Archive

UEX to Acquire 100% ownership of JCU (Canada) Exploration Company, Limited

| |||||||||

|  |  | |||||||

Ownership Stake Includes the Wheeler River and Millennium Development Projects

Saskatoon, Saskatchewan – TheNewswire - April 22, 2021 – UEX Corporation (TSX:UEX), (OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that the Company has signed a definitive purchase agreement with Overseas Uranium Resources Development Co., Ltd. (“OURD”) to acquire 100% ownership of OURD’s wholly-owned subsidiary, JCU (Canada) Exploration Company, Limited (“JCU”).

JCU has a long history in the Canadian uranium exploration and development sector dating back to 2000, when it acquired a portfolio of Canadian uranium exploration and development assets from PNC Exploration (Canada) Co., Ltd. (“PNC Canada”), a wholly-owned subsidiary of Power Reactor and Nuclear Fuel Development Corporation (“PNC”). JCU’s key exploration projects cover an area of 139,346 ha and include a 10% ownership position in the Wheeler River Project (Denison Mines Corp. 90%), a 30.099% ownership stake in Cameco Corporation’s (“Cameco”) Millennium Project (Cameco 69.901%), a 33.8123% ownership in the Kiggavik Project (Orano Canada Inc. 66.1877%), and a 34.4508% interest in UEX’s Christie Lake Project. JCU also owns a minority equity stake in eight other grassroots and mid-stage exploration projects within the Athabasca Basin (see Table 1 and Figure 1).

The combination of UEX and JCU will create a compelling mid-size uranium development company with exposure to near-term uranium production with a solid pipeline of advanced resource and mid-stage exploration projects.

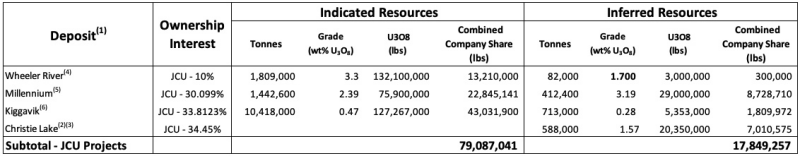

By acquiring JCU’s mineral property portfolio comprised of an indicated historic resource of approximately 79 million (M) pounds (lbs) of U3O8, and an inferred historic resource of approximately 18 M lbs of U3O8, (see Table 2 for tonnages and grades) the combined companies will make UEX the second largest junior uranium resource owner in Canada. These are historic resource estimates taken from the sources listed in Table 2 (attached). A qualified person has not done sufficient work to classify these historical estimates as current mineral resources. The Company is not treating this information as current mineral resources, has not verified this information and is not relying on it. The Company currently does not plan to conduct any work to verify the historical estimates other than using them to guide its exploratory and possible development work.

“UEX is honoured by OURD’s trust of UEX as their selected steward of JCU and its Canadian exploration and development projects, which have been thoughtfully cultivated over the past 20 years. We are excited about what benefits this transaction will bring to UEX shareholders. The combination of JCU and UEX will be transformational, forming a unique Canadian focused uranium development and exploration company. The resulting portfolio will have a significant resource base, and ownership interests in two Tier 1 Athabasca uranium development projects, Wheeler River and Millennium, both of which have production visibility within the next uranium upswing. Shea Creek, Kiggavik, Horseshoe-Raven and Christie Lake will provide the Company with a range of solid future development projects and UEX shareholders will continue to have exposure to resource growth through our portfolio of mid-stage and resource exploration projects.”

-

--Roger Lemaitre, President CEO, UEX Corporation

The Transaction

Through this transaction, UEX will acquire 100% of the shares of JCU from OURD by making cash payments of up to C$12.5 million and assuming JCU’s existing liabilities. UEX’s cash payments will consist of C$10 million on closing and up to C$2.5 million which is expected to be paid within 45 days of the closing date, subject to adjustment based upon JCU’s actual working capital on the closing date. It is anticipated that JCU will have cash in its treasury after closing which will be retained by JCU under UEX’s management.

