Archive

Jervois Global Quarterly Activities Report to 31 March 2023

| |||||||||

|  | ||||||||

Australia - TheNewswire - April 27, 2023 - Jervois Global Limited (ASX/TSX-V: JRV) (OTC:JRVMF)

Highlights

Jervois Finland:

-

Positive cash flow from operations of US$1.3 million resulting from business stabilisation and working capital improvements

-

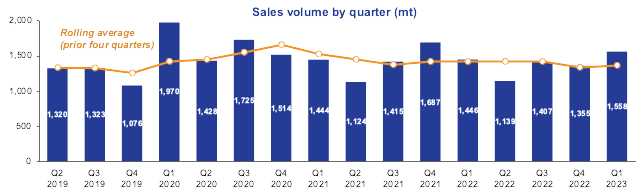

Q1 2023 cobalt sales of 1,558 metric tonnes, representing a +15% increase compared to prior quarter;

-

revenue US$58 million

-

Q1 was final quarter where high priced 2022 raw material purchases impacted financial results; Kokkola refinery expansion Bankable Feasibility Study pivoted to the U.S.

Idaho Cobalt Operations (“ICO”), United States (“U.S.”):

-

Final construction and commissioning suspended due to cobalt market conditions and U.S. inflationary impacts; restart to occur with higher cobalt prices

-

In-fill and expansion drill holes all intersected RAM’s main mineralised horizon

-

Updated Mineral Resource Estimate for RAM deposit offers opportunity to extend ICO mine life

-

U.S. Government (Department of Defense) grant for drilling and to assess construction of a U.S. cobalt refinery

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil:

-

Initial supply contract secured from Gordes plant in Turkey (marketed by Traxys Europe SA); up to 25% SMP nickel capacity for three years

-

Refinery restart pace moderated pending financing

Corporate:

-

Mercuria increased its shareholding to 8.8%

-

Jervois ends March 2023 quarter with US$50 million in cash, US$66 million physical cobalt inventories in Jervois Finland, and total drawn debt of US$170 million1

Resetting of business priorities for 2023

With cyclical weakness in the cobalt market currently impacting the business and operations of Jervois, the Company has adjusted its priorities to ensure long-term resilience and sustainability across the asset base.

The key priorities for 2023 are:

-

Consolidate Jervois Finland turnaround with objective of returning to positive EBITDA in April 2023 and maximising cash generation across Q2.

-

Deliver cost effective suspension phase at ICO and maximise restart optionality.

-

SMP restart pause; debt and partnership funding options advancing.

-

Execute U.S. Government funded ICO drilling programme and domestic refinery studies; advance other U.S. Government funding applications, including ATVM loan.

-

Maximise value for Nico Young nickel-cobalt laterite project via sales process.

Management is focussed on delivery of these priority activities as they will provide a solid foundation for the medium to long-term future of the Company. Even at current low cobalt prices, Jervois has a pathway to sustain its revised strategy.

Jervois Finland

-

Quarterly revenue: US$57.6 million (Q4 2022: US$73.0 million)

-

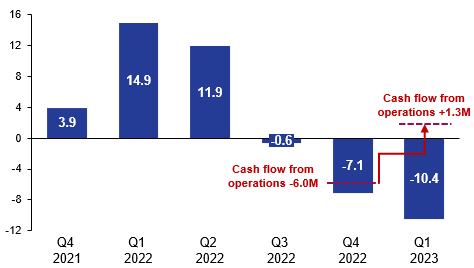

Cash flow from operations: US$1.3 million (Q4 2022: -US$6.0 million)

-

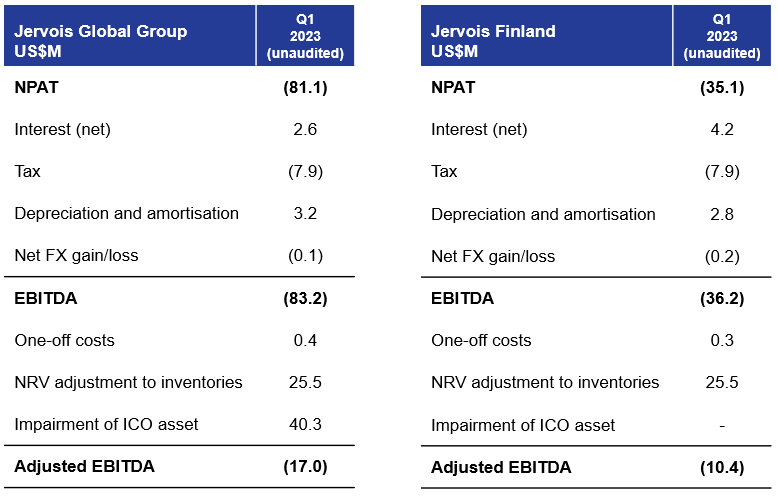

Adjusted EBITDA2 -US$10.4 million (Q4 2022: -US$7.1 million)

-

Sales volume: 1,558 metric tonnes (Q4 2022: 1,355 metric tonnes)

-

Production volume: 1,082 metric tonnes (Q4 2022: 1,258 metric tonnes)

Sales and Marketing

Jervois Finland produced 1,082 metric tonnes and sold 1,558 metric tonnes of cobalt in the quarter. Production was temporarily reduced early in the quarter to take account of finished goods inventory levels and underlying market demand.

Cobalt markets remained weak in the quarter driven by ongoing Chinese destocking, as reported in Q4 2022. The outlook across 2023 is expected to be more stable than the volatility experienced across 2022. Cobalt tonnage requested from the battery sector, including automakers, across the back end of 2023 and particularly from 2024 and beyond continues to be positive. Consumer electronics demand, which makes up around half of cobalt battery demand today, is expected to recover in 2024, from a record 13 per cent decline in 2022.

The Company’s outlook for key market segments is summarised below.

Batteries:

-

Inventory levels from existing customers remains high and demand subdued, and this is not expected to recover until Q4 2023 or 2024 at the earliest.

-

Recent U.S. Inflation Reduction Act of 2022 ("IRA”) indication that Japanese cobalt containing products will be considered eligible for the consumer electric vehicles (EVs”) credit have been positively received.

-

European and U.S. OEM or automaker enquiries have increased significantly, with strong volume and pricing requests from the start of 2024, and rising sharply in following years.

-

With increasing pressure to separate battery supply chains from China, Jervois Finland is undertaking a qualification process with many South Korean battery producers.

Chemicals, Catalysts and Ceramics:

-

Catalysts: Cobalt consumption in refinery applications firming across 2023, consumption by Jervois’s customers expected to be higher year on year.

-

Chemicals: Demand across key applications such as electrowinning, coatings and rubber adhesion chemicals are stable.

-

Ceramics: Key global ceramics markets are experiencing softer demand after the Covid-related surge in the home improvement market.

Powder Metallurgy:

-

Automotive remains weak across all global markets, with recovery expected in Q4 2023 and moving into 2024.

-

General engineering, including construction, is experiencing softening with interest rate increases and a slowing global economy.

-

U.S. oil and gas has remained robust. Aerospace has been strong due to high order intake.

Financial Performance3

Jervois Finland achieved revenue of US$57.6 million in the first quarter, a 21 per cent decline relative to the prior quarter. A 15 per cent increase in sales volumes, was more than offset by the impact of lower cobalt prices in the period.

