Archive

Rifco Announces Management-initiated and Voluntary Internal Review of GST/HST Remittances

| |||||||||

|  | ||||||||

Red Deer, Alberta / TheNewswire / July 24, 2017 - Rifco Inc. (TSXV-RFC) (the “Company”) announces that the Company is conducting an internally initiated, voluntary review (the “Review”) of the Company's GST/HST remittances.

Due to possible reporting and remittance errors resulting from a misinterpretation of the applicable sales tax regulations, the Company has initiated disclosure through the Voluntary Disclosure Program with the Canada Revenue Agency (“CRA”). The process is intended for the Company to correct historical errors and render itself compliant. Unremitted amounts, for previous periods, will be remitted to the CRA.

While the Review is not yet completed, the Company does not believe that it will be required to refile previous financial statements. Further, based on the preliminary findings, the Company does not believe any of the covenants in its lending facilities will be breached.

Internal Review

The Review stems from GST/HST collection and remittances on repossessed vehicle auction sale proceeds with certain auction agents.

The sale of repossessed vehicles, at agent auctions, mitigate the Company’s credit losses from defaulted loans. Due to an error of interpretation, the GST/HST, and the associated input tax credits (the “ITCs”) from many small transactions, may not have been reported and remitted correctly on a historical basis.

The potential errors were discovered internally and came to the attention of the Company's recently appointed Vice President and Chief Financial Officer, Warren Van Orman. Once the potential error was detected, it was immediately recommended to the Board of Directors that the Review be initiated. The Company’s Board of Directors is comprised of a majority of independent directors.

The Company has acted quickly to initiate the Review, retain expert advisors, and develop credible estimates for public disclosure.

The Company will take all appropriate steps necessary to remedy any material weaknesses and to ensure that a similar situation is avoided in the future. The Review will ensure compliant practices in connection with GST/HST remittances.

Preliminary Findings

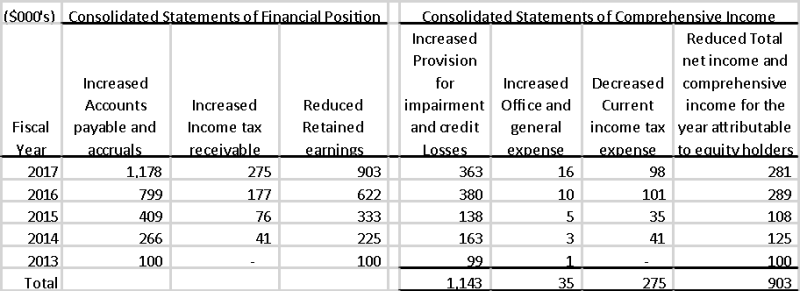

The Company has identified transactions where the GST/HST portion of certain auction sale proceeds had been recorded as a recovery against loan losses. Instead, GST/HST received, net of applicable ITCs, should have been reported and remitted to the CRA in the ordinary course of business. The correction of this error will result in reductions to net income tax expense. The preliminary findings from the Review are as follows:

The findings are necessarily preliminary, are unaudited, and could significantly change as the Review continues. The amounts owing will vary from year to year and may include an additional year or part

year.

Due to the Company’s disclosure within the Voluntary Disclosure Program with the CRA, it is not anticipating that significant penalties will be applied. However, there is no assurance that the CRA will provide penalty relief. The Company expects to have the capacity to pay these remittances from working capital.

Retrospective Corrections to Historically Reported Results

The Company is in consultation with its Auditors. While the Review is not yet completed, the Company does not believe that it will be required to refile previous financial statements.

The Company will retrospectively correct certain, previously reported results by adjusting all comparative amounts in the Company’s interim results as of June 30, 2017 and subsequent financial statements as if the amounts had previously been reported correctly. Adjusted comparative amounts will include Provision for Impairment and Credit Loss Expenses, Net Income, and Retained Earnings.