Both UEX and OURD Board of Directors have voted in favour of this transaction. The transaction is subject to approval of OURD shareholders at a meeting scheduled for June 18, 2021. OURD is a private Japanese company with 29 shareholders comprised of some of the major companies in Japan. Closing is subject to UEX securing the necessary purchase financing and obtaining any required regulatory approvals. The transaction is expected to close on or prior to June 29, 2021.

UEX has committed to retaining JCU as a corporate subsidiary in order for JCU to meet its joint venture commitments.

JCU’s Liabilities

Other than the usual trade payables and current obligations under its joint ventures, JCU has an outstanding liability to the Japan Atomic Energy Agency (“JAEA”) as a result of a transaction in November 2000 pursuant to which JCU acquired the Canadian exploration assets of PNC Canada. JAEA is the successor company to PNC and PNC Canada.

Under the JCU-PNC Canada transaction, JCU acquired the Canadian uranium exploration assets of PNC Canada. The purchase price paid to PNC Canada was not funded in cash, but rather through an agreement to make payments from free cash flow derived from future production of uranium from the acquired projects. As of December 31, 2020 the liability, comprised of the purchase price plus accrued interest, totals $34.5 million.

JCU is required to provide JAEA with annual payments equal to 10% of free cash flow from any projects in the JCU portfolio that have entered commercial production. None of JCU’s projects are currently in commercial production. The requirement for future cash flow payments to JAEA ceases on the earlier of payment of all outstanding liability (including accrued interest) and the termination date of March 31, 2030 at which time all financial obligations to JAEA are deemed to have been paid and are fully extinguished.

UEX has committed to JAEA that it will ensure that JCU honours its commitments to JAEA under the JCU-PNC Canada transaction.

Qualified Persons and Data Acquisition

The technical information in this news release has been reviewed and approved by Roger Lemaitre, P.Eng., P.Geo., UEX’s President and CEO who is considered to be a Qualified Person as defined by National Instrument 43-101.

About UEX

UEX is a Canadian uranium and cobalt exploration and development company involved in an exceptional portfolio of uranium projects, including a number that are 100% owned and operated by UEX, one joint venture with Orano Canada Inc. (“Orano”) and ALX Uranium Corp. (“ALX”) that is 51.43% owned by UEX, as well as eight joint ventures with Orano, one joint venture with Orano and JCU (Canada) Exploration Company Limited, which are operated by Orano, and one project (Christie Lake), that is 65.55% owned by UEX with JCU (Canada) Exploration Company Limited which is operated by UEX.

The Company is also leading the discovery of cobalt in Canada, with three cobalt-nickel exploration projects located in the Athabasca Basin of northern Saskatchewan, including the only primary cobalt deposit in Canada. The 100% owned West Bear Project was formerly part of UEX’s Hidden Bay Project and contains the West Bear Cobalt-Nickel Deposit and the West Bear Uranium Deposit. UEX also owns 100% of two early stage cobalt exploration projects, the Axis Lake and Key West Projects.

Our portfolio of projects is located in the eastern, western and northern perimeters of the Athabasca Basin, the world's richest uranium belt, which in 2019 accounted for approximately 12.6% of the global primary uranium production. UEX is currently advancing several uranium deposits in the Athabasca Basin which include the Christie Lake deposits, the Kianna, Anne, Colette and 58B deposits at its currently 49.1%-owned Shea Creek Project (located 50 kilometres north of Fission’s Triple R Deposit and Patterson Lake South Project, and NexGen’s Arrow Deposit), the Horseshoe and Raven deposits located on its 100%-owned Horseshoe-Raven Development Project and the West Bear Uranium Deposit located at its 100%-owned West Bear Project.

About JCU

JCU is a private company that is actively engaged in uranium exploration and development in Canada. JCU is owned by Overseas Uranium Resources Development Co., Ltd. (“OURD”) who acts as the manager of JCU. JCU has partnerships with UEX, Orano, Cameco, Denison and others on uranium exploration and development projects in the Athabasca Basin of Northern Saskatchewan including Millennium and Wheeler River and the Kiggavik project in the Thelon Basin in Nunavut.

Advisors

Koffman Kalef LLP is acting as legal advisor to UEX in connection with this transaction and DLA Piper (Canada) LLP is acting as legal advisor to OURD in connection with this transaction.

