Archive

Yorkton Equity Group Inc. Announces Financial Results for Third Quarter Ended September 30th, 2023 and Provides Corporate Update

| |||||||||

|  | ||||||||

Edmonton, Alberta - TheNewswire - November 27, 2023 - Yorkton Equity Group Inc. (TSXV:YEG) (“Yorkton” or the “Company”) is very pleased to announce its financial results for the third quarter ended September 30, 2023.

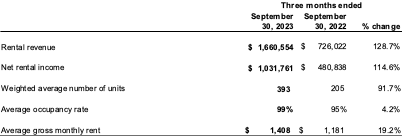

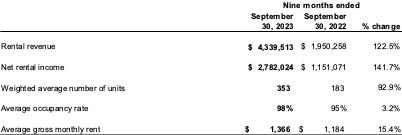

Mr. Ben Lui, President and CEO of Yorkton, is excited to report, "Our residential rental revenue has increased by 128.7%, to over $1.6 million during Q3 2023, and 122.5%, to over $4.3 million during the nine months ended September 30th, 2023. This noteworthy accomplishment can be directly attributed to our acquisition of The Dwell, a 188-unit luxurious multi-family rental property located in Edmonton, Alberta. This acquisition has strategically positioned us to take advantage of the growth potential within Alberta's multi-family rental market, which is fueled by factors such as a rapidly expanding population from interprovincial and international immigration, a resilient economy, a robust labor market, affordable housing costs and no rent price controls compared to other markets in Canada.”

Q3 2023 Financial Highlights

-

Residential rental revenue increased by $934,532 or 128.7% to $1,660,554 and commercial rental revenue increased by $10,553 or 10.3% to $113,309 in Q3 2023. Total rental revenue in Q3 2023 was $1,773,863.

-

Residential rental revenue increased by $2,389,255 or 122.5% to $4,339,513 and commercial rental revenue increased by $39,465 or 12.9% to $345,577 during the nine months ended September 30th, 2023. Total rental revenue during the nine months ended September 30th, 2023 was $4,685,090.

-

Net rental income increased by $572,350 or 99.9% to $1,145,466 in Q3 2023.

-

Net rental income increased by $1,606,414 or 112.2% to $3,038,117 during the nine months ended September 30th, 2023.

-

The acquisition of The Dwell (Edmonton, AB) on February 27th, 2023 added $892,982 of rental revenue and $551,642 of net rental income during Q3 2023 and $2,073,181 of rental revenue and $1,388,944 of net rental income to the nine months ended September 30th, 2023.

-

Overall net income of $2,400 in Q3 2023 as compared to $34,397 in Q3 2022.

-

Overall net loss of $131,864 during the nine months ended September 30th, 2023 as compared to $244,492 in the same period in 2022.

-

Yorkton holds 393 residential rental units and 28,036 sq.ft. of commercial space for a total portfolio value of $96,730,863 which grew by 71.7% as compared to September 30th, 2022.

During the nine months ended September 30th, 2023, the Company entered into a loan with Lui Holdings Corporation (“Lui Holdings”), as previously announced on October 2, 2023, to borrow up to $1,700,000, of which it had received $1,500,000 as at September 30th, 2023. The loan had a maturity date twenty-four (24) months from the date of issuance and bore interest at a rate of five percent (5%) per annum for the first thirty days and ten percent (10%) per annum from the 31st day until the maturity date, or upon the early repayment of the loan in full, whichever came first. The loan was made by Lui Holdings for the purpose of satisfying the required deposits and other related payments for the acquisition of The FUSE (discussed in Corporate Update section below).

Highlights of the residential rental portfolio for the three and nine months ended September 30th, 2023 are:

Corporate Update

On October 12, 2023, the Company announced a non-brokered private placement of up to 2,200 unsecured convertible debentures at an issue price of $1,000 per convertible debenture for gross proceeds of $2,200,000. Each convertible debenture will have a principal amount of $1,000 with an interest rate equal to 8% per annum, payable annually, only in cash without any conversion of that interest component into common shares. Each convertible debenture will mature on the date that is five (5) years from the date of issuance. The Company, after a period of thirty-six (36) months following the date of closing, will also have the right, but not the obligation, to redeem the principal amount and any unpaid interest of the convertible debenture in cash, without penalty, at any time prior to the date of maturity subject to certain conditions. The principal amount of each convertible debenture may, at the option of the convertible debenture holder, be converted, in whole or in part, into common shares at a conversion price of $0.20 per common share.

