Archive

Airborne Survey Outlines Prominent Mag Low at the New Pilot Copper-Gold Project

| |||||||||

|  |  |  |  |  | ||||

Vancouver, Canada – TheNewswire - June 7, 2021 - Nexus Gold Corp. (“Nexus” or the “Company”) (TSX-V: NXS, OTCQB: NXXGF, FSE: N6E) is pleased to report it has the final report from Precision GeoSurveys detailing results for the 301 line kilometer airborne magnetic and radiometric survey on the Company’s New Pilot property located in the Bridge River Camp in central B.C., Canada.

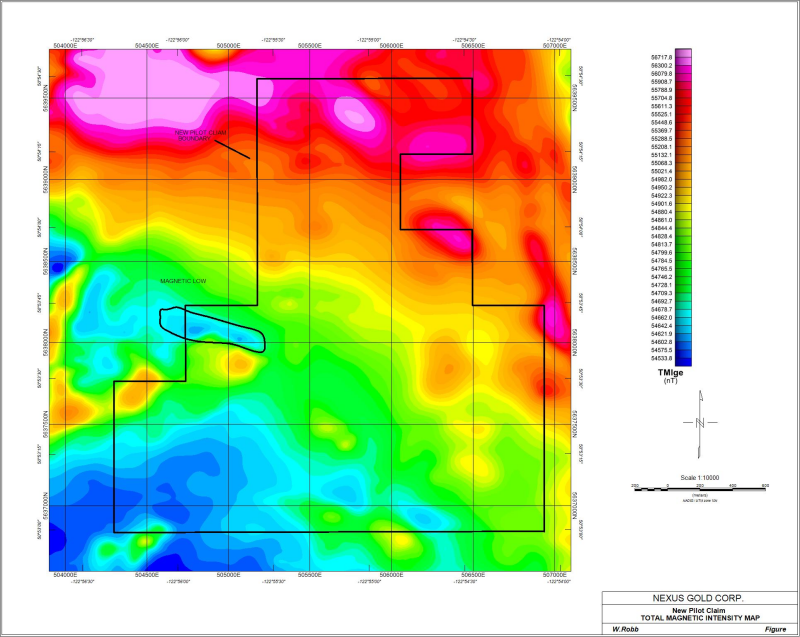

The survey outlined a prominent magnetic low occurring coincidentally with an area which has returned high historic gold values. Historic Grab samples collected in this area returned values of 7.5 grams-per-tonne (“g/t”) gold (“Au”) and 106 g/t Au, respectively. This magnetic low feature extends for some 450 meters on the New Pilot property and measures up to 150 meters in width. The company is planning a follow up airborne EM survey to cover the property and to identify potential conductive and resistive zones to aid in interpretation and identifications of targets for follow up.

Image 1: Mag low at the New Pilot project, central BC, Canada

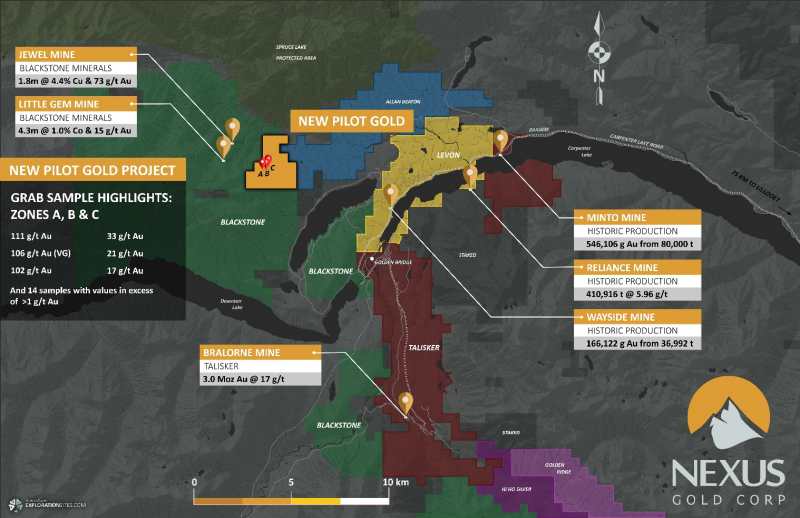

New Pilot is a copper-gold exploration property located in the historic Bridge River Mining Camp, approximately 180 kilometers north of Vancouver, and 10.5 kilometres west of the village of Gold Bridge, British Columbia.