FOR FURTHER INFORMATION PLEASE CONTACT

Roger Lemaitre

President & CEO

(306) 979-3849

Forward-Looking Information

This news release contains statements that constitute "forward-looking information" for the purposes of Canadian securities laws. Such statements are based on UEX's current expectations, estimates, forecasts and projections. Such forward-looking information includes statements regarding the Company’s strategic plans, completion of the acquisition of JCU, estimates of mineral resources on the Company’s properties and historical estimates of mineral resources on the JCU properties, the outlook for future operations, plans and timing for exploration activities, and other expectations, intentions and plans that are not historical fact. Such forward-looking information is based on certain factors and assumptions, including shareholder approval of the sale of JCU by OURD shareholders, the reliability of historic resource estimates on JCU’s mineral properties and liabilities and working capital of JCU at closing. Important factors that could cause actual results to differ materially from UEX's expectations include uncertainties relating to the historic resource estimates on the JCU properties, continuity and grade of deposits, fluctuations in uranium, cobalt and nickel prices and currency exchange rates, changes in environmental and other laws affecting uranium, cobalt and nickel exploration and mining, and other risks and uncertainties disclosed in UEX's Annual Information Form and other filings with the applicable Canadian securities commissions on SEDAR. Many of these factors are beyond the control of UEX. Consequently, all forward-looking information contained in this news release is qualified by this cautionary statement and there can be no assurance that actual results or developments anticipated by UEX with respect to the acquisition of JCU will be realized. For the reasons set forth above, investors should not place undue reliance on such forward-looking information. Except as required by applicable law, UEX disclaims any intention or obligation to update or revise forward-looking information, whether as a result of new information, future events or otherwise.

Table 1 - JCU ‘s Canadian Exploration Projects and Ownership as of December 31, 2020

|

Project |

Province |

JCU Share (%) |

Partners (%) * Operator |

|

|

Millennium |

Saskatchewan |

30.0990 |

Cameco Corporation* |

69.9010 |

|

Kiggavik |

Nunavut |

33.8123 |

Orano Canada Inc.* Urangesellschaft Canada Ltd |

24.0033 42.1844 |

|

Wheeler River |

Saskatchewan |

10.0000 |

Denison Mines Corp.* |

90.0000 |

|

Christie Lake |

Saskatchewan |

34.4508 |

UEX Corporation* |

65.5492 |

|

Wolly |

Saskatchewan |

13.1077 |

Orano Canada Inc.* Denison Mines Corp. |

64.9997 21.8926 |

|

Close Lake |

Saskatchewan |

10.3128 |

Orano Canada Inc.* Cameco Corporation |

75.1279 14.5593 |

|

Candle Lake |

Saskatchewan |

25.0000 |

Denison Mines Corp.* Uranium One |

44.9400 30.0600 |

|

Beatty River |

Saskatchewan |

21.4253 |

Orano Canada Inc.* UEX Corporation |

56.5303 22.0444 |

|

Waterfound River |

Saskatchewan |

26.9830 |

Orano Canada Inc.* Denison Mines Corp. |

60.7008 12.3162 |

|

Cree Extension |

Saskatchewan |

30.0990 |

Cameco Corporation* Orano Canada Inc. |

41.9645 27.9365 |

|

Moon Lake |

Saskatchewan |

20.1494 |

Cameco Corporation* Orano Canada Inc. |

56.6816 23.1690 |

|

Moore Tomblin |

Saskatchewan |

13.5947 |

Orano Canada Inc.* Cameco Corporation |

66.6194 19.7859 |

Table 2 – Historic Indicated and Inferred Resources – JCU Projects

-

(1)Other than the Christie Lake resource estimate, these are historical resource estimates taken from the sources listed below. To the Company’s knowledge, a qualified person has not done sufficient work to classify these historical estimates as current mineral resources. The Company is not treating this information as current mineral resources, has not verified this information and is not relying on it. The Company currently does not plan to conduct any work to verify the historical estimates other than using them to guide its exploratory and possible development work.

