Archive

Global Energy Metals Strengthens Land Position in Idaho by 25%; Commences Interpretation of Key Findings at Monument Peak Copper-Silver-Gold Project

| |||||||||

|  | ||||||||

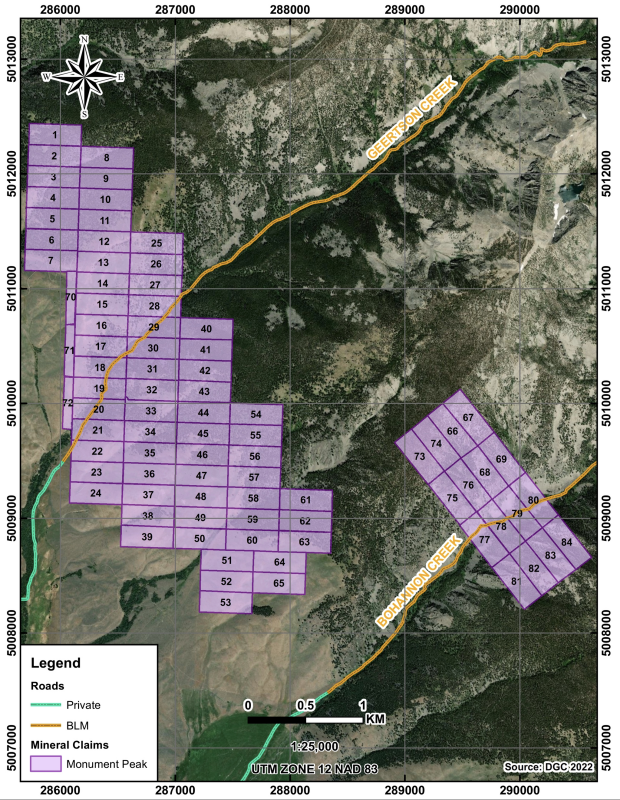

Vancouver, BC / TheNewswire / March 23, 2022 / Global Energy Metals Corporation (TSXV:GEMC) | (OTC:GBLEF) | (FSE:5GE1) (“Global Energy Metals”, the “Company” and/or “GEMC”), a company involved in the battery metals supply chain, is pleased to announce that it has increased its land position at the Monument Peak copper-silver-gold project (the “Project” and/or “Monument Peak”) in Lemhi County, Idaho, United States by 328 acres (133 hectares), or by nearly 25%, to 1708 acres (691 hectares) through low-cost, organic claim staking. These new claims are in close proximity to the existing claims as seen in Figure 1. The expanded land position incorporates prospective copper-gold-silver targets identified during the 2021 field program.

The Company is also pleased to report that having completed a geological field work program at Monument Peak that it has commenced the preparation of the Monument Peak NI 43-101 technical report (the “Report”).

Phase 1 Highlights of Soil Sampling and Geological Reconnaissance:

-

In total 557 soil samples and 13 rock samples collected,

-

Rock samples ranged up to 5.61% Cu, 175 g/t Ag, 17.6 g/t Au; the samples returned an arithmetic average of 2.18% Cu, 63 g/t Ag, 3.65 g/t Au,

-

Soil samples show strong geochemical (Cu, Ag, Au) anomalies along the known mineralized trend, which extends for 3,200+ metres,

-

A mineralized pit in the south part of the property was identified 200 metres due east of previous known mineralization,

-

A newly identified historical trench between the south and central showings confirms continuity of mineralization, and

-

Workings, outcrops, and soil geochemistry imply the mineralized system could be continuous over its entire known strike length of 3,200+ metres.

A site visit by the author was completed during the fall of 2021, while the field work was ongoing. It is worth noting that this NI 43-101, in addition to being a strategic technical document, will also be an important marketing document for the Company. The Report will look at past programs, field work conducted more recently and will focus on the tremendous upside, compelling targets and present a new geological model for the Cu-Ag-Au mineralization at Monument Peak. Refer to news release dated September 9, 2021: Global Energy Metals Provides Updates on Potential for Larger System with Monument Peak Copper-Silver-Gold Project in Idaho, USA.

Figure 1. Monument Peak claims map highlighting recently acquired prospective ground in Idaho.

Exploration has advanced sufficiently to allow for the identification of multiple drill targets, which will be confirmed and released in the very near future. Given the southern portion of the project is both road accessible and within lands of the Bureau of Land Management (BLM), it is anticipated that available drill targets would be readily accessible.

As announced at the end of 2021, the exploration program, conducted by Dahrouge Geological Consulting USA (“DGC”), included the collection of 557 soil samples and 13 rock samples (see Figure 1).

