Archive

Granada Gold Announces Recent Drill Program has Increased Measured and Indicated Mineral Resources by 21% to 543,000 oz Au and Inferred by 71% To 456,000 oz Au

| |||||||||

|  |  | |||||||

July 6, 2022 – TheNewswire - Rouyn-Noranda, Quebec, Granada Gold Mine Inc. (TSXV:GGM) (OTC:GBBFF) (the “Company” or “Granada”) is pleased to provide an updated mineral resources estimate at the Granada property, a past producer located adjacent to the prolific Cadillac Break in the Abitibi near Rouyn-Noranda and close to several gold deposits and operating mines in northwestern Quebec.

The estimates combine in-pit constrained and underground mineral resources estimates and include the results of the 30,000-meter drill program conducted on the Big Claim at Granada since the last estimate was published in January 2021.

HIGHLIGHTS:

-

Measured and indicated in-pit and underground mineral resources estimated at 8,220,000 tonnes grading 2.05 grams/tonne (g/t) gold (Au), containing 543,000 oz Au;

-

Inferred in-pit and underground mineral resource estimated at 3,010,000 tonnes grading 4.71 g/t Au, containing 456,000 oz Au;

-

New estimates represent a 21 percent increase in measured and indicated gold mineral resources and a 71 percent increase in inferred mineral resources compared with the previous estimate;

-

Grades are in line with the Company’s target of 2 g/t Au for open pit and 4 g/t Au for underground resources;

-

Step-out drilling 250 meters (m) to the north of the pit in the Big Claim confirmed gold mineralization at depth which was also indicated by past drilling on the property;

-

Other step-out drilling further north to a depth of 1,600m surprisingly encountered 21 mineralized zones of alkali metals, with a significant 53.1m thick zone of rubidium grading 340 ppm (in-hole length) above the downward trending gold veins (a rubidium mineral resource to be reported in a separate news release). The real thickness is expected to be about 35-40% of the in-hole length.

“Granada has been successful in achieving its goals with last year’s 30,000m drill program, which was the first phase of a planned 120,000m of drilling. We had planned to do much of the drilling during the first phase in, around and below the existing pit aiming to significantly increase the gold mineral resources in line with our target grades, and also to confirm gold mineralization with step-out drilling to the north of the pit. We did all that and, with the drill results we reported in news releases along the way and with this resource update, we have quite adequately achieved our goals. In addition, we unexpectedly encountered a massive rubidium mineralization which has the potential to change the economics of Granada as rubidium is an increasingly important alkali metal used in the EV battery industry (see January 11, 2022 news release),” stated Frank J Basa, B.Eng., P.Eng., President and CEO.

“The potential of Granada has not yet been realized, as only about 20% of the property has been explored, and drilling has been conducted on only 2 km of the 5.5km estimated mineralized east-west zone. We have plenty of prospective targets. Past and recent drilling confirmed the presence of downward-sloping gold veins at depth to the north of the pit but we mostly have not drilled enough there to count that as part of the mineral resource. And there is a lot of exploration drilling we could do to the east as well along the mineralized zone which we believe could be productive,” Mr. Basa added.

The Granada property includes the former Granada Gold underground mine which produced more than 50,000 oz of gold at 9.7 g/t Au from two shafts before a fire destroyed the surface buildings. Bulk samples taken from the surface in the 1990s and since then have graded in the 3-5 g/t range (see May 10, 2022 news release).

The 2022 mineral resource estimates in this news release represent the second estimate since the Company shifted its approach to the deposit by reducing the size of the pit in order to increase the pit grade to the range of 2 g/t Au from 1 g/t Au (and reduce the production of waste and overburden removal) to improve the potential economics of the deposit for future mining. The first estimate since the shift was published in a news release on January 29, 2021 and an associated National Instrument (NI) 43-101 technical report was released on March 15, 2021.

The previous mineral resource estimate published in 2021 had reported a measured and indicated estimates for open pit of 5,113,000 tonnes grading 2.06 g/t Au containing 339,0n00 oz Au, and underground of 844,000 tonnes grading 4.03 g/t containing 109,000 oz Au (amounting to a combined open pit and underground contained 449,000 oz Au). The 2021 estimate also reported inferred resources for open pit of 34,000 tonnes grading 11.29 g/t Au containing 12,000 oz, and underground of 1,244,000 tonnes grading 6.33 g/t Au containing 253,000 oz Au (amounting to a combined open pit and underground contained 266,000 oz Au). Compared to the 2021 amounts of contained gold, the new in-pit and underground resource estimates represent a 21 percent increase for measured and indicated (543,000 oz Au in 2022 vs 449,000 oz Au in 2021) and a 71 percent increase for inferred (456,000 oz Au in 2022 vs 266,000 oz Au in 2021).