Previous work by the Company in 2019 at New Pilot consisted of a summer reconnaissance and sampling program in and around areas of historical exploration. A total of 36 rock samples were collected at this time. Results confirmed a zone of copper-gold mineralization, with selective samples returning values of 15.3 g/t Au, 33.4 g/t, silver (“Ag”), and 2.5% copper (“Cu”), in addition to 4.27 g/t Au, 5.5 g/t Ag, and 0.27% Cu, and 3.91 g/t Au, 3.72 g/t Ag, and 0.51% Cu (See company News Release dated August 27, 2019).

The 509-hectare property has been the subject of historical exploration. Between 1992 to 1994 Cogema Canada Ltd conducted detailed prospecting and sampling. 99 grab samples were taken in three zones, with three returning values in excess of 100 g/t Au, including 102 g/t Au, 106 g/t Au with visible gold, and 111g/t Au; three returning values in excess of 10 g/t Au (17 g/t Au, 21 g/t Au, 33 g/t Au); and 14 others returning values in excess of 1 g/t Au.

In addition, 59 soil samples, 229 rock samples, and 66 core samples from a small 108-meter diamond drill program were also obtained. Significant results obtained included chip samples of 4.03 g/t Au over 10 meters, and 1 g/t Au over 10.5 meters in drill core.

Three styles of mineralization have been identified on the Project: siliceous fractures containing sulphides, carbonate altered shears, and quartz veins containing arsenopyrite. The Project location is situated at the contact of the Coast Crystalline Complex and the Bridge River sediments. Over the past 80 years several exploration programs have been conducted over or near the property, initially concentrating on the Pilot Mine and its strike extension. The Project is relatively close to the producing Bralorne Pioneer Mine, located 18 kilometres to the south east.

Image 2: Location of the New Pilot Copper-Gold Project, NW of Bralorne, BC, Canada

The Bralorne gold camp represents one of Canada’s most prolific mining operations. From 1928 to 1971, the Bralorne and nearby Pioneer and King mines produced 4.15 million ounces of gold from 7.9 million tons of ore*. The Bridge River Mining Camp is the largest past producer of gold in British Columbia**. In 2017, Blackstone Minerals Ltd, an Australian-based company, acquired the Little Gem Project, a high-grade cobalt and gold project, located approximately 900 meters from the New Pilot location.

Private Placement

The Company also announces that it has completed the offering of 18,500,000 units (each, a “Unit”). The Units were offered by way of non-brokered private placement, at a price of $0.05 per Unit, for gross proceeds of $925,000. Each “Unit” is comprised of one common share, and one common share purchase warrant (each whole warrant, a “Warrant”) exercisable to acquire an additional common share at a price of $0.07 until May 31, 2024. The gross proceeds from the offering will be used for further project development work and for general working capital purposes.

In connection with completion of the offering, the Company paid finders’ fees of $12,000 and issued 240,000 Warrants to certain arms-length parties who introduced subscribers to the offering. All securities issued in connection with completion of the offering are subject to a four-month-and-day statutory hold period, in accordance with applicable securities laws, until October 1, 2021.

* Avino Silver & Gold Mines, Ltd

** Bralorne Project 1992 Pilot Property BC Assessment Report, Schimann-Robb, 1992

- Grab samples are selective by nature and may not represent the true grade or style of mineralization across the property.

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for, and has approved, the technical information contained in this release.

About the Company

Nexus Gold is a Canadian-based gold exploration and development company with an extensive portfolio of eleven projects in Canada and West Africa. The Company’s West African-based portfolio totals five projects encompassing over 750-sq kms of land located on active gold belts and proven mineralized trends, while it’s 100%-owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario; the New Pilot Project, located in British Columbia's historic Bridge River Mining Camp; and four prospective gold and gold-copper projects (3,700-ha) in the Province of Newfoundland. The Company is focusing on the development of several core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its growing portfolio.

For more information, please visit nexus.gold

On behalf of the Board of Directors of

NEXUS GOLD CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nxs.gold

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.