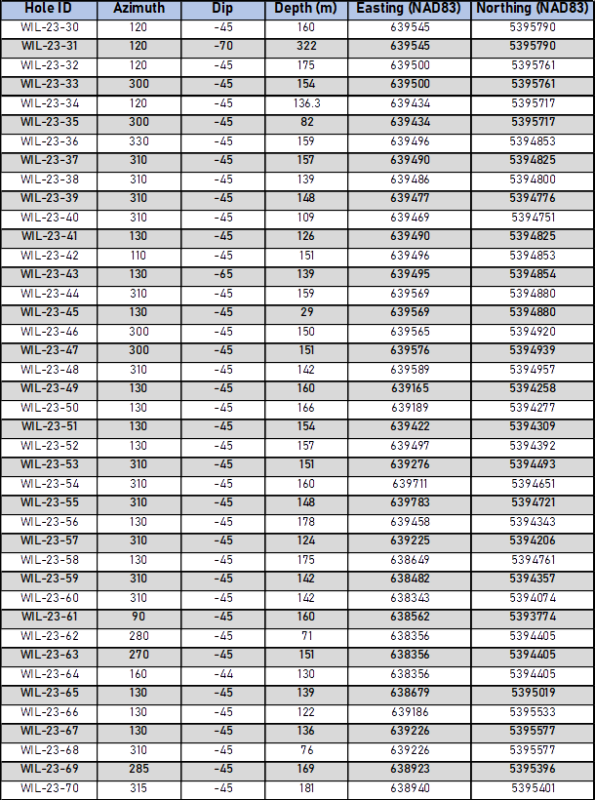

Williams Gold Property 2023 Drill Program

In total, 41 holes were completed during Phase II drilling campaign consisting of 5,982 meters. Upon completion of this program Golden Ridge Resources Ltd. has now drilled 70 holes at the Williams Property for a grand total of 10,182 meters. With an average depth between 100-200 meters each drill hole was focused on testing near surface gold-mineralization associated with soil, bedrock and drilling anomalies identified during earlier exploration programs. Highlights from these programs include soil, grab and core samples yielding 1.5 g/t, 281 g/t and 77.4 g/t respectively. Building on earlier successes, the Phase II diamond drilling campaign continued to increase the potential of the Williams Project. Infill drilling at the Grey Jay, Cabin and Cabin Zone Extension outlined a core region of Au-mineralization with intercepts up to 86.00 meters yielding 1.00 g/t Au (WIL-23-30; Nov 30, 2023 News Release) and 70.75-meters with 1.05 g/t (WIL-23-42; January 30, 2024 News Release). Individual core samples from this region also returned assay results up to 13.30 g/t at the Cabin Zone Extension and 6.58 g/t at the Gray Jay Zone and increased the overall Au-grade at these prospects. Drilling at prospects outside the mineralized core also confirmed the presence of Au-in-bedrock mineralization throughout the project area. This is exemplified by WIL-23-54 (Blue Jay Zone – included in news release) which intersected 24.65-meters of 2.22g/t. Interestingly, this drill hole also contains the highest Au-grade sample obtained in drill core to date at 0.65-meters at 77.40g/t further confirming the presence of high-grade gold samples throughout the Williams Property.

Phase II drilling indicates that mineralization at the Williams Zone is more widespread than previously identified. This program continued to characterize the style of gold-mineralization as a complex system of up to 1.5 meters veins, veinlets, and vein breccias. This Au-bearing system is associated with weak to locally intense sericitic and chloritic alteration with the highest gold assays correlating to areas of increased alteration. Additionally, sulphide mineralization appears to be more pervasive in core obtained from Phase II drill holes. The host rock often contains disseminated pyrite crystals, blebs, and stringers throughout and acicular crystals and blebs of arsenopyrite occur near mineralized zones. Gold-bearing veins contain primarily pyrite and are often associated with arsenopyrite, pyrrhotite, chalcopyrite, and galena with trace amounts of stibnite, molybdenite and sphalerite. Golden Ridge has noted that the most reliable pathfinder for the presence of high-grade gold is increasing concentrations of arsenopyrite.

Golden Ridge is continuing to model the structural controls of the transportation and deposition of mineralizing fluids at the Williams Property. Deformation of the mineralized system suggests the presence of both brittle and ductile features indicating a transitionary tectonic environment. Fracture filling appears to be the most prevalent style of vein deposition representing a trans-tensional environment, however, the presence of sigma clasts, gouge in faults, and folding in quartz veins also are indicative of a more ductile environment. Further structural analysis and drilling will be required to full delineate the relationship between the ore forming fluids, structural controls on mineralization and post mineralization movement at the Williams Property. Vein systems associated with sericitic-chloritic alteration and containing arsenopyrite can be used to distinguish gold-bearing veins from other generations of quartz veins observed throughout the Property.

