Archive

Peloton Acquires Copper-Molybdenum Porphyry Project Near Butte, Montana and Plans a Dividend in Kind to Peloton Shareholders

| |||||||||

August 30 - TheNewswire - London, Ontario - Peloton Minerals Corporation (“PMC” or the “Company”) (CNSX:PMC.CN) (OTC:PMCCF) has reached an agreement to acquire 100% of the issued and outstanding shares of privately held Westmount Resources LLC (“Westmount”) through its wholly owned subsidiary, Celerity Mineral Corporation (“Celerity”). Westmount holds a 100% interest in 331 unpatented mineral claims called the Boulder Porphyry Property located near Butte, Montana. The shareholders of Westmount (the “Westmount Shareholders”) will be issued 50% of the issued and outstanding shares of Celerity in exchange for their Westmount Shares in this arms length transaction.

The Boulder Porphyry Property (the “Boulder Property”) is located approximately 16 miles (26 km) north-northeast of Butte, Montana, home of the historic Butte mining district. The Boulder Property is also approximately 20 miles (32 km) south-southwest of the Montana Tunnels, another large-scale former base and precious metal producer. Wikipedia describes the historic production of the Butte district as: “From 1880 through 2005, the mines of the Butte district have produced more than 9.6 million metric tons of copper, 2.1 million metric tons of zinc, 1.6 million metric tons of manganese, 381,000 metric tons of lead, 87,000 metric tons of molybdenum, 715 million troy ounces (22,200 metric tons) of silver, and 2.9 million ounces (90 metric tons) of gold.”

The Butte, Boulder Property, and Montana Tunnels are all situated along the northeast-trending Great Falls Tectonic Zone (GFTZ) which is a continental scale, deep-seated, structural zone of crustal weakness that appears to have been intermittently active since the late Proterozoic (1.4 billion years ago) and at times has tapped deep mantle melts. Most of the epithermal and porphyry metal occurrences in Montana are localized along the GFTZ.

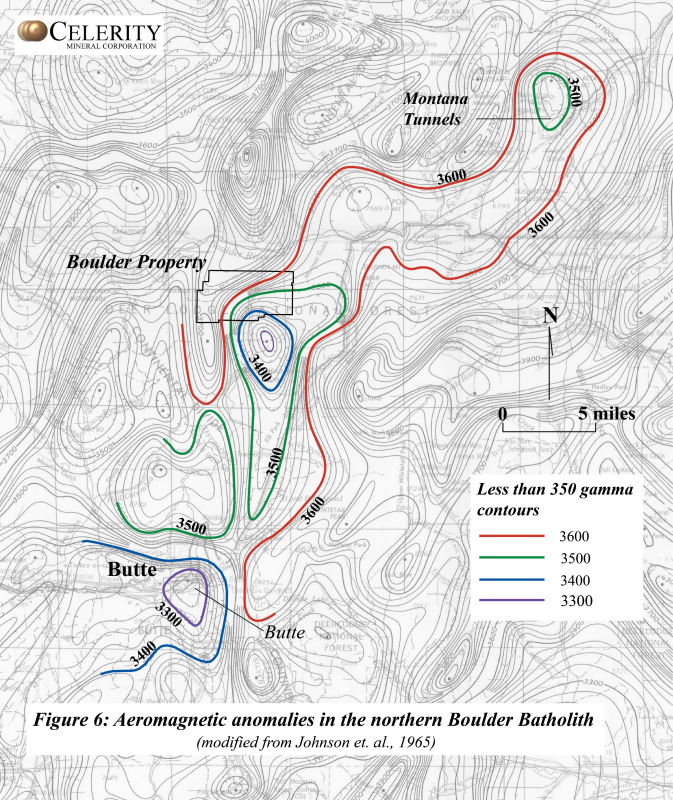

The Butte, Boulder Property, and Montana Tunnels are along or adjacent to a similarly trending major magnetic low along the axis of the GFTZ (see Figure 6 accompanying this release - USGS regional magnetics, Johnson 1965). The Boulder Property is the least explored of these three magnetic low areas.

The Boulder Property is known to contain a large copper-molybdenum porphyry system within the Boulder Batholith and coeval Elkhorn Mountains Volcanics which is overlain by 300 to 2,100 feet of post-mineral Lowland Creek Volcanics. As a result, the porphyry system on the Boulder Property is not well exposed.

Between 1965 and 1977, the Anaconda Company (Anaconda) and Union Oil (Molycorp) drilled 8 deep core holes on the property into the Boulder Batholith based on the USGS regional magnetics and an Anaconda IP survey. These holes intersected a large porphyry system with low-grade copper mineralization. Continuous mineralized drill intercepts of between 1,255 and 1,614 feet grading a weighted average of between 600 and 1,000 ppm Cu were intersected. Three deep core holes were completed by O.T. Mining in 2004-5, approximately 1 mile southwest of the Anaconda and Molycorp drilling, intersecting similar porphyry alteration and continuous copper mineralization with drill intersects between 1,242 and 2,630 feet grading a weighted average of between 313 and 785 ppm Cu. In 2005-6 O.T. Mining conducted extensive geophysics and located potential higher-grade targets within the identified porphyry system however these targets were never drilled and the property has remained dormant since.

