Archive

Tocvan Announces Results from Property Scale Soil Survey, Includes Highest Soil Results to Date with 8 g/t Gold & 317 g/t Silver New East Zone Discovery, at the Pilar Gold-Silver Project in Sonora, Mexico

| |||||||||

|  |  |  | ||||||

Calgary, Alberta - TheNewswire – June 24, 2020. Tocvan Ventures Corp. (CSE:TOC) (CNSX:TOC.CN) (“Tocvan” or the “Corporation”) is pleased to announce results from the soil sampling survey at the Pilar Gold-Silver Project in Sonora, Mexico.

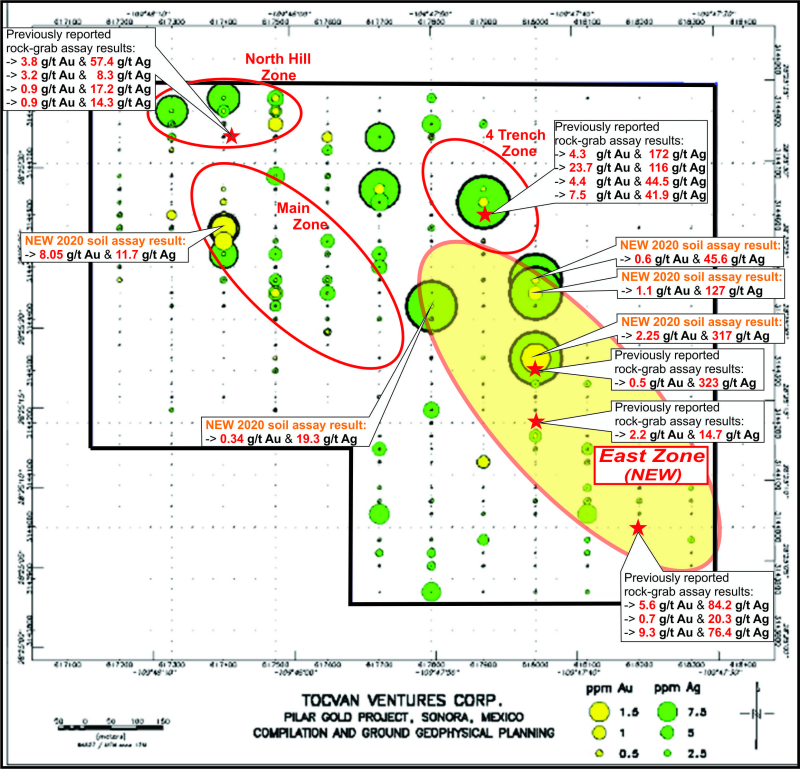

The highest assay results have been returned for gold and silver on the Pilar property in separate soil assays; 8 g/t Au & 317 g/t Ag. Also, a new zone of gold and silver mineralization containing areas of high grade gold and high grade silver has been revealed and is termed the “East Zone”, see figure 1.

Soil samples were systematically collected across the property as one of several survey tools to define mineralization trends associated with geological structures. To further help define mineralization trends previous results were also included and are shown below. Combined, these results have highlighted gold-silver areas and gold-silver trends across the Pilar property from north to south to narrow the focus for drilling.

Historically, the focus for development on the Pilar property has been in the north-west part of the property in the Main Zone and North Hill Zone. These zones along with the 4-Trench Zone have received over 17,700m of drilling. The Pilar property is a low-sulphide epithermal system, structure is key in mineralization deposition. In order to know where the mineralization is located, the structures need to be known and understood. In the efforts to define the structures controlling mineralization in the Main, North Hill, and 4-Trench zones, discoveries have been made elsewhere on the property, and those discoveries collectively have revealed a new zone of gold-silver mineralization, the East Zone (Figure 1).

Figure 1 characterizes the gold-silver assay results from the soil survey conducted this past March into April across the Pilar property. Also shown on figure 1 are gold-silver assay results from rock-grabs collected on the property this past November and previously reported January 7, 2020, they are included and shown here to provide a holistic view. Those rock-grabs were collected in response to testing high grade gold-silver soil assay results reported by Colibri Resource Corp. in 2018 and therefore show the effectiveness of assaying soil samples.