On October 17, 2023, the Company completed an initial tranche closing on the private placement announced on October 12, 2023 with Lui Holdings, which included the loan from Lui Holdings (discussed in the Q3 2023 Financial Highlights section above), which adopted the terms and conditions of the convertible debentures offered in the private placement, for a total aggregate subscription of 2,000 convertible debentures in the principal amount of $2,000,000.

On October 17, 2023, the Company also closed on the acquisition of “The FUSE”, a one hundred and twenty-five (125) unit condominium grade multi-family residential complex that was constructed in 2015 and is comprised of two buildings situated on approximately 2.67 acres of land located in the Summerside neighborhood of Edmonton, Alberta for a purchase price of $25,625,000. As part of the financing of the acquisition of the property, the Company obtained a Canada Mortgage and Housing Corporation (“CMHC”) insured mortgage on The FUSE of $24,423,140 at a fixed interest rate of 4.0% per annum, amortized over 50 years, maturing on November 30, 2028 and secured by the property, general assignment of rent, specific assignment of present and future leases of the property, and general security agreement. In addition, as a condition on the mortgage payable, the property holding company is required to maintain a minimum of 80% of the units in The FUSE as “affordable units”, as defined by the CMHC, with residential rents at or below 30% of the median renter income in Edmonton, Alberta at the time of the issuance of the Certificate of Insurance (“COI”) and with allowable annual increases according to the Consumer Price Index (“CPI”) as stipulated by Statistics Canada for Alberta, of which the allowable rent increase is 6.4% for 2024.

On November 1, 2023, Yorkton successfully implemented the YARDI VOYAGER system, a cloud-based enterprise resource planning system (“ERP”) suite that covers all the key areas of finance, accounting, human resources, and property management, including marketing and leasing, business and market intelligence, customer relationship management (“CRM”), energy management, supply chain, and end-to-end procurement. It also can provide a two-way real-time connection with tenants via secure tenant portals and mobile applications for online payments, concierge services, maintenance requests, property and tenant documents, announcements and more. The YARDI system is being used to manage certain properties of the Company and other properties will be added in the future. It is expected that the use of YARDI will improve the efficiency and effectiveness of Yorkton’s operations and allow Yorkton’s management team to measure and monitor the progress and efficacy of its organic growth.

About Yorkton

Yorkton Equity Group Inc. is a growth-oriented real estate investment company committed to providing shareholders with growing assets through accretive acquisitions, organic growth, and the active management of multi-family rental properties with significant upside potential. Our current geographical focus is in Alberta and British Columbia with diversified and growing economies, and strong population in-migration. Our business objectives are to achieve growing Net Operating Income (“NOI”) as well as the asset values in our multi-family rental property portfolio in strategic markets across Western Canada.

The management team at Yorkton Equity Group Inc. has well over 30 years of prior real estate experience in acquiring and managing rental assets.

Further information about Yorkton is available on the Company’s website at www.yorktonequitygroup.com and the SEDAR+ website at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information on Yorkton, please contact:

Ben Lui, CEO - Corporate Office: (780) 409-8228

Yorkton Equity Group Inc. – Shareholder Communications: (780) 907-5263

Email: investors@yorktonequitygroup.com

Forward-looking information

This press release may include forward-looking information within the meaning of Canadian securities legislation concerning the business of Yorkton. Forward-looking information is based on certain key expectations and assumptions made by the management of Yorkton. Although Yorkton believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Yorkton can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. Yorkton disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended, or any applicable securities laws or any state of the United States and may not be offered or sold in the United States or to the account or benefit of a person in the United States absent an exemption from the registration requirement.