The planned upcoming 2022 NI 43-101 technical report using data available as of January 2022 and including the updated mineral resources for Granada contained in this news release is currently being completed by SGS and is expected to be delivered and filed on SEDAR by Granada within 45 days. The goal is to present resources with both open pit potential and underground potential using cut-off grades (see table and notes) based on a gold price of US$1,700/oz, a foreign exchange rate of US$0.78 for CA$1 and a processing gold recovery of 93% (versus the use of US$1,600/oz, US$0.76 for CA$1 and 93%, respectively, in the 2021 report).

Table 1: Granada Mineral Resources Estimates as of June 23, 2022

|

Resource Report |

|||||

|

CutOff |

Classification |

Type |

Tonnes |

Au (g/t) |

Gold Ounces |

|

0.55 / 2.5 |

Measured1 |

InPit+UG |

4,900,000 |

1.70 |

269,000 |

|

Indicated |

InPit+UG |

3,320,000 |

2.57 |

274,000 |

|

|

Measured+Indicated |

InPit+UG |

8,220,000 |

2.05 |

543,000 |

|

|

Inferred |

InPit+UG |

3,010,000 |

4.71 |

456,000 |

|

(1) The 1930-1935 production was removed from these numbers (164,816 tonnes at 9.7 g/t Au / 51,400 ounces Au).

(2) The Independent QP for this resources statement is Yann Camus, P.Eng., SGS Canada Inc.

(3) The effective date is June 23rd, 2022.

(4) CIM (2014) definitions were followed for Mineral Resources.

(5) Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(6) No economic evaluation of the resources has been produced.

(7) All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add due to rounding

(8) Composites have been capped where appropriate. The 2.5 m composites were capped at 21 g/t Au in the thin rich veins and at 7 g/t Au in the low-grade volumes.

(9) Cut-off grades are based on a gold price of US$1,700 per ounce, a foreign exchange rate of US$0.78 for CA$1, a processing gold recovery of 93%.

(10) Pit constrained mineral resources are reported at a cut-off grade of 0.55 g/t Au within a conceptual pit shell

(11) Underground mineral resources are reported at a cut-off grade of 2.5 g/t Au within reasonably mineable volumes.

(12) A fixed specific gravity value of 2.78 g/cm3 was used to estimate the tonnage from block model volumes

(13) There are no mineral reserves on the Property.

(14) The deepest resources reported are at a depth of 990 m.

(15) SGS is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially affect the mineral resource estimate.

(16) The results from the pit optimization are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a mineral resource statement and to select an appropriate resource reporting cut-off grade.

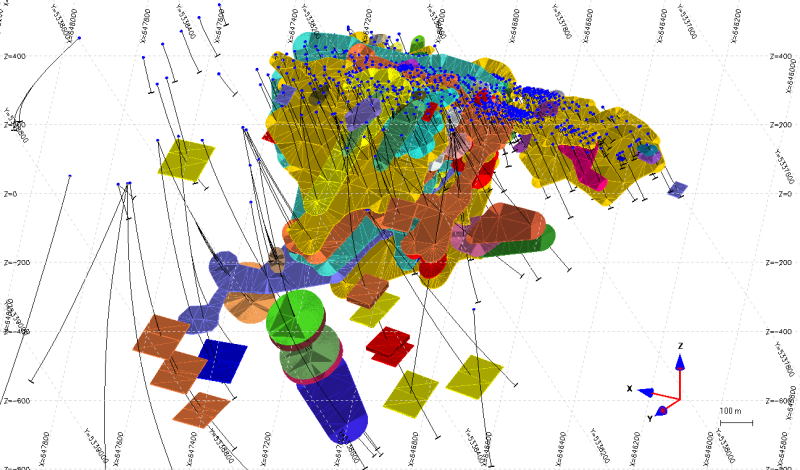

Figure 1 Isometric View Looking SSE Showing the Drill Holes, and the Thin, Rich Veins Model (107 wireframes)