Cash Flow Performance

Cash flow from operations (before interest payments) was US$1.3 million in the quarter. Positive cash flow resulted from the stabilisation of the Jervois Finland business following a period of volatility in 2022. Working capital improvements contributed to the cash flow results, with the planned unwind of inventory commencing in the quarter. Production rates were temporarily reduced in early Q1 as part of Jervois Finland’s response to market conditions, that generated cash savings and enabled the company to reduce inventories to meet sales commitments.

Adjusted EBITDA

Adjusted EBITDA was -US$10.4 million in the quarter, impacted by a decision to accelerate processing of remaining high-priced cobalt raw materials. Q1 2023 is expected to be the final quarter where raw material purchases linked to 2022 cobalt prices have an adverse impact on Jervois Finland’s EBITDA result. The high-priced raw materials are a legacy of contractual arrangements for purchasing cobalt hydroxide established prior to Jervois’ acquisition of the business. This has a resulted in feed costs realised in the profit and loss account in the first quarter that are significantly higher than the average cost (both payable and price) for settlement of new purchases in 2023. Normalisation of feed pricing in late first quarter is a key factor that underpins the company’s near-term expectation to return to positive EBITDA.

Operating cost pressures continued to impact margins in the quarter, including due to elevated pricing of key input costs, particularly into Umicore’s refinery. Caustic soda prices began to ease late in the first quarter. A continuation of this trend would contribute to stabilisation of operating margins in 2023. Jervois Finland has implemented operating efficiency and cost reduction programmes to offset headwinds from external factors.

Figure 2: Jervois Finland Adjusted EBITDA (US$M, unaudited)

Working Capital

Jervois Finland cobalt inventories reduced from 2,540 mt at 31 December 2022 to 2,196 mt at 31 March 2023. This represented an improvement from ~155 days to ~134 days. Jervois will continue to pursue a disciplined approach to the unwind of its inventory and expects to reach a target level of 90 to 110 days later in 2023. Jervois anticipates that a proportion of the cash released from working capital reductions will be used to meet partial repayment of the Mercuria working capital facility.

The net realisable value (“NRV”) of cobalt inventories as at 31 March 2023 was lower than historic cost and, therefore, a US$25.5 million non-cash accounting adjustment has been recorded in the first quarter. The NRV write-down is a non-cash adjustment to the book value of inventory and does not impact the economic gain or loss associated with the inventory position. The economic gain or loss is expected to be realised in future cash flows according to market conditions and other circumstances in the future period when the inventory is sold. The cost has been excluded from Adjusted EBITDA.

Kokkola Refinery Expansion Bankable Feasibility Study (“BFS”) Pivots to U.S.

The BFS for a proposed refinery expansion at the Kokkola Industrial Park in Finland will be redirected to be a study for a greenfield cobalt refinery in the U.S.; the BFS is now expected be completed based on this new location.

Jervois Finland’s technical team and engineering and consulting company AFRY Finland Oy (“AFRY”) have designed a BFS flowsheet for an initial refinery capacity of 6,000 mt per annum of contained cobalt in sulphate, the physical form required for the battery industry, including EVs.

AFRY will continue to provide specialist refinery expertise and leadership from Finland, but with the BFS to be run out of AFRY USA LLC. Jervois USA’s team in Salmon, Idaho, will also provide specialist support for the U.S. BFS across key areas such as environment and permitting, logistics, utilities and construction readiness. Jervois Finland, a leading supplier of high quality cobalt products and with 50 years of experience in cobalt refining and advanced manufacturing at Kokkola, will continue to provide stewardship of the BFS.

The IRA is a landmark piece of federal legislation designed to incentivise domestic energy production, promote clean energy, and support a U.S. transition away from fossil fuels, including for transportation. The legislation provides for more than US$390 billion to support U.S. climate and clean energy policies. A key focus of the legislation is to increase domestic extraction and processing rates of key battery materials and critical minerals including cobalt.

The IRA is designed to stimulate U.S. domestic cobalt refining and recycling activities. Jervois’ future U.S. cobalt refinery is expected to benefit from, inter alia, a 10 percent operating cost credit for the duration of its operating life. Despite initial steps by Europe through its recent 2023 European Union Critical Raw Materials Act and Net Zero Industry Act, this represents a material competitive advantage over facilities not located in the U.S. In addition, Jervois is encouraged by discussions with the U.S. Department of Energy (“DOE”) regarding various loan and grant programmes that are expected to be available to support refinery construction. Jervois announced on 24 April 2023 its funding application under the DOE’s Advanced Technology Vehicles Manufacturing Loan Program (“ATVM”).

Idaho Cobalt Operations (“ICO”), U.S.

ICO Development

The mine component of ICO’s construction has been completed, with a successful start to underground stoping and more than 30,000 short tons of ore ready for processing.

However, the current U.S. inflationary construction and cost environment, particularly at ICO’s remote location, has proven challenging for Jervois to manage effectively.

In late March, Jervois announced a decision to suspend final construction and full concentrator commissioning at ICO due to continuing low cobalt prices and the U.S. inflationary impacts on construction costs.

ICO’s mineral resource and reserve is the largest and highest grade confirmed cobalt orebody in the U.S. and, when commissioned, will represent the country’s only primary cobalt mine supply. Cobalt is a critical mineral as declared by the U.S. Government. Jervois has determined that not mining ICO cobalt at cyclically low prices will preserve the optionality and inherent strategic value of ICO for shareholders and key stakeholders, including local communities and the State of Idaho. The Company also views not mining ICO at current prices is consistent with U.S. Government critical mineral policy objectives.

Jervois remains confident regarding the medium- and longer-term future of cobalt. The trajectory of structurally higher prices is expected to be increasingly influenced by rising cobalt demand from the energy transition including EVs. The Company’s expectation also is that Western cobalt purchasers will increasingly prefer cobalt from sources with Western ESG credentials, particularly given the concentration of supply from the Democratic Republic of Congo and China.

The U.S. Department of Defense (“DOD”) has advised that it intends to award Jervois an immediate need for Defense Production Act (“DPA”) Title III with US$15 million of funding through a Not to Exceed Technology Investment Agreement. The DOD award is subject to Jervois successfully completing required documentary steps including agreement to terms and conditions of the award; this process continues.

Jervois applied for the DOD award monies to accelerate its drilling aimed at increasing the ICO mineral resource and reserve, and for studies to assess construction of a U.S. cobalt refinery; both can proceed despite ICO’s suspension.

Jervois views the DOD’s intention to issue its award as an indication of the importance to the U.S. Government of securing its cobalt supply chain. Accordingly, the Company continues to engage with the U.S. Department of Energy and EXIM, the official export credit agency of the U.S., on further financing initiatives. Whilst there can be no assurance any additional funding will be received, Jervois believes U.S. Government support in developing a viable domestic cobalt supply chain is important given the energy transition and Jervois’ expectation that Western cobalt purchasers will increasingly prefer cobalt from sources with Western ESG credentials, such as ICO.

Jervois has safely completed ICO site demobilisation and total workforce, including contractors, will be ramped down to approximately 30 during suspension, which represents a fit-for-purpose workforce to maintain the site in compliance with its regulatory requirements and execute the envisaged DOD programmes.

ICO continues to be a key part of delivering Jervois’ strategy of acquiring and operating geopolitically strategic mining and critical mineral processing assets important to energy transition and the defence industry.

Updated Mineral Reserve and Resource Estimate and Drilling

In-fill and expansion drilling campaigns conducted throughout 2022 returned promising results which Jervois has incorporated into an updated Mineral Resource Estimate (“MRE”) for the RAM deposit, which was calculated in accordance with standards set forth in both the Australasian JORC Code 2012 (“JORC”) and by the Canadian Institute of Mining (“CIM”).

