Archive

Yorkton Equity Group Inc. Announces Financial Results for the Second Quarter Ended June 30, 2025

| |||||||||

|  | ||||||||

Edmonton, Alberta – (August 20, 2025) – TheNewswire - Yorkton Equity Group Inc. (TSXV YEG) (“Yorkton” or the “Company”) is pleased to announce its financial results for the second quarter ended June 30, 2025.

“Recent rent escalations have increased overall revenues at our Edmonton properties, despite the resulting tenant turnover, which is expected to stabilize with higher occupancy in the short term,” said Mr. Ben Lui, President and Chief Executive Officer. “During the second quarter, we continued to focus on driving rental growth and improving operational efficiency. We also remain disciplined in evaluating potential acquisitions to expand our portfolio of high-quality rental properties. In today’s evolving economic environment, we believe that well-managed residential assets continue to offer relative stability and the potential for consistent and predictable long-term returns.”

Q2 2025 Financial Highlights

As at June 30, 2025, Yorkton had total assets of $139.79 million, which included 518 residential rental units and one commercial rental unit across 10 multi-family rental properties with a total fair market value of $124.33 million and one commercial rental property with 28,026 square feet of net leasable area, together with an adjacent parking lot, with a total fair market value of $11.99 million.

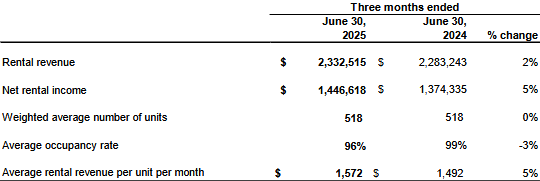

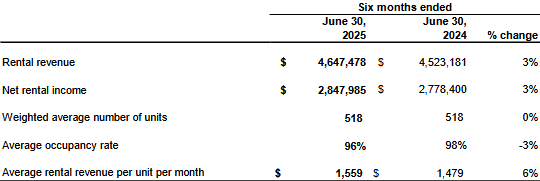

For the residential units, during the three and six months ended June 30, 2025, as compared to the same period in 2024, Yorkton reported:

Management has implemented improvements in operational efficiency across the portfolio, with a focus on aligning rents at its Edmonton properties to current market rates. While this has led to higher tenant turnover and increased vacancy and maintenance costs, management anticipates these effects will stabilize in the coming quarters, with the portfolio benefiting from steady rental rate growth and improved occupancy.

The Company’s commercial rental revenue and net rental income, from its Alberta commercial property and British Columbia commercial unit, were not significant during the three and six months ended June 30, 2025.

In addition, the Company recognized overall net income and comprehensive income of $704,141 and $917,969, respectively, during the three and six months ended June 30, 2025, as compared to $1,046,365 and $1,047,403, respectively, during the same periods in 2024.

About Yorkton

Yorkton Equity Group Inc. is a growth-oriented real estate investment company committed to providing shareholders with growing assets through accretive acquisitions, organic growth, and the active management of multi-family rental properties with significant upside potential. Our current geographical focus is in Alberta and British Columbia with diversified and growing economies, and strong population in-migration. Our business objectives are to achieve growing Net Operating Income (“NOI”) and asset values in our multi-family rental property portfolio in strategic markets across Western Canada.

The management team at Yorkton Equity Group Inc. has well over 30 years of prior real estate experience in acquiring and managing rental assets.

Further information about Yorkton is available on the Company’s website at www.yorktonequitygroup.com and the SEDAR+ website at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information on Yorkton, please contact:

Ben Lui, Chief Executive Officer

Telephone: (780) 409-8228

Email: investors@yorktonequitygroup.com

Forward-looking information

This press release may include forward-looking information within the meaning of Canadian securities legislation concerning the business of Yorkton. Forward-looking information is based on certain key expectations and assumptions made by the management of Yorkton. Although Yorkton believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Yorkton can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. Yorkton disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended, or any applicable securities laws or any state of the United States and may not be offered or sold in the United States or to the account or benefit of a person in the United States absent an exemption from the registration requirement