Figure 1 – Williams Gold Property Location1

Figure 2 – GLDN Williams Property Located Within Newfound Gold Corp.’s Queensway South Project1

Figure 3 – 2023 Drill Collars

Sampling & Laboratory Methodology:

True widths of the report intersections have not been calculated at this time. Drilling was primarily conducted in NQ. Samples were marked and QAQC by Golden Ridge staff. Drill core was split using a diamond core cutting saw and sealed in polybags.

Samples were sent to the Mobile Sample Preparation Unit (MSPU) of SGS Canada Inc. (SGS) in Grand Falls, Newfoundland for sample preparation, and then to the laboratory of SGS Canada Inc. in Burnaby, British Columbia for fire assay. SGS is ISO/IEC 17025 accredited. Samples were analyzed for gold by fire assay using a 30g charge (ICP-AES). Samples containing visible gold or greater than 1 g/t Au in fire assay were also assayed using the metallic screen method. Golden Ridge submits certified reference standards and blanks at a rate of approximately 5.1% of the sample total and sampling duplicates at 2.2% of the sample total.

Qualified Person:

Dr. Stephen Amor, PhD, PGeo, technical advisor to the Company, is the Qualified Person as defined by National Instrument 43-101 who has reviewed and approved the technical data in this news release.

Acknowledgments:

Golden Ridge Resources acknowledges the financial support of the Junior Exploration Assistance Program, Department of Industry, Energy, and Technology, Government of Newfoundland and Labrador.

Corporate

Golden Ridge advises announces that the Board has approved the adoption of a 10% fixed stock option plan (the “Fixed Option Plan”) effective March 22, 2024 which replaces the Company’s legacy 10% rolling plan subject to the approval of the TSX Venture Exchange (the “Exchange”).

Under the Fixed Option Plan, the Company may grant options to acquire up to an aggregate of 5,844,132 common shares of the Company, representing 10% of the current issued and outstanding common shares of the Company, subject to the terms and conditions prescribed by the Exchange and applicable securities laws. Prior to the adoption of the Fixed Option Plan, 3,520,000 stock options were outstanding under the previous 10% rolling stock option plan, which options will now be governed by the terms of the new Fixed Option Plan.

The Board has reasoned that the Fixed Option Plan will satisfy the objective to attract and retain our personnel as well as align with the interests of our shareholders. All previously granted options shall continue to exist and be exercisable under the new plan.

About Golden Ridge Resources:

Golden Ridge is a TSX-V listed exploration company engaged in acquiring and advancing mineral properties located in Newfoundland and British Columbia. Golden Ridge is currently focused on exploration and development of the Williams Gold Property located in the Central Newfoundland Gold Belt. The Company owns a 100% interest in the 1,700-hectare Hank copper-gold-silver-lead-zinc property which is currently under option to King Fisher Metals Corporation and the 3,000-hectare Hickman copper-gold property located in the Golden Triangle district, approximately 140 kilometres north of Stewart, British Columbia.

Golden Ridge Resources Ltd.

Mike Blady

Chief Executive Officer

Tel: (250) 717-3151

Website: www.goldenridgeresources.com

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including: that the Company's financial condition and development plans do not change as a result of unforeseen events, that the Company obtains required regulatory approvals, that the Company continues to maintain a good relationship with the local project communities. Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Factors that could cause the forward-looking information in this news release to change or to be inaccurate include, but are not limited to, the risk that any of the assumptions referred to prove not to be valid or reliable, which could result in delays, or cessation in planned work, that the Company's financial condition and development plans change, delays in regulatory approval, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company's expectations, as well as the other risks and uncertainties applicable to mineral exploration and development activities and to the Company as set forth in the Company's Management’s Discussion and Analysis reports filed under the Company's profile at www.sedar.com. There can be no assurance that any forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader should not place any undue reliance on forward-looking information or statements. The Company undertakes no obligation to update forward-looking information or statements, other than as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1This news release contains information about adjacent properties on which Golden Ridge has no right to explore or mine. Readers are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company’s properties

2The intervals reported in these tables represent drilling intersects and insufficient data is available at this time to state true thickness of the mineralized intervals.