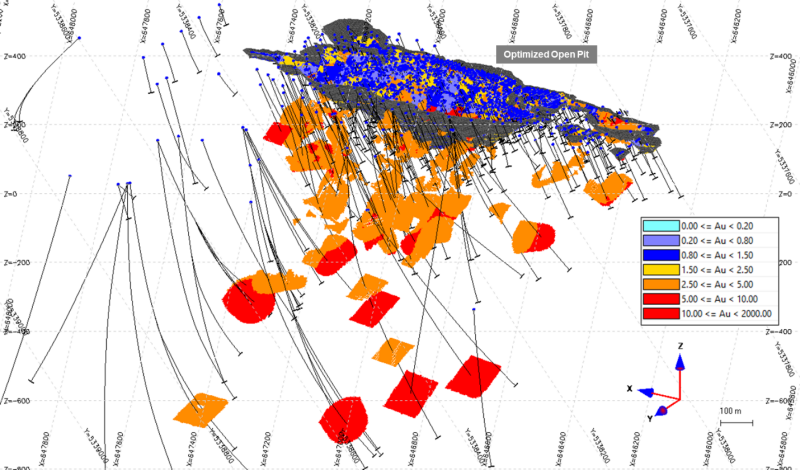

Figure 2 Isometric View Looking SSE with Block Model and drill holes. 0.55 g/t Au COG inside the pit and 2.5 g/t Au COG under the pit

Table 2: Granada Pit-Constrained Mineral Resources Estimate

|

Resource Report |

|||||

|

CutOff |

Classification |

Type |

Tonnes |

Au (g/t) |

Gold Ounces |

|

0.55 |

Measured1 |

InPit |

4,840,000 |

1.68 |

261,000 |

|

Indicated |

InPit |

2,440,000 |

2.09 |

164,000 |

|

|

Measured+Indicated |

InPit |

7,280,000 |

1.81 |

425,000 |

|

|

Inferred |

InPit |

420,000 |

1.78 |

24,000 |

|

Same footnotes as Table 1 apply to this table.

Table 3: Granada Underground Mineral Resources Estimate

|

Resource Report |

|||||

|

CutOff |

Classification |

Type |

Tonnes |

Au (g/t) |

Gold Ounces |

|

2.5 |

Measured |

UG |

60,000 |

3.84 |

8,000 |

|

Indicated |

UG |

870,000 |

3.93 |

110,000 |

|

|

Measured+Indicated |

UG |

940,000 |

3.92 |

118,000 |

|

|

Inferred |

UG |

2,590,000 |

5.19 |

431,000 |

|

Same footnotes as Table 1 apply to this table.

Table 4: Comparison of 2021 and 2022 Assumptions Used for the Preparation of the Pit Shell Limiting the Mineral Resource Estimates

|

Parameter |

Value |

Unit |

|

|

2021 |

2022 |

||

|

Gold Price |

1,600 |

1,700 |

US$ per oz |

|

Exchange Rate |

0.76 US$ : 1 CA$ |

0.78 US$ : 1 CA$ |

|

|

Pit Slope |

50 |

50 |

Degrees |

|

Open Pit Mining Cost |

6 |

6 |

CA$ per tonne mined |

|

Underground Mining Cost |

105 |

105 |

CA$ per tonne mined |

|

Processing, Transportation Cost and G&A |

35 |

25 |

CA$ per tonne milled |

|

Gold Recovery |

93 |

93 |

Percent (%) |

|

Open Pit Mining loss / Dilution |

10 / 20 |

10 / 20 |

Percent (%) / Percent (%) |

|

Underground Mining loss / Dilution |

10 / 20 |

10 / 10 |

Percent (%) / Percent (%) |

|

Open Pit Cut-off Grade |

0.9 |

0.55 |

g/t Au |

|

Underground Cut-off Grade |

3.0 |

2.5 |

g/t Au |

About the Mineral Resource Estimate

The Gold Deposit using narrow, rich, vein modelling and both open pit and underground resources and revised pit optimization parameters which are based on the possibility of on-site milling rather than of site custom milling. The methodology used for this update of the resource estimation is largely the same as the previous estimation from 2021.

Metallurgical and environmental characterization studies on the mineralization are being untaken at SGS for a potential mill on the Granada Mine Property.

In order to update the resource estimation, the individual thin, rich veins were modelled individually. These veins are quite continuous (over distances of 1,400m in strike and 1,000m down dip). Mineralization is open at depth and on strike. The maximum distance between linked intervals is currently about 150 m. Some gaps of about 300 m have no drilling but should contain mineralization given the continuous nature of the deposit.