The 2022 drilling programme at ICO consisted of 10,300 metres (“m”) in 69 completed diamond drill holes. With the exception of a single geotechnical drillhole, the 2022 drilling focused on the RAM deposit underpinning current mine development at ICO, and its down-dip extents, and comprised 62 infill drillholes (totalling 7,730m) and six targeted RAM resource expansion drillholes (totalling 2,300m).

In-fill Drilling:

In-fill drilling targeted the Main Mineralised Horizon (“MMH”) of the RAM deposit. All holes drilled intersected the MMH, indicating continuity and consistency with existing RAM resource drilling and correspond well with grades and widths predicted by the previous 2020 RAM resource model.

In total, Jervois has now drilled 81 drill holes targeting the MMH of the RAM deposit since acquiring the project in mid-2019 (including 19 holes completed in late 2019), with all holes intersecting mineralisation. This represents an increase of more than 80 per cent with respect to the total number of resource drillholes defining the RAM deposit prior to Jervois ownership; a step change in orebody delineation and de-risking its mine plan.

Expansion Drilling:

Expansion drilling (holes outside the existing wireframes supporting the current MRE) returned results of:

-

6.0m calculated true width (CTW”) @ 0.58% cobalt (“Co”), 0.66% copper (“Cu”) and 0.31 grams per metric tonne gold (“g/t Au”) (Drill hole JS22-001B)

-

2.4m CTW @ 0.27% Co, 0.67% Cu and 0.14 g/t Au (Drill hole JU22-064)

-

3.1m CTW @ 0.43% Co, 0.17% Cu and 0.34 g/t Au (Drill hole JU22-065)

-

3.9m CTW @ 0.16% Co, 2.20% Cu and 1.03 g/t Au (Drill hole JU22-066)

-

5.8m CTW @ 0.31% Co, 1.50% Cu and 0.38 g/t Au (Drill hole JU22-068)

-

5.7m CTW @ 0.37% Co, 1.37% Cu and 0.89 g/t Au (Drill hole JU22-069).

All holes encountered mineralisation with all of their respective hanging walls, and all except one of their MMH intersections occurring outside of the extents of the current JORC and CIM compliant MRRE and current mine model, as described in the ICO BFS. Together with two 2019 holes that tested foot wall targets underlaying the RAM deposit4, all eight targeted exploration or expansion holes outside of the 2020 defined MRRE intersected mineralisation.

These drilling results continue to confirm that the RAM orebody is expected to support extended mine life at ICO and introduces the potential for higher annual production rates5. The RAM deposit remains open at depth and along strike, and Jervois is confident that there is significant potential of both resource and reserve expansion.

Table 1: RAM deposit Expansion Drilling Results

|

Hole ID |

Zone |

From (m) |

To (m) |

Calculated True Width* (m) |

Cobalt (%) |

Copper (%) |

Gold (g/t) |

|

JS22-001B |

MMH |

417.9 |

425.2 |

6.0 |

0.58 |

0.66 |

0.31 |

|

JU22-064 |

MMH |

294.4 |

297.8 |

2.4 |

0.27 |

0.67 |

0.14 |

|

JU22-065 |

HW |

300.7 |

306.3 |

2.9 |

1.21 |

2.04 |

0.99 |

|

JU22-065 |

MMH |

375.8 |

381.3 |

3.1 |

0.43 |

0.17 |

0.34 |

|

Including |

375.8 |

378.6 |

1.6 |

0.71 |

0.32 |

0.62 |

|

|

JU22-066 |

MMH |

241.1 |

247.4 |

3.9 |

0.16 |

2.20 |

1.03 |

|

JU22-068 |

MMH |

274.9 |

282.6 |

5.8 |

0.31 |

1.50 |

0.38 |

|

Including |

281.0 |

282.6 |

1.3 |

0.63 |

3.81 |

0.86 |

|

|

JU22-069 |

MMH |

312.4 |

321.6 |

5.7 |

0.37 |

1.37 |

0.89 |

|

Including |

313.0 |

317.9 |

2.9 |

0.50 |

2.13 |

1.41 |

|

Updated Mineral Resource Estimate

Jervois completed an updated JORC/CIM compliant MRE in April 20236, which incorporates the above drilling results.

An updated MRE for the RAM deposit is presented below (Tables 2 and 3) at a series of cut-off grades (“CoG”) that includes a 0.15% Co CoG, which was the reported CoG for the previous 2020 MRE, as well as the 0.20% Co CoG that has been selected for current reporting, due to a revised evaluation of anticipated mining and processing costs. The current ICO mineral resource estimation work incorporates revised geological modelling that more accurately represents Co-Cu mineralisation within the RAM deposit. The revised modelling approach, along with modified resource categorisation criteria, has resulted in a minor decrease in tonnage (-11%) of the 2023 total Measured and Indicated (“M&I”) resources relative to the 2020 MRE. However, these changes have also resulted in corresponding increases in Co and Cu grades of +6% and +12%, respectively.

Table 2: Measured and Indicated Mineral Resources (Inclusive of Mineral Reserves)

