Archive

Ashley Gold Corp. Completes Kenora District Land Consolidation with 100% Acquisition of the Tabor Lake Mine Lease

| |||||||||

|  |  |  | ||||||

Calgary, Alberta – TheNewswire - October 18, 2022 – Ashley Gold Corp. ("Ashley" or the "Company") (CSE:ASHL) is pleased to announce it has entered into a property purchase agreement dated October 13, 2022 (the "Agreement"), to purchase a lease block located SE of Dryden, Ontario, known as the Tabor Lake Mine (the "Property").

HISTORICAL EXPLORATION HIGHLIGHTS*

-

DDH-8 (1958) – Three (3), 3ft (0.9m) wide Parallel Veins over 60m with historical assays ranging between 1.93 oz/t (60.03 g/t) Au* and 26.95 oz/t (838.24 g/t) Au*

-

Mine Dewatering and Sampling Program (1982) – Samples taken from the historical 125ft and 250ft levels described as “Wall Rock” averaged 0.59 g/t Au*. “Vein” assays up to 352 g/t Au*.

-

Historical Bulk Sampling (1938)– Open cut (surface) 77 tons milled with an average grade of 0.54 oz/t (16.8 g/t) Au*. A 1.75 ton sample at 125 ft drift average 1.5 oz/t (42.43 g/t) Au*.

*Please note, the gold grades, depths, and widths of drilling intercepts, historic workings architecture and average mining grades, and bulk sample sizes and grades are all historic in nature and non-compliant to the current 43-101 standards of reporting and cannot be accurately verified by the issuer at this time.

George Stephenson, President and CEO of Ashley, commented, “The Acquisition of the Tabor Lake Mine lease finalizes the consolidation of the strategic contiguous land position to the northwest of our existing Santa Maria project that we acquired this summer. Although the Tabor Lake Lease covers a small area “ (257.15 hectares), “the claims are of particular significance because they align with a VTEM and magnetic geophysical survey trend that runs from the southeast to the northwest of our newly amalgamated project. Ashley’s exploration team is looking forward to getting out into the field to start collecting samples and furthering their knowledge of the mineralized system at the Tabor Lake Mine”.

ABOUT THE TABOR LAKE PROPERTY

The property is located approximately 40 km southeast of Dryden, Ontario and is readily accessible by travelling 35 km east of Dryden via Trans-Canada Highway (Hwy 17) then heading south approximately 7 km on an all season maintained gravel logging road known as Snake Bay Road for 7 km. From this point, Camp 33 Road and numerous historic logging roads head east for 5 km and transect the project providing additional access throughout the region. The amalgamated (19.09 km2) project consists of the newly acquired Tabor lease block that will be wholly owned by Ashley Gold Corp. after completion of the sale transaction and the recently acquired contiguous “Santa Maria” project consisting of an additional 74 mining claims.

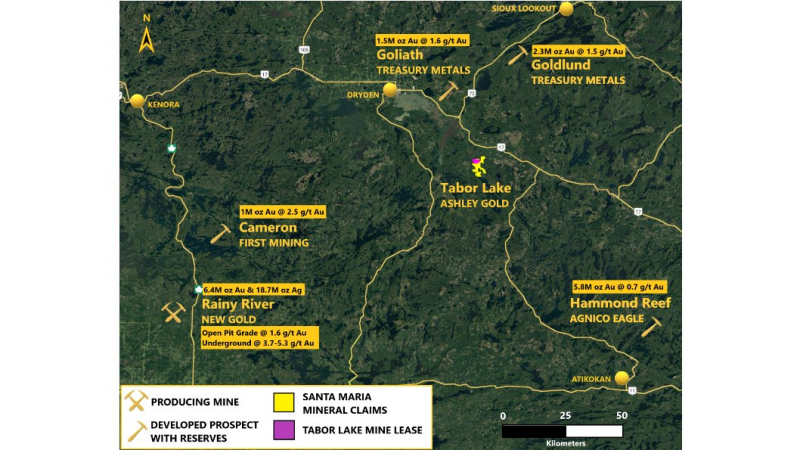

The project is centrally located within the prolific Wabigoon Greenstone Belt in western Ontario with numerous significant multi-million ounce gold reserves including Treasury Metals’ Goliath and Goldlund, New Gold’s Rainy River, Agnico Eagle’s Hammond Reef, and First Mining’s Cameron deposits (Figure 1). The Greenstone belt lies within the western Wabigoon Subprovince, a granite-greenstone terrane of the Superior Province. A number of thick volcano-sedimentary sequences consisting of mafic to felsic lavas and associated intrusions and pyroclastic rocks, all of which are generally overlain by sedimentary sequences, characterize the belt. Gold-bearing mineralized zones on the project are focused in a northwest-southeast corridor within both greenstone and porphyritic intrusions.