Amounts to be corrected are expected to fall within the Company's reported results for the five years ended March 31, 2017 inclusive. Future financial statements to be provided by the Company will reflect the error correction in the comparative amounts.

Although the timeline for the resolution of these matters is not determinable at this time, the Company will provide further information, as is available, in its future regulatory filings.

CRA Voluntary Disclosure

With the assistance of its external advisors, the Company has voluntarily initiated a disclosure process with the CRA. The process is intended to correct reporting and remittance errors, render itself compliant and avail itself of the benefit of penalty relief provided under the CRA’s Voluntary Disclosure Program. The Company is not the subject of any ongoing CRA audit, investigation or enforcement activity and has initiated a disclosure process voluntarily.

As soon as the Company became aware of the errors, it acted to participate in the Voluntary Disclosure Program.

Trading Blackout

In conjunction with the preparation of the Company’s Q1 Filings (defined below) and as a result of the Review, Rifco established a blackout on trading by directors, officers and other insiders of the Company, and intends to continue the blackout until the Q1 Filings.

Filing Requirements

Under National Instrument 51-102 of the Canadian Securities Administrators, the Company's unaudited interim financial statements for the three-month periods ended June 30, 2017 and the related MD&A and management certifications (the "Q1 Filings") are to be filed no later than August 29, 2017.

About Rifco

Rifco Inc. operates through its wholly owned subsidiary Rifco National Auto Finance Corporation in order to provide automobile loans through its dealership network across Canada. Rifco National Auto Finance provides consumers with financing options on new and used vehicles. Rifco specializes in building long-term partnerships with dealers by investing time in personalized services through dedicated account representatives. Rifco’s quick credit decisions, common sense lending, and expedited funding processes give its dealers better financing options and more closed deals. Rifco’s most successful partnerships result in Fast Forward 500 Club status for its loyal dealerships. Rifco is committed to continuing growth. Key strategies for achieving this growth include the expansion of its automobile dealer base and excellence in credit and collections processes.

The common shares of Rifco Inc. are traded on the TSX Venture Exchange under the symbol "RFC". There are 21.60 million shares outstanding and 22.91 million (fully diluted) shares.

CONTACT:

Rifco Inc.

Warren Van Orman

Vice President and Chief Financial Officer

Telephone: 1-403-314-1288 Ext 7007

Fax: 1-403-314-1132

Email: vanorman@rifco.net

Website: www.rifco.net

Forward-Looking Statements

Certain statements contained in this document constitute forward-looking statements or information (collectively "forward-looking statements") within the meaning of the "safe harbour" provisions of applicable securities legislation. Forward-looking statements are typically identified by words suggesting future events or future performance. In particular, this document contains forward-looking statements pertaining to, without limitation, the following: the scope of the impact of the preliminary findings, our belief that the preliminary findings from the review to date could change as the review continues; our belief that no restatement is required; our intention to provide further comment when the review is completed; and our intention to continue the blackout on directors, officers and other insiders until the Q1 Filings have been filed.

With respect to forward-looking statements contained in this document, we have made assumptions regarding, among other things: the nature and magnitude of the possible remittance errors that will need to be remedied in; that the final results of the internal review will not be substantially different than the preliminary results of the review. In addition, many of the forward-looking statements contained in this document are located proximate to assumptions that are specific to those forward-looking statements, and such assumptions should be taken into account when reading such forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements contained in this document, and the assumptions on which such forward-looking statements are made, are reasonable, there can be no assurance that such expectations will prove to be correct. Readers are cautioned not to place undue reliance on forward-looking statements included in this document, as there can be no assurance that the plans, intentions or expectations upon which the forward-looking statements are based will occur. By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will not occur, which may cause our actual performance and financial results in future periods to differ materially from any estimates or projections of future performance or results expressed or implied by such forward-looking statements.

The forward-looking statements contained in this document speak only as of the date of this document. Except as expressly required by applicable securities laws, we do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this document are expressly qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.