Archive

Bolt Metals Completes Induced Polarization Survey at the Northwind Property

| |||||||||

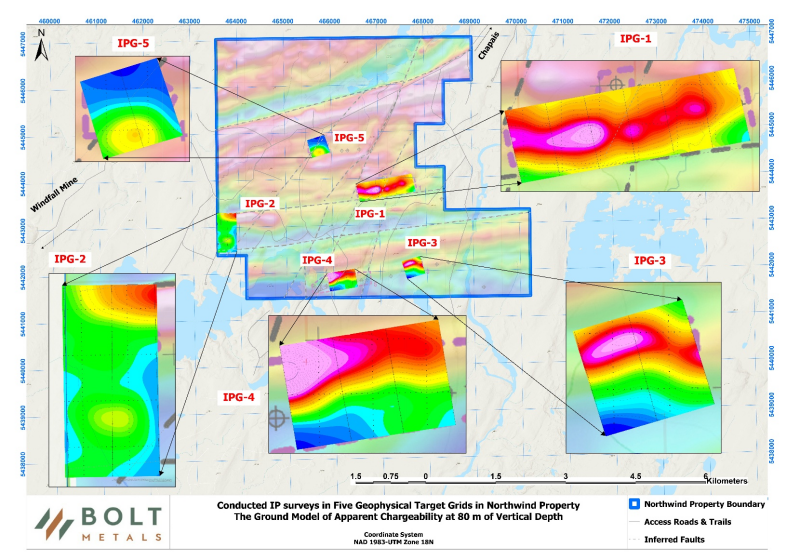

Vancouver, British Columbia – TheNewswire - October 23, 2025 – Bolt Metals Corp. (“Bolt” or the “Company”) (TSXV: BOLT) (OTC: PCRCF) (FSE: A3D8AK), a North American mineral acquisition and exploration company, is pleased to announce that the Company has completed ground IP surveys in five geophysical high potential zones identified by a historical heliborne TDEM survey at its Northwind property.

Induced Polarization (IP) surveys were conducted over promising target zones, which were initially identified as anomalies from heliborne TDEM surveys (Fig. 1). These IP surveys covered 11.125 line-km across five separate grids, utilizing 20 survey lines spaced 200 metres apart with a dipole-dipole electrode array.

Analysis of the collected geophysical data revealed eight primary IP axes, indicating distinct polarizable anomalies spread across the five surveyed grids. These findings generally correlate with low resistivity conductors. Some anomalies are also associated with or located near electromagnetic (EM) conductors, which were highlighted by a heliborne MAG-EM survey conducted in 2017. Additionally, some of these anomalies show a relationship with weak to moderate magnetic (MAG) anomalies.

This specific IP-RES signature suggests the presence of disseminated to sulfide-rich mineralization. This mineralization could be remobilized along faults or wide shear zones, or it might be hosted within altered beds or horizons that were conducive to the upwelling of hydrothermal fluids. All of these characteristics indicate favorable targets for gold mineralization. The chargeability anomalies have been grouped into what are termed polarizable axes, with eight such anomalies delineated after reviewing the IP data. The most promising targets were identified within IPG-1, IPG-3, and IPG-4. Based on these results, drill targets will be proposed to confirm the mineral potential of these IP anomalies.

Fig-1: The IP Surveys Ground Model of Apparent Chargeability at 80 m of Vertical Depth in Northwind Property

The Northwind property comprises a package of 53 claims, covering approximately 2,986 ha of ground, in the marginal zone of the Urban-Barry greenstone belt of the Abitibi geological subprovince of Quebec. The claims are strategically located proximal to numerous showings and several regionally significant discoveries, including the Windfall gold deposit, and is situated only 15 km from the Northwind claims.

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The bedrock geology of the Northwind claims is dominated by east-west striking packages of diorite, pegmatitic granite+tonalite and gneissic tonalite, with a lesser portion of basalt mapped in the northeast quadrant. The claims are bound to the south and southwest by a volcano-sedimentary terrane that hosts several notable gold deposits.

Zac Kotowych, CEO of the Company, commented: “Gold prices have recently witnessed a historic surge, reaching an unprecedented all-time high of approximately US$4,381 per ounce earlier this week. This monumental increase, driven by sustained central bank accumulation, ongoing geopolitical uncertainties, and heightened global inflationary pressures, substantially enhances the projected economic viability and strategic importance of gold exploration assets worldwide, including Bolt’s Northwinds project.”