Taken collectively, the gold-silver assay results have revealed trends and zones of mineralization as depicted in figure 1 and the following figures. In figure 1 the gold-assay soil return is represented by

and the silver-assay-soil return is represented by

. Gold and silver assay results collected as rock-grabs this past November and reported January 7, 2020 are represented by

.

The new East Zone (Figure 1) is represented by high grade gold and high grade silver assay results from rock grabs and soil sampling, and is a new trend of mineralization parallel to the NW-SE trend of mineralization of the Main Zone and North Hill Zone (see the bottom of this press release for summary drill results of the Main and North Hill zones). This trend/zone first started to reveal itself after a rock sampling survey conducted this past November. Some significant results include over 5 g/t gold and over 9 g/t gold (Figure 1), but also notably 323 g/t silver, 317 g/t silver, 127 g/t silver, and at the south-east corner of the property 84 and 76 g/t silver (Figure 1). This area roughly covers 600m x 200m and trends in the same direction as the Main Zone (which has been drilled to a depth of ~100m) and with NW-SE trending structures. Historically, previous operators have focused on developing gold on the Pilar property, clearly silver should be included as a part of that focus as well, and will be.

Figure 1. Results from the 2020 Soil Survey at Pilar Au-Ag Project

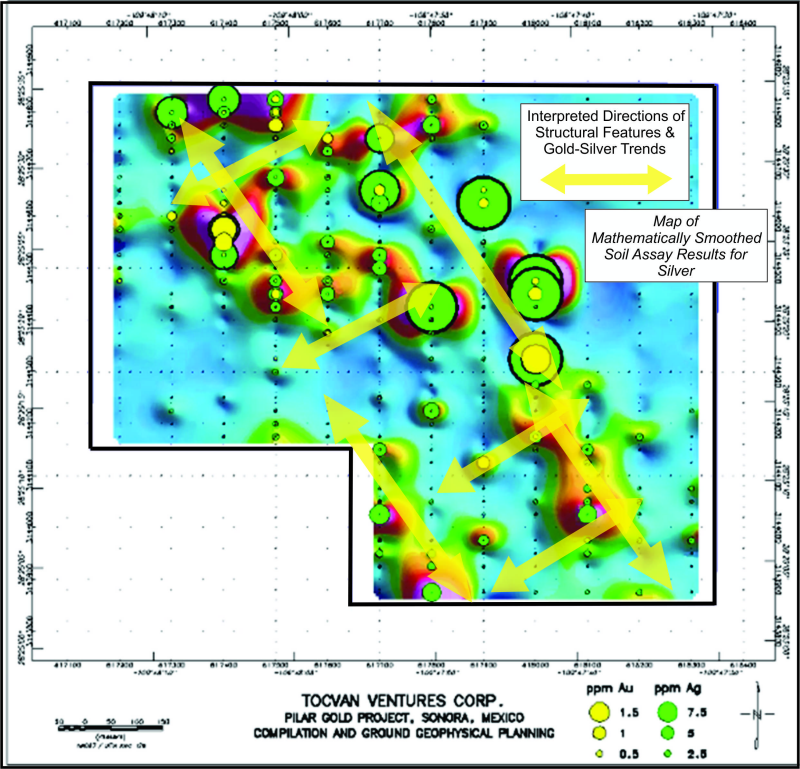

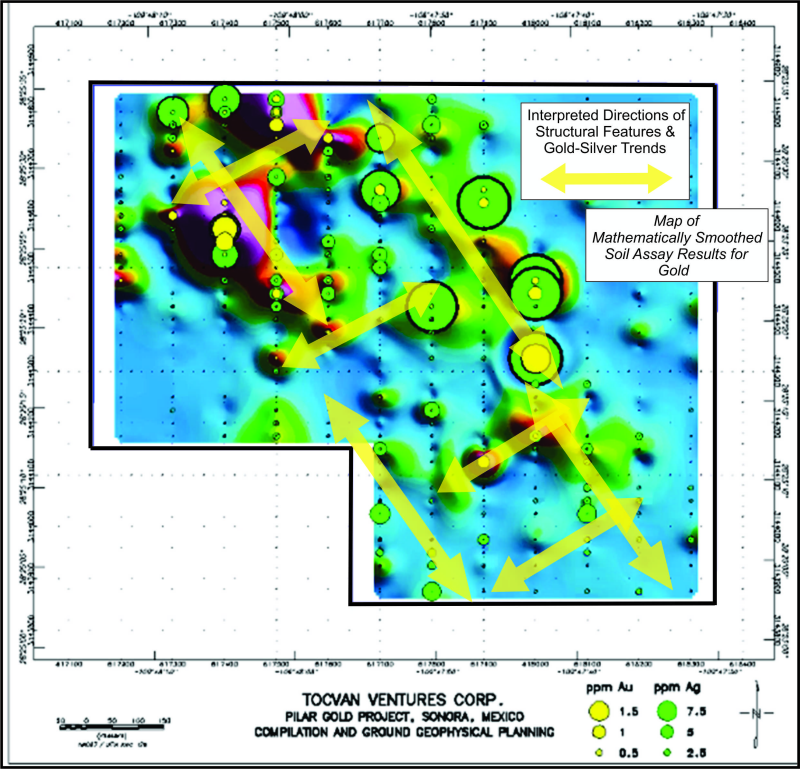

Figures 2 and 3 below are mathematically smoothed soil gold-silver assay data to better reveal trends of mineralization and hence structural trends. The property is known to have cross-cutting NW-SE trending structures and NE-SW trending structures, an excellent combination of structures for mineralized fluid deposition. Directional trends have tentatively been interpreted and are depicted by yellow arrows on both figures. The figures below show trends of mineralization (structure) in under explored areas, and so, provide additional growth opportunities to locate more gold and silver. Mineralization is structurally controlled, knowing the locations, directions and especially the intersections of the structures will help to narrow the focus for locating drill targets.