|

Measured and Indicated Mineral Resources (Inclusive of Mineral Reserves) |

|||||||||||||||

|

2023 MRE |

2020 MRE |

||||||||||||||

|

Co Cut-off (%) |

Metric tonnes |

Co (%) |

Co (lbs) |

Cu (%) |

Cu (lbs) |

Au (g/t) |

Au (Oz*) |

Metric tonnes |

Co (%) |

Co (lbs) |

Cu (%) |

Cu (lbs) |

Au (g/t) |

Au (Oz*) |

|

|

0.15 |

4,350,000 |

0.48 |

45,750,000 |

0.79 |

76,270,000 |

0.50 |

70,354 |

5,230,000 |

0.44 |

50,100,000 |

0.69 |

80,060,000 |

0.53 |

89,260 |

|

|

0.20 |

3,780,000 |

0.52 |

43,540,000 |

0.84 |

69,820,000 |

0.54 |

65,299 |

4,260,000 |

0.49 |

46,300,000 |

0.75 |

70,080,000 |

0.60 |

82,300 |

|

|

0.25 |

3,260,000 |

0.57 |

40,990,000 |

0.87 |

62,680,000 |

0.57 |

59,447 |

3,500,000 |

0.56 |

42,600,000 |

0.79 |

61,270,000 |

0.65 |

73,220 |

|

|

0.30 |

2,780,000 |

0.62 |

38,110,000 |

0.92 |

56,180,000 |

0.61 |

54,211 |

2,920,000 |

0.61 |

39,100,000 |

0.83 |

53,620,000 |

0.68 |

64,220 |

|

|

0.35 |

2,410,000 |

0.67 |

35,420,000 |

0.95 |

50,330,000 |

0.64 |

49,390 |

2,440,000 |

0.66 |

35,600,000 |

0.86 |

46,520,000 |

0.73 |

57,450 |

|

*Troy ounce

Table 3: Inferred Mineral Resources

|

Inferred Mineral Resources |

|||||||||||||||

|

2023 MRE |

2020 MRE |

||||||||||||||

|

Co Cut-off (%) |

Metric tonnes |

Co (%) |

Co (lbs) |

Cu (%) |

Cu (lbs) |

Au (g/t) |

Au (Oz*) |

Metric tonnes |

Co (%) |

Co (lbs) |

Cu (%) |

Cu (lbs) |

Au (g/t) |

Au (Oz*) |

|

|

0.15 |

1,940,000 |

0.45 |

19,330,000 |

0.83 |

35,550,000 |

0.58 |

36,156 |

1,570,000 |

0.35 |

12,000,000 |

0.44 |

13,820,000 |

0.45 |

22,490 |

|

|

0.20 |

1,590,000 |

0.51 |

17,990,000 |

0.92 |

32,250,000 |

0.65 |

33,053 |

1,110,000 |

0.42 |

10,300,000 |

0.50 |

11,100,000 |

0.55 |

19,520 |

|

|

0.25 |

1,370,000 |

0.56 |

16,880,000 |

0.98 |

29,660,000 |

0.69 |

30,558 |

830,000 |

0.49 |

8,900,000 |

0.56 |

9,300,000 |

0.62 |

16,380 |

|

|

0.30 |

1,160,000 |

0.61 |

15,580,000 |

1.05 |

26,800,000 |

0.75 |

27,885 |

610,000 |

0.57 |

7,600,000 |

0.65 |

7,930,000 |

0.72 |

14,070 |

|

|

0.35 |

970,000 |

0.67 |

14,280,000 |

1.09 |

23,420,000 |

0.80 |

24,877 |

450,000 |

0.65 |

6,400,000 |

0.71 |

6,390,000 |

0.72 |

10,500 |

|

*Troy ounce

Table 4: ICO Underground Constrained Mineral Resource Estimate @ 0.20% Co CoG

|

Classification |

Tonnes |

Co (%) |

Co (lbs) |

Cu (%) |

Cu (lbs) |

Au (g/t) |

Au (Oz*) |

|

Measured |

460,000 |

0.70 |

7,100,000 |

1.16 |

11,800,000 |

0.783 |

11,500 |

|

Indicated |

3,320,000 |

0.50 |

36,500,000 |

0.79 |

58,000,000 |

0.504 |

54,000 |

|

M&I |

3,780,000 |

0.52 |

43,600,000 |

0.84 |

69,800,000 |

0.538 |

65,500 |

|

Inferred |

1,590,000 |

0.51 |

18,000,000 |

0.92 |

32,300,000 |

0.645 |

33,000 |

*Troy ounce

Notes:

-

Mr. Andrew Turner, P.Geol. of APEX Geoscience Ltd., a Qualified Person as defined by NI 43-101 and a Competent Person as defined by JORC, is responsible for the completion of the updated mineral resource estimation, with an effective date of April 1, 2023.

-

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

-

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

-

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

-

The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

-

The cut-off grade of 0.20% Co is based on an estimated process cost and GA cost of US$123.17/t, and metal prices of US$25.00/lb Co, US$3.00/lb Cu, and US$1,750/troy oz Au, with process recoveries of 91.0% Co, 95.4% Cu, and 84.9% Au. An average contribution of 22% to Co payable values from Cu and Au has been assumed based upon the relative concentrations of the payable metals within the reported MI resources.

-

The reported mineral resources are constrained by manually created wireframe solids (mineable shapes) that encapsulate contiguous blocks demonstrating reasonable prospects for eventual economic extraction within the minable shapes.

Jervois anticipates it will continue expansion drilling throughout 2023 to further explore the open extents of the RAM deposit, provided documentary steps to formalise the U.S. DOD US$15 million award under the DPA Title III programme can be finalised rapidly.

In addition, Jervois continues permitting efforts to drill 12 holes at the neighbouring Sunshine and East Sunshine deposits this coming U.S. summer (June – August 2023) to confirm historic datasets of more than 100 holes and 19,000m of prior drilling. A final decision on drilling the Sunshine deposit will be made based upon the timing under which the DPA Title III programme can be finalised.

Sunshine is a 100%-owned Jervois property located a short distance from ICO’s processing facilities and infrastructure. In addition to the Sunshine area, Jervois continues to evaluate additional exploration targets at ICO.

Non-cash Impairment Charge

As noted in the ASX release “Jervois suspends final construction at Idaho Cobalt Operations” (29 March 2023), Jervois commenced a review of ICO’s asset carrying value on the group's balance sheet because of the suspension. The review was completed in April 2023 and has resulted in a non-cash impairment charge of US$40 million at 31 March 2023. The impairment is based on Jervois’ best estimate at this time. As outlined in the 31 December 2022 accounts, the recoverable amount is sensitive to a number of future assumptions. Future changes to assumptions could lead to further impairment or reversal of the impairment charge recorded at 31 March 2023.

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil

Jervois has moderated the pace of restart of the SMP nickel and cobalt refinery in São Paulo, Brazil. First production is estimated to be 12 months from full mobilisation. The project cost guidance remains unchanged (R$345 million or ~US$65 million) with near-term costs minimised. Discussions with lenders and other interested parties continue to advance.

During the quarter, Jervois announced it has entered into a raw material supply agreement for the restart phase of SMP with Traxys Europe S.A. (“Traxys”) for the supply of MHP from the Gordes nickel-cobalt facility in Turkey.

Jervois supply agreement with Traxys is expected to provide a base load of MHP feed of up to approximately 25 per cent of SMP’s annual nickel feed requirement over an initial period of 36 months. Jervois will initially restart SMP in a staged, capital efficient manner, below its prior 25,000 mtpa nickel capacity, basis the BFS completed in April 2022. Expected initial refined production is 10,000 mtpa nickel and 2,000 mtpa cobalt metal cathode.

SMP is located within the São Paulo city limits with ready access to labour, utilities and services and is 120km via highway from the largest container port in Brazil (Santos), ensuring it is well placed to serve domestic and export markets.

SMP previously produced ‘Tocantins’ nickel and cobalt products, which are well established domestically in Brazil and in key Western export markets such as Europe and Japan. The Company’s commercial team are re-establishing nickel and cobalt customer relationships.

Progress was made with suppliers of materials, equipment and services representing over 50% of capital expenditure identified and negotiated. The main contractor selection (over 30% of total project capital expenditure) has been concluded.

Nico Young Nickel-Cobalt Project, New South Wales (“NSW”), Australia

As part of an ongoing portfolio review, Jervois has determined that Nico Young nickel and cobalt project is no longer core to the company’s strategy. Jervois will commence a divestment process and expects to pursue the sale of all or part of its 100 per cent interest.

During the quarter, Jervois completed an infill drilling campaign at Nico Young as part of work initiated towards a BFS. The drill programme comprised eighty-six drill holes totalling slightly over 3,000m and was designed to increase confidence in the mineral resource by converting portions of the Ardnaree deposit from the Inferred to Indicated category. The drilling was successfully executed by Wallis Drilling Pty. Ltd.

Jervois was awarded funding under the NSW Government Critical Minerals Activation Fund, Stream 1, for environmental studies and metallurgical testwork associated with a BFS for Nico Young. The Critical Minerals and High-Tech Activation Fund is designed to support regional NSW to become a global leader in these sectors. The award of A$0.5 million will supplement Jervois’ and/or future Nico Young owners’ contribution to these studies.

The funding supports further environmental and metallurgical testwork and will underpin environmental and infrastructure permitting required to advance the project’s development. These studies are a critical element that will improve process definition, progress water access management and key Environmental Impact Studies, define the product path-to-market, de-risk the project and support project financing. Funding for the complete BFS is subject of a separate application under the Australian Federal Government’s Critical Minerals Development Program.

Nico Young nickel and cobalt deposits are comprised of mineralisation bodies held under separate but adjacent exploration licenses, “Ardnaree” and “Thuddungra”. The project envisages heap leaching nickel and cobalt laterite ore to produce MHP. In prior roles, Jervois’ Directors and Executives constructed, commissioned, and operated the only commercially successful nickel – cobalt heap leach operation outside of China at Glencore’s Murrin Murrin facility in Western Australia, which was based on ores similar to Nico Young.