Figure-1 Tabor Lake Project Location

Historical workings within the Tabor Mine lease consist of a 275’ (~84m) vertical shaft with two horizontal crosscuts at the 125’ (~38m) and 250’ (~76m) levels both of which intersected high-grade gold-bearing quartz-carbonate vein systems which were drifted and an unspecified quantity of ore extracted noted to grade an average of at least 0.34 oz/t (10.58 g/t) Au up to 1.36 oz/t (42.43 g/t) Au.

At least nine (9) individual veins have been encountered in past exploration, both on surface and in drilling ranging in thickness from 6” (15cm) to 5’ (~1.5m) in width with several high-grade intercepts. The main “A” Vein extends from surface where an open-cut bulk sample of 77 tons averaging 16.8 g/t Au was extracted to a minimum vertical depth of 400’ (125m). The “A” Vein was also intersected and drifted on the 125’ level where a bulk sample of 1.75 tons averaging 42.43 g/t Au was extracted during resampling efforts in the 1980’s. Historic drilling and exploration also note at least three (3) additional parallel veins between the 225’ (70m) and 425’ (130m) vertical depths with highlights of 26.95 oz/t (838.24 g/t) Au over 3’ (0.9m), 4.95 oz/t (153.96 g/t) Au over 3’ (0.9m), and 1.93 oz/t (60.03 g/t) Au over 3’ (0.9m).

*Please note, the gold grades, depths, and widths of drilling intercepts, historic workings architecture and average mining grades, and bulk sample sizes and grades are all historic in nature and non-compliant to the current 43-101 standards of reporting and cannot be accurately verified by the issuer at this time.

Detailed compilation, digitization, 3D modeling, and interpretation of all historic data will commence immediately once this agreement is finalized in preparation for upcoming exploration.

THE AGREEMENT

Pursuant to the Agreement, subject to the Canadian Stock exchange (CSE) approval, Ashley is required to issue 330,000 common shares at a deemed price per share of $0.075, on satisfaction of all closing conditions. The common shares issued in connection with the Agreement will be subject to a hold period expiring 4 months and 1 day from the date of issuance.

The Seller will retain a 1.5% Net smelter royalty (NSR) and Ashley has the right to buy back half of the NSR for $750,000 at anytime.

ABOUT ASHLEY GOLD CORP.

Ashley Gold is focused on creating substantive long-term value for its shareholders through the discovery and development of world class gold deposits. Ashley currently holds an option to earn 100% interest in the Ashley Mine Project, subject to a 2% royalty. In addition, Ashley has acquired, 100% of the Tabor Lake Lease subject to a 1.5% royalty, 100% of the Santa Maria Project subject to a 1.75% royalty, 100% interest in the Howie Lake Project subject to a 0.5 % royalty and 100% interest in the Alto-Gardnar project subject to a 0.5 % royalty.

Ashley Gold Corp. is an early-stage natural resource company engaged primarily in the acquisition, exploration, and if warranted, development of mineral properties. The Corporation’s objective is to conduct efficient and economical exploration on its growing portfolio of high-quality gold projects, currently focused in northeastern and northwestern Ontario within the western Abitibi and the Eagle-Wabigoon-Manitou Lakes Greenstone Belts.

The responsibility of this release lies with Mr. George Stephenson, CEO and President +1 (403) 816-2262 • gstephenson@ashleygoldcorp.com, who, with Mr. Darcy Christian, Vice President, Operations • +1 (587) 777-9072 • dchristian@ashleygoldcorp.com , may be contacted for further information. www.ashleygoldcorp.com

The Qualified Person responsible for the technical content of this press release is Shannon Baird, P.Geo, Exploration Manager of Ashley Gold Corp.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

DISCLAIMER & FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management’s expectations. Factors which cause results to differ materially are set out in the Company’s documents filed on SEDAR. Undue reliance should not be placed on “forward looking statements”.