The soil samples were analyzed by ALS Limited for gold and silver via Au-AA23 package (fire assay and atomic absorption) and Ag-AA45(aqua regia digestion and atomic absorption).

Next Steps for Pilar

Moving forward, scheduled work to be done, and included with these and previous results, are structural analyses with associated survey tools by structural geologists, and XRF survey of samples across the property and of historic drill hole samples held in storage. XRF identifies elements and their amounts which in turn help to identify pathfinder elements. All these surveys and analyses will be taken collectively in order to locate the structures and hence mineralization to provide targets for the drill program; currently anticipated in late summer/early fall of this year.

Figure 2. Silver in Soil Results.

Figure 3. Gold in Soil Results.

The current world health situation requires adjustments to work programs, health and safety is considered first.

Current health advice is for families and groups to self-isolate and to use caution with suggested recommendations from health leaders when social-distancing becomes a challenge. Countries are beginning to allow businesses to operate again. Isolation is an inherent part of mineral development programs.

About the Pilar Property

The Pilar Gold-Silver property has been identified as a structurally controlled low-sulphidation epithermal project hosted in Andesite and Rhyolite rocks. Hydrothermal fluids carrying gold, silver and other minerals are transported through the pre-existing structures and deposit out of the fluids and become emplaced within the structures and surrounding host rock. Three zones of mineralization have been identified in the north-west part of the property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4 Trench. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Over 17,700m of drilling have been completed to date. Significant results are highlighted below from previous operators:

- 17,700m of Core & RC drilling. Highlights include (all lengths are drilled thicknesses):

- 0.73g/t Au over 40m

-

-

- 0.75g/t Au over 61m

-

- 17.3g/t Au over 1.5m

- 5.27g/t Au over 3m

- 53.47g/t Au & 53.4g/t Ag over 16m

- 9.64g/t Au over 13m

- 10.6g/t Au & 37.8g/t Ag over 9m

- 2,650m of surface and trench channel sampling. Highlights include:

- 55g/t Au over 3m

- 28.6g/t Au over 6m

- 3.39 g/t Au over 50m

- Soil sampling results from undrilled areas indicating mineralization extends towards the southeast from the Main Zone, North Hill Zone, and 4-Trench Zone

Additional areas of mineralization have been identified resulting from surface rock-grab-sample assay results that extend known mineralized trends and show a second NW-SE trend of mineralization to the east parallel to the trending zone described above; gold-silver mineralization is indicated across the property from the north to the south, see press release dated January 7, 2020. Significant results from that particular survey are highlighted below:

|

Sample # |

Au g/t |

Ag g/t |

Cu % |

Pb % |

|

PILAR-MTS-02 |

0.9 |

14.3 |

0.261 |

0.003 |

|

PILAR-MTS-03 |

1.3 |

5.4 |

0.338 |

0.002 |

|

PILAR-MTS-05 |

0.8 |

12.7 |

0.129 |

0.002 |

|

PILAR-MTS-06 |

3.2 |

8.3 |

0.350 |

0.001 |

|

PILAR-MTS-09 |

0.2 |

2.2 |

1.255 |

0.005 |

|

PILAR-MTS-10 |

0.9 |

17.2 |

0.734 |

0.010 |

|

PILAR-MTS-11 |

3.8 |

57.4 |

0.846 |

0.005 |

|

PILAR-MTS-12 |

0.0 |

5.6 |

1.910 |

0.001 |

|

PILAR-MTS-13 |

0.0 |

12.9 |

0.946 |

0.001 |

|

PILAR-MTS-14 |

0.1 |

3.3 |

1.400 |

0.001 |

|

PILAR-MTS-19 |

0.8 |

1.7 |

0.013 |

0.008 |

|

PILAR-MTS-20 |

5.6 |

84.2 |

0.088 |

1.710 |

|

PILAR-MTS-21 |

0.7 |

20.3 |

0.027 |

0.185 |

|

PILAR-MTS-22 |

9.3 |

76.4 |

0.120 |

2.150 |

|

PILAR-MTS-25 |

0.5 |

323.0 |

0.016 |

0.242 |

|

PILAR-MTS-26 |

1.4 |

2.4 |

0.002 |

0.013 |

|

PILAR-MTS-27 |

2.2 |

14.7 |

0.012 |

0.259 |

|

PILAR-MTS-29 |

4.3 |

172.0 |

0.086 |

1.125 |

|

PILAR-MTS-30 |

23.7 |

116.0 |

0.089 |

0.040 |

|

PILAR-MTS-33 |

4.4 |

44.5 |

0.109 |

0.036 |

|

PILAR-MTS-34 |

7.5 |

41.9 |

0.044 |

0.022 |

|

PILAR-MTS-35 |

2.2 |

3.5 |

0.179 |

0.008 |

The technical information in this news release pertaining to geological data and its interpretation has been prepared by Mark T. Smethurst, P.Geo., COO, Director of the Company, and a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Tocvan Ventures Corp.

Tocvan is a well-structured exploration mining company. Tocvan was created in order to take advantage of the prolonged downturn the junior mining exploration sector, by identifying and negotiating interest in opportunities where management feels they can build upon previous success. Tocvan Ventures Currently has approximately 17.7 million shares outstanding and is earning into two exiting opportunities. The Pilar Gold project in the Sonora state of Mexico and the Rogers Creek project in Southern British Columbia, Management feels both projects represent tremendous opportunity.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company’s business, the Company’s formative stage of development and the Company’s financial position.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

FOR FURTHER INFORMATION, PLEASE CONTACT:

TOCVAN VENTURES CORP.

Derek A. Wood, President and CEO

Suite 1150 Iveagh House,

707 – 7th Avenue SW

Calgary, Alberta T2P 3H6

Telephone: (403) 200-3569

Email: dwood@tocvan.ca

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.