Jervois’ view is that heap leaching is the most attractive development route for the low-grade nickel-cobalt laterite mineralisation typical of Eastern Australia. Heap leaching nickel laterites containing a high silica and low iron contents in dry climates has lower capital intensity, a reduced carbon footprint and less technical and environmental risk compared to the high capital, energy intensive, elevated construction and operating risk nature of high-pressure acid leach facilities.

Corporate Activities

Liquidity

Jervois ended the March 2023 quarter with US$49.8 million in cash, US$66.0 million in physical cobalt inventories in Jervois Finland, and total drawn debt of US$170 million.

At 31 March 2023, Jervois has spent ~US$130 million in cash on construction at ICO. Since the December 2022 year end, Jervois has paid down US$45 million of its US$150 million Mercuria loan facility, resulting in a decrease from the end December 2022 drawn balance of US$115 million to US$70 million. The Company’s US$100 million senior secured bonds remain due in July 2026, with no prior amortisation.

Jervois remains in compliance with its bond covenants and there is no expected adverse impact on the bonds to Jervois based on the suspension of operations at ICO.

Director On-Market Buying

In March 2023, Jervois Board members acquired more than A$0.65 million of Jervois shares in on-market purchases.

This included Non-Executive Chairman Peter Johnston, who acquired 3,681,317 shares for A$0.225 million, Non-Executive Director David Issroff, who acquired 5,000,000 shares for A$0.315 million and Non-Executive Director Brian Kennedy, who acquired 2,000,000 shares for A$0.112 million.

Environmental, Social, Governance (“ESG”) and Compliance

ESG Integration:

Embedding ESG within management Key Performance Indicators (“KPIs”) is a powerful tool for driving sustainable business practices and building a strong, resilient company that can thrive in the long-term. In efforts to further embed ESG throughout the organisation, a review was completed with all members of the executive and senior management team to identify entry points to strengthen the integration of ESG within management KPIs. In 2022, three-quarters of the management team had KPIs related to ESG with an average weight of 21%. In 2023, Jervois aims to ensure each management team member has at least one ESG KPI, with areas of focus aligned with core functions of individuals.

Given the phase of activities at SMP in Brazil, considerable focus was given in the quarter to ESG integration within legal, finance, human resources, procurement, environment, health and safety and community engagement functions. With a strong focus on emerging ESG legislation and industry standards, the groundwork was laid to enable SMP to align with Jervois’ group-wide efforts to support responsible supply chain management, enhanced environmental and human rights due diligence and diversity, equity and inclusion. In conjunction with this, SMP’s management team initiated a joint review of its risk management processes and mechanisms to further integrate human rights and other ESG dimensions. Considerable progress was made towards finalising SMP’s Stakeholder Engagement Plan as outreach to adjacent communities continued.

Sustainability Disclosures:

Work during the quarter focused on finalisation of Jervois’ second annual Sustainability Report. Jervois looks forward to disseminating this report, highlighting progress across the spectrum of material ESG priorities, in the next quarter.

Engaging the Global Community:

During the quarter, Jervois’ Group Manager, ESG, Dr. Jennifer Hinton, took on the role as Chair of the Cobalt Institute (“CI”) Responsible Sourcing and Sustainability Committee (“RESSCOM”). Engagement in RESSCOM and CI’s Government Affairs Committee and Chemicals Management Committee included participation in committee meetings and various working groups, including on decarbonisation and the circular economy, and contribution to ESG related submissions.

In the quarter, Jervois continued its engagement with the National Mining Association including through participation in resource sessions on the Task Force on Nature-related Financial Disclosures and Chain-of-Custody Solutions from the London Metal Exchange.

Exploration and Development Expenditure

During the quarter, Jervois incurred cash outflows of US$0.3 million relating to exploration and development at the Nico Young nickel-laterite project in New South Wales, Australia.

Insider Compensation Reporting

During the quarter, US$0.1 million was paid to Non-Executive Directors and US$0.1 million was paid to the CEO (Executive Director).

Non-Core Assets

The non-core assets are summarised on the Company’s website. Jervois will continue to assess options to divest these interests.

ASX Waiver Information

On 6 June 2019, the ASX granted a waiver to Jervois in respect of extending the period to 8 November 2023 in which it may issue new Jervois shares to the eCobalt option holders as part of the eCobalt transaction.

As at 31 March 2023, the following Jervois shares were issued in the quarter on exercise of eCobalt options and the following eCobalt options remain outstanding:

|

Jervois shares issued in the quarter on exercise of eCobalt options: |

Nil |

|

eCobalt options remaining7 |

|

|

1,179,750 1,980,000 |

eCobalt options exercisable until 28 June 2023 at C$0.61 each eCobalt options exercisable until 1 October 2023 at C$0.53 each |

|

3,159,750 |

|

By Order of the Board

Bryce Crocker

Chief Executive Officer

For further information, please contact:

|

Investors and analysts: James May Chief Financial Officer Jervois Global Limited |

Media: Nathan Ryan NWR Communications nathan.ryan@nwrcommunications.com.au Mob: +61 420 582 887 |

Forward-Looking Statements

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to future sales for the group, operations at Jervois Finland, construction work undertaken at ICO, timing of restart of operations at ICO, timing of restart of SMP refinery, third party feed to SMP, sales from SMP and the reliability of third party information, and certain other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Financial Summary

Reconciliation of NPAT to EBITDA and Adjusted EBITDA

EBITDA is a non-IFRS financial measure. EBITDA is presented as net income after adding back interest, tax, depreciation and amortisation, and extraordinary items. Adjusted EBITDA represents EBITDA adjusted to exclude items which do not reflect the underlying performance of the company’s operations. Exclusions from adjusted EBITDA are items that require exclusion in order to maximise insight and consistency on the financial performance of the company’s operations.

Exclusions include gains/losses on disposals, impairment charges (or reversals), certain derivative items, NRV adjustments to inventories, and one-off costs related to post-acquisition integration.