The database used for this mineral resource estimate includes drill results obtained from drill programs in 2009, 2010, 2011, 2012, 2016, 2017, 2018, 2019, 2020, 2021 and trenches from 2014 and 2015 plus many of the historic holes (1990's).

The thin, rich veins were modelled as a first step in the estimation process. A grade of 0.7 g/t over a length of 2.5 m was used as a minimum. While the 2.5 m constraint was always met, some intervals were considered under 0.7 g/t to allow to model continuous mineralized structures. We estimate that the final 107 thin, rich veins modelled contain 92% of the gold from intervals that meet the 0.7 g/t over 2.5 m criteria.

A large, low-grade zone was modelled around all intervals containing significant gold. This large, low-grade volume is similar in shape and size to the previous resource model.

Composites of 2.5 m were created inside the thin, rich veins and in the low-grade volume. All resulting 107 volumes were estimated as hard boundaries. The rich, thin vein composites were capped at 21 g/t. It has a similar impact on gold content as the previous estimate capping methodology. The low-grade composites were capped at 7 g/t.

A block model was created with blocks of 5 x 2.5 x 2.5 m to fill the rich, thin veins while using block centers as indicators for the block’s nature. Both the kriging and inverse square distance estimation methods were tested with very similar results globally. The kriging is more conservative in grade and gold content once we apply the cut-off grades to report resources. Kriging was retained as the estimation method of choice for this project. Search ellipsoids used for the estimation are of 30 x 30 x 7.5 m, 60 x 60 x 15 m and 100 x 100 x 30 m respectively. A minimum of a single drillhole is needed to estimate blocks inside thin, rich veins. A minimum of 2 drillholes are needed to estimate blocks in the low-grade volume. Search ellipsoid orientations are variable depending on local orientation of the model.

The classification in measured, indicated and inferred was done as a separate step with an algorithm with ellipsoids centered on composites. A drilling grid with a minimum of 3 drillholes within 30 m of each other or less defines measured resources (under 25 m most of the time) and a drilling grid with a minimum of 3 drillholes within 60 m of each other or less defines indicated resources (under 50 m most of the time). Measured resource extends only by 20 m around drillholes and indicated extends only by 40 m.

The mineral resource statement EXCLUDES the historical production of 51,476 ounces of gold (181,744 Tons @ 0.28 oz/Ton Au) from 1930 to 1935. These numbers were subtracted from the measured resources in the whittle open pit.

Qualified person

The technical information in this news release has been prepared by Yann Camus, P.Eng., independent qualified person of SGS and was reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc. member of Québec Order of Engineers and a qualified person in accordance with National Instrument 43-101 standards.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop and explore its 100% owned Granada Gold Property adjacent to the prolific Cadillac Break near Rouyn-Noranda, Quebec. The Company owns 14.73 square kilometers of land in a combination of mining leases and claims and to date Granada has conducted 150,000m of drilling on the property. The Company recently completed 30,000m of a planned 120,000m drill program aimed at expanding the size of the deposit. The drills are currently paused to provide the technical team with the necessary time to evaluate and assimilate existing data.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and a half kilometers. Three of these structures were mined historically from four shafts and three open pits. Historical underground grades were 8 to 10 grams per tonne (g/t) gold from two shafts down to 236m and 498m with open pit grades from 3.5 to 5 g/t gold.

The property includes the former Granada Gold underground mine which produced more than 50,000 ounces of gold at 10 grams per tonne gold in the 1930’s from two shafts before a fire destroyed the surface buildings. In the 1990’s, Granada Resources extracted a bulk sample (Pit #1) of 87,311 tonnes grading 5.17 g/t Au. They also extracted a bulk sample (Pit # 2) of 22,095 tonnes grading 3.46 g/t Au.

The Company is in possession of all mining permits required to commence the initial mining phase, known as the “Rolling Start”, which allows the company to mine up to 550 tonnes per day. Additional information is available at www.granadagoldmine.com.

“Frank J. Basa”

Frank J. Basa P. Eng.

President and Chief Executive Officer

For further information, please contact:

Frank J. Basa, P. Eng., President and CEO at 1-819-797-4144 or

Wayne Cheveldayoff, Corporate Communications, at 416-710-2410 or waynecheveldayoff@gmail.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.