-

(2)The Christie Lake mineral resources were estimated at a cut off of 0.2% U, and are documented in the “Technical Report on the Christie Lake Uranium Project, Saskatchewan, Canada” (the “Christie Lake Technical Report”) with an effective date of December 13, 2018 which was filed on SEDAR at www.sedar.com on February 1, 2019. Inferred resources have been modified from the stated values in the Christie Lake Technical Report to reflect UEX’s increase in the ownership of Christie Lake Project from 60% to 65.5492% effective January 1, 2021.

-

(3)Certain amounts presented in the Christie Lake Technical Report have been rounded for presentation purposes. This rounding may impact the footing of certain amounts included in the tables above.

-

(4)Wheeler River resources as reported by Denison’s Prefeasibility Study as posted on October 30, 2018 on SEDAR.com using a cut-off grade of 0.2% U3O8 for the Gryphon Deposit and 0.8% U3O8 for the Phoenix Deposit. These are treated by the Company as historic resource estimates.

-

(5)Millennium resources as reported by Cameco on their website at https://www.cameco.com/businesses/uranium-projects/millennium/reserves-resources#measured_and_indicated as of December 31, 2020. Cut-off grades used to estimate resources are unknown. The reader is cautioned that UEX is not aware whether Cameco’s reporting of resources conforms to NI 43-101 and CIM guidelines.These are treated by the Company as historic resource estimates.

-

(6)Kiggavik resources as reported by Orano in their 2019 Activities Report available on their website at https://www.orano.group/docs/default-source/orano-doc/finance/publications-financieres-et-reglementees/2019/orano_2019_annual_activity_report.pdf?sfvrsn=2abbc744_8 and converted from tonnes U to pounds U and from %U to %U. Cut-off grades used to estimate resources are unknown. The reader is cautioned that UEX is not aware whether Orano’s reporting of resources conforms to NI 43-101 and CIM guidelines.These are treated by the Company as historic resource estimates.

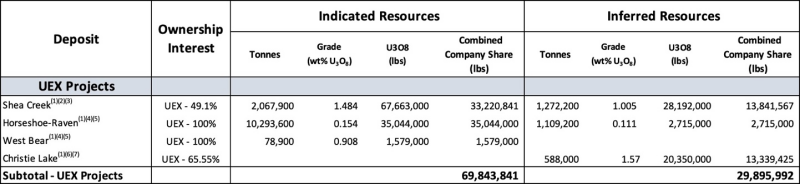

Table 3 –Indicated and Inferred Resources – Current UEX Projects

(1) The mineral resource estimates follow the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects and classifications follow CIM definition standards.

(2) The Shea Creek mineral resources were estimated at a cut-off of 0.30% U3O8, and are documented in the technical report titled “Technical Report on the Shea Creek Property, Northern Saskatchewan, with an Updated Mineral Resource Estimate” (the “Shea Creek Technical Report”) with an effective date of May 31, 2013 which was filed on SEDAR at www.sedar.com on May 31, 2013.

(3) Certain amounts presented in the Shea Creek Technical Report have been rounded for presentation purposes. This rounding may impact the footing of certain amounts included in the tables above.

(4) The Horseshoe, Raven, and West Bear mineral resources were estimated at a cut off of 0.05% U3O8, and are documented in the “Preliminary Assessment Technical Report on the Horseshoe and Raven Deposits, Hidden Bay Project, Saskatchewan, Canada” (the ”Horseshoe-Raven Technical Report”) with an effective date of February 15, 2011 which was filed on SEDAR at www.sedar.com on February 23, 2011.

(5) Certain amounts presented in the Horseshoe-Raven Technical Report have been rounded for presentation purposes. This rounding may impact the footing of certain amounts included in the tables above.

(6) The Christie Lake mineral resources were estimated at a cut off of 0.2% U3O8, and are documented in the “Technical Report on the Christie Lake Uranium Project, Saskatchewan, Canada” (the “Christie Lake Technical Report”) with an effective date of December 13, 2018 which was filed on SEDAR at www.sedar.com on February 1, 2019. Inferred resources have been modified from the stated values in the Christie Lake Technical Report to reflect UEX’s increase in the ownership of Christie Lake Project from 60% to 65.5492%% effective January 1, 2021.

(7) Certain amounts presented in the Christie Lake Technical Report have been rounded for presentation purposes. This rounding may impact the footing of certain amounts included in the tables above.