Westmount acquired the Boulder Property in 2020 and 2021 through staking and other legal processes.

Under the agreement to acquire Westmount and the underlying project, in addition to 50% of the issued and outstanding Celerity Shares, the Westmount Shareholders will also receive a promissory note in the amount of US $600,000 to be paid within one year (the “Promissory Note”), and a 1% net smelter return royalty (NSR) that may be bought down prior to commercial production by one-half for US $5 million. If the Promissory Note is not paid within one year the Westmount ownership and property revert back to the Westmount Shareholders.

Peloton plans to have Celerity self-fund its operations and seek to become its own publicly traded company in a series of financings and transactions. Peloton shareholders will receive Celerity shares at no cost as a dividend in kind and be given the opportunity to participate in Celerity financings by way of a rights offering or other private placements. The proceeds of such financings when completed will be used to pay out the Promissory Note; complete geophysical field work this year; initiate the drill permitting process; complete and file an NI 43-101 compliant technical report; file a Celerity prospectus; and seek a Celerity listing on a Canadian Exchange. It is expected to take up to one year to complete these tasks, and upon completion, it is anticipated that Peloton will retain a meaningful interest in Celerity going forward. No agreements have been established for any of the financings and no record dates for any of the above transactions have been set. Further details will be announced as the Company develops and proceeds with its plans.

President and CEO Edward (Ted) Ellwood comments: “We have had our eye on this project for over ten years and are thrilled that it is coming to us. It is an exciting exploration target with tremendous upside potential and fits extremely well with the potential of our Nevada Carlin style gold projects which we also continue to advance and remain excited about. As for the financing and structural strategy, we feel this is the best approach toward financing the project adequately while minimizing Peloton dilution. Any percentage of another Butte would be significant.”

Peloton now holds interests in two Montana projects (this Boulder Property and the SBSL epithermal gold exploration project which is under option to Frederick Private Equity and African Metals) as well as three Carlin style gold exploration projects in Elko County, Nevada all of which are permitted for drilling. In Nevada, Peloton is planning a geophysical program at Golden Trail later this year and plans to seek joint venture partners on the other two projects. Should joint venture partners be found, it would mean that Peloton would only need to directly finance one of the five projects in the portfolio (Golden Trail) while retaining a meaningful interest in all of the projects.

Further announcements will be made as the Company proceeds on the various projects.

For further information please contact:

Edward (Ted) Ellwood, MBA

President & CEO 1-519-964-2836

Richard C. Capps, PhD, is the qualified person responsible for approving the technical information contained within this release.

Peloton Minerals Corporation is a reporting issuer in good standing in the Provinces of Ontario and British Columbia whose common shares are listed on the CSE (Symbol: PMC) and trade in the U.S. on the OTC QB (Symbol: PMCCF). There are 104,086,641 common shares issued and outstanding in the capital of the Company.

CSE has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" (within the meaning of applicable Canadian securities laws) and "forward-looking statements" (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995). Such statements or information are identified with words such as "anticipate", "believe", "expect", "plan", "intend", "potential", "estimate", "propose", "project", "outlook", "foresee", “looking” or similar words suggesting future outcomes or statements regarding an outlook.

Such statements include, among others, those concerning the Company’s plans for exploration activity and to conduct future exploration programs, its plans to have Celerity self-fund its operations and seek to become its own publicly traded company in a series of financings and transactions, its plans to have its shareholders receive Celerity shares at no cost as a dividend in kind and be given the opportunity to participate in Celerity financings by way of a rights offering and other private placements. They also include the Company’s plans with respect to the proceeds of such financings, when completed, and its plans to file a Celerity prospectus; and seek a Celerity listing on a Canadian Exchange, its expectations regarding the timing of such plans and the resulting shareholdings in Celerity of Peloton. Such forward-looking information or statements are based on a number of risks, uncertainties, and assumptions which may cause actual results or other expectations to differ materially from those anticipated and which may prove to be incorrect. Assumptions have been made regarding, among other things, management's expectations regarding its ability to initiate and complete future exploration work as expected or to attract joint venture partners. Actual results could differ materially due to a number of factors, including, without limitation, operational risks in the completion of the Company’s future exploration work; technical, safety or regulatory issues; availability of capital; the worldwide economic and social impact of COVID-19; the duration and extent of COVID-19; changes in general economic conditions and financial markets; the imposition of government restrictions on business related to COVID-19, any positive cases of COVID-19 at a project site or in the area which may cause a reduction or suspension in operations and activities which may ultimately affect and delay the exploration timeline; and changes in prices for gold and other metals. The Company’s plans are subject to regulatory requirements and approvals and the Company may never become a reporting issuer or be listed on a Canadian Exchange.

Although the Company believes that the expectations reflected in the forward-looking information or statements are reasonable and does not believe that the worldwide COVID-19 situation will have any immediate or long term effect on its projects, prospective investors in the Company’s securities should not place undue reliance on forward-looking statements because the Company can provide no assurance that such expectations will prove to be correct. Forward-looking information and statements contained in this news release are as of the date of this news release and the Company assumes no obligation to update or revise this forward-looking information and statements except as required by law.