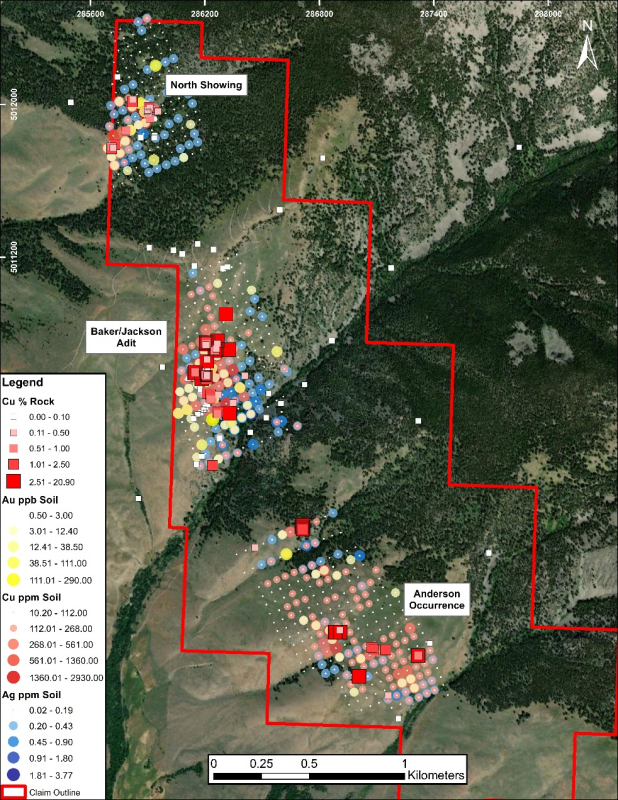

The exploration identified several new areas of visible copper and silver/gold mineralization (see Figures 2-4). The strongly mineralized samples contained variable amounts of chalcopyrite and copper oxide minerals, consistent with the known Cu-Ag-Au mineralization on the property.

Figure 2. Monument Peak location map highlighting rock and soil samples collected.

The 2021 rock samples demonstrated strong precious metal enrichment; 12 of the 13 rock (grab) samples returned from 7.6 to 175 g/t Ag and 0.16 to 17.6 g/t Au.

Table 1. 2021 Rock Sample Results

|

Sample ID |

Cu (%) |

Ag (g/tonne) |

Au (g/tonne) |

|

151401 |

5.61 |

42.8 |

0.955 |

|

151402 |

2.76 |

20.1 |

0.535 |

|

151403 |

0.91 |

93.0 |

1.03 |

|

151404 |

0.61 |

48.2 |

2.44 |

|

151405 |

- |

1.0 |

- |

|

151406 |

2.51 |

7.6 |

1.43 |

|

151407 |

0.32 |

47.5 |

1.01 |

|

151408 |

4.63 |

175 |

17.4 |

|

151409 |

3.59 |

112 |

1.63 |

|

151410 |

4.93 |

87.8 |

17.6 |

|

151411 |

1.40 |

29.9 |

0.626 |

|

151412 |

0.44 |

20.3 |

0.161 |

|

151413 |

0.69 |

139 |

2.72 |

Soil and rock samples were shipped to Actlabs in Kamploops, BC for multi element analysis (including silver) by aqua regia digestion with ICP-OES finish (code 1E3) for rock samples and ICP-MS finish (code UT1) for soil samples and gold analysis by fire assay with AA finish (package 1A2B-30).

Monument Peak Copper-Silver-Gold Project, Idaho, USA

The Monument Peak Project consists of 84 claims covering approximately 1,708 acres (~691 hectares). It is an exploration-staged, high-grade, copper-silver-gold project, which covers two small past producing copper mines: Jackson and Hungry Hill. Sporadic development and production in the area occurred primarily during the early 1900’s, with some additional development in the 1950’s. The most recent exploration occurred during the 1970’s and 1980’s.

Mitchel (1972) described the Cu-Ag-Au mineralization at Monument as having “unusual continuity” in association with structural zones within sericitic quartzites, which can be traced along 3,200 m strike that vary from 3 to 6 m width.

The mineralization is described (Lavery, 1988) as “syngenetic and fits a volcanic-hosted (massive) sulfide model … where … the copper-mineralized section might be as much as 175 feet thick”.

A previous program undertaken by DGC in 2020, included the collection of 56 rock samples to confirm historical results, as announced in a previous news release dated April 27, 2021. The field work confirmed both the presence of significant Cu, Ag mineralization, but also the presence of significant gold mineralization. The samples were collected from three main areas over 3,200 m strike and from the separate Hungry Hill Mine; the arithmetic average of all samples was 2.34% Cu, 57.6 g/t Ag, and 0.68 g/t Au.

Project highlights follow (from North to South):

-

North Showing: grab samples to 0.57% Cu, 248 g/t Ag, 57.5 g/t Au;

-

Jackson Adit: grab samples to 13.6% Cu, 2,589 g/t Ag, 17.1 g/t Au;

-

Chip Sample: 3.0 m of 7.03% Cu, 109 g/t Ag

-

Chip Sample: 1.8 m of 3.11% Cu, 101 g/t Ag

-

Chip Sample: 6.1 m of 4.32% Cu, 99 g/t Ag

-

-

Anderson Occurrence: grab samples to 3.9% Cu, 89 g/t Ag, 2.5 g/t Au.

-

Hungry Hill Mine (2 km east of main trend): 2.4 m of 17% Cu.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believe the the time to be part of this electrification movement.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

www.globalenergymetals.com

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Subscribe to the GEMC eNewsletter

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.