The Company believes that the Northwinds Gold Deposit is poised to potentially benefit from this elevated commodity pricing environment.

-

Increased Project Economics: A higher gold price lowers the effective cut-off grade and improves the economics of potential future gold discoveries or resource definition, maximizing the value per ounce of gold.

-

Strategic Positioning: The current market environment validates the Company’s focus on high-potential, drill-ready mineral properties. The Northwinds property, which features multiple shear zones and high-priority exploration targets identified through previous work, now represents a significantly more compelling opportunity for a potential discovery.

-

Catalyst for Exploration: The Company believes that a strong gold market may create ideal conditions for securing investment and financing. Bolt is planning a comprehensive program at its Northwinds property in 2026.

The Company also announced that it has entered into a non-binding letter of intent with Max Iron Brazil Ltd. to acquire an option to earn a 100% interest in a iron property in Brazil (the “Property”). Under the proposed terms, Bolt will pay USD$200,000 to Jaguar Mining Inc. on behalf of Max Iron Brazil Ltda. (“Max Brazil”), keep the property in good standing, and issue an aggregate of 26,200,000 common shares to Max Brazil and 6,094,679 common shares to Max Resource Corp. over a 30-month period.

The Property, located in Brazil and originally held under mineral right 832.022/2018, covers a district-scale land position within the Iron Quadrangle, a prolific mining region historically known for its high-grade gold and base-metal production and existing mining infrastructure. Completion of the transaction remains subject to satisfactory due diligence, definitive documentation, and applicable regulatory approvals.

The Company is also pleased to announce to announce a non-brokered private placement of up to $1,500,000 units of the Company (the "Units" and each, a "Unit") at a price of $0.20 per Unit (the "Private Placement"). Each Unit shall consist of one common share in the capital of the Company (a "Share") and one Share purchase warrant (a "Warrant"), whereby each Warrant shall be exercisable at $0.40 into an additional Share for a period of 36 months from the date of issuance. Proceeds from the sale of the Units will be used for general working capital purposes. Closing of the Private Placement, subject to the receipt of all necessary regulatory and other approvals. All securities issued pursuant to the Private Placement will be subject to a statutory hold period under applicable Canadian securities laws of four months and one day from the date of closing of the Private Placement. In addition to the Private Placement, the Company also announced a non-brokered private placement of up to 2,565,000 units of the Company (each, a “Life Unit”) at a price of $0.20 per Life Unit for gross proceeds of up to $513,000 (the “Offering”). Each Life Unit will consist of one common share in the capital of the Company (a “Life Unit Share”) to be issued pursuant to Part 5A (the “Listed Issuer Financing Exemption”) of National Instrument 45-106 – Prospectus Exemptions (“NI 45-106”), and one Common Share purchase warrant (a “Life Warrant”) of the Company to be issued under the “accredited investor” exemption or any other applicable exemptions from any prospectus requirements as contained in NI 45-106. Each Life Warrant will entitle the holder thereof to acquire one common share of the Company (a “Life Warrant Share”) at a price per Life Warrant Share of $0.40 for a period of 24 months from the date of issuance. The Warrants will be exercisable 60 days following the closing date of the Offering. The Company is also pleased to announce that it has entered into debt settlement agreements (the “Settlement Agreements”) to settle outstanding debts owed to certain arm’s length creditors (the “Creditors”) totaling an aggregate of $328,250 (the “Debt Settlement”). Pursuant to the Settlement Agreements, the Company has agreed to issue an aggregate of 1,641,250 common shares (“Debt Shares”) at a deemed price of $0.20 per Debt Share. The Company will seek shareholder consent pursuant to CSE Policy 4, as the Private Placement, Offering and Debt Settlement will result in the Company issuing more than 100% of the currently issued and outstanding common shares.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo. (EGBC#62313, OGQ#10876), a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic.

About Bolt Metals Corp.

Bolt Metals Corp. is a North American mineral acquisition and exploration company focused on the development of quality precious and base metal properties that are drill-ready with high-upside and expansion potential. Bolt trades on the CSE Exchange under the symbol BOLT, the OTC under the symbol PCRFC and in Germany under the WKN A3D8AK.

BOLT METALS CORP.

Zac Kotowych, CEO and Director

For more information, please email info@boltmetals.com or visit www.boltmetals.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.