Tenements

Australian Tenements

|

Ardnaree (NSW) |

EL 5527 |

100.0 |

|

|

Thuddungra (NSW) |

EL 5571 |

100.0 |

|

|

Nico Young (NSW) |

EL 8698 |

100.0 |

|

|

West Arunta (WA) |

E80 4820 |

17.9 |

|

|

West Arunta (WA) |

E80 4986 |

17.9 |

|

|

West Arunta (WA) |

E80 4987 |

17.9 |

|

Kilembe Area |

EL0292 |

100.0 |

|

|

Kilembe Area |

EL0012 |

100.0 |

|

|

SUN 1 |

222991 |

174156 |

|

|

SUN 2 |

222992 |

174157 |

|

|

SUN 3 Amended |

245690 |

174158 |

|

|

SUN 4 |

222994 |

174159 |

|

|

SUN 5 |

222995 |

174160 |

|

|

SUN 6 |

222996 |

174161 |

|

|

SUN 7 |

224162 |

174628 |

|

|

SUN 8 |

224163 |

174629 |

|

|

SUN 9 |

224164 |

174630 |

|

|

SUN 16 Amended |

245691 |

177247 |

|

|

SUN 18 Amended |

245692 |

177249 |

|

|

Sun 19 |

277457 |

196394 |

|

|

SUN FRAC 1 |

228059 |

176755 |

|

|

SUN FRAC 2 |

228060 |

176756 |

|

|

TOGO 1 |

228049 |

176769 |

|

|

TOGO 2 |

228050 |

176770 |

|

|

TOGO 3 |

228051 |

176771 |

|

|

DEWEY FRAC Amended |

248739 |

177253 |

|

|

Powder 1 |

269506 |

190491 |

|

|

Powder 2 |

269505 |

190492 |

|

|

LDC-1 |

224140 |

174579 |

|

|

LDC-2 |

224141 |

174580 |

|

|

LDC-3 |

224142 |

174581 |

|

|

LDC-5 |

224144 |

174583 |

|

|

LDC-6 |

224145 |

174584 |

|

|

LDC-7 |

224146 |

174585 |

|

|

LDC-8 |

224147 |

174586 |

|

|

LDC-9 |

224148 |

174587 |

|

|

LDC-10 |

224149 |

174588 |

|

|

LDC-11 |

224150 |

174589 |

|

|

LDC-12 |

224151 |

174590 |

|

|

LDC-13 Amended |

248718 |

174591 |

|

|

LDC-14 Amended |

248719 |

174592 |

|

|

LDC-16 |

224155 |

174594 |

|

|

LDC-18 |

224157 |

174596 |

|

|

LDC-20 |

224159 |

174598 |

|

|

LDC-22 |

224161 |

174600 |

|

|

LDC FRAC 1 Amended |

248720 |

175880 |

|

|

LDC FRAC 2 Amended |

248721 |

175881 |

|

|

LDC FRAC 3 Amended |

248722 |

175882 |

|

|

LDC FRAC 4 Amended |

248723 |

175883 |

|

|

LDC FRAC 5 Amended |

248724 |

175884 |

|

|

RAM 1 |

228501 |

176757 |

|

|

RAM 2 |

228502 |

176758 |

|

|

RAM 3 |

228503 |

176759 |

|

|

RAM 4 |

228504 |

176760 |

|

|

RAM 5 |

228505 |

176761 |

|

|

RAM 6 |

228506 |

176762 |

|

|

RAM 7 |

228507 |

176763 |

|

|

RAM 8 |

228508 |

176764 |

|

|

RAM 9 |

228509 |

176765 |

|

|

RAM 10 |

228510 |

176766 |

|

|

RAM 11 |

228511 |

176767 |

|

|

RAM 12 |

228512 |

176768 |

|

|

RAM 13 Amended |

245700 |

181276 |

|

|

RAM 14 Amended |

245699 |

181277 |

|

|

RAM 15 Amended |

245698 |

181278 |

|

|

RAM 16 Amended |

245697 |

181279 |

|

|

Ram Frac 1 Amended |

245696 |

178081 |

|

|

Ram Frac 2 Amended |

245695 |

178082 |

|

|

Ram Frac 3 Amended |

245694 |

178083 |

|

|

Ram Frac 4 Amended |

245693 |

178084 |

|

|

HZ 1 |

224173 |

174639 |

|

|

HZ 2 |

224174 |

174640 |

|

|

HZ 3 |

224175 |

174641 |

|

|

HZ 4 |

224176 |

174642 |

|

|

HZ 5 |

224413 |

174643 |

|

|

HZ 6 |

224414 |

174644 |

|

|

HZ 7 |

224415 |

174645 |

|

|

HZ 8 |

224416 |

174646 |

|

|

HZ 9 |

224417 |

174647 |

|

|

HZ 10 |

224418 |

174648 |

|

|

HZ 11 |

224419 |

174649 |

|

|

HZ 12 |

224420 |

174650 |

|

|

HZ 13 |

224421 |

174651 |

|

|

HZ 14 |

224422 |

174652 |

|

|

HZ 15 |

231338 |

178085 |

|

|

HZ 16 |

231339 |

178086 |

|

|

HZ 18 |

231340 |

178087 |

|

|

HZ 19 |

224427 |

174657 |

|

|

Z 20 |

224428 |

174658 |

|

|

HZ 21 |

224193 |

174659 |

|

|

HZ 22 |

224194 |

174660 |

|

|

HZ 23 |

224195 |

174661 |

|

|

HZ 24 |

224196 |

174662 |

|

|

HZ 25 |

224197 |

174663 |

|

|

HZ 26 |

224198 |

174664 |

|

|

HZ 27 |

224199 |

174665 |

|

|

HZ 28 |

224200 |

174666 |

|

|

HZ 29 |

224201 |

174667 |

|

|

HZ 30 |

224202 |

174668 |

|

|

HZ 31 |

224203 |

174669 |

|

|

HZ 32 |

224204 |

174670 |

|

|

HZ FRAC |

228967 |

177254 |

|

|

JC 1 |

224165 |

174631 |

|

|

JC 2 |

224166 |

174632 |

|

|

JC 3 |

224167 |

174633 |

|

|

JC 4 |

224168 |

174634 |

|

|

JC 5 Amended |

245689 |

174635 |

|

|

JC 6 |

224170 |

174636 |

|

|

JC FR 7 |

224171 |

174637 |

|

|

JC FR 8 |

224172 |

174638 |

|

|

JC 9 |

228054 |

176750 |

|

|

JC 10 |

228055 |

176751 |

|

|

JC 11 |

228056 |

176752 |

|

|

JC-12 |

228057 |

176753 |

|

|

JC-13 |

228058 |

176754 |

|

|

JC 14 |

228971 |

177250 |

|

|

JC 15 |

228970 |

177251 |

|

|

JC 16 |

228969 |

177252 |

|

|

JC 17 |

259006 |

187091 |

|

|

JC 18 |

259007 |

187092 |

|

|

JC 19 |

259008 |

187093 |

|

|

JC 20 |

259009 |

187094 |

|

|

JC 21 |

259010 |

187095 |

|

|

JC 22 |

259011 |

187096 |

|

|

CHELAN NO. 1 Amended |

248345 |

175861 |

|

|

GOOSE 2 Amended |

259554 |

175863 |

|

|

GOOSE 3 |

227285 |

175864 |

|

|

GOOSE 4 Amended |

259553 |

175865 |

|

|

GOOSE 6 |

227282 |

175867 |

|

|

GOOSE 7 Amended |

259552 |

175868 |

|

|

GOOSE 8 Amended |

259551 |

175869 |

|

|

GOOSE 10 Amended |

259550 |

175871 |

|

|

GOOSE 11 Amended |

259549 |

175872 |

|

|

GOOSE 12 Amended |

259548 |

175873 |

|

|

GOOSE 13 |

228028 |

176729 |

|

|

GOOSE 14 Amended |

259547 |

176730 |

|

|

GOOSE 15 |

228030 |

176731 |

|

|

GOOSE 16 |

228031 |

176732 |

|

|

GOOSE 17 |

228032 |

176733 |

|

|

GOOSE 18 Amended |

259546 |

176734 |

|

|

GOOSE 19 Amended |

259545 |

176735 |

|

|

GOOSE 20 |

228035 |

176736 |

|

|

GOOSE 21 |

228036 |

176737 |

|

|

GOOSE 22 |

228037 |

176738 |

|

|

GOOSE 23 |

228038 |

176739 |

|

|

GOOSE 24 |

228039 |

176740 |

|

|

GOOSE 25 |

228040 |

176741 |

|

|

SOUTH ID 1 Amended |

248725 |

175874 |

|

|

SOUTH ID 2 Amended |

248726 |

175875 |

|

|

SOUTH ID 3 Amended |

248727 |

175876 |

|

|

SOUTH ID 4 Amended |

248717 |

175877 |

|

|

SOUTH ID 5 Amended |

248715 |

176743 |

|

|

SOUTH ID 6 Amended |

