Archive

One World Lithium Drilling Update, Corporate Progress and Industry Trends

| |||||||||

|  |  | |||||||

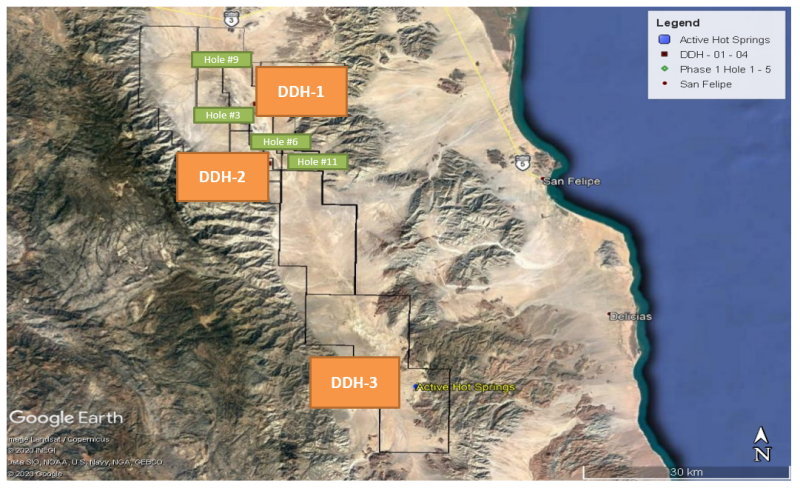

VANCOUVER, BC - TheNewswire – April 6, 2021 - One World Lithium Inc. (CSE:OWLI) (OTCQB:OWRDF) (CNSX:OWLI) (the “Company” or “OWL”) is pleased to announce that Layne Drilling from Hermosillo, Mexico will begin mobilizing the diamond drill rig and related equipment to San Felipe this week for the DDH-3 (diamond drill hole) program expected to begin on April 15, 2021. Layne Drilling will be sending three four man drill crews to drill 24 hours per day.

As previously reported, DDH-3 is located approximately 50 kilometers to the south of DDH-2 on the Company’s Salar del Diablo property, located in the State of Baja California, Mexico. Mike Rosko, the Operator, from Montgomery & Associates expects DDH-3 and possibly DDH-4 will be more cost effective than previous holes drilled as aa more aggressive drill bit will be used and DDH 3 and 4 may only require total depths between 300 and 400 meters as DDH 1 and 2 reached an average total depth of 624 meters. Mike also noted the prospective area of possible hydrothermal activity may cover 20,000 hectares.

All samples will be assayed for drill holes DDH – 1 through 4 with the assay results released at the same time. On completing phase three of the drill program, OWL will have increased its working interest in the Salar del Diablo property from 60% to 80%. For more information on Salar del Diablo property and the terms of the Company’s option thereon, please see the Company’s press release dated March 10, 2017, and July 28, 2017.

In Mexico, mineral exploration has been deemed an essential service despite the country’s various Covid-19 restrictions and, at present, the States of Baja California and Sonora currently have no further restrictions.

Lithium Separation Technologies

An ecosystem of junior mining companies are looking to take market share from major producers to meet the demand for high quality lithium chemicals and new resources to obtain these has become one of the most important emerging themes in lithium over the last five years.1 Accordingly, many of these new technologies can be developed and used in house by junior mining companies.

OWL has the right to purchase 100% of a lithium separation technology which is subject to a proof of concept testing. The Company hopes this may be successful within two months. The technology has the potential to separate lithium carbonate (“LCE”) from a brine and, because of this, the Company perceives the technologies implementation as a potential industry game changer. Accordingly, some of the potential benefits may include not requiring evaporation ponds to separate LCE as well as returning the waste brine back to its producing brine formations that may stabilized the brine formation and extend a mine’s life.

For more information, please see the Company’s press release dated October 27, 2020.

One World Lithium Trends

-

- OWL’s recent private placement offering was oversubscribed by 50% for proceeds of CAD $2,250,000.2

- During the three month period ended December 31, 2020, OWL’s secondary market traded 4.5 million common shares (each, a “Share”) and in the first quarter ended March 31, 2021 it has traded 23.4 million Shares, for an increase of 421%.3

Lithium Industry Trends Are Impressive

-

- The seaborne LCE battery grade spot price has increased from USD$6,000 to USD$7,500 per tonne on October 23, 2020 to USD$9,500 to USD$11,000 per tonne on March 19, 2021 (trading between China, South Korea, and Japan).4

-

- Since January 1, 2021,Bloomberg reported a total of US$3.4 billion raised in equity financings in the North and South America which is seven times the total amount raised from 2018 to 2020. 5

- Since January 1,2021 to March 18, 2021, Bloomberg reports that junior lithium companies have raised an aggregate of USD$529 million from the capital markets. That is about USD$63 million more than the total amount raised from 2018 to 20205

- The demand for lithium for electrical vehicles (EVs”) is expected to in increase approximately 599% by 2025.6

Given the renewed investor interest in the lithium sector which is driven by significant increases in the price of lithium carbonate equivalent (LCE), it has impacted OWL as its previous private placement was oversubscribed by 50% or $750,000 and its secondary market trading volume also increased over 421% to 23.4 million shares from the three month period ended December 31, 2020 compared to the three month period ended March 31, 2021. This is in response to the increase in demand for lithium-ion batteries.

About One World Lithium Inc.

One World Lithium Inc. is an exploration company focused on lithium in brine projects and new lithium separation technologies. OWL has the right to own 100% of the separation technology, subject to a positive proof of concept program. OWL has earned a 60% property interest in the Salar del Diablo property, located in the State of Baja California, Mexico. Upon completion of a three phase drill program, OWL will earn an additional 20% property interest and has an option to purchase a further 10% property interest for a total of a 90% property interest in the 103,450 hectare (399 square mile) Salar del Diablo lithium brine project.

On behalf of the Board of Directors of One World Lithium Inc.

“Douglas Fulcher”

President and Chief Executive Officer

For further information please visit www.oneworldlithium.com or email info@oneworldlithium.com or call 1-604-564-2017 Extension-3.

Forward-Looking Information and Disclaimer: This press release may include forward looking information within the meaning of Canadian securities legislation. Forward looking information is based on certain key expectations and assumptions made by the management of the OWL, including the expected start date of the Company’s DDH-3 drill campaign, costs and depths for the Company’s anticipated DDH-3 and DDH-4 drill programs, the market trends of the lithium and elective car industries, the intention of OWL to proceed with the advancement of the Salar del Diablo property, or the Company’s ability to exercise its right to acquire a 100% interest in certain lithium separation technology and the anticipated benefits therefrom obtained by the Company. Although OWL believes that the expectations and assumptions on which such forward looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because OWL can give no assurance that they will prove to be correct. Forward looking statements contained in this press release are made as of the date of this press release. OWL disclaims any intent or obligation to update publically any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from the those anticipated in such statements, important factors that could cause actual results to differ materially from the company’s expectations include: (I) inability of OWL to execute its business plan and raise the required financing (II) accuracy of mineral or resource exploration activity (III) continued access to the Company’s mineral property (IV) risks and market fluctuations common to the mining industry and lithium sector, (V) advancements in new separation technologies, and (VI) other general business, economic, or market related risks beyond the director control of the Company and which may adversely affect the Company’s business or operations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, some of which are beyond the control of the OWL. The reader is cautioned not to place undue reliance on any forward-looking information contained in this press release.

This press release also contains certain information and data taken from various third party sources. Please note that any opinion, estimate or forecast made by the authors of such third party statements presented in this press release are theirs alone and do not represent opinions, forecasts or predictions of the Company or its management. OWL does not, by the reference or distribution of these quotes, links, or citations imply their endorsement of or concurrence with such information, conclusions or recommendations.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Chris Berry and Alex Grant, “Gradually, Then Suddenly: Adoption of New Technology in Lithium Brine Extraction”, House Mountain Partners (September 24, 2019).

2 See the Company’s news releases dated September 15, 2020 and March 2, 2021 for more information.

3 Figures taken from the Stockwatch’s website: https://www.stockwatch.com/symbol OWLI/historical.

4 Carrie Shi & Susan Zou Dalilia Ouerghi, “GLOBAL WRAP: Bullish offers from Chinese producers narrow domestic carbonate range further”, Fastmarkets (October 23, 2020) and Susan Zou Dalilia Ouerghi, “GLOBAL LITHIUM WARP: Seaborne Asia prices play catch up”, Fastmarkets (March 19, 2021).

5 Yvonne Yue Li, “Wall Street is Betting Billions on EV-Fueled Lithium Comeback”, Bloomberg News (March 19, 2021).

6 Maxx Chatsko, “Lithium Demand for Electric Vehicles Could Grow 599% by 2025”, Motley Fools (March 24, 2020).