248716 |

176744 |

|

|

South ID 7 |

306433 |

218216 |

|

|

South ID 8 |

306434 |

218217 |

|

|

South ID 9 |

306435 |

218218 |

|

|

South ID 10 |

306436 |

218219 |

|

|

South ID 11 |

306437 |

218220 |

|

|

South ID 12 |

306438 |

218221 |

|

|

South ID 13 |

306439 |

218222 |

|

|

South ID 14 |

306440 |

218223 |

|

|

OMS-1 |

307477 |

218904 |

|

|

Chip 1 |

248956 |

184883 |

|

|

Chip 2 |

248957 |

184884 |

|

|

Chip 3 Amended |

277465 |

196402 |

|

|

Chip 4 Amended |

277466 |

196403 |

|

|

Chip 5 Amended |

277467 |

196404 |

|

|

Chip 6 Amended |

277468 |

196405 |

|

|

Chip 7 Amended |

277469 |

196406 |

|

|

Chip 8 Amended |

277470 |

196407 |

|

|

Chip 9 Amended |

277471 |

196408 |

|

|

Chip 10 Amended |

277472 |

196409 |

|

|

Chip 11 Amended |

277473 |

196410 |

|

|

Chip 12 Amended |

277474 |

196411 |

|

|

Chip 13 Amended |

277475 |

196412 |

|

|

Chip 14 Amended |

277476 |

196413 |

|

|

Chip 15 Amended |

277477 |

196414 |

|

|

Chip 16 Amended |

277478 |

196415 |

|

|

Chip 17 Amended |

277479 |

196416 |

|

|

Chip 18 Amended |

277480 |

196417 |

|

|

Sun 20 |

306042 |

218133 |

|

|

Sun 21 |

306043 |

218134 |

|

|

Sun 22 |

306044 |

218135 |

|

|

Sun 23 |

306045 |

218136 |

|

|

Sun 24 |

306046 |

218137 |

|

|

Sun 25 |

306047 |

218138 |

|

|

Sun 26 |

306048 |

218139 |

|

|

Sun 27 |

306049 |

218140 |

|

|

Sun 28 |

306050 |

218141 |

|

|

Sun 29 |

306051 |

218142 |

|

|

Sun 30 |

306052 |

218143 |

|

|

Sun 31 |

306053 |

218144 |

|

|

Sun 32 |

306054 |

218145 |

|

|

Sun 33 |

306055 |

218146 |

|

|

Sun 34 |

306056 |

218147 |

|

|

Sun 35 |

306057 |

218148 |

|

|

Sun 36 |

306058 |

218149 |

|

|

Chip 21 Fraction |

306059 |

218113 |

|

|

Chip 22 Fraction |

306060 |

218114 |

|

|

Chip 23 |

306025 |

218115 |

|

|

Chip 24 |

306026 |

218116 |

|

|

Chip 25 |

306027 |

218117 |

|

|

Chip 26 |

306028 |

218118 |

|

|

Chip 27 |

306029 |

218119 |

|

|

Chip 28 |

306030 |

218120 |

|

|

Chip 29 |

306031 |

218121 |

|

|

Chip 30 |

306032 |

218122 |

|

|

Chip 31 |

306033 |

218123 |

|

|

Chip 32 |

306034 |

218124 |

|

|

Chip 33 |

306035 |

218125 |

|

|

Chip 34 |

306036 |

218126 |

|

|

Chip 35 |

306037 |

218127 |

|

|

Chip 36 |

306038 |

218128 |

|

|

Chip 37 |

306039 |

218129 |

|

|

Chip 38 |

306040 |

218130 |

|

|

Chip 39 |

306041 |

218131 |

|

|

Chip 40 |

307491 |

218895 |

|

|

DRC NW 1 |

307492 |

218847 |

|

|

DRC NW 2 |

307493 |

218848 |

|

|

DRC NW 3 |

307494 |

218849 |

|

|

DRC NW 4 |

307495 |

218850 |

|

|

DRC NW 5 |

307496 |

218851 |

|

|

DRC NW 6 |

307497 |

218852 |

|

|

DRC NW 7 |

307498 |

218853 |

|

|

DRC NW 8 |

307499 |

218854 |

|

|

DRC NW 9 |

307500 |

218855 |

|

|

DRC NW 10 |

307501 |

218856 |

|

|

DRC NW 11 |

307502 |

218857 |

|

|

DRC NW 12 |

307503 |

218858 |

|

|

DRC NW 13 |

307504 |

218859 |

|

|

DRC NW 14 |

307505 |

218860 |

|

|

DRC NW 15 |

307506 |

218861 |

|

|

DRC NW 16 |

307507 |

218862 |

|

|

DRC NW 17 |

307508 |

218863 |

|

|

DRC NW 18 |

307509 |

218864 |

|

|

DRC NW 19 |

307510 |

218865 |

|

|

DRC NW 20 |

307511 |

218866 |

|

|

DRC NW 21 |

307512 |

218867 |

|

|

DRC NW 22 |

307513 |

218868 |

|

|

DRC NW 23 |

307514 |

218869 |

|

|

DRC NW 24 |

307515 |

218870 |

|

|

DRC NW 25 |

307516 |

218871 |

|

|

DRC NW 26 |

307517 |

218872 |

|

|

DRC NW 27 |

307518 |

218873 |

|

|

DRC NW 28 |

307519 |

218874 |

|

|

DRC NW 29 |

307520 |

218875 |

|

|

DRC NW 30 |

307521 |

218876 |

|

|

DRC NW 31 |

307522 |

218877 |

|

|

DRC NW 32 |

307523 |

218878 |

|

|

DRC NW 33 |

307524 |

218879 |

|

|

DRC NW 34 |

307525 |

218880 |

|

|

DRC NW 35 |

307526 |

218881 |

|

|

DRC NW 36 |

307527 |

218882 |

|

|

DRC NW 37 |

307528 |

218883 |

|

|

DRC NW 38 |

307529 |

218884 |

|

|

DRC NW 39 |

307530 |

218885 |

|

|

DRC NW 40 |

307531 |

218886 |

|

|

DRC NW 41 |

307532 |

218887 |

|

|

DRC NW 42 |

307533 |

218888 |

|

|

DRC NW 43 |

307534 |

218889 |

|

|

DRC NW 44 |

307535 |

218890 |

|

|

DRC NW 45 |

307536 |

218891 |

|

|

DRC NW 46 |

307537 |

218892 |

|

|

DRC NW 47 |

307538 |

218893 |

|

|

DRC NW 48 |

307539 |

218894 |

|

|

EBatt 1 |

307483 |

218896 |

|

|

EBatt 2 |

307484 |

218897 |

|

|

EBatt 3 |

307485 |

218898 |

|

|

EBatt 4 |

307486 |

218899 |

|

|

EBatt 5 |

307487 |

218900 |

|

|

EBatt 6 |

307488 |

218901 |

|

|

EBatt 7 |

307489 |

218902 |

|

|

EBatt 8 |

307490 |

218903 |

|

|

OMM-1 |

307478 |

218905 |

|

|

OMM-2 |

307479 |

218906 |

|

|

OMN-2 |

307481 |

218908 |

|

|

OMN-3 |

307482 |

218909 |

|

|

BTG-1 |

307471 |

218910 |

|

|

BTG-2 |

307472 |

218911 |

|

|

BTG-3 |

307473 |

218912 |

|

|

BTG-4 |

307474 |

218913 |

|

|

BTG-5 |

307475 |

218914 |

|

|

BTG-6 |

307476 |

218915 |

|

|

NFX 17 |

307230 |

218685 |

|

|

NFX 18 |

307231 |

218686 |

|

|

NFX 19 |

307232 |

218687 |

|

|

NFX 20 |

307233 |

218688 |

|

|

NFX 21 |

307234 |

218689 |

|

|

NFX 22 |

307235 |

218690 |

|

|

NFX 23 |

307236 |

218691 |

|

|

NFX 24 |

307237 |

218692 |

|

|

NFX 25 |

307238 |

218693 |

|

|

NFX 30 |

307243 |

218698 |

|

|

NFX 31 |

307244 |

218699 |

|

|

NFX 32 |

307245 |

218700 |

|

|

NFX 33 |

307246 |

218701 |

|

|

NFX 34 |

307247 |

218702 |

|

|

NFX 35 |

307248 |

218703 |

|

|

NFX 36 |

307249 |

218704 |

|

|

NFX 37 |

307250 |

218705 |

|

|

NFX 38 |

307251 |

218706 |

|

|

NFX 42 |

307255 |

218710 |

|

|

NFX 43 |

307256 |

218711 |

|

|

NFX 44 |

307257 |

218712 |

|

|

NFX 45 |

307258 |

218713 |

|

|

NFX 46 |

307259 |

218714 |

|

|

NFX 47 |

307260 |

218715 |

|

|

NFX 48 |

307261 |

218716 |

|

|

NFX 49 |

307262 |

218717 |

|

|

NFX 50 |

307263 |

218718 |

|

|

NFX 56 |

307269 |

218724 |

|

|

NFX 57 |

307270 |

218725 |

|

|

NFX 58 |

307271 |

218726 |

|

|

NFX 59 |

307272 |

218727 |

|

|

NFX 60 Amended |

307558 |

218728 |

|

|

NFX 61 |

307274 |

218729 |

|

|

NFX 62 |

307275 |

218730 |

|

|

NFX 63 |

307276 |

218731 |

|

|

NFX 64 |

307277 |

218732 |

|

|

OMN-1 revised |

315879 |

228322 |

|

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

|

Jervois Global Limited |

||

|

52 007 626 575 |

31 March 2023 |

|

|

Current quarter |

Year to date (3 months) $US’000 |

||

|

1. |

Cash flows from operating activities |

57,950 |

57,950 |

|

1.1 |

Receipts from customers |

||

|

1.2 |

Payments for |

- |

- |

|

|||

|

- |

- |

|

|

(55,953) |

(55,953) |

|

|

(3,116) |

(3,116) |

|

|

(2,219) |

(2,219) |

|

|

1.3 |

Dividends received (see note 3) |

- |

- |

|

1.4 |

Interest received |

628 |

628 |

|

1.5 |

Interest and other costs of finance paid |

(9,356) |

(9,356) |

|

1.6 |

Income taxes paid |

(727) |

(727) |

|

1.7 |

Other |

- |

- |

|

1.9 |

Net cash from / (used in) operating activities |

(12,793) |

(12,793) |

|

2. |

Cash flows from investing activities |

- |

- |

|

2.1 |

Payments to acquire or for: |

||

|

|||

|

- |

- |

|

|

(44,220) |

(44,220) |

|

|

(315) |

(315) |

|

|

- |

- |

|

|

- |

- |

|

|

- |

- |

|

|

2.2 |

Proceeds from the disposal of: |

- |

- |

|

|||

|

- |

- |

|

|

17 |

17 |

|

|

- |

- |

|

|

- |

- |

|

|

2.3 |

Cash flows from loans to other entities |

- |

- |

|

2.4 |

Dividends received (see note 3) |

- |

- |

|

2.5 |

Other |

- |

- |

|

2.6 |

Net cash from / (used in) investing activities |

(44,518) |

(44,518) |

|

3. |

Cash flows from financing activities |

- |

- |

|

3.1 |

Proceeds from issues of equity securities (excluding convertible debt securities) |

||

|

3.2 |

Proceeds from issue of convertible debt securities |

- |

- |

|

3.3 |

Proceeds from exercise of options |

- |

- |

|

3.4 |

Transaction costs related to issues of equity securities or convertible debt securities |

(55) |

(55) |

|

3.5 |

Proceeds from borrowings |

- |

- |

|

3.6 |

Repayment of borrowings |

(45,000) |

(45,000) |

|

3.7 |

Transaction costs related to loans and borrowings |

- |

- |

|

3.8 |

Dividends paid |

- |

- |

|

3.9 |

Other – incl. lease liabilities |

(495) |

(495) |

|

Other - Government grants and tax incentives |

167 |

167 |

|

|

Other |

- |

- |

|

|

3.10 |

Net cash from / (used in) financing activities |

(45,383) |

(45,383) |

|

4. |

Net increase / (decrease) in cash and cash equivalents for the period |

||

|

4.1 |

Cash and cash equivalents at beginning of period |

152,647 |

152,647 |

|

4.2 |

Net cash from / (used in) operating activities (item 1.9 above) |

(12,793) |

(12,793) |

|

4.3 |

Net cash from / (used in) investing activities (item 2.6 above) |

(44,518) |

(44,518) |

|

4.4 |

Net cash from / (used in) financing activities (item 3.10 above) |

(45,383) |

(45,383) |

|

4.5 |

Effect of movement in exchange rates on cash held |

(116) |

(116) |

|

4.6 |

Cash and cash equivalents at end of period |

49,837 |

49,837 |

|

8. |

$US’000 |

|

|

8.1 |

Net cash from / (used in) operating activities (item 1.9) |

(12,793) |

|

8.2 |

(Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) |

(315) |

|

8.3 |

Total relevant outgoings (item 8.1 + item 8.2) |

(13,108) |

|

8.4 |

Cash and cash equivalents at quarter end (item 4.6) |

49,837 |

|

8.5 |

Unused finance facilities available at quarter end (item 7.5) |

- |

|

8.6 |

Total available funding (item 8.4 + item 8.5) |

49,837 |

|

8.7 |

Estimated quarters of funding available (item 8.6 divided by item 8.3) |

3.8 |

|

Note: if the entity has reported positive relevant outgoings (i.e., a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. |

||

|

8.8 |

If item 8.7 is less than 2 quarters, please provide answers to the following questions: |

|

|

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

||

|

Answer: N/A |

||

|

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? |

||

|

Answer: N/A |

||

|

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

||

|

Answer: N/A |

||

|

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. |

||

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 27 April 2023

Authorised by: Disclosure Committee

(Name of body or officer authorising release – see note 4)

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – e.g., Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

1 Debt drawn down represents the aggregate of amounts drawn under the US$150 million working capital facility and amounts drawn under the terms of the US$100 million Senior Secured Bonds. Amounts represent the nominal loan amounts; balances recorded in the Company’s financial statements under International Financial Reporting Standards will differ.

2 Information on the basis of preparation for the financial information included in this Quarterly Activities Report is set out on page 18 below.

3 Information on the basis of preparation for the financial information included in this Quarterly Activities Report is set out on page 18 below.

4 See ASX announcement “Jervois update on drilling at Idaho Cobalt Operations, USA” dated 15 October 2019

5 See ASX announcement “Jervois releases BFS for Idaho Cobalt Operations” dated 29 September 2020

6 See ASX announcement “Updated RAM resource – opportunity to extend ICO mine life” dated 19 April 2023 (Australia)

7 The number of options represent the number of Jervois shares that will be issued on exercise. The exercise price represents the price to be paid for